Finance

What Is Restricted Cash On Balance Sheet

Modified: December 30, 2023

Learn about restricted cash on balance sheet and its implications for financial statements. Explore the importance of this finance concept in managing cash flow.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on restricted cash on the balance sheet. Understanding the concept of restricted cash is essential for individuals and businesses looking to gain a deeper understanding of their financial statements. Restricted cash represents a specific category of cash that is not readily available for general use. Instead, it is earmarked for a particular purpose or held under certain restrictions.

In this article, we will delve into the definition of restricted cash, its purpose, examples, and the presentation of restricted cash on the balance sheet. We will also discuss the disclosure requirements related to restricted cash and highlight the importance of monitoring these funds.

Whether you are a business owner, investor, or simply interested in finances, grasping the concept of restricted cash is crucial for a comprehensive understanding of a company’s financial health. On the balance sheet, restricted cash is distinguished from unrestricted cash and can have a significant impact on a company’s liquidity and financial reporting.

So, let’s embark on this educational journey to explore the intricacies of restricted cash and its implications for financial decision-making. By the end of this article, you will have a clear understanding of restricted cash and how it is reflected on a balance sheet.

Definition of Restricted Cash

Restricted cash refers to cash or cash equivalents that are subject to specific restrictions on their use. These restrictions can arise from various factors, such as legal requirements, contractual obligations, or internal policies. Unlike unrestricted cash, which can be freely used for any purpose, restricted cash has limitations on its utilization.

Restricted cash can come in different forms, such as cash held in escrow accounts, cash set aside for debt payments, or cash designated for specific projects or investments. It is important to note that restricted cash should be clearly distinguished and reported separately from other cash balances on a company’s balance sheet.

There are several reasons why cash may become restricted. Let’s take a look at some common scenarios:

- Legal Requirements: Certain regulatory or legal obligations may stipulate that a portion of the company’s cash be restricted. For example, a company involved in a lawsuit may be required to set aside cash as a reserve to cover potential legal liabilities.

- Loan Agreements: When a company borrows funds from a lender, the loan agreement may include provisions that restrict the use of some of the borrowed cash. This ensures that the borrowed funds are utilized for specific purposes, such as capital expenditures or debt servicing.

- Project Funding: In situations where a company undertakes a large-scale project, it may set aside cash specifically for financing the project’s expenses. This allows for better tracking of project costs and ensures that funds are not diverted for other purposes.

- Governmental Restrictions: Some industries, such as healthcare or education, may face strict regulations that require certain cash reserves to be maintained. These reserves serve as a safeguard and ensure that the company can meet its financial obligations in compliance with industry standards.

By segregating restricted cash from unrestricted cash, companies can provide transparency in their financial reporting and demonstrate their compliance with various restrictions. This distinction helps stakeholders, including investors, creditors, and regulators, gain a clearer understanding of a company’s financial position and its ability to meet its obligations.

Purpose of Restricted Cash

The purpose of holding restricted cash is to ensure that funds are set aside for specific purposes and to comply with legal, contractual, or internal requirements. By restricting the use of cash, companies can better manage their financial resources and allocate them efficiently.

Here are some key purposes for holding restricted cash:

- Risk Mitigation: Many companies face various risks, such as legal disputes, environmental liabilities, or potential operational disruptions. By setting aside cash reserves to cover these risks, companies can mitigate the potential financial impact and ensure they are prepared to address any future needs.

- Debt Servicing: When a company has outstanding debt, it may have contractual obligations to make regular interest and principal payments. Holding restricted cash specifically designated for debt servicing ensures that these payment obligations are met on time, reducing the risk of default and maintaining a favorable relationship with creditors.

- Capital Expenditures: Companies often need to invest in new assets, such as buildings, equipment, or technology, to support their operations and drive growth. By segregating cash for capital expenditures, businesses can ensure that funds are available to finance these important investments and avoid diverting them for other purposes.

- Project Funding: Large-scale projects, such as infrastructure development or research initiatives, usually require significant financial resources. By holding restricted cash for project funding, companies can allocate funds specifically for these initiatives, allowing for better budgeting, tracking of expenses, and accountability.

