Home>Finance>Retail Investor: Definition, What They Do, And Market Impact

Finance

Retail Investor: Definition, What They Do, And Market Impact

Published: January 19, 2024

Learn about retail investors in finance and their impact on the market. Discover the definition and what they do to make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Retail Investor?

When it comes to investing, most people are familiar with large institutional investors like hedge funds, pension funds, and mutual funds. But there is another group of investors that make up a significant portion of the market – retail investors. In this blog post, we will explore what retail investors are, what they do, and the impact they have on the overall market.

Key Takeaways:

- Retail investors are individual investors who buy and sell securities for their personal accounts, rather than on behalf of an institution.

- They typically have smaller investment portfolios and less capital compared to institutional investors.

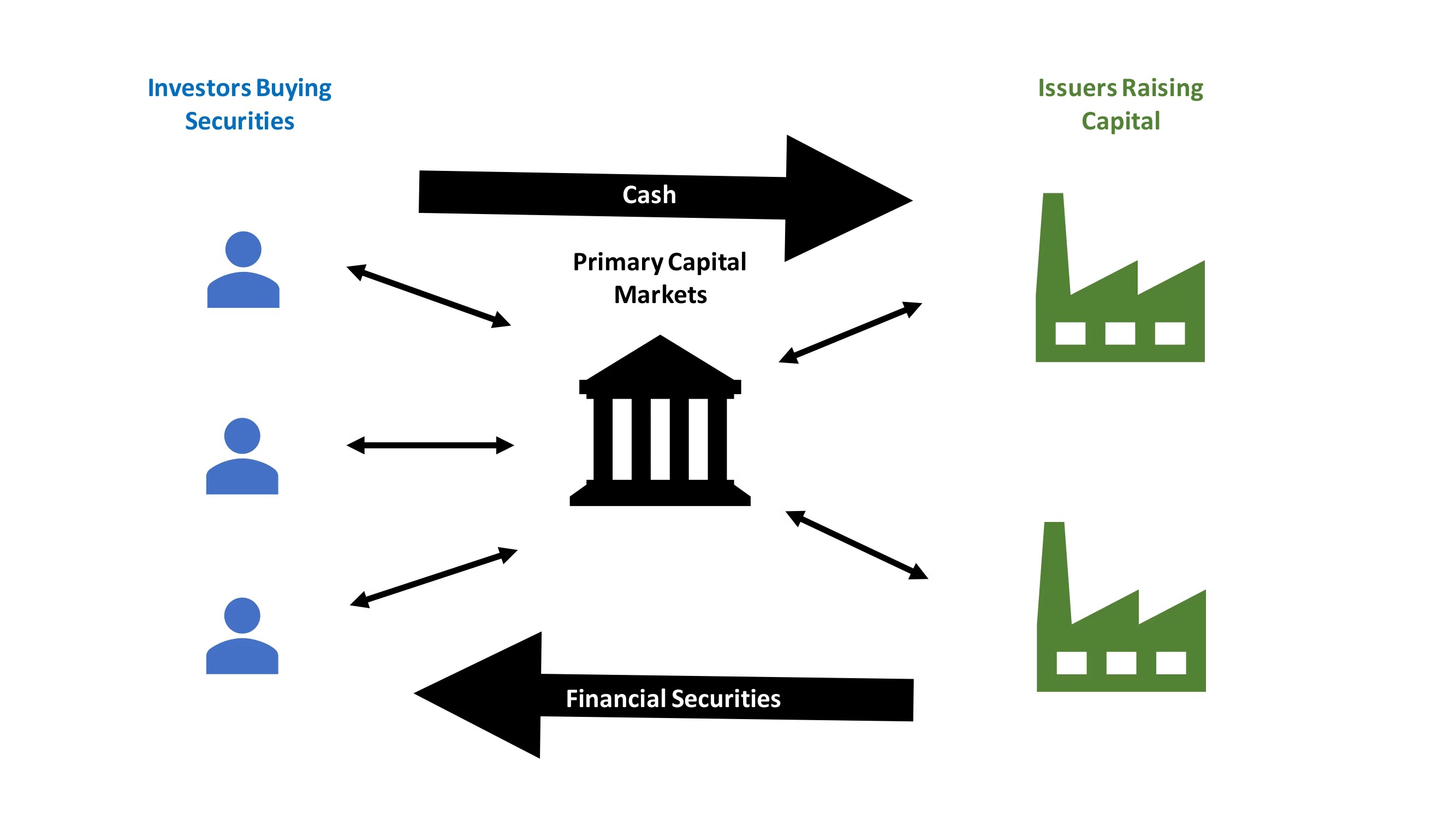

So, what exactly is a retail investor? In simple terms, a retail investor is an individual who buys and sells financial securities, such as stocks, bonds, or mutual funds, for their personal investment portfolio. Unlike institutional investors, who invest on behalf of organizations or funds, retail investors invest their own money.

Retail investors can range from novice investors just starting out to experienced individuals who actively manage their portfolios. They may invest through various channels, such as online trading platforms, traditional brokerage firms, or financial advisors.

What Do Retail Investors Do?

Retail investors engage in a wide range of investment strategies, depending on their goals, risk tolerance, and financial knowledge. Some common activities that retail investors participate in include:

- Stock trading: Retail investors often buy and sell individual stocks, either based on their own research or through recommendations from financial experts.

- Mutual fund investments: Many retail investors prefer to invest in mutual funds, which allow them to diversify their portfolios by pooling their money with other investors.

- ETFs: Exchange-Traded Funds (ETFs) have become increasingly popular among retail investors, as they offer exposure to diverse portfolios of stocks or other assets.

- Retirement planning: Retail investors commonly invest in retirement accounts like IRAs or 401(k)s to secure their financial future.

- Online trading platforms: With the rise of technology, retail investors now have access to online trading platforms, making it easier for them to trade and manage their investments.

The Market Impact of Retail Investors

While retail investors may not have as much capital as institutional investors, their collective actions can still have a significant impact on the market. Here are a few ways retail investors can influence the market:

- Market trends: Retail investors’ buying and selling patterns can drive trends in the stock market, impacting prices and market sentiment.

- Increased liquidity: Retail investors contribute to the liquidity of the market by actively buying and selling securities.

- Initial Public Offerings (IPOs): Retail investors often participate in IPOs, which can create a demand for new stocks and potentially drive up prices.

- Market volatility: Retail investors’ reactions to market events or news can sometimes contribute to market volatility.

In conclusion, retail investors play a vital role in the financial markets. Their ability to participate in various investment opportunities and contribute to market trends should not be underestimated. While their individual impact may be less consequential than that of large institutional investors, it is important to recognize their influence and understand how it shapes the financial landscape.

So, whether you are a retail investor yourself or just curious about the world of finance, understanding the role of retail investors is crucial for comprehending market dynamics and trends.