Finance

How To Find Market Value Capital Structure

Modified: December 30, 2023

Learn how to find the market value capital structure in finance. Gain insight into determining the optimal mix of debt and equity for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Market Value Capital Structure

- Factors Affecting Market Value Capital Structure

- Analyzing Market Value Capital Structure

- Methods to Determine Market Value Capital Structure

- Importance of Finding Market Value Capital Structure

- Challenges in Finding Market Value Capital Structure

- Case Studies on Finding Market Value Capital Structure

- Conclusion

Introduction

Understanding and determining the market value capital structure is crucial for businesses in the finance industry. The market value capital structure refers to the mix of debt and equity that a company uses to finance its operations and investments, and it plays a significant role in determining the overall value of a business.

Knowing the market value capital structure is essential for various reasons. Firstly, it helps businesses assess their financial position and make informed decisions regarding their financing options. Additionally, it provides valuable insights for investors, creditors, and other stakeholders who analyze a company’s capital structure to evaluate its risk profile and potential returns.

The market value capital structure is influenced by several factors, including industry dynamics, the company’s growth prospects, and market conditions. Analyzing and identifying the optimal capital structure requires a comprehensive understanding of these factors and utilizing various techniques and models.

In this article, we will delve into the intricacies of finding the market value capital structure. We will explore the key factors that impact it, methods for analyzing and determining it, and the significance of knowing the market value capital structure for businesses. Furthermore, we will discuss the challenges that companies may face when attempting to determine their ideal capital structure and provide real-world case studies to illustrate these concepts.

By the end of this article, readers will have a comprehensive understanding of how to find the market value capital structure and the importance of this financial metric in assessing a company’s financial health and investment potential.

Understanding Market Value Capital Structure

The market value capital structure refers to the composition of a company’s financing sources, specifically the mix of debt and equity. It represents the proportion of a company’s total capitalization that comes from different sources and determines how a company finances its operations and investments.

Debt represents borrowed money that a company must repay over time, usually with interest. Equity, on the other hand, represents ownership in the company, typically in the form of shares of common stock. The market value capital structure is a reflection of a company’s financial risk and the distribution of ownership among shareholders.

A company’s capital structure may vary based on its industry, size, growth prospects, and financial objectives. Different businesses may have different optimal capital structures depending on their unique circumstances.

The market value capital structure directly impacts a company’s cost of capital and affects its overall profitability. The cost of debt is associated with interest payments, while the cost of equity is associated with expected returns for shareholders. A company’s capital structure determines the balance between these costs and influences the company’s weighted average cost of capital (WACC).

Understanding the market value capital structure is crucial because it enables companies to assess their financial stability and make informed decisions about capital allocation. It also helps investors and creditors evaluate the risk and return potential of a company. A company with a high proportion of debt may be at higher financial risk but could also provide higher returns. Alternatively, a company with a higher proportion of equity may have a lower risk profile but reduced profitability.

By analyzing and understanding the market value capital structure, businesses can optimize their financial structure, minimize costs, and increase the value of the company. It allows companies to evaluate the trade-offs between debt and equity financing and identify the most efficient combination for their specific goals and circumstances.

Factors Affecting Market Value Capital Structure

The market value capital structure of a company is influenced by various factors that shape the financing choices and decisions made by the management. Understanding these factors is crucial in determining the optimal mix of debt and equity for a business. Here are some key factors that affect market value capital structure:

- Business Risk: The level of risk associated with a company’s operations plays a significant role in determining its capital structure. Companies with stable and predictable cash flows may be more inclined to use debt financing, while those operating in volatile industries may prefer a higher proportion of equity to mitigate risk.

- Financial Risk: Financial risk refers to a company’s ability to meet its debt obligations. Businesses with higher levels of debt face increased financial risk, especially if they have insufficient cash flow or limited access to credit. Therefore, the financial risk profile of a company impacts its capital structure decisions.

- Growth Prospects: The growth prospects of a company influence its capital structure choices. Companies with high growth potential may opt for equity financing to fund expansion, as it allows them to retain control and avoid the burden of debt repayments. Conversely, companies with stable or slow growth may lean towards debt financing to take advantage of tax benefits and lower interest rates.

- Industry Norms: The capital structure of a company is often influenced by industry-wide norms and practices. Different industries may have different levels of leverage and acceptable debt ratios. Companies operating within a specific industry may align their capital structure with industry benchmarks to maintain competitiveness and investor confidence.

- Tax Considerations: Tax implications significantly affect the choice between debt and equity financing. Interest payments on debt are generally tax-deductible, which can provide tax advantages for leveraged companies. In contrast, dividends on equity are not tax-deductible, making equity financing less tax-efficient. Companies must consider the tax implications when positioning their capital structure.

