Home>Finance>T-Account: Definition, Example, Recording, And Benefits

Finance

T-Account: Definition, Example, Recording, And Benefits

Published: February 5, 2024

Learn how to define, record, and benefit from T-Accounts in finance with clear examples and explanations. Master the art of tracking financial transactions effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

T-Account: Definition, Example, Recording, and Benefits

Welcome to our Finance category, where we dive deep into various aspects of financial management to provide valuable insights for businesses and individuals alike. In this blog post, we will explore the concept of a T-Account – a fundamental tool used in bookkeeping and accounting. We’ll cover its definition, provide an example, discuss how to record transactions using T-Accounts, and highlight the benefits of using this accounting method. So, let’s get started!

Key Takeaways:

- A T-Account is a visual representation of a general ledger account, consisting of two columns resembling the letter “T”.

- It helps in understanding the flow of transactions, analyzing balances, and preparing financial statements.

What is a T-Account?

A T-Account is a financial tool used to record and track account transactions in a simplified and organized manner. It gets its name from its visual structure, resembling the letter “T”. The account title is usually written above the “T,” and transactions are recorded on the left and right sides of the vertical line.

To understand the concept better, imagine that you have a business and want to track the cash flow in your bank account. You would create a T-Account with the account title “Bank.” On the left side of the “T,” you record the inflows (e.g., deposits, interest received), while on the right side, you record the outflows (e.g., withdrawals, bank charges).

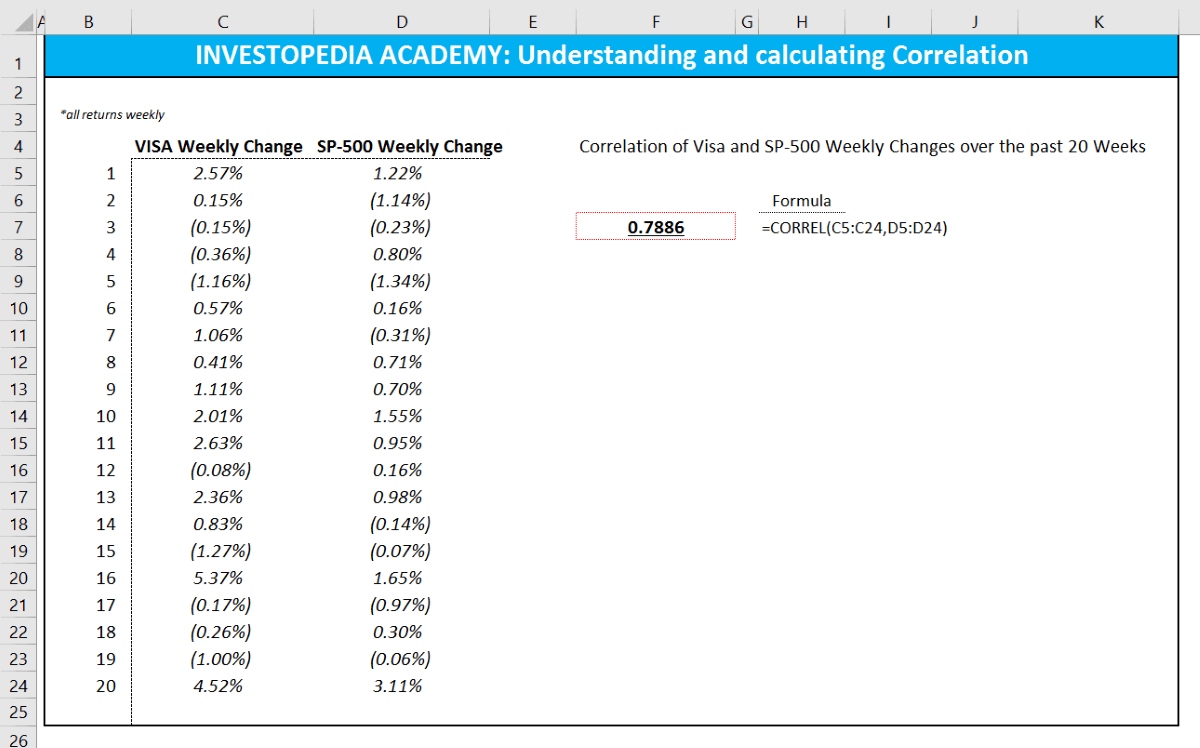

Recording Transactions using T-Accounts:

Using T-Accounts to record transactions is relatively straightforward. Here’s a step-by-step approach:

- Identify the accounts – Determine which accounts are affected by the transaction. For example, a cash sale would involve the “Cash” and “Revenue” accounts.

- Decide the direction of the transaction – Determine whether the transaction increases or decreases each relevant account. In the case of a cash sale, “Cash” would increase, while “Revenue” would increase as well.

- Record the transaction – Draw a T-Account for each affected account. Write the account title above the “T” and label the left side as “Debit” and the right side as “Credit.” Record the transaction by entering the appropriate amounts on the respective sides of the T-Accounts.

- Calculate balances – Total the Debit and Credit columns for each account and calculate their balances. The difference between the Debit and Credit sides represents the account balance.

By following these steps consistently, you can track all financial activities accurately and ensure that the books remain balanced.

Benefits of Using T-Accounts:

Now that we understand how T-Accounts work, let’s explore some of the benefits they offer:

- Visual representation – T-Accounts provide a clear and visual representation of transactions, making it easier to understand the flow of money and account balances.

- Identification of errors – T-Accounts can help identify errors or imbalances in the books by ensuring that the total Debit and Credit amounts are equal for each account.

- Preparation of financial statements – The information recorded in T-Accounts serves as a foundation for preparing financial statements, such as the balance sheet and income statement.

- Analysis and decision-making – T-Accounts allow for easy analysis of accounts and can help businesses make informed decisions based on financial data.

With these benefits, T-Accounts prove to be a valuable tool in the world of accounting and bookkeeping.

So, the next time you encounter a financial transaction, consider employing T-Accounts to record and track your accounts. The simplicity and effectiveness of this method will help you gain a better understanding of your financial position and make well-informed decisions for your business.