Finance

How To Find Capital Structure Formula

Published: December 24, 2023

Learn how to find the capital structure formula in finance with our comprehensive guide. Understand the key factors that determine a company's ideal capital structure and optimize your financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing finances, understanding the concept of capital structure is crucial. Capital structure refers to the way a company funds its operations and investments through a combination of debt and equity. It determines the financial health, risk profile, and sustainability of a business.

For investors and stakeholders, analyzing the capital structure of a company is essential in gauging its financial stability and potential returns. In order to assess the risk and profitability of an investment, it is important to find the capital structure formula, which provides insights into the optimal mix of debt and equity for a company.

This article will delve into the various components of capital structure, the weighted average cost of capital (WACC), and the factors that influence the decision-making process. Additionally, we will explore the importance of finding the capital structure formula and outline the steps involved in determining it.

So, if you are a business owner, investor, or financial professional striving to make informed decisions, keep reading to discover how to find the capital structure formula.

Understanding Capital Structure

Capital structure refers to the way a company finances its operations and investments. It represents the combination of debt and equity that a company uses to fund its activities. Debt refers to borrowing money from external sources, such as banks or bondholders, while equity represents the ownership stake held by shareholders.

A company’s capital structure plays a crucial role in determining its financial health and risk profile. It affects the cost of capital and influences the company’s ability to grow and generate profits. The capital structure decisions also impact the company’s ability to attract investors and access funding from the capital markets.

There are two primary components of capital structure: debt and equity. Debt includes any borrowed funds that the company is obligated to repay over a specific period. This can include bank loans, bonds, or other forms of debt securities. Equity, on the other hand, represents the ownership interest in the company and is held by shareholders. It can be in the form of common stock, preferred stock, or retained earnings.

The proportion and mix of debt and equity in a company’s capital structure can vary depending on factors such as industry, business risk, growth prospects, and financial conditions. A company’s capital structure decisions should aim for an optimal mix that maximizes the firm’s value and minimizes its cost of capital.

Understanding the capital structure of a company is essential for investors and stakeholders. By analyzing the capital structure, investors can assess the risk and potential returns associated with investing in a particular company. It helps provide insights into the stability, growth prospects, and financial well-being of the business.

Furthermore, understanding the capital structure is vital for financial professionals who need to evaluate the company’s ability to meet its financial obligations and make sound investment decisions. It helps in assessing the leverage level, solvency, and financial sustainability of the company.

Now that we have a basic understanding of capital structure, let’s explore how the weighted average cost of capital (WACC) comes into play and its significance in capital structure decisions.

Components of Capital Structure

Capital structure is composed of two main components: debt and equity. These components represent the sources of financing used by a company to fund its operations and investments.

1. Debt: Debt refers to borrowed funds that a company is obligated to repay over a specific period. It is an external source of financing and involves taking on financial obligations to creditors. Debt can be obtained in the form of loans from banks, issuance of bonds, or other debt securities.

Debt financing offers several advantages for companies. It provides immediate access to capital without diluting ownership. Additionally, interest payments made on the debt may be tax deductible, reducing the overall cost of financing.

However, there are also risks associated with debt. Companies need to make regular interest payments and principal repayments, which can create a financial burden, especially in times of economic downturns or when the company’s cash flows are constrained. Excessive debt levels can also impact the company’s creditworthiness and increase its financial risk.

2. Equity: Equity represents the ownership stake in a company and is held by shareholders. It can be in the form of common stock, preferred stock, or retained earnings. Equity financing allows companies to raise funds by selling ownership shares to investors.

Equity financing has its own set of advantages. It does not require regular interest or principal payments, providing more flexibility in terms of cash outflows. Shareholders participate in the company’s success and benefit from the potential increase in the company’s value and profitability.

However, equity financing also comes with certain drawbacks. Selling ownership shares dilutes the ownership stake of existing shareholders, which may result in loss of control for the company’s management. Furthermore, distributing profits among a larger number of shareholders reduces the earnings per share and can affect the company’s ability to attract new investors.

