Home>Finance>Insurance Premium Defined, How It’s Calculated, And Types

Finance

Insurance Premium Defined, How It’s Calculated, And Types

Published: December 10, 2023

Learn about insurance premiums, how they are calculated, and the various types available in the finance industry. Discover the key factors influencing insurance costs and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Insurance Premium: How It’s Calculated and Different Types

Welcome to our finance blog, where we delve into the intricate world of insurance premiums. At some point in our lives, most of us will need insurance coverage, whether it’s for our car, home, or ourselves. But have you ever wondered how insurance premiums are calculated or what factors contribute to the sticker price of your coverage? In this blog post, we’ll explore the concept of insurance premiums, how they are determined, and the various types of coverage available, so you can make informed decisions when it comes to protecting yourself and your assets.

Key Takeaways:

- Insurance premiums are the amount of money you pay to an insurance company in exchange for coverage.

- Premiums are calculated using various factors, such as the type of coverage, your risk profile, and the likelihood of you making a claim.

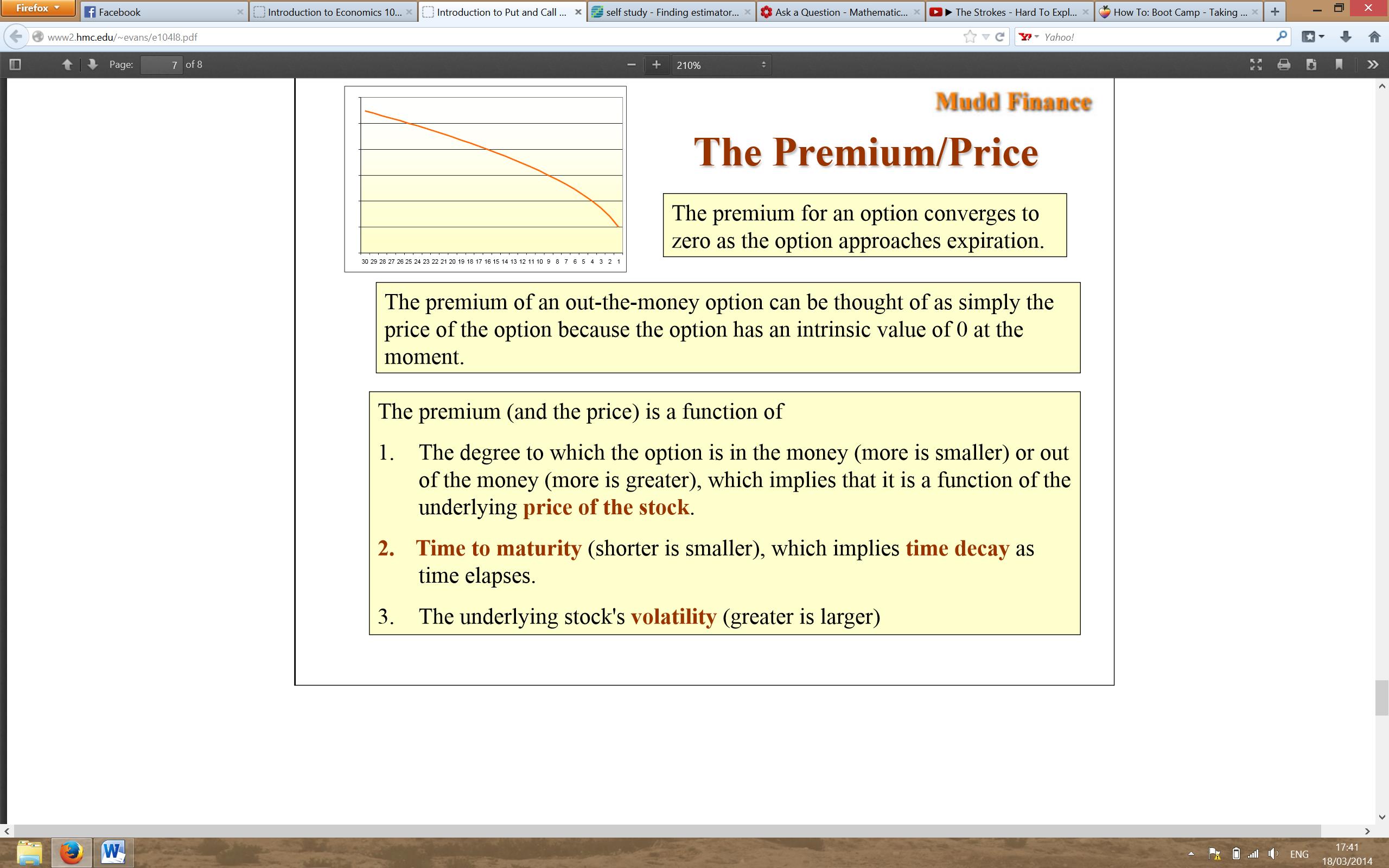

So, what exactly is an insurance premium? In simple terms, it’s the price you pay for the peace of mind that comes with knowing your assets are protected. Insurance companies use a complex formula to calculate premiums, taking into account several key factors. Let’s take a closer look at some of these variables:

Type of Coverage:

The type of coverage you choose plays a significant role in determining your insurance premium. Different types of insurance, such as auto, home, health, or life insurance, come with their own risk factors and coverage options. For example, comprehensive auto insurance that covers theft, damage, and even roadside assistance, will likely have a higher premium than basic liability coverage. It’s important to assess your needs and choose a coverage option that balances protection with affordability.

Risk Profile:

Insurance companies assess your risk profile to determine the likelihood of you making a claim. Factors such as your age, location, driving record, credit score, and health history are taken into consideration. Individuals with a high risk profile, such as young drivers or those living in areas prone to natural disasters, may face more expensive premiums. Maintaining a good driving record, practicing good health habits, and improving your credit score can help lower your insurance costs over time.

Claim History:

Your past claim history can impact your insurance premium as well. If you have made several claims in the past, especially for high-value items or incidents that were your fault, insurers may perceive you as a higher risk and charge higher premiums. On the other hand, individuals with a clean claims history may be eligible for discounts or lower premiums due to their lower perceived risk.

Types of Insurance Premiums:

Insurance premiums can be further categorized into two main types:

- Annual Premiums: An annual premium is paid once a year, typically upfront or in monthly installments. This type of premium is commonly used for long-term policies, such as home or life insurance.

- Monthly Premiums: Monthly premiums are paid on a monthly basis and are often used for shorter-term policies, such as auto insurance. These premiums may require less of a financial commitment upfront but can add up over time.

Conclusion:

Understanding insurance premiums and how they are calculated is crucial when it comes to choosing the right coverage and managing your financial responsibilities. By considering factors such as the type of coverage, your risk profile, and your claim history, you can make informed decisions and potentially save money on premiums. Remember, it’s essential to review your insurance needs regularly and shop around for the best coverage options to ensure you’re getting the most value for your hard-earned money.