Home>Finance>Restrictive Covenants: Definition, How They Work, And Examples

Finance

Restrictive Covenants: Definition, How They Work, And Examples

Published: January 19, 2024

Learn about restrictive covenants in finance, including their definition, how they work, and explore real-life examples. Understand the impact of these legal agreements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Restrictive Covenants in Finance

When it comes to the world of finance, there are many legal terms and concepts that may seem complicated and confusing. One such concept is restrictive covenants. In this article, we will break down what restrictive covenants are, how they work, and provide some examples to help you understand their importance in the financial industry.

Key Takeaways

- Restrictive covenants are legal restrictions placed on borrowers by lenders to protect their interests and minimize risk.

- These covenants can include financial ratios, limitations on business activities, and restrictions on borrowing additional funds.

What Are Restrictive Covenants?

Restrictive covenants, also known as loan covenants or debt covenants, are terms and conditions agreed upon between a borrower and a lender. These covenants are included in loan agreements or bond indentures to protect the lender’s interests and minimize their risk.

Think of them as rules that borrowers must follow during the term of their loan agreement. These rules are designed to ensure that borrowers maintain certain financial and operational performance levels, as well as limit their ability to take actions that may negatively impact the lender’s position.

How Do Restrictive Covenants Work?

Restrictive covenants work by setting specific limitations and requirements for borrowers. If a borrower fails to meet these requirements or violates the terms of the covenants, they may be in default of their loan agreement. This can result in various consequences, such as increased interest rates, penalties, or even acceleration of the loan repayment.

Here are some common types of restrictive covenants and how they work:

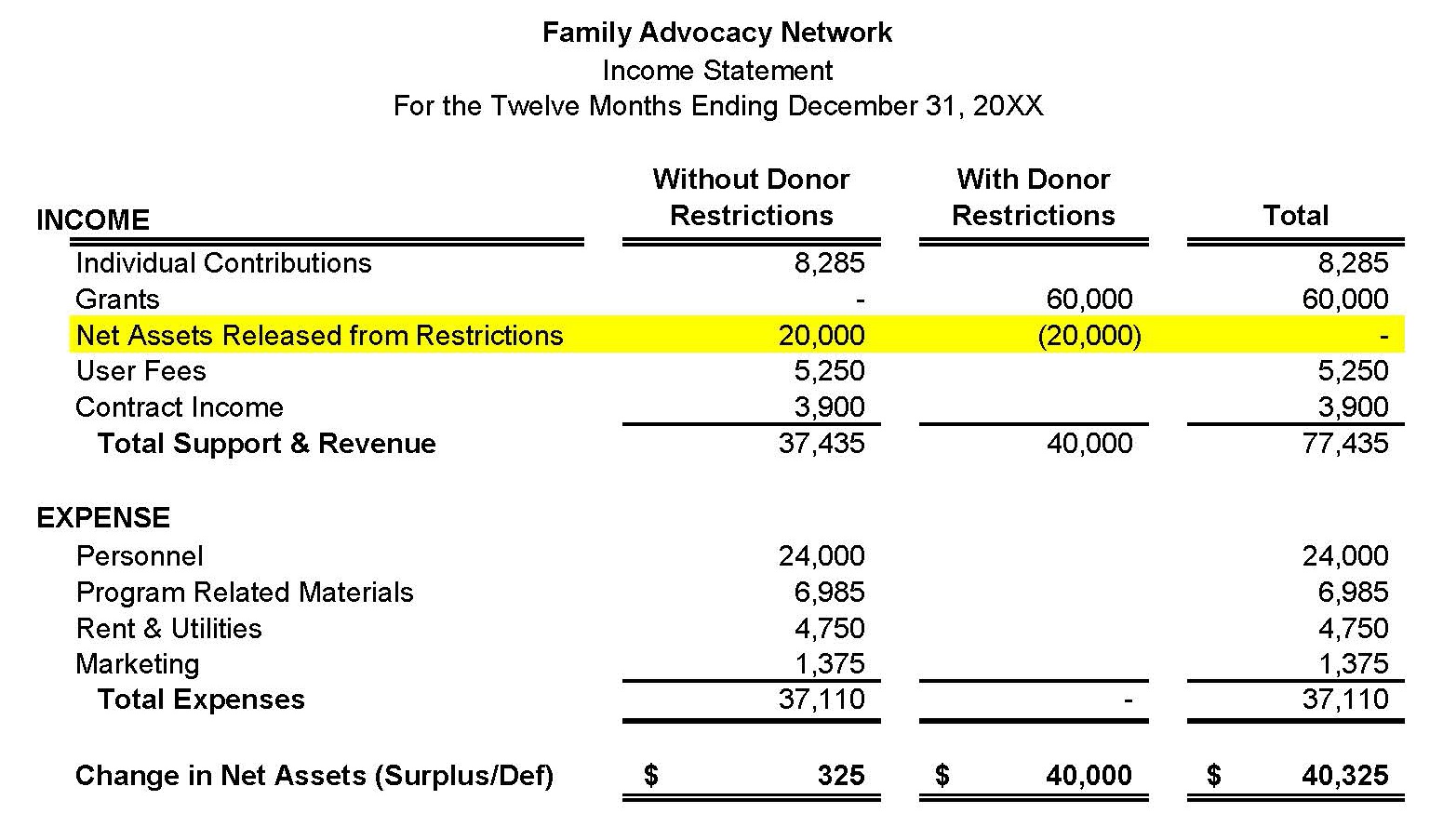

- Financial Covenants: These covenants focus on the borrower’s financial health and require them to maintain certain financial ratios or meet specific financial targets. Examples include maintaining a minimum debt-to-equity ratio, a maximum leverage ratio, or a minimum level of liquidity.

- Operational Covenants: These covenants restrict certain business activities of the borrower. For example, they may limit the borrower’s ability to sell major assets, enter into partnerships or joint ventures, or make significant changes to their business operations without the lender’s approval.

- Change of Control Covenants: These covenants come into play when there is a change in ownership or control of the borrower’s business. They may require the new owners to assume the obligations of the loan agreement or receive the lender’s consent before transferring ownership.

Examples of Restrictive Covenants

Here are a few examples that demonstrate how restrictive covenants can be applied in different financial situations:

- A company may be required to maintain a minimum earnings before interest, taxes, depreciation, and amortization (EBITDA) to ensure it remains financially viable.

- A real estate developer may be prohibited from selling a portion of their property without the lender’s consent to protect the value of the collateral.

- A borrower may be restricted from incurring additional debt or issuing new securities to prevent overleveraging and ensure the lender’s position is not compromised.

These examples highlight the diverse nature of restrictive covenants and how they can vary based on the type of loan, industry, and specific agreement between the borrower and lender.

Conclusion

Restrictive covenants play a crucial role in the financial industry by protecting lenders’ interests and minimizing risk. They are designed to ensure that borrowers maintain certain financial and operational standards, as well as limit their ability to take actions that may negatively impact the lender’s position. By understanding these covenants and their implications, borrowers can navigate the world of finance more effectively and make informed decisions regarding their obligations.