These factors are not exhaustive, and there are other nuanced considerations that may influence a company’s market value capital structure decisions. It is essential for businesses to evaluate these factors in combination and assess their unique circumstances to determine the most suitable capital structure for long-term financial success.

Analyzing Market Value Capital Structure

Analyzing the market value capital structure allows companies to assess their current financial structure and determine if it aligns with their goals and objectives. It involves evaluating the mix of debt and equity, analyzing the cost of capital, and assessing the impact on the overall value of the company.

There are several key steps involved in analyzing the market value capital structure:

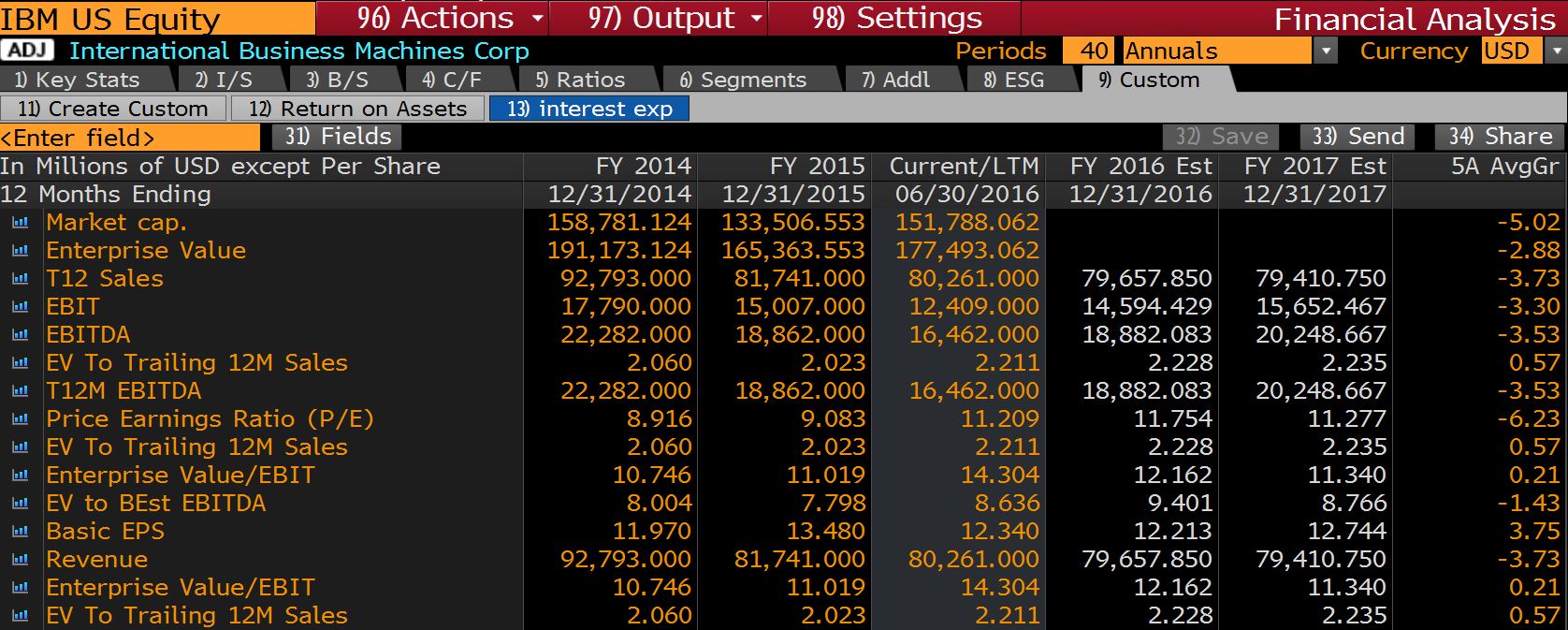

- Reviewing Financial Statements: Start by examining the company’s financial statements, including the balance sheet, income statement, and cash flow statement. These statements provide insights into the company’s existing capital structure and its financial health.

- Calculating Key Financial Ratios: Calculate important financial ratios that help evaluate the company’s capital structure, such as debt-to-equity ratio, equity ratio, and leverage ratio. These ratios provide an understanding of the company’s overall leverage and financial risk.

- Comparing to Industry Peers: Compare the company’s capital structure to those of its industry peers. This analysis helps determine if the company’s capital structure is in line with industry norms and whether adjustments need to be made.

- Evaluating WACC: Calculate the weighted average cost of capital (WACC), which represents the average cost of financing for the company. The WACC considers the cost of debt and equity and provides insights into the company’s overall cost of capital.

- Assessing Risk and Return: Evaluate the risks associated with the current capital structure and the potential returns it generates. Determine if the capital structure adequately balances risk and return and if adjustments could optimize the company’s financial position.