The proportion and mix of debt and equity in a company’s capital structure vary depending on various factors, including industry norms, business risk, growth prospects, and financial conditions. Finding the right balance between debt and equity is crucial to optimize the cost of capital and maximize the value of the company.

Next, let’s explore the concept of the weighted average cost of capital (WACC) and its significance in capital structure decisions.

Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) is a financial metric that represents the average cost of financing for a company. It is calculated by taking into account the proportion of debt and equity in the company’s capital structure and the respective costs associated with each.

The WACC is a crucial tool used by companies to evaluate investment opportunities and make informed financial decisions. It serves as a benchmark to determine if a project or investment is generating returns above the cost of capital and adding value to the company.

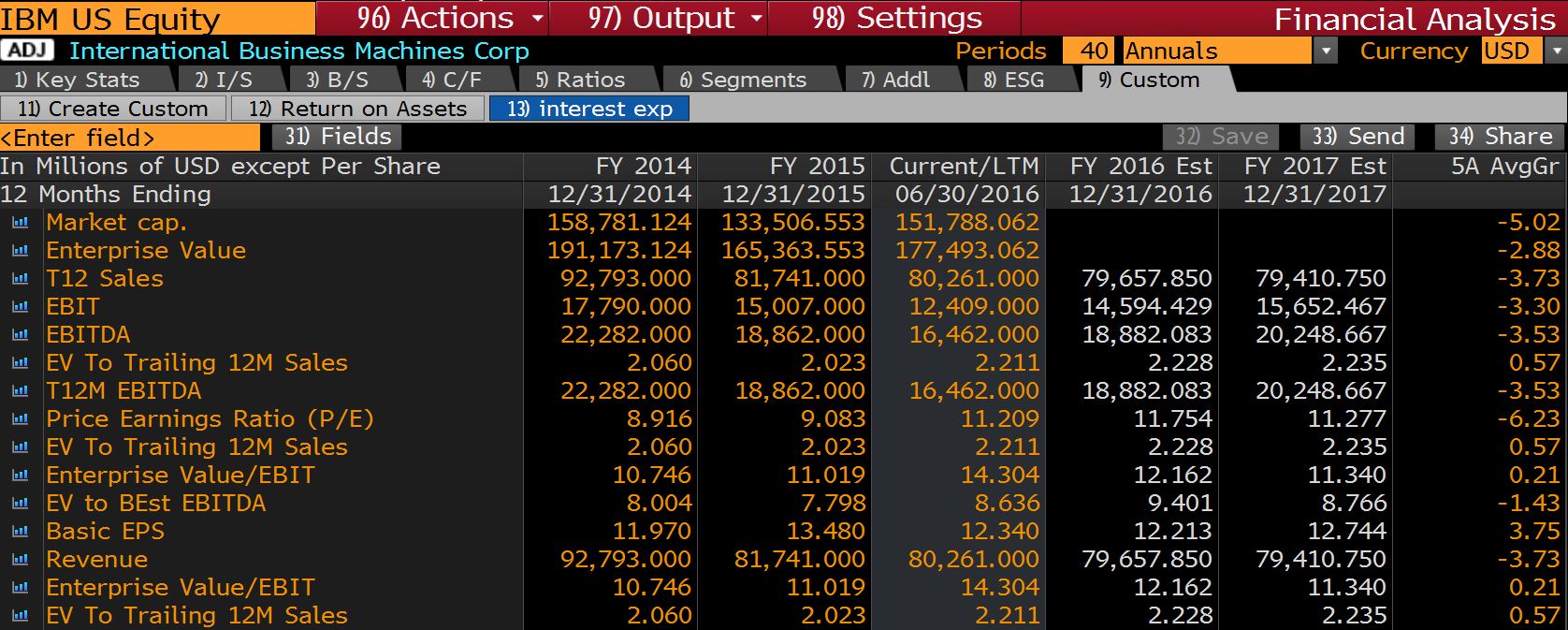

The formula to calculate WACC is as follows:

WACC = (E/V) * Re + (D/V) * Rd * (1 – Tax Rate)

Where:

- WACC: Weighted Average Cost of Capital

- E: Market value of equity

- V: Total market value of equity and debt

- Re: Cost of equity

- D: Market value of debt

- Rd: Cost of debt

- Tax Rate: Corporate tax rate

The WACC takes into account the cost of both debt and equity financing. The cost of equity (Re) represents the return required by shareholders to compensate for the risk associated with owning the company’s shares. It is influenced by factors such as the company’s beta, risk-free rate, and market risk premium.

