Finance

What TSP Fund Invests Solely In Bonds

Modified: March 1, 2024

Find out how TSP funds that focus on bonds can help you with your finance goals. Learn more about investing solely in bonds and its benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in the TSP (Thrift Savings Plan) Fund is a smart way to secure your financial future, and understanding the different fund options available can help you make informed decisions. One such option is the TSP Bond Fund, which focuses solely on investing in bonds. Bonds are a popular investment choice due to their relatively lower risk when compared to stocks and the potential for steady returns.

In this article, we will explore what a bond is, the TSP Fund, and the importance of investing solely in bonds. We will also discuss the performance and risk factors associated with the TSP Bond Fund, as well as its pros and cons. Lastly, we will provide some recommended strategies for investing in the TSP Bond Fund.

Whether you are a beginner or an experienced investor, this comprehensive guide will equip you with the knowledge you need to make sound investment decisions and maximize your returns with the TSP Bond Fund.

Understanding TSP Funds

Before delving into the TSP Bond Fund, it’s important to have a basic understanding of TSP Funds in general. The Thrift Savings Plan is a retirement savings and investment plan available to federal employees and members of the uniformed services. It offers a range of investment options, known as TSP Funds, to help participants grow their retirement savings.

There are five core TSP Funds, each with its own investment strategy and level of risk:

- G Fund: Invests in government securities and offers a low-risk, stable return.

- F Fund: Invests in fixed-income bonds and aims to provide a moderate level of risk with potential for higher returns than the G Fund.

- C Fund: Invests in a diverse range of common stocks and closely mirrors the performance of the S&P 500 Index.

- S Fund: Invests in small and mid-sized company stocks and aims to match the performance of the Dow Jones U.S. Completion Total Stock Market Index.

- I Fund: Invests in international stocks and seeks to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index.

Each TSP Fund has its own set of risks and returns, allowing participants to tailor their investment portfolio based on their risk tolerance and financial goals. The TSP Bond Fund, as the name implies, focuses solely on investing in bonds.

Understanding the different TSP Funds and their investment objectives is crucial for effectively allocating your retirement savings and diversifying your investment portfolio. It allows you to strike a balance between risk and reward, ensuring that your investments align with your long-term financial goals.

What is a Bond?

A bond is a debt instrument issued by corporations, municipalities, and governments to raise capital. When you invest in a bond, you are effectively lending your money to the issuer in exchange for regular interest payments over a fixed period of time, known as the bond’s maturity. At the end of the maturity period, the issuer repays the principal amount borrowed to the bondholder.

Bonds offer several key features that make them an attractive investment option:

- Fixed Income: Bonds provide a predictable and regular stream of income in the form of interest payments. The interest rate, also known as the coupon rate, is determined at the time of issuance and remains fixed throughout the life of the bond.

- Low Risk: Bonds are generally considered less risky than stocks. This is because bondholders have a higher priority claim on the issuer’s assets and are more likely to receive their principal and interest payments even in the event of bankruptcy.

- Diverse Issuers: Bonds can be issued by various entities, including corporations, municipalities, and governments at different levels (local, state, and federal). This allows investors to diversify their bond holdings across different issuers, spreading the risk.

- Typically Mature: Bonds have specific maturity dates, making them suitable for investors with fixed financial goals or those seeking a more stable investment option.

- Capital Appreciation: While bonds are primarily known for their fixed income, they can also have the potential for capital appreciation if interest rates decrease, leading to an increase in bond prices.

Investing in bonds can provide stability to your investment portfolio, especially during volatile market conditions. Bonds are often seen as a way to preserve capital and generate income, making them an important component of a diversified investment strategy.

What is the TSP Fund?

The Thrift Savings Plan (TSP) Fund is a series of investment options designed to help federal employees and members of the uniformed services grow their retirement savings. It is governed by the Federal Retirement Thrift Investment Board (FRTIB) and offers participants a range of investment funds to choose from.

