Finance

Restricted Asset Definition

Published: January 19, 2024

Discover the meaning of restricted assets in finance and how they impact financial statements. Learn how to define restricted assets and their implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Restricted Asset Definition: Unlocking the Secrets of Financial Success

In today’s fast-paced world, mastering your finances is more important than ever. Whether you’re looking to save for a dream vacation, buy a new home, or plan for retirement, understanding the concept of restricted assets is essential. In this blog post, we will delve into the fascinating world of restricted asset definition and how it can help you secure your financial future.

Key Takeaways:

- Restricted assets are financial resources that have limitations or restrictions on their use.

- Understanding and managing restricted assets can help you make informed financial decisions and achieve your goals.

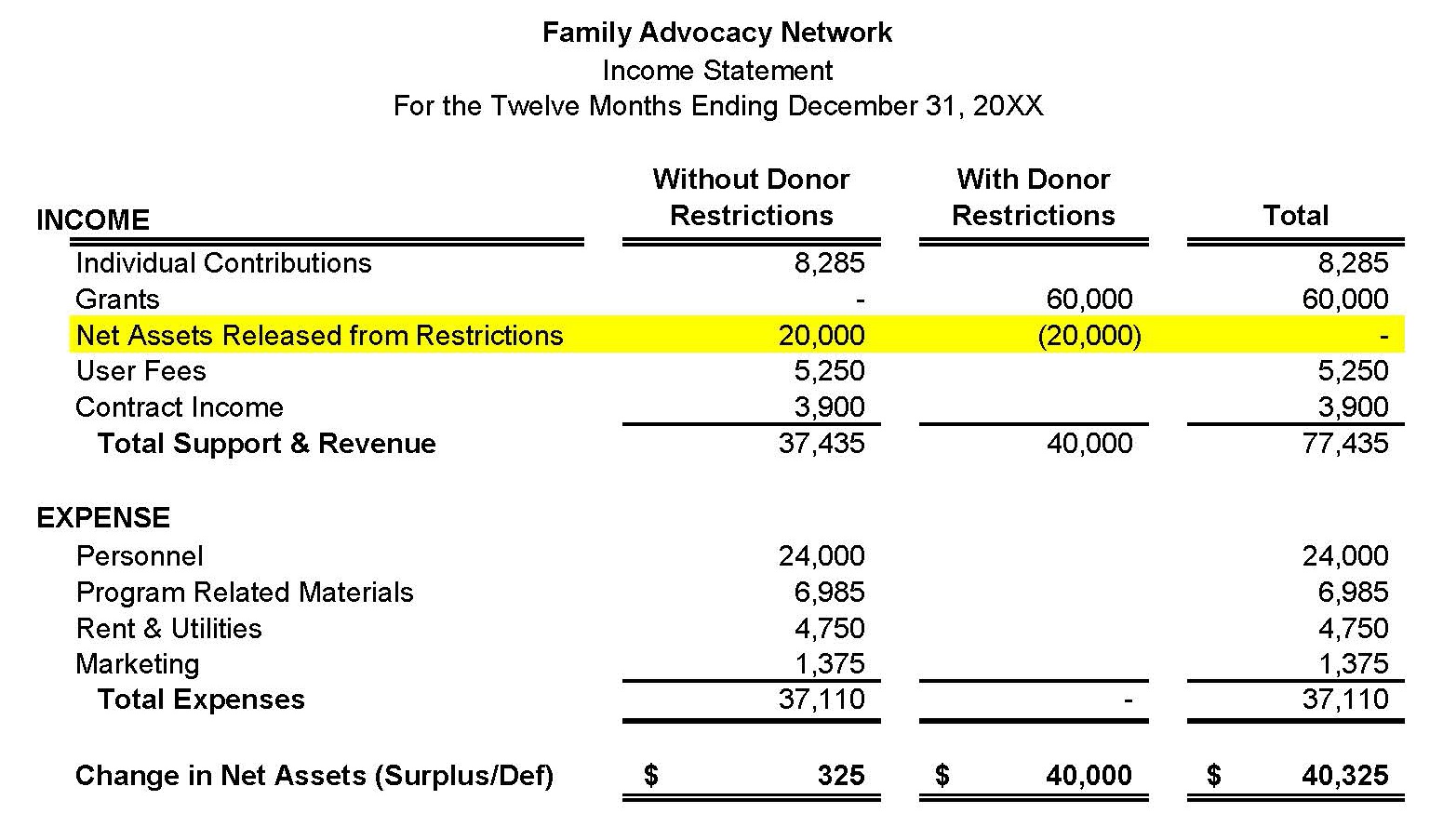

So, what exactly is a restricted asset? Essentially, it refers to any financial resource that has restrictions or limitations on its use. These restrictions can be imposed by external parties such as government regulations, legal obligations, or contractual agreements. Restricted assets can include a wide range of financial resources including properties, investments, trust funds, and more.

Now that we’ve defined restricted assets, let’s explore why understanding them is crucial for your financial success:

The Importance of Understanding Restricted Assets

- Optimizing Financial Planning: By knowing which assets are restricted, you can tailor your financial plan accordingly. This ensures that you allocate your resources effectively and make the most of the assets available for use.

- Legal Compliance: Many restricted assets are subject to specific legal obligations or regulations. By understanding these restrictions, you can ensure that you abide by the law and avoid any potential penalties or legal complications.

- Maximizing Investment Potential: Some restricted assets, such as certain types of investments, may offer unique opportunities for growth or tax benefits. By understanding these assets, you can capitalize on their potential and make informed investment decisions.

- Asset Protection: Restricted assets often come with specific protections that safeguard them from being seized, liquidated, or misused by creditors or other parties. Understanding these protections can help you safeguard your assets and maintain financial security.

In conclusion, gaining a deep understanding of restricted asset definition is fundamental in navigating the complex world of finance. By recognizing which assets are restricted and how they can impact your financial decisions, you can make informed choices to achieve your goals while ensuring legal compliance and maximizing the potential of your resources. Remember, financial success starts with knowledge, and understanding restricted assets is a crucial step towards unlocking your financial potential.