The cost of debt (Rd) represents the interest rate or yield paid by the company on its outstanding debt. It considers factors such as the market interest rates, creditworthiness of the company, and prevailing economic conditions.

The weights of debt and equity in the capital structure are determined by their respective market values. The proportion of debt (D/V) and equity (E/V) in the formula reflects their importance in financing the company’s operations.

By incorporating these factors, the WACC provides an overall measure of the cost of capital for a company’s investments. It helps management assess the financial feasibility of projects, determine hurdle rates for investment decisions, and judge the attractiveness of new ventures.

Furthermore, the WACC is useful when comparing investment opportunities and strategies. Projects with a return higher than the WACC are considered value-enhancing, while those falling below the WACC may erode shareholder value.

Understanding the WACC and its components is essential for financial professionals and investors in assessing the risk and potential returns of an investment. It assists in making informed decisions that align with the company’s capital structure and financial goals.

Next, we will explore the concept of optimal capital structure and its significance for businesses.

Optimal Capital Structure

The optimal capital structure refers to the ideal mix of debt and equity financing that maximizes a company’s value and minimizes its cost of capital. It represents the balance between risk and return, taking into consideration various factors such as industry norms, business risk, and financial conditions.

Finding the optimal capital structure is a critical decision for companies as it directly impacts their ability to generate profits, manage risk, and attract investors. A well-designed capital structure can enhance a company’s financial performance and create value for shareholders.

There is no one-size-fits-all formula for determining the optimal capital structure. It varies from company to company based on their specific circumstances and strategic objectives. However, there are a few theories and considerations that can guide the decision-making process:

1. Trade-off Theory: This theory suggests that companies need to strike a balance between the costs and benefits of debt financing. Debt offers the advantage of tax-deductible interest payments but also carries the risk of financial distress and increased borrowing costs. The optimal capital structure finds the balance between the tax benefits of debt and the costs associated with financial risk.

2. Pecking Order Theory: This theory proposes that companies prefer internal financing (such as retained earnings) over external financing (such as issuing new equity or debt) to fund their investments. It suggests that companies only resort to external financing when internal resources are insufficient. The optimal capital structure under this theory favors less reliance on external financing and more on internal resources.

3. Market Timing Theory: This theory suggests that companies should time their debt or equity issuances based on the prevailing market conditions. Companies may take advantage of periods of low interest rates to issue debt and capitalize on favorable borrowing conditions. Similarly, companies may raise equity when their stock prices are high. The optimal capital structure in this theory considers the timing of debt and equity issuances to optimize the cost of financing.

While these theories provide insights, determining the optimal capital structure requires a thorough analysis of the company’s specific needs, growth prospects, and risk tolerance. Factors such as industry characteristics, competitive dynamics, and macroeconomic conditions also play a role in shaping the capital structure.

It is important to note that the optimal capital structure is not a fixed target but rather a dynamic concept that evolves with the changing business environment. As companies grow, their capital structure may need to be adjusted to accommodate new investments, changing market conditions, and shifts in risk preferences.

Ultimately, the optimal capital structure is a strategic decision that requires a careful balancing act, considering the company’s risk appetite, financial goals, and investment opportunities. By finding the right mix of debt and equity financing, companies can position themselves for sustainable growth and maximize shareholder value.

Next, let’s explore the factors that influence capital structure decisions.

Factors Affecting Capital Structure

Several factors influence the capital structure decisions of a company. These factors can vary depending on the industry, economic conditions, and the specific characteristics of the business. Understanding these factors is crucial in finding the appropriate mix of debt and equity financing that aligns with the company’s goals and maximizes its value. Here are some key factors that affect capital structure:

1. Business Risk: The level of business risk, including factors such as market volatility, competition, and the company’s ability to generate steady cash flows, plays a significant role in determining the capital structure. Companies with high business risk may opt for lower debt levels to minimize financial risk, while those in stable industries may choose more debt to take advantage of tax benefits.