- Considering Long-Term Financing Strategies: Analyze the company’s long-term financing strategies, taking into account its growth plans, cash flow projections, and risk tolerance. Consider the potential benefits and drawbacks of different financing options and their impact on the market value capital structure.

By conducting a thorough analysis of the market value capital structure, companies can identify areas for improvement, assess the impact of changes in financing decisions, and optimize their financial structure for long-term growth and profitability.

Methods to Determine Market Value Capital Structure

Determining the market value capital structure involves utilizing various methods and approaches to assess the optimal mix of debt and equity for a company. These methods provide insights into the proportion of financing sources that can maximize the value of the business. Here are some commonly used methods to determine market value capital structure:

- Debt-to-Equity Ratio: The debt-to-equity ratio compares the total debt of a company to its total equity. A higher ratio indicates a larger proportion of debt in the capital structure. Companies can analyze historical data, industry benchmarks, and financial projections to determine an appropriate debt-to-equity ratio.

- Cost of Capital Analysis: Conducting a cost of capital analysis involves calculating the weighted average cost of capital (WACC), which considers the cost of both debt and equity. Companies evaluate different capital structure scenarios to determine the combination that minimizes the WACC and maximizes shareholder value.

- Modigliani-Miller Theorem: The Modigliani-Miller theorem states that in the absence of taxes and financial distress costs, the market value capital structure is irrelevant to the value of the firm. However, in real-world scenarios, this theoretical concept can serve as a benchmark for analyzing the impact of capital structure decisions on a company’s value.

- Comparable Company Analysis: This method involves benchmarking a company’s capital structure against its industry peers. By comparing key financial ratios and capital structure metrics, businesses can gain insights into market norms and make adjustments to align their capital structure effectively.

- Simulation Models: Utilizing simulation models allows companies to evaluate the impact of different financing decisions on their market value capital structure. These models consider variables such as interest rates, profitability, growth projections, and tax implications to simulate potential outcomes under different scenarios.

It is important to note that no single method is universally applicable or superior. Companies often use a combination of these techniques, considering their specific industry dynamics, financial goals, and risk tolerance. By using these methods, businesses can make informed decisions about their capital structure and optimize it to enhance financial performance and shareholder value.

Importance of Finding Market Value Capital Structure

Understanding and finding the market value capital structure is of utmost importance for businesses and investors alike. It provides valuable insights into a company’s financial health, risk profile, and long-term sustainability. Here are some key reasons why finding the market value capital structure is essential:

- Optimal Financing Mix: Determining the market value capital structure helps companies identify the optimal mix of debt and equity financing. It allows businesses to balance the benefits and costs associated with different funding sources and optimize their capital structure to minimize costs and maximize returns.

- Financial Stability: A well-structured capital mix supports a company’s financial stability. By finding the appropriate market value capital structure, businesses can ensure they have adequate financial resources to meet their obligations, fund growth initiatives, and navigate economic downturns effectively.

- Cost of Capital Management: The market value capital structure has a direct impact on a company’s cost of capital. By determining the optimal capital structure, businesses can minimize their cost of borrowing and equity financing, leading to lower overall costs and improved profitability.

- Investor Confidence: Investors and stakeholders closely examine a company’s capital structure when evaluating investment opportunities. A well-balanced and transparent capital structure enhances investor confidence, leading to better access to capital markets, potential partnerships, and overall support for business growth initiatives.

- Risk and Return Trade-off: The market value capital structure helps businesses strike the right balance between risk and return. By analyzing different financing alternatives, companies can choose a capital structure that aligns with their risk appetite and expected returns, optimizing their chances of achieving long-term financial objectives.

- Competitive Advantage: Maintaining an optimal market value capital structure can provide a competitive advantage in the market. A well-structured capital mix allows businesses to respond to market dynamics, pursue growth opportunities, and adapt to changing industry conditions more effectively than their competitors.

Ultimately, finding the market value capital structure provides companies with a roadmap for sustainable financial management. It enables businesses to make informed decisions about the financing mix, reduce financial vulnerabilities, enhance profitability, and position themselves for long-term success in the marketplace.

Challenges in Finding Market Value Capital Structure

While determining the market value capital structure is crucial for businesses, it is not without its challenges. Various factors, both internal and external, can complicate the process of finding the optimal capital mix. Here are some common challenges faced when determining the market value capital structure:

- Evolving Business Dynamics: Businesses operate in dynamic environments where market conditions, industry trends, and competitive landscapes change rapidly. Keeping up with these dynamics and adapting the capital structure accordingly can be challenging, as it requires constant monitoring and evaluation.

- Uncertain Economic Environment: Economic uncertainties, such as fluctuations in interest rates, inflation, and exchange rates, can pose challenges in determining the market value capital structure. These uncertainties impact the cost of borrowing, equity returns, and overall profitability, making it difficult to accurately predict the optimal financing mix.