The TSP Fund consists of five core investment options:

- G Fund: The G Fund invests in government securities and offers a low-risk, stable rate of return. It is considered the most secure option, as it is backed by the U.S. government. The G Fund is an attractive choice for conservative investors who prioritize capital preservation over high returns.

- F Fund: The F Fund invests in fixed-income bonds, specifically in the U.S. bond market. It aims to provide a moderate level of risk and potential for higher returns compared to the G Fund. The F Fund is suitable for investors seeking a balance between safety and income generation.

- C Fund: The C Fund invests in a diverse range of common stocks, closely tracking the performance of the Standard & Poor’s 500 (S&P 500) Index. This fund offers exposure to the U.S. stock market and is suitable for investors looking for long-term growth potential.

- S Fund: The S Fund invests in small and mid-sized company stocks, aiming to match the performance of the Dow Jones U.S. Completion Total Stock Market Index. This fund offers exposure to a broader segment of the stock market, providing potential for higher returns but also increased volatility.

- I Fund: The I Fund invests in international stocks and seeks to mirror the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. This fund allows investors to diversify their portfolio internationally and capture opportunities in global markets.

The TSP Fund offers participants flexibility and control over their retirement savings, allowing them to choose the fund(s) that align with their risk tolerance, investment objectives, and time horizon. Participants can allocate their contributions among different funds or choose a specific fund to invest in.

It is important to note that the TSP Fund operates as a long-term retirement savings vehicle, subject to certain restrictions on withdrawals and early withdrawals may be subject to penalties. By understanding the various TSP Fund options, participants can make informed decisions to build a diversified portfolio and work towards their retirement goals.

Importance of Investing Solely in Bonds

Investing solely in bonds, such as through the TSP Bond Fund, serves an essential purpose within an investment portfolio. While stocks and other investment options offer the potential for higher returns, bonds provide stability and income, making them a crucial component of a well-rounded strategy. Here are some reasons why investing solely in bonds can be important:

- Capital Preservation: One of the main benefits of investing in bonds is the preservation of capital. Bonds are generally considered less volatile than stocks, making them a reliable way to safeguard your initial investment. By allocating a portion of your portfolio to bonds, you can mitigate the risk of losing money during market downturns.

- Income Generation: Bonds provide a steady stream of income through regular interest payments. This can be particularly valuable for retirees or individuals seeking a consistent source of passive income. The TSP Bond Fund focuses solely on bonds, maximizing the potential for income generation.

- Diversification: Diversification is a key strategy in investment management, and bonds play a vital role in achieving it. By investing solely in bonds, you can balance the riskier components of your portfolio, such as stocks or real estate investments. Bonds have historically exhibited low correlation to stocks, meaning they often perform differently, offering potential portfolio stability during turbulent market conditions.

- Risk Management: Bonds are generally considered less risky than stocks, providing a cushion during market volatility. By investing solely in bonds, you can reduce overall portfolio risk and create a more balanced investment approach. This is particularly important for conservative investors, those nearing retirement, or individuals with a lower tolerance for risk.

- Preserving Wealth in Deflationary Periods: Bond prices tend to rise during deflationary periods when the economy experiences a decrease in prices and economic activity. By investing solely in bonds, you can protect your assets and potentially benefit from price appreciation during deflationary periods.

Investing solely in bonds can help reduce volatility in your portfolio, generate income, and provide stability during uncertain economic times. While it may not offer the same growth potential as stocks, it can serve as a cornerstone for a well-diversified investment strategy that aligns with your risk tolerance and financial goals.

Performance and Risk Factors

When considering investing in the TSP Bond Fund or any other investment option, it is important to assess its performance and associated risk factors. Here, we will look at both aspects to give you a comprehensive understanding.

