Home>Finance>Trial Balance: Definition, How It Works, Purpose, And Requirements

Finance

Trial Balance: Definition, How It Works, Purpose, And Requirements

Published: February 11, 2024

Learn about trial balance in finance, its definition, how it works, its purpose, and requirements. Gain insights into this crucial financial statement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Trial Balance: Unraveling the Mysteries of Finance

Imagine this scenario: you’re managing your finances like a pro, effortlessly juggling expenses, income, and investments. But have you ever stopped to wonder how financial professionals keep track of all these numbers? This is where trial balance comes into play. In this blog post, we will delve into the world of finance and explore the concept of trial balance, breaking it down from its definition, how it works, its purpose, and the requirements to implement it. Let’s dive in!

Key Takeaways:

- Trial balance is a crucial tool used in accounting to ensure that debits and credits are balanced, helping to detect errors in financial statements.

- It involves listing all the general ledger accounts and totaling the debit and credit values to ascertain if they are equal.

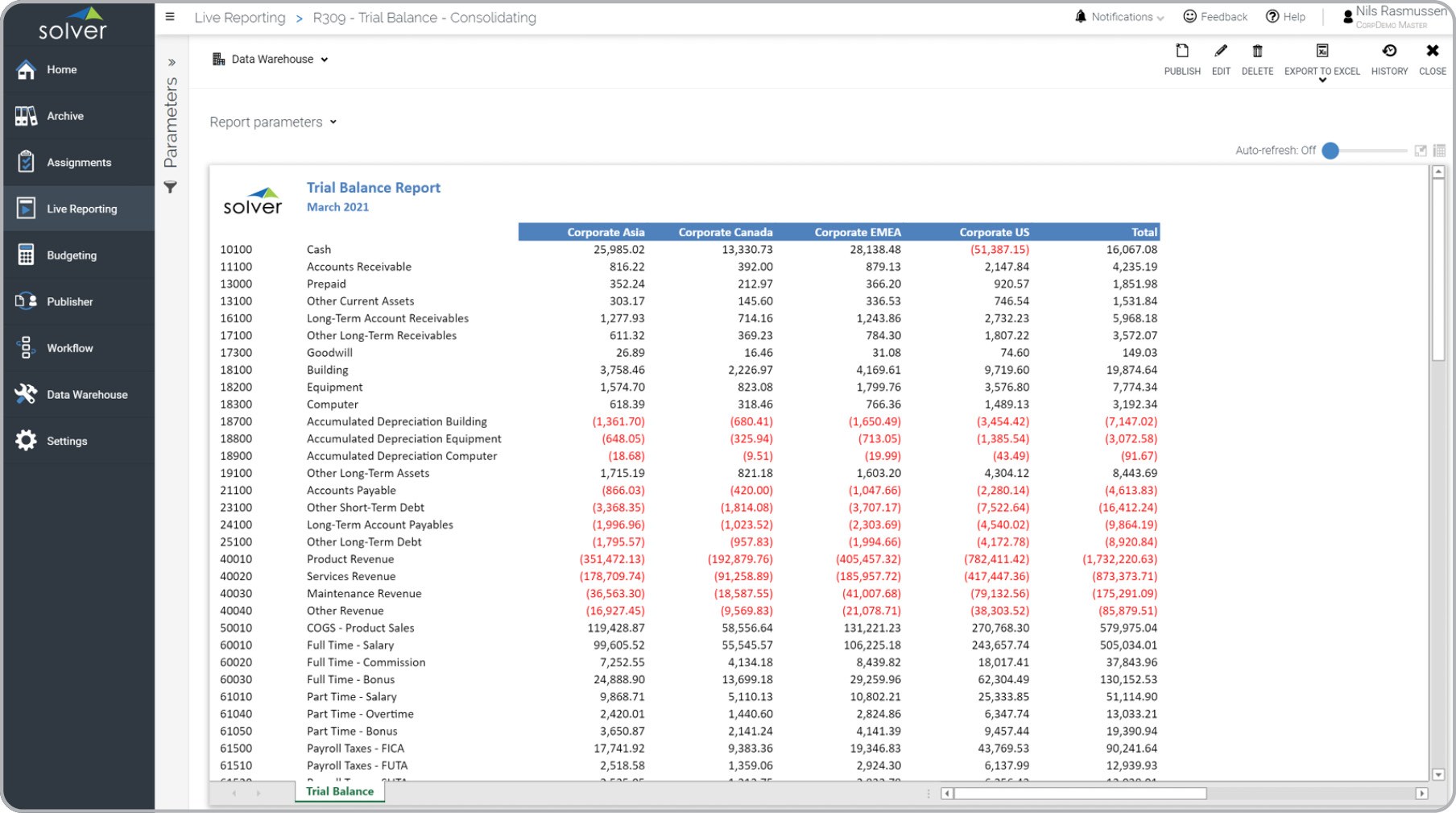

First things first, let’s define what a trial balance is. In simple terms, a trial balance refers to a statement or report outlining the balances of all general ledger accounts within an organization. This financial statement showcases the summary of the debit and credit entries recorded in an accounting system over a specific period of time.

So, how does a trial balance work? Well, it follows a simple concept of double-entry bookkeeping, where every transaction affects at least two accounts: one debited and one credited. The trial balance compiles all the account balances, segregating them into debit and credit columns, and then adds them up. The fundamental principle behind a trial balance is that the total debits should always be equal to the total credits. By comparing these totals, any discrepancy or error in the accounting records can be detected.

Now, let’s explore the purpose of using a trial balance. The primary goal is to validate the accuracy of the accounting records by ensuring that the total debits match the total credits. When the trial balance balances, it provides confidence to financial professionals that errors in recording transactions have been minimized. However, it is important to note that a balanced trial balance does not guarantee error-free financial statements. It simply determines if the transactions have been recorded correctly or if there are numerical mistakes within the accounts.

Requirements for Implementing a Trial Balance:

- Accurate and up-to-date general ledger accounts

- A comprehensive understanding of double-entry bookkeeping

- Attention to detail and meticulous recording of transactions

- Knowledge of the chart of accounts and its classification

- Software or spreadsheet tools capable of compiling and calculating the trial balance

Implementing a trial balance requires maintaining accurate and up-to-date general ledger accounts. These accounts serve as the foundation for compiling the trial balance, so precision is of utmost importance. Additionally, one must possess a comprehensive understanding of double-entry bookkeeping to ensure that each transaction is recorded correctly in the respective accounts.

Attention to detail plays a vital role in maintaining an error-free trial balance. Any missing transactions, incorrect entries, or imbalances can lead to inaccurate financial statements. Adequate knowledge of the chart of accounts and its classification helps in organizing the accounts systematically