- Compliance and Regulatory Requirements: In some industries, there are strict regulations governing the usage of cash. Companies may need to hold restricted cash to meet regulatory requirements, such as maintaining cash reserves for insurance companies or meeting capital adequacy ratios for financial institutions.

Overall, the purpose of restricted cash is to ensure that funds are dedicated to specific needs and obligations, providing financial stability, compliance, and strategic planning. By effectively managing restricted cash, companies can enhance their financial resilience, maintain healthy relationships with stakeholders, and meet their long-term financial objectives.

Examples of Restricted Cash

Restricted cash can take various forms depending on the specific circumstances and restrictions imposed on the funds. Here are some examples of how restricted cash may be utilized:

- Escrow Accounts: Escrow accounts are commonly used in real estate transactions. A portion of the purchase price is held in a restricted cash account until certain conditions or obligations are fulfilled, such as property inspections or the resolution of title issues. This ensures that the funds are available for the intended purpose and provides protection for all parties involved in the transaction.

- Debt Service Reserves: When a company has outstanding debt, lenders may require the establishment of a restricted cash account to ensure that funds are available to meet debt payment obligations. These reserves provide a safety net for creditors and reduce the risk of default by ensuring that the necessary funds are set aside for timely repayment.

- Legal Settlements and Claims: In the case of legal disputes or claims, companies may be required to maintain restricted cash reserves as a provision for potential settlement payments. These funds are set aside to cover any financial obligations resulting from legal proceedings, ensuring that the company can meet its legal liabilities without disrupting its daily operations.

- Research and Development (R&D) Funding: Companies engaged in research and development activities may allocate restricted cash to finance specific R&D projects. These funds are dedicated to innovation, product development, and technological advancements, enabling companies to invest in future growth and maintain their competitive edge.

- Compliance Reserves: Certain industries, such as the insurance sector, may have regulatory requirements for holding restricted cash reserves. These reserves act as a safeguard to ensure that insurance companies have adequate funds available to cover potential claims and fulfill their policyholder obligations.

These examples illustrate how restricted cash can be used for specific purposes, such as securing transactions, meeting financial obligations, managing legal liabilities, driving innovation, and complying with industry regulations. It is essential for businesses to accurately report and disclose these restricted cash balances on their balance sheets to provide transparency and ensure compliance with applicable accounting standards and regulations.