2. Industry Norms and Practices: Different industries have varying capital structure norms based on their characteristics and risk profiles. For example, capital-intensive industries like manufacturing or telecommunications may rely more on debt financing, while technology or service-based sectors may have higher equity components in their capital structure.

3. Growth Opportunities: Companies with substantial growth opportunities may choose to retain earnings and reinvest in the business rather than distributing profits to shareholders. This may result in lower debt levels and a higher equity component in the capital structure to support growth initiatives.

4. Tax Considerations: The tax environment and applicable tax rates play a role in capital structure decisions. Debt financing often offers tax advantages as interest payments can be tax-deductible, reducing the overall cost of financing. This can incentivize companies to take on debt to benefit from tax shields.

5. Cost of Capital: The cost of capital, including the cost of debt and the required return on equity, influences capital structure decisions. The cost of debt is influenced by interest rates and borrowing costs, while the cost of equity depends on factors like the company’s risk profile, market conditions, and investor expectations.

6. Company Size and Life Cycle: The size and life cycle stage of a company can affect its capital structure. Start-up companies with limited assets and revenue streams may rely more on equity financing, while established companies with stable cash flows and a strong asset base can afford to take on more debt.

7. Market Conditions: Economic conditions and the availability of external financing influence capital structure decisions. During periods of favorable market conditions with low interest rates, companies may take on more debt to capitalize on cheap financing. Conversely, during economic downturns or credit crunches, companies may opt for more conservative financing options and lower debt levels.

8. Debt Capacity and Credit Ratings: The company’s ability to manage debt and its creditworthiness impact capital structure decisions. Companies with higher credit ratings can access capital markets at more favorable terms, enabling them to issue debt at lower interest rates. Conversely, companies with lower credit ratings may face higher borrowing costs and opt for lower debt levels.

It is important to note that these factors are interconnected and should be analyzed holistically. Companies must evaluate each factor in conjunction with their strategic goals, financial position, and risk tolerance to determine the optimal capital structure.

By carefully considering these factors, companies can make informed capital structure decisions that align with their long-term objectives and create value for shareholders.

Next, let’s explore the importance of finding the capital structure formula.

Importance of Finding the Capital Structure Formula

Finding the capital structure formula is of utmost importance for companies, investors, and financial professionals. It provides valuable insights into the optimal mix of debt and equity financing that maximizes value and minimizes the cost of capital. Here are the key reasons why finding the capital structure formula is essential:

1. Maximizing Value: The capital structure formula helps companies determine the most efficient mix of financing that maximizes the value of the business. By finding the optimal balance between debt and equity, companies can minimize the cost of capital and enhance their profitability, leading to increased shareholder value.

2. Managing Risk: The capital structure formula allows companies to assess and manage their financial risk. By understanding the right proportion of debt and equity, companies can strike a balance that minimizes the risk of financial distress while providing the necessary financing for growth and investment opportunities.

3. Attracting Investors: Investors consider the capital structure when evaluating a company for investment. A well-designed capital structure that aligns with industry norms and risk profiles can attract investors by demonstrating financial stability and the potential for returns. Investors are more likely to invest in companies with a solid capital structure that mitigates risks and provides a favorable risk-reward tradeoff.

4. Accessing Funding: Finding the capital structure formula is crucial for companies seeking external funding. Whether it’s through debt or equity financing, understanding the optimal mix enables companies to access funding sources at favorable terms. Lenders and investors are more inclined to support companies with a sound capital structure that inspires confidence in the ability to repay debt or generate returns on equity investment.

5. Meeting Financial Obligations: The capital structure formula helps companies determine their capacity to meet financial obligations, such as interest payments on debt. By ensuring a sustainable capital structure, companies can forecast their cash flow generation and assure creditors and investors of their ability to honor financial commitments.

6. Strategic Decision-Making: The capital structure formula provides a framework for making informed strategic decisions. It assists management in evaluating investment opportunities, analyzing potential projects, and determining the financing mix that aligns with the company’s long-term goals and risk appetite.

7. Adapting to Changing Conditions: The capital structure formula is not a static concept; it must be regularly reviewed and adjusted to reflect changing market conditions, industry dynamics, and business circumstances. By regularly reassessing the capital structure, companies can adapt to evolving environments and maintain a sustainable and optimal financing mix.

By finding the capital structure formula, companies can optimize their financial structure, enhance their competitiveness, and create long-term value for shareholders. It provides a roadmap for sound financial decisions and strategic management of resources.

Now that we understand the importance of finding the capital structure formula, let’s explore the steps involved in determining it.

Steps to Find the Capital Structure Formula

Finding the capital structure formula involves a systematic approach that considers various factors and prioritizes the company’s goals and risk tolerance. Here are the key steps involved in determining the capital structure formula:

1. Assess Financial Goals and Risk Tolerance: Begin by identifying the company’s financial objectives and risk tolerance. Consider factors such as growth targets, profitability goals, and the level of risk the company is willing to undertake. Understanding these fundamental aspects will help guide the decision-making process.

2. Analyze the Business and Industry: Conduct a thorough analysis of the company’s business and industry dynamics. Consider factors such as the company’s revenue streams, competitive landscape, growth opportunities, and the level of business risk associated with the industry. This analysis helps determine the appropriate mix of debt and equity based on the company’s specific circumstances.

3. Evaluate Funding Options: Assess the available funding options, including debt and equity financing. Evaluate the advantages, risks, costs, and terms associated with each option. Consider the company’s ability to access debt markets, the cost of debt financing, and the impact of equity dilution on ownership and control.

