Home>Finance>Terminal Value (TV) Definition And How To Find The Value (With Formula)

Finance

Terminal Value (TV) Definition And How To Find The Value (With Formula)

Published: February 7, 2024

Learn the definition of Terminal Value (TV) in finance and discover how to calculate its value with the formula. Gain insight into this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Terminal Value (TV) and How to Find Its Value

When it comes to financial analysis, one of the key factors that investors and analysts consider is the terminal value (TV) of an investment. But what exactly is terminal value and how can you determine its value? In this blog post, we will explore the definition of terminal value and provide you with a step-by-step guide on how to calculate it using a simple formula.

Key Takeaways:

- Terminal value is the estimated value of an investment at the end of a specific time period.

- It is used to account for the future cash flows beyond the explicit forecast period.

So, what exactly is terminal value?

Terminal value is a critical concept in finance that represents the estimated value of an investment at the end of a specified period. It captures the future cash flows that are expected to be generated beyond the explicit forecast period. In simpler terms, it is the value of an investment after the projected growth has stabilized.

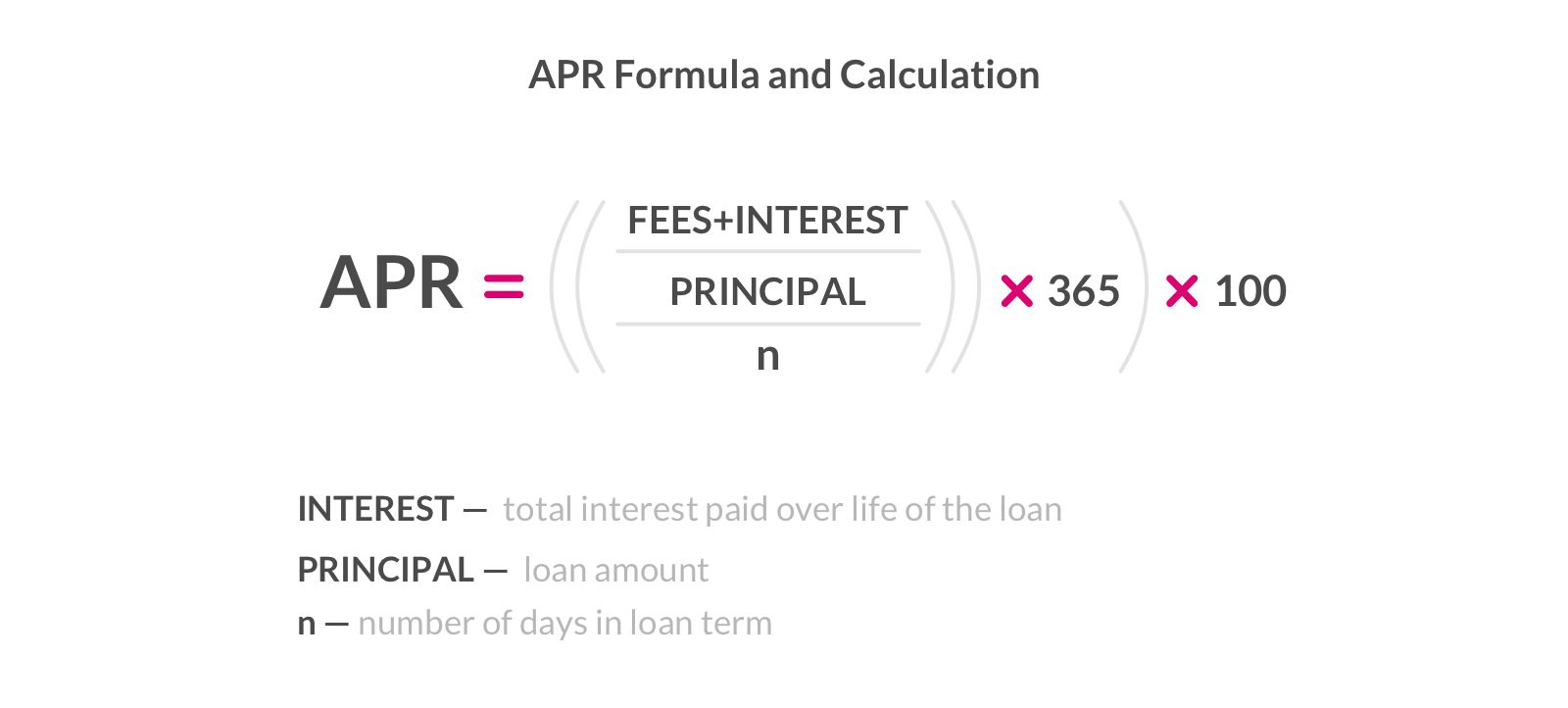

There are several methods to calculate terminal value, but one commonly used formula is the Gordon Growth Model. This model assumes that the investment will grow at a constant rate indefinitely. The formula is as follows:

Terminal Value = Cash Flow in the final year * (1 + Growth Rate) / (Discount Rate – Growth Rate)

Let’s break down the components of this formula:

- Cash Flow in the final year: This refers to the expected cash flow generated by the investment in the final year of the projection period.

- Growth Rate: It represents the projected growth rate beyond the explicit forecast period. This rate is typically based on historical data or industry benchmarks.

- Discount Rate: Also known as the required rate of return or the discount rate, it reflects the investor’s expected return on the investment. This rate takes into account the risk associated with the investment.

Now that we understand the formula, let’s go through an example to illustrate how to calculate terminal value:

Example:

Imagine you are a financial analyst evaluating a company’s investment opportunity. The cash flow in the final year is projected to be $500,000. The growth rate is estimated at 3%, and the discount rate is 8%. Using the formula mentioned earlier, we can calculate the terminal value as follows:

Terminal Value = $500,000 * (1 + 0.03) / (0.08 – 0.03) = $500,000 * 1.03 / 0.05 = $10,300,000

So, the terminal value of the investment in this example is $10,300,000.

Key Takeaways:

- Terminal value is crucial in financial analysis as it accounts for the future cash flows beyond the explicit forecast period.

- The Gordon Growth Model is one commonly used formula to calculate terminal value.

In conclusion

Understanding terminal value and how to calculate it can significantly impact your investment decisions. By incorporating terminal value into your financial analysis, you can better assess the long-term potential of an investment and make more informed decisions. Remember to consider industry-specific factors, future growth prospects, and the appropriate discount rate when calculating the terminal value. Now armed with this knowledge, you can apply the formula and make more accurate projections in your financial analysis.