Presentation of Restricted Cash on the Balance Sheet

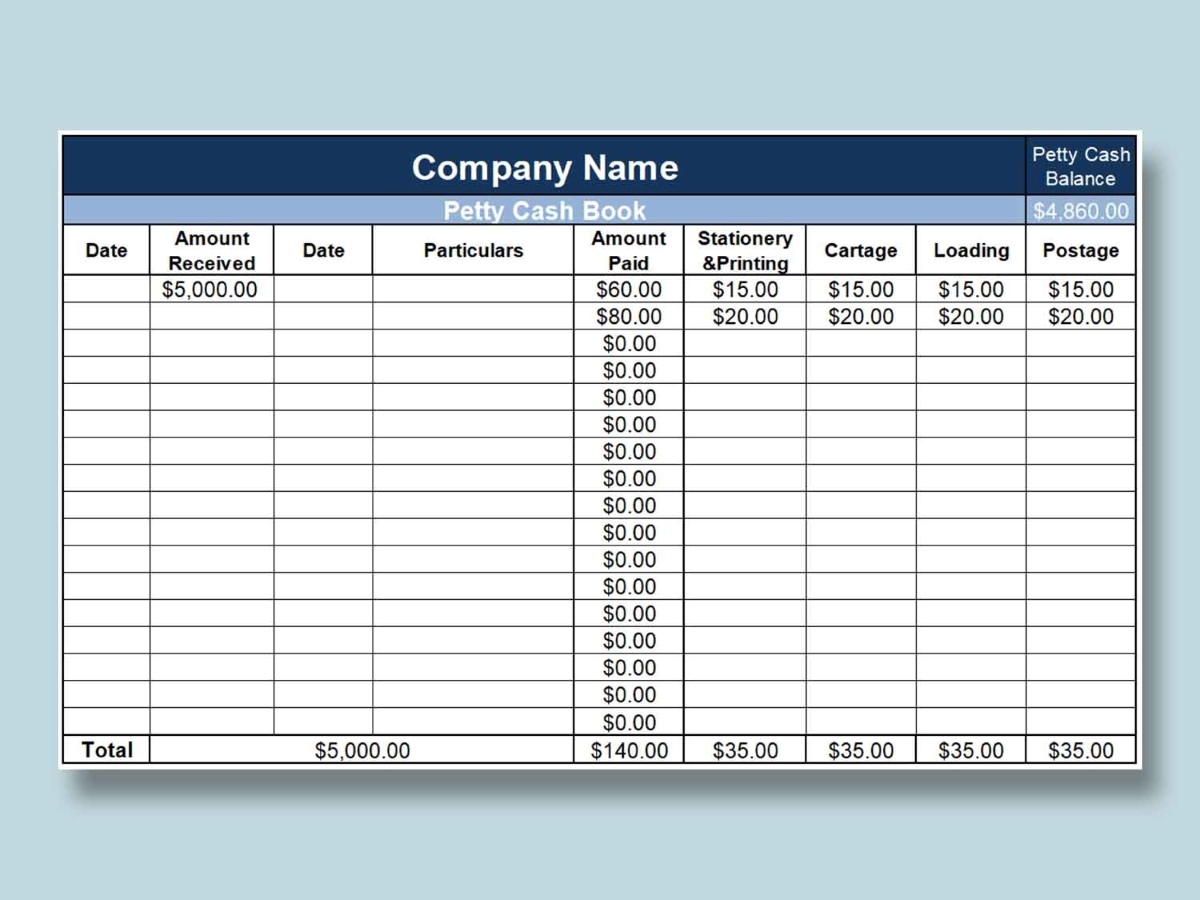

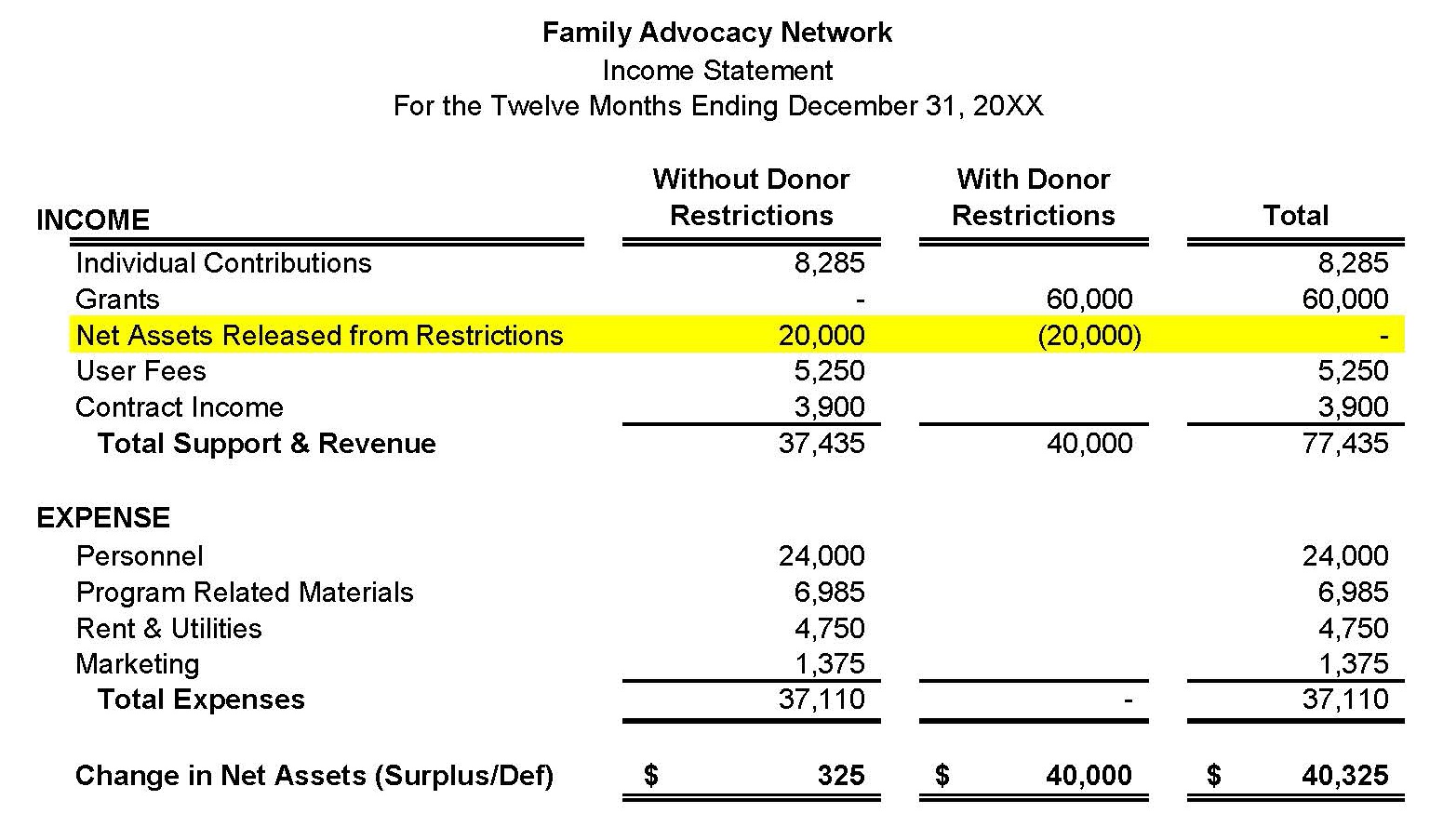

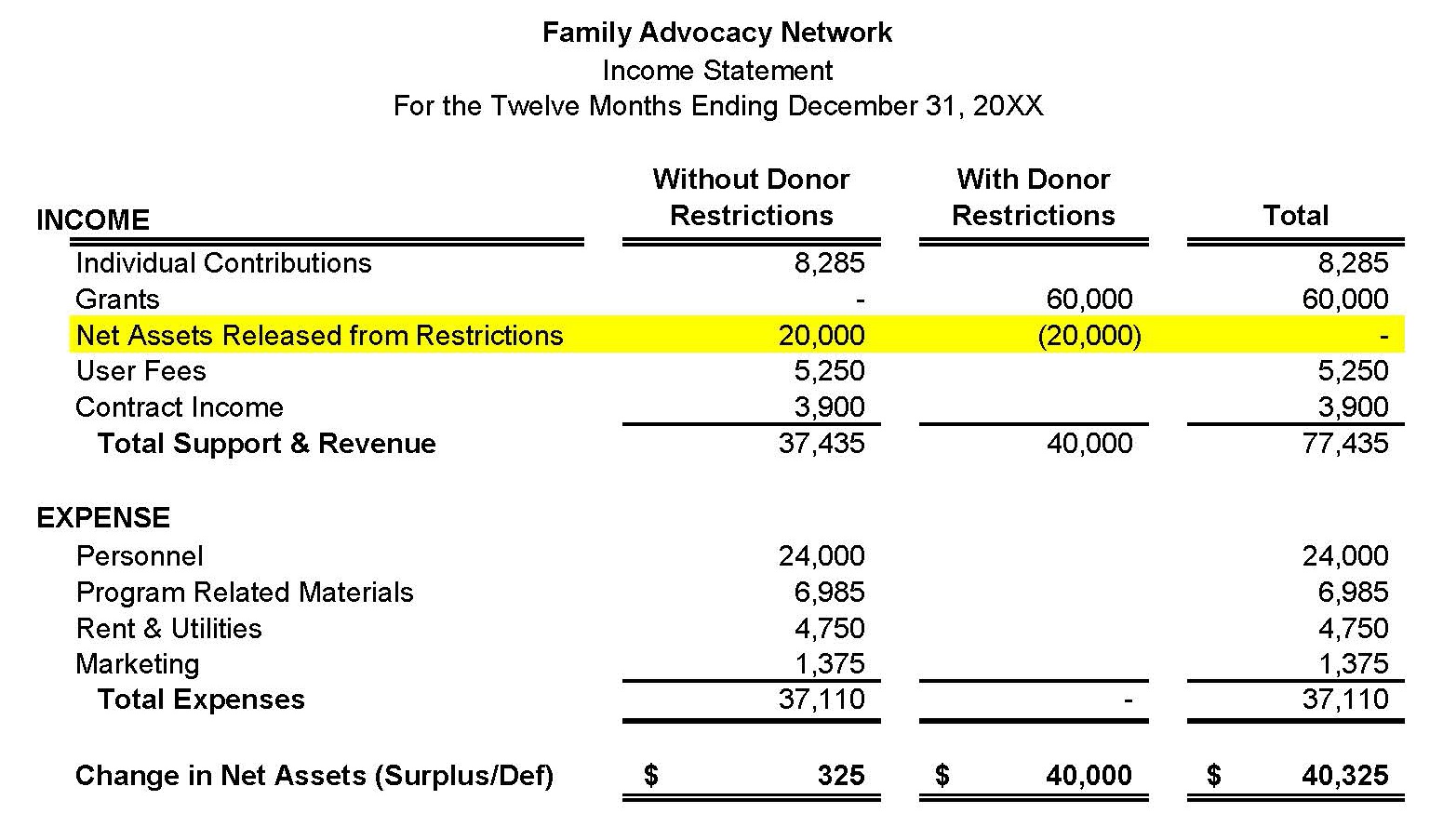

The presentation of restricted cash on the balance sheet is crucial to provide transparency and enable stakeholders to understand the availability and restrictions on a company’s cash resources. When preparing financial statements, companies must clearly distinguish between restricted cash and unrestricted cash to accurately reflect their financial position.

Typically, restricted cash is presented as a separate line item within the current assets section of the balance sheet. It is important to note that restricted cash should not be commingled with other cash balances, as this could lead to misleading financial reporting.

The restricted cash line item is usually labeled as “Restricted Cash” or “Cash and Cash Equivalents – Restricted”. Alongside the amount of restricted cash, the balance sheet should disclose details of the restrictions imposed on these funds, providing clarity to stakeholders.

Additionally, if there are different categories of restricted cash, such as escrow accounts, debt service reserves, or project-specific funds, companies may choose to provide further breakdowns within the restricted cash line item. This allows for better transparency and understanding of the nature and purpose of the restrictions.

