Home>Finance>Secondary Mortgage Market: Definition, Purpose, And Example

Finance

Secondary Mortgage Market: Definition, Purpose, And Example

Published: January 25, 2024

Learn about the secondary mortgage market in finance, including its definition, purpose, and example. Understand how it impacts the overall mortgage industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Secondary Mortgage Market: Definition, Purpose, and Example

Welcome to our “FINANCE” category, where we explore various aspects of the financial world. In today’s blog post, we will dive into the secondary mortgage market, an essential component of the real estate and finance industries. If you’ve ever wondered about the role of this market in the mortgage industry, the purpose it serves, and how it works, you’ve come to the right place.

Key Takeaways:

- The secondary mortgage market allows lenders to sell mortgage loans to investors, freeing up capital for further lending.

- Investors in the secondary mortgage market can earn profit through interest payments and the potential resale of mortgage-backed securities.

Before we delve into the details, let’s first define what the secondary mortgage market is. The secondary mortgage market refers to the buying and selling of existing mortgage loans on a secondary market platform, such as mortgage-backed securities (MBS) or whole loan sales, where lenders sell their loans to investors or other financial institutions. This market provides liquidity, efficiency, and stability to the mortgage industry.

Now, you might wonder why the secondary mortgage market exists and what purpose it serves. Here are some key reasons:

- Liquidity: The secondary mortgage market allows lenders to quickly convert their mortgage loans into cash by selling them to investors. This helps to free up capital for further lending, enabling lenders to provide more mortgages to potential homebuyers.

- Risk Mitigation: By selling mortgages on the secondary market, lenders can transfer the risk associated with default and interest rate fluctuations to investors. This helps lenders manage their risk exposure and maintain a healthy balance sheet.

- Lower Interest Rates: The secondary mortgage market plays a significant role in influencing interest rates for borrowers. When investors purchase mortgage-backed securities, they contribute funds to the mortgage market, increasing the available capital and helping to lower interest rates for borrowers.

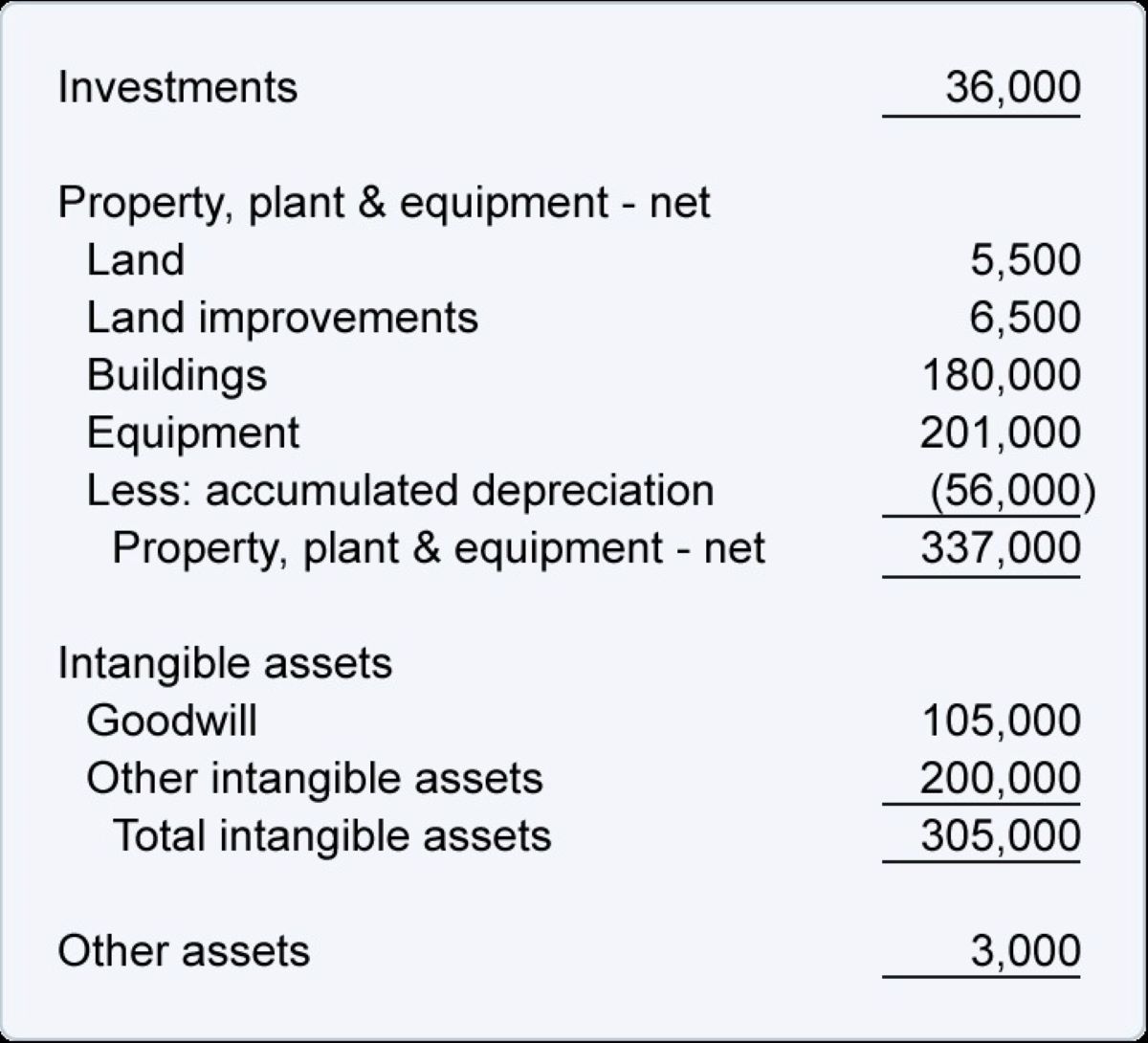

Now, let’s explore an example of how the secondary mortgage market works in practice. Imagine a bank that originates mortgages for homebuyers. Instead of holding all these loans on its balance sheet, the bank decides to sell them on the secondary market. It packages a group of mortgage loans into a mortgage-backed security (MBS) and sells it to investors.

The investors who buy this MBS become the new mortgage lenders, receiving interest payments from the homeowners in return. By purchasing these securities, investors gain exposure to the real estate market and earn profit through interest payments and the potential resale of the MBS.

Keep in mind that the secondary mortgage market isn’t limited to institutional investors. Mortgage loans can also be sold to government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, which play a significant role in the mortgage market by purchasing and securitizing mortgages.

In conclusion, the secondary mortgage market plays a vital role in the mortgage industry, providing liquidity, risk mitigation, and lower interest rates for borrowers. By allowing lenders to sell mortgage loans to investors, it enables financial institutions to free up capital and promote further lending, benefiting both lenders and borrowers alike.

Stay tuned for more insightful articles on a wide range of finance-related topics in our “FINANCE” category!