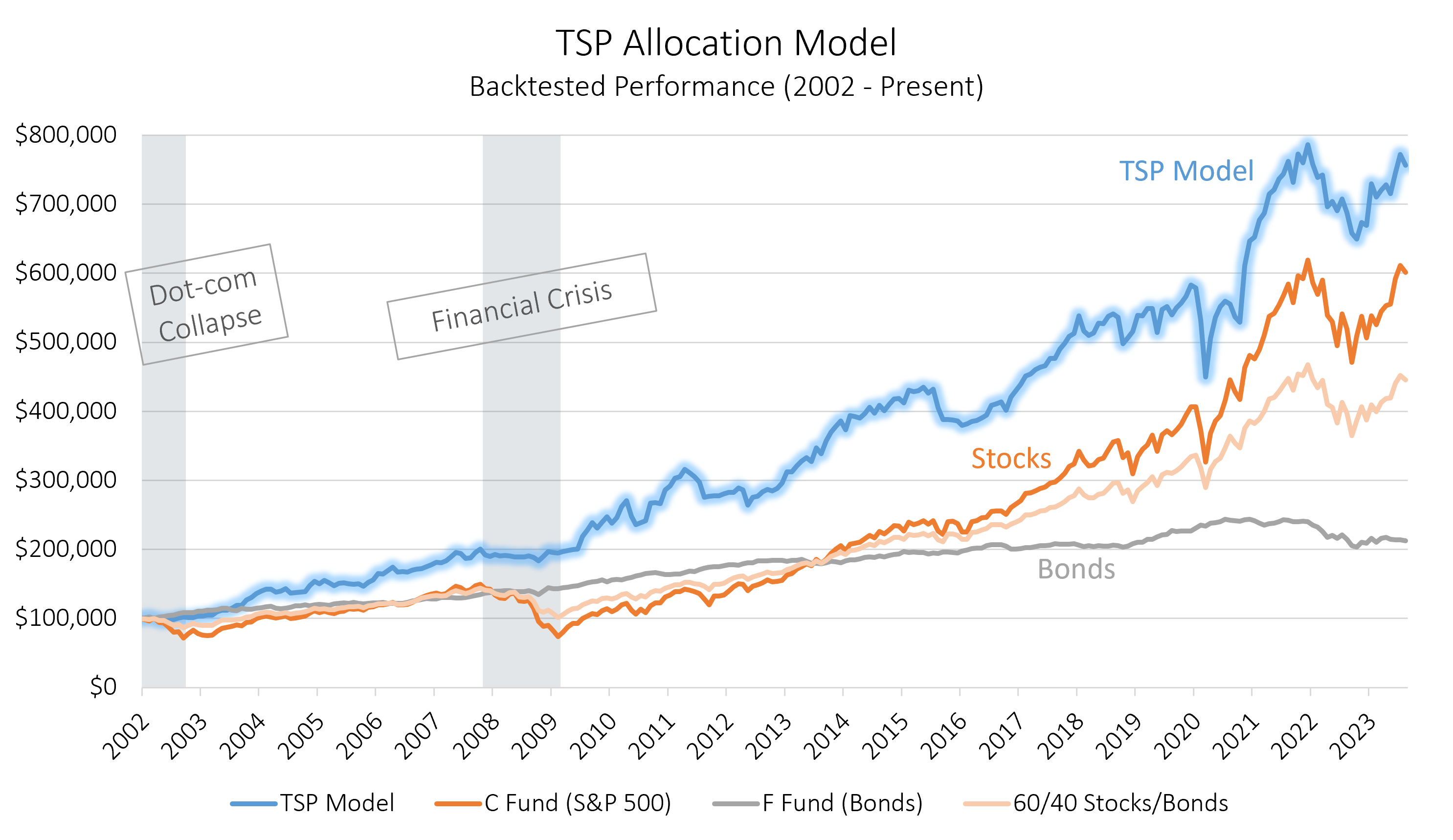

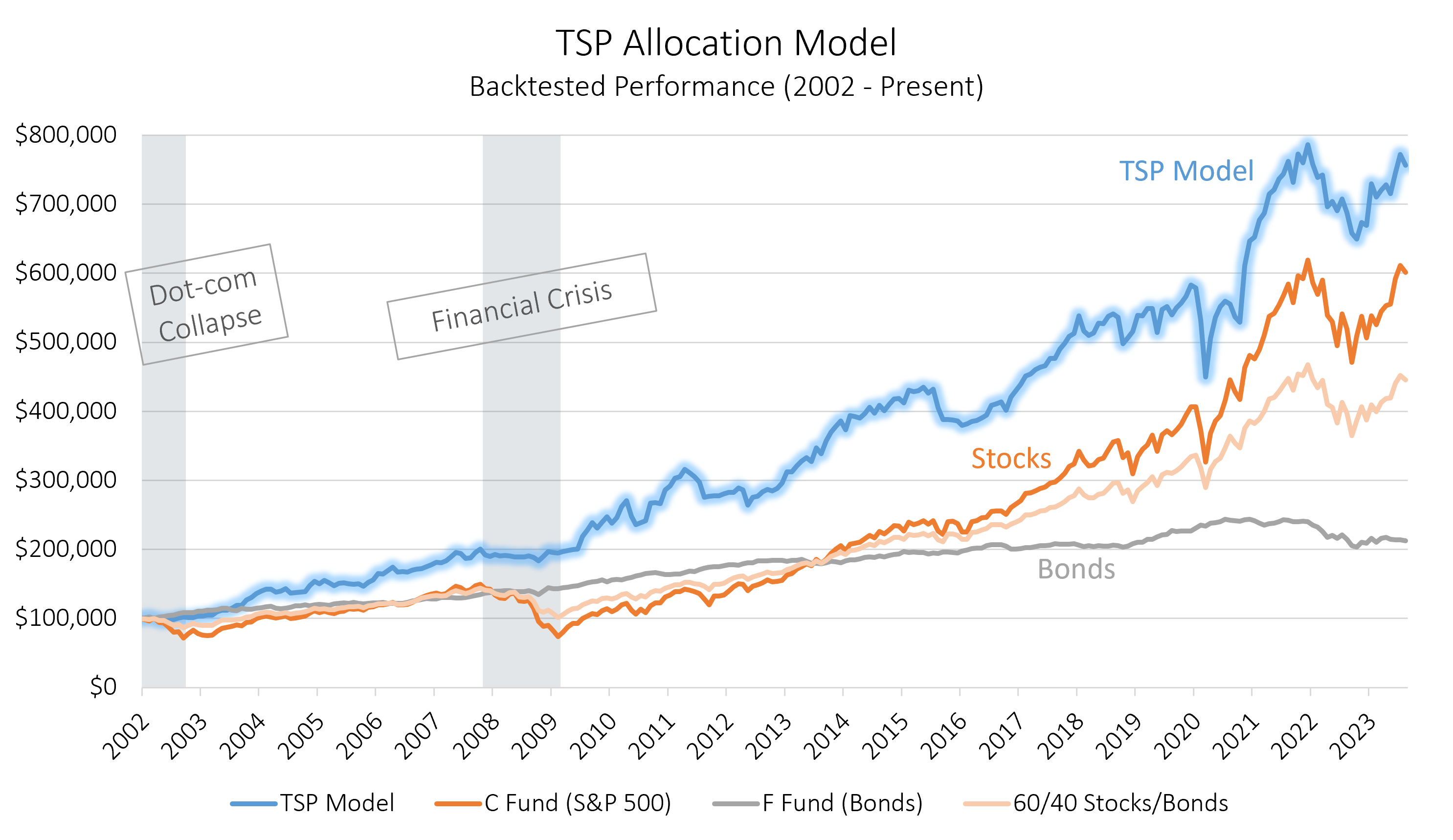

Performance: The performance of the TSP Bond Fund is influenced by various factors, including interest rates, market conditions, and the overall performance of the bond market. Historically, bonds have provided a more stable return compared to stocks, with a focus on income generation rather than capital growth. However, it is important to note that past performance does not guarantee future results.