It is worth mentioning that when restricted cash is presented on the balance sheet, the corresponding liability or obligation may also be disclosed in the liabilities section. For example, if there is restricted cash reserved for loan servicing, the corresponding debt may be disclosed as a liability.

Proper disclosure and presentation of restricted cash on the balance sheet are essential for stakeholders to make informed decisions. Investors, creditors, and other interested parties rely on this information to assess a company’s liquidity, solvency, and compliance with financial commitments.

Moreover, companies should provide sufficient details in the accompanying notes to the financial statements to explain the nature, terms, and impact of the restrictions on the restricted cash balances. This helps stakeholders understand the context and significance of the restricted cash and its implications for the overall financial picture.

By accurately presenting and disclosing restricted cash on the balance sheet, companies demonstrate transparency, meet accounting standards, and provide stakeholders with the necessary information to assess a company’s financial health and performance.

Disclosure Requirements for Restricted Cash

Disclosure requirements for restricted cash are essential for transparent financial reporting and ensuring that stakeholders have a clear understanding of a company’s cash resources and restrictions. These requirements help provide insights into the nature, terms, and impact of the restrictions on a company’s financial statements.

Here are some key disclosure requirements for restricted cash:

- Nature of Restrictions: Companies should disclose the nature of the restrictions imposed on the cash and the reasons behind them. This could include legal requirements, loan agreements, project funding, or compliance with industry regulations. The disclosure should clearly state the purpose and limitations of the restricted cash.

- Terms and Conditions: Companies should provide information about the terms and conditions associated with the restricted cash. This may include details about any contractual obligations, such as minimum balance requirements, withdrawal restrictions, or specific permitted uses. This information helps stakeholders understand the extent to which the restricted cash can be utilized.

- Duration of Restrictions: It is important to disclose the expected duration of the restrictions on the cash. This helps stakeholders assess the long-term impact on a company’s liquidity and financial flexibility. For example, if a cash reserve is held for a project that has a specific timeline, the duration of the restriction should be disclosed.

- Future Cash Flow Impact: Companies should disclose the potential impact of the restricted cash on their future cash flows. This may involve providing estimates or projections of cash inflows or outflows related to the restrictions. It allows stakeholders to assess the implications on a company’s ability to meet its financial obligations.