- Industry-specific Constraints: Different industries have unique characteristics and regulatory constraints that influence their capital structure. For example, highly regulated industries may have limitations on debt levels, and capital-intensive industries may face difficulties in raising equity financing. Adhering to industry-specific constraints while finding the optimal capital structure can be challenging.

- Access to Capital: The availability of capital can be a challenge for businesses, especially for small and medium-sized enterprises (SMEs) or companies with limited credit history. Limited access to debt markets or high borrowing costs can impact the capital structure decisions and the ability to secure optimal financing sources.

- Tax Considerations: Tax regulations and policies have a significant impact on capital structure decisions. Understanding the complex tax implications of different financing options can be challenging, especially when considering various tax jurisdictions and changes to tax laws over time.

- Financial Planning and Modelling: Accurately projecting future cash flows, profitability, and risk factors is crucial for determining the market value capital structure. However, developing comprehensive financial models and forecasts that capture all variables and uncertainties can be challenging, often requiring specialized financial expertise.

Overcoming these challenges requires careful analysis, detailed financial planning, and a deep understanding of a company’s specific circumstances. It may also involve seeking professional advice from financial experts who can provide insights and guidance on navigating these complexities. By addressing these challenges, businesses can make informed decisions and adapt their capital structure to optimize financial performance and support long-term growth.

Case Studies on Finding Market Value Capital Structure

Examining real-world case studies can provide valuable insights into the process of finding the market value capital structure and the impact it can have on businesses. Here are two case studies showcasing different scenarios:

Case Study 1: Technology Startup

A technology startup, XYZ Tech, was in the early stages of business expansion and needed to raise capital to fund its growth initiatives. The management team faced the challenge of determining the optimal market value capital structure to secure financing while minimizing costs and maximizing shareholder value.

By conducting in-depth financial analysis and considering their growth projections, the management team opted for a capital structure that included a mix of debt and equity financing. The debt component consisted of a convertible loan, which provided flexibility in terms of interest payments and conversion to equity. The equity component involved issuing new shares to venture capital investors.

Through careful analysis and negotiations, XYZ Tech successfully secured the necessary capital while maintaining a reasonable level of financial risk. The chosen capital structure enabled the company to leverage the growth potential of the technology sector and attract potential investors, leading to successful expansion and increased market value.

Case Study 2: Established Manufacturing Company

An established manufacturing company, ABC Manufacturing, faced the challenge of optimizing its market value capital structure amid declining industry demand and economic uncertainties. With a significant amount of existing debt, ABC Manufacturing needed to reassess its financial position and determine the most suitable capital mix.

The management team conducted a thorough analysis of their financial statements, industry benchmarks, and alternative financing options. They decided to focus on debt reduction to minimize financial risk and enhance financial stability. The company implemented a debt restructuring strategy, where they refinanced existing loans at more favorable terms and utilized cash flow to gradually pay off debt.

As a result of their strategic efforts, ABC Manufacturing was able to lower its debt-to-equity ratio, reduce interest expenses, and improve its financial profile. The optimized market value capital structure provided a stronger foundation for future growth and increased confidence among stakeholders.

These case studies highlight the importance of tailored approaches in determining the market value capital structure. Companies must evaluate their unique circumstances, industry dynamics, and risk tolerance to find the optimal mix of debt and equity that aligns with their financial goals and maximizes long-term value.

Conclusion

Determining the market value capital structure is a critical process for businesses in the finance industry. It involves analyzing the composition of debt and equity financing to optimize financial stability, minimize costs, and maximize shareholder value. By understanding the factors influencing the capital structure, analyzing financial statements, and utilizing various methods, companies can make informed decisions that align with their growth objectives and risk appetite.

The importance of finding the market value capital structure cannot be overstated. It enables businesses to optimize their financing mix, effectively manage their cost of capital, and enhance their financial stability. Additionally, it instills investor confidence, attracts capital, and provides a competitive advantage. By striking the right balance between risk and return, businesses can position themselves for long-term success.

However, challenges exist in the process of determining the market value capital structure. Factors such as evolving business dynamics, economic uncertainties, and access to capital can pose obstacles. Nevertheless, by addressing these challenges, businesses can navigate the complexities and make informed decisions to optimize their financial structure.

Real-world case studies provide valuable insights into the practical application of finding the market value capital structure. These examples demonstrate the importance of tailored approaches that consider industry dynamics, risk profiles, and growth objectives. Each company’s unique circumstances must be carefully evaluated to determine the most suitable capital mix that enhances financial health and supports long-term growth.

In conclusion, finding the market value capital structure is crucial for businesses looking to establish financial stability, optimize costs, and maximize shareholder value. By understanding the factors at play, analyzing financial metrics, and leveraging various methods, businesses can make well-informed decisions that position them for success in a dynamic and competitive market.