Home>Finance>Paid-Up Capital: Definition, How It Works, And Importance

Finance

Paid-Up Capital: Definition, How It Works, And Importance

Published: January 5, 2024

Learn about the definition, working, and significance of paid-up capital in finance. Understand its role in business financing and corporate governance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Paid-Up Capital: What It Means and Why It Matters

When it comes to managing your finances, there are many terms and concepts that may seem confusing at first. One such term is “paid-up capital.” In this article, we will break down the definition of paid-up capital, explain how it works, and discuss its importance for businesses and investors.

Key Takeaways:

- Paid-up capital refers to the total amount of money that investors have contributed to a company in exchange for shares.

- It plays a crucial role in determining a company’s financial strength and legal requirements.

What is Paid-Up Capital?

Paid-up capital, also known as paid-in capital, is a financial term that refers to the total amount of money that investors have contributed to a company in exchange for shares. It represents the actual funds that a company has received from its shareholders.

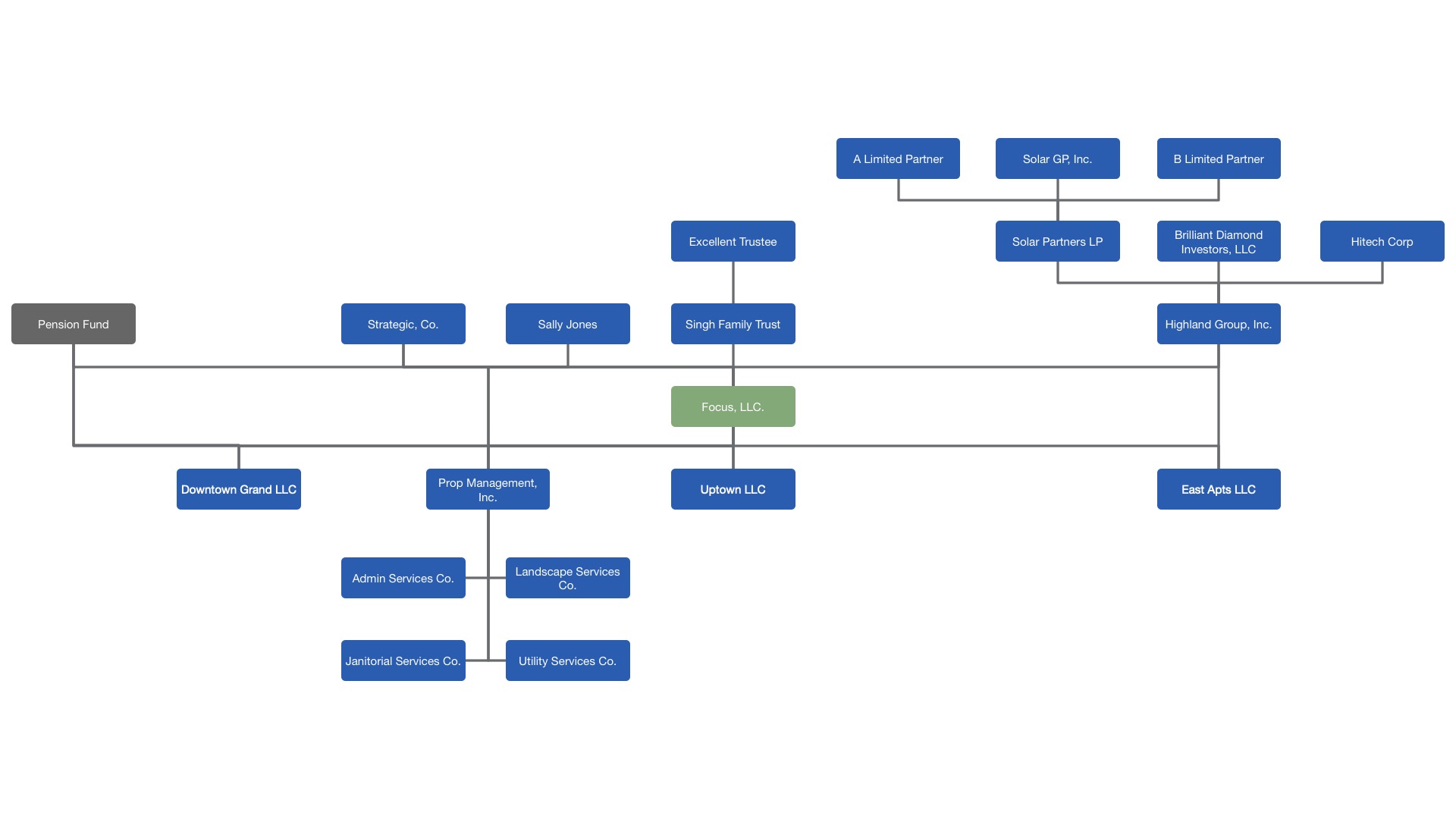

When a company is formed, it issues shares to individuals or entities who invest money in the business. The investors become shareholders and the money they contribute becomes the company’s paid-up capital. This capital is used by the company to finance its operations, purchase assets, or invest in growth opportunities.

How Does Paid-Up Capital Work?

When investors contribute funds to a company, they can do so in different ways. They may provide cash, assets, or services, all of which can be valued and added to the company’s paid-up capital.

Paid-up capital is typically represented in the company’s balance sheet and is an essential component in determining its financial health. It indicates the initial investment made by shareholders and can give insight into the company’s ability to meet financial obligations or secure additional funding.

In some cases, companies may also issue additional shares and raise more capital after their initial formation. This can be done through public offerings or private placements. When new shares are issued, the paid-up capital figure increases accordingly.

The Importance of Paid-Up Capital

Paid-up capital holds significant importance for both businesses and investors. Here’s why:

- Financial Strength: The paid-up capital amount provides a measure of financial stability for a company. A higher paid-up capital indicates that the company has more resources at its disposal to handle unexpected expenses, repay debts, and fund growth.

- Legal Requirements: Paid-up capital plays a vital role in complying with regulatory and legal requirements. In many jurisdictions, companies are required to have a minimum paid-up capital amount when incorporating. This ensures that businesses have a solid financial base before they start operating.

Investors also consider the level of paid-up capital when evaluating a company’s potential. A higher paid-up capital can signal investor confidence, making the company more attractive for future investments.

In Conclusion

Paid-up capital is an essential financial concept that represents the total amount of money that investors have contributed to a company in exchange for shares. It provides insights into a company’s financial strength and plays a crucial role in meeting legal requirements. Understanding paid-up capital is key for business owners and investors alike, as it can help in making informed decisions and assessing the financial health of a company.

For more insightful articles on finance and other related topics, be sure to explore our Finance category.