- Contingencies and Risks: If there are any contingencies or risks associated with the restricted cash, such as potential additional funding requirements or uncertainties surrounding legal proceedings, these should be disclosed. This provides stakeholders with a complete picture of the potential risks and uncertainties faced by the company.

It is important for companies to ensure that all disclosure requirements related to restricted cash are met in accordance with the applicable accounting standards and regulations, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

By providing detailed and comprehensive disclosures, companies can enhance transparency, build trust with stakeholders, and enable them to make informed decisions about the company’s financial position and future prospects. Compliance with disclosure requirements also helps demonstrate the company’s commitment to financial reporting integrity and regulatory compliance.

Importance of Monitoring Restricted Cash

Monitoring restricted cash is of utmost importance for companies to ensure compliance with restrictions, optimize cash utilization, and maintain financial stability. By actively monitoring restricted cash, businesses can make informed decisions regarding their financial resources and address any potential risks or issues that may arise.

Here are some key reasons highlighting the importance of monitoring restricted cash:

- Compliance: Restricted cash is subject to specific restrictions imposed by legal requirements, loan agreements, or other contractual obligations. By monitoring these restrictions, companies can ensure that they are in compliance with the terms and conditions associated with the restricted cash. Failure to comply with restrictions can lead to legal and financial consequences, such as breaches of contracts, fines, or reputational damage.

- Optimal Cash Utilization: Monitoring restricted cash allows companies to assess available cash resources and make informed decisions on how to allocate funds efficiently. By understanding the specific purposes and limitations of restricted cash, businesses can prioritize spending, manage liquidity levels, and avoid diverting restricted funds for unauthorized purposes.

- Liquidity Management: Monitoring restricted cash helps companies maintain a clear picture of their overall liquidity position. By understanding the amount of cash that is readily available for use versus the cash that is restricted, businesses can effectively plan for future cash needs, such as debt payments, capital expenditures, or funding of specific projects.

- Risk Mitigation: Regular monitoring of restricted cash allows businesses to identify any potential risks or issues that may impact the availability or usage of these funds. By staying proactive, companies can address these risks in a timely manner, such as renegotiating loan agreements, seeking legal advice, or adjusting financial plans, to mitigate potential disruptions to their operations or financial stability.

- Financial Reporting: Accurate and transparent financial reporting is essential for building trust with stakeholders. Monitoring restricted cash ensures that the information reported on the balance sheet and in financial statements is reliable and reflects the true financial position of the company. This helps stakeholders, including investors, creditors, and regulators, make informed decisions based on accurate and up-to-date information.

Regular monitoring of restricted cash allows companies to maintain control over their financial resources, mitigate risks, and ensure compliance with legal and contractual obligations. It enables businesses to optimize cash utilization, enhance liquidity management, and maintain a solid financial position. Additionally, effective monitoring contributes to reliable and transparent financial reporting, fostering trust and confidence among stakeholders.

Conclusion

Understanding restricted cash and its implications on the balance sheet is crucial for individuals and businesses alike. Restricted cash represents funds that are subject to specific restrictions, often due to legal, contractual, or regulatory requirements. By segregating restricted cash from unrestricted cash on the balance sheet, companies can provide transparency and accurately reflect their financial position.

In this comprehensive guide, we explored the definition of restricted cash, its purpose, examples, and the presentation of restricted cash on the balance sheet. We also discussed the disclosure requirements for restricted cash and highlighted the importance of monitoring these funds.

From escrow accounts to debt service reserves, restricted cash takes various forms and serves specific purposes. Properly presenting and disclosing restricted cash on the balance sheet is essential for stakeholders to make informed decisions and understand a company’s financial health. Compliance with disclosure requirements ensures transparency and regulatory compliance, enhancing trust between companies and stakeholders.

Monitoring restricted cash is vital for businesses as it enables compliance with restrictions, optimal cash utilization, liquidity management, risk mitigation, and reliable financial reporting. By regularly monitoring and managing restricted cash, companies can maintain control over their financial resources, mitigate risks, and make informed decisions regarding their cash utilization.

In conclusion, understanding and effectively managing restricted cash are essential components of financial management. By adhering to disclosure requirements, accurately presenting restricted cash on the balance sheet, and monitoring these funds, companies can enhance their financial stability and maintain transparent financial reporting to ensure the trust and confidence of stakeholders.