The performance of the TSP Bond Fund can be evaluated by analyzing its average annual return over different time periods. It is important to compare the fund’s performance against its benchmark, such as the Barclays U.S. Aggregate Bond Index or similar indices. This allows you to assess whether the fund is outperforming or underperforming its benchmark and make informed decisions.

Risk Factors: While bonds are generally considered less risky than stocks, there are still inherent risks associated with investing in the TSP Bond Fund:

- Interest Rate Risk: One of the primary risks for bond investors is interest rate risk. When interest rates rise, bond prices tend to fall, leading to a potential decrease in the value of your investment. Conversely, when interest rates decline, bond prices may rise. It is crucial to consider the potential impact of interest rate movements on the performance of the TSP Bond Fund.

- Credit Risk: Credit risk refers to the possibility that the issuer of a bond may default on its payments. While the TSP Bond Fund primarily invests in U.S. government bonds, which are considered low-risk, there is still a small degree of credit risk associated with any bond investment. Monitoring the credit quality of the bonds held in the fund is essential to assess and mitigate this risk.

- Liquidity Risk: Liquidity risk refers to the ease with which you can buy or sell a bond. Some bonds may have low trading volumes or limited marketability, which can affect the fund’s ability to buy or sell bonds at favorable prices. This can impact the overall performance and liquidity of the TSP Bond Fund.

- Reinvestment Risk: Reinvestment risk arises when the interest income from a bond cannot be reinvested at the same rate of return as the original bond. This risk is particularly relevant in falling interest rate environments, as it may lead to lower yields on reinvested income.

Understanding and monitoring these risk factors is essential for making informed decisions when investing in the TSP Bond Fund or any bond investment option. It is recommended to diversify your investment portfolio and consult with a financial advisor to align your risk tolerance with suitable investments.

Pros and Cons of Investing in the TSP Bond Fund

Investing in the TSP Bond Fund, like any investment option, comes with its own set of pros and cons. Understanding these advantages and disadvantages can help you make an informed decision about whether the TSP Bond Fund is the right choice for your investment goals and risk tolerance.

Pros:

- Stability: The TSP Bond Fund provides stability to your investment portfolio due to the lower risk associated with bonds compared to stocks. It can act as a counterbalance to more volatile investments, helping to cushion against market downturns.

- Income Generation: The TSP Bond Fund focuses solely on bonds, which are known for providing regular interest payments. This income generation can be particularly attractive for retirees or individuals seeking a consistent source of passive income.

- Diversification: By investing in the TSP Bond Fund, you can diversify your investment portfolio and reduce overall risk exposure. Bonds generally have low correlation with stocks, so adding bonds to your investment mix can help balance the fluctuations in other asset classes.

- Lower Liquidity Risk: The TSP Bond Fund primarily consists of highly liquid government securities. This reduces the liquidity risk associated with investing in bonds, ensuring that you can easily buy or sell your holdings when needed.

- Risk Mitigation: Investing in the TSP Bond Fund can be an effective way to mitigate risk, especially for conservative investors or those nearing retirement. Bonds are typically less volatile than stocks and can provide a more stable return over the long term.

Cons:

- Potential for Lower Returns: The TSP Bond Fund focuses on fixed-income investments, which generally offer lower returns compared to stocks. If you are seeking higher growth potential, investing solely in bonds may not align with your financial goals.

- Interest Rate Risk: Bonds are sensitive to changes in interest rates, and this can affect the performance of the TSP Bond Fund. If interest rates rise, bond prices may fall, leading to potential capital losses for bondholders.

- Lower Capital Appreciation Potential: While bonds provide income in the form of interest payments, they typically have limited capital appreciation potential. If you are looking for investments that can grow your capital significantly, investing solely in bonds may not meet your objectives.

- Market Dependency: The TSP Bond Fund’s performance is tied to the bond market and the overall economic conditions. Factors such as changes in inflation, credit ratings, and geopolitical events can impact bond prices and, consequently, the fund’s performance.

- Inflation Risk: Bonds may carry inflation risk, as inflation can erode the purchasing power of future interest payments and principal repayment. If inflation exceeds the interest rate earned on the bonds, the real return on investment may be negative.

It is important to carefully consider these pros and cons and align them with your investment objectives and risk tolerance. Additionally, diversifying your investment portfolio across different asset classes can help mitigate the limitations associated with investing solely in the TSP Bond Fund.

Recommended Strategies for Investing in the TSP Bond Fund

Investing in the TSP Bond Fund requires careful consideration and planning to optimize your returns and manage risk effectively. Here are some recommended strategies to consider when investing in the TSP Bond Fund:

- Determine Your Risk Tolerance: Assess your risk tolerance and investment objectives to determine the appropriate allocation to the TSP Bond Fund. If you have a lower risk tolerance or are close to retirement, you may allocate a larger portion of your portfolio to the TSP Bond Fund to prioritize capital preservation and stable income.

- Understand the Impact of Interest Rates: Stay informed about interest rate movements and understand their potential impact on bond prices and the performance of the TSP Bond Fund. If interest rates are expected to rise, you may consider adjusting your allocation to bonds accordingly to mitigate potential losses.

- Diversify Your Portfolio: While investing in the TSP Bond Fund provides diversification through exposure to bonds, it is still important to diversify your overall investment portfolio across different asset classes. Consider combining the TSP Bond Fund with other TSP Funds, such as the G Fund or even equity-based funds like the C Fund or S Fund, to achieve a well-balanced and diversified portfolio.

- Rebalance Regularly: Periodically review and rebalance your investment portfolio to maintain your desired asset allocation. As the performance of different funds within your portfolio fluctuates, rebalancing ensures that you realign your investments with your original investment strategy.

- Consider a Lifecycle Fund: If you prefer a hands-off approach to investing, you may opt for a TSP Lifecycle Fund that automatically adjusts your allocation based on your target retirement date. These funds gradually shift towards more conservative investments, including bonds, as you approach retirement age, ensuring a suitable risk profile as you near the end of your career.

- Consult a Financial Advisor: Seeking professional guidance from a qualified financial advisor can help you navigate the complexities of investing in the TSP Bond Fund and tailor an investment strategy that aligns with your specific goals and risk appetite. An advisor can provide personalized advice based on your unique financial situation.

Remember that investing in the TSP Bond Fund, or any investment option, requires a long-term perspective. Stay updated on market conditions, review your investment strategy periodically, and make necessary adjustments based on your changing financial goals.

Conclusion

The TSP Bond Fund can be a valuable addition to your investment portfolio, offering stability, income generation, and risk mitigation through its focus on bonds. Understanding the fundamentals of investing in bonds and the specific features of the TSP Bond Fund is crucial for making informed investment decisions.

Investing solely in bonds, such as through the TSP Bond Fund, provides a range of benefits. It can help preserve your capital, generate a steady stream of income, diversify your portfolio, and protect against market volatility. Bonds are often seen as a safe haven during uncertain economic times, offering stability and income even when other asset classes are experiencing turbulence.

However, it is important to consider the potential limitations of investing solely in bonds as well. Bonds typically offer lower returns than stocks and may have limited capital appreciation potential. Interest rates, credit risks, liquidity risks, and inflation risks should be carefully monitored to mitigate potential downsides.

To optimize your investment in the TSP Bond Fund, consider recommended strategies such as determining your risk tolerance, diversifying your portfolio, understanding interest rate movements, rebalancing regularly, and seeking professional advice. These strategies can help align your investment with your financial goals, risk tolerance, and changing market conditions.

As with any investment, it is important to conduct thorough research, stay informed about market trends, and evaluate your investment strategy periodically. Long-term planning and a well-diversified portfolio that includes bonds, along with other asset classes, can help you achieve your financial goals and strengthen your retirement savings through the TSP Bond Fund.