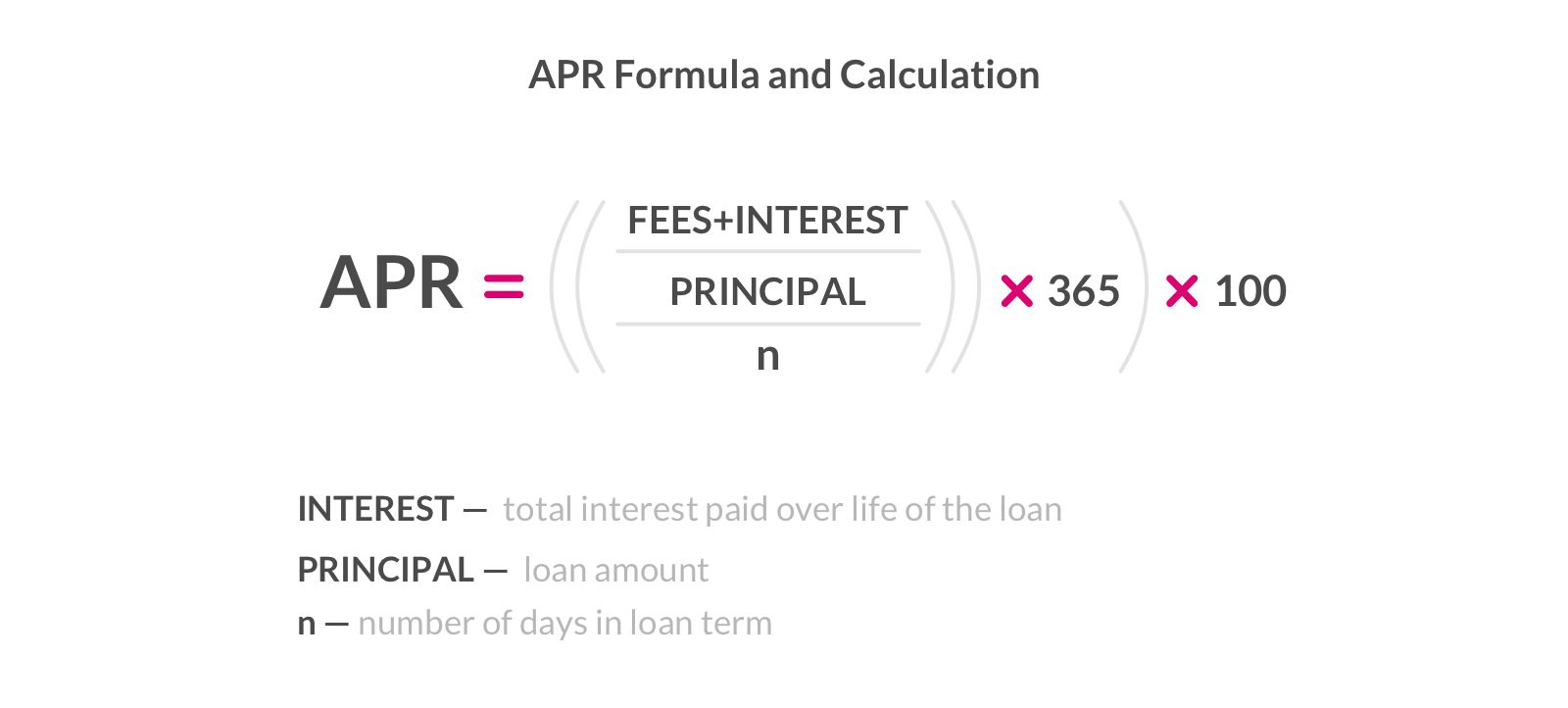

4. Calculate the Weighted Average Cost of Capital (WACC): Determine the company’s weighted average cost of capital (WACC) by incorporating the costs of both debt and equity financing. Calculate the cost of debt based on interest rates and borrowing costs, and the cost of equity by considering factors such as the company’s risk profile and market conditions. Weight these costs based on the proportion of debt and equity in the capital structure.

5. Conduct Sensitivity Analysis: Perform sensitivity analysis to understand how changes in the capital structure impact the company’s financials and risk profile. This analysis helps assess the company’s capacity to withstand adverse conditions and identify potential trade-offs between cost of capital, risk, and profitability.

6. Consider Tax Implications: Take into account the tax implications of different financing options. Debt financing often provides tax benefits through interest deductions, which can reduce the overall cost of financing. Understanding the tax implications helps in optimizing the capital structure by capturing tax advantages.

7. Continuously Monitor and Adjust: The capital structure should be regularly monitored and adjusted to adapt to changing market conditions, business circumstances, and financial goals. Periodically review the capital structure formula in light of new investment opportunities, market trends, and evolving risk factors.

8. Seek Expert Advice: Consider seeking guidance from financial professionals or consultants who specialize in capital structure analysis. Their expertise and experience can provide valuable insights and assist in making informed decisions regarding the optimal mix of debt and equity financing.

By following these steps, companies can determine the capital structure formula that aligns with their financial goals, risk tolerance, and market conditions. It enables them to optimize their financing mix, enhance financial performance, and create long-term value for stakeholders.

Now that we have explored the steps involved in finding the capital structure formula, let’s summarize the key takeaways.

Conclusion

Understanding and finding the capital structure formula is paramount for companies, investors, and financial professionals. The capital structure, which represents the mix of debt and equity financing, plays a crucial role in determining a company’s financial health, risk profile, and ability to generate returns. By finding the optimal capital structure formula, businesses can enhance their value, manage risk effectively, and attract investors.

The components of capital structure, including debt and equity, must be carefully balanced to achieve the desired financial goals. Factors such as business risk, industry norms, growth opportunities, and market conditions influence the decision-making process. Additionally, the weighted average cost of capital (WACC) serves as a benchmark for evaluating investment opportunities and determining the cost of financing.

Through a systematic approach, companies can determine the capital structure formula that aligns with their strategic objectives, risk tolerance, and financial circumstances. This involves assessing financial goals, analyzing the business and industry dynamics, and evaluating different funding options. Sensitivity analysis, tax considerations, and continuous monitoring are also crucial components in the process.

By finding the optimal capital structure formula, companies can enhance their financial performance, access funding at favorable terms, and effectively manage their financial obligations. Investors can assess the risk and potential returns of an investment, while financial professionals can make informed decisions that align with the company’s long-term objectives.

In conclusion, the capital structure formula is a fundamental aspect of financial management. It provides a roadmap for companies to optimize their financing mix, manage risk effectively, and create long-term value for shareholders. By understanding the importance of capital structure and following the steps to find the optimal formula, companies can position themselves for sustainable growth and financial success.