Finance

Total Bond Fund Definition

Published: February 9, 2024

Discover the definition of a total bond fund in the world of finance. Learn how this investment vehicle can help diversify your portfolio and generate stable returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Total Bond Fund Definition: Understanding the Basics of Fixed Income Investments

Welcome to our FINANCE category! In this blog post, we will delve into the world of fixed income investments and specifically explore what a Total Bond Fund is all about. If you’re new to investing or just looking to diversify your portfolio, understanding this financial instrument can be a valuable addition to your knowledge. So, let’s dive in!

Key Takeaways:

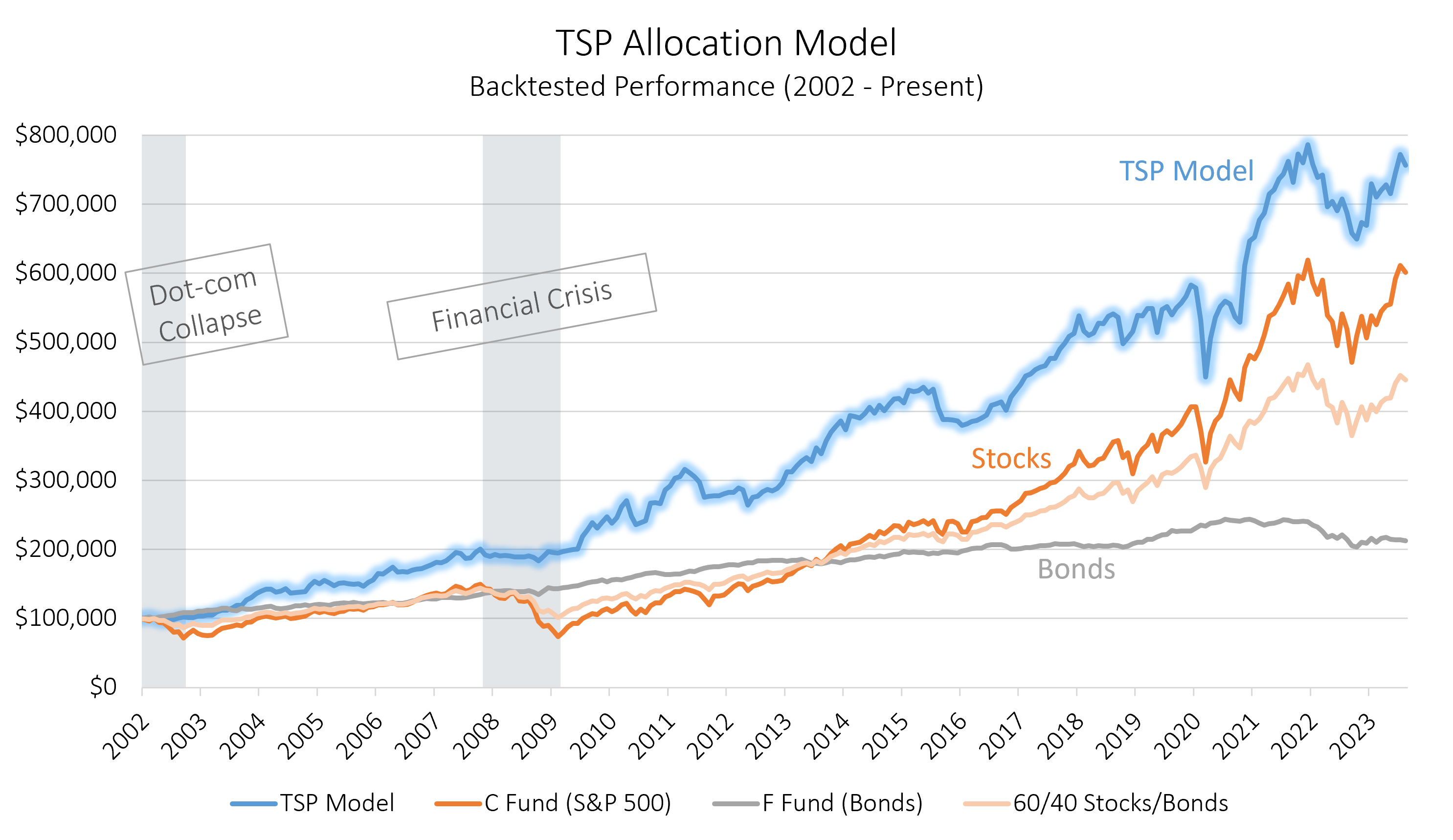

- A Total Bond Fund is a type of mutual fund that invests in a diversified portfolio of fixed income securities, such as government bonds, corporate bonds, and mortgage-backed securities.

- These funds are designed to provide investors with a steady stream of income through regular interest payments, while preserving capital and reducing overall risk.

Now, let’s get a better grasp of what exactly a Total Bond Fund is and how it can fit into your investment strategy.

What is a Total Bond Fund?

A Total Bond Fund is a mutual fund that aims to provide investors with exposure to a wide range of fixed income securities. These funds are managed by professional fund managers who carefully select and monitor the portfolio holdings based on specific criteria and objectives. The objective of a Total Bond Fund is to generate income through interest payments while minimizing the risk associated with investing in individual bonds.

When you invest in a Total Bond Fund, you essentially become a shareholder in a diversified portfolio of bonds. The fund’s manager actively manages the portfolio, buying and selling bonds to achieve the desired investment goals and optimize returns. By pooling together investors’ capital, these funds can provide access to a broader range of fixed income securities than an individual investor may have on their own.

Benefits of Investing in Total Bond Funds

Investing in Total Bond Funds offers several advantages that make them appealing to a wide range of investors. Here are some key benefits:

- Diversification: By investing in a Total Bond Fund, you gain exposure to a diversified portfolio of bonds. This diversification helps spread risk across different types of bonds, issuers, and sectors, reducing the impact of any single bond default or market fluctuation.

- Professional Management: Total Bond Funds are managed by experienced professionals who have in-depth knowledge of fixed income markets and track record in managing bond portfolios. Their expertise can help navigate the complexities of the market and make decisions that align with the fund’s investment objectives.

- Steady Income: Total Bond Funds typically generate regular income through interest payments from the underlying bond holdings. This can be particularly attractive for investors seeking a steady stream of income without taking on excessive risk.

- Liquidity: Unlike individual bonds that may have specific maturity dates, Total Bond Funds offer daily liquidity. Investors can buy and sell shares of the fund at the prevailing net asset value (NAV) on any business day.

- Cost Efficiency: Investing in a Total Bond Fund can be cost-efficient compared to building and managing a diversified portfolio of individual bonds. The fund’s expenses are shared among all investors, making it more accessible for those with smaller investment amounts.

Conclusion

A Total Bond Fund is a valuable tool that can add stability and income potential to your investment portfolio. By diversifying your fixed income holdings and benefiting from professional management, you can navigate the ever-changing bond market with confidence. As with any investment, it’s crucial to carefully assess your financial goals, risk tolerance, and consult with a financial advisor to determine if a Total Bond Fund is right for you.

Thanks for reading our blog post on the Total Bond Fund Definition. Stay tuned for more informative articles in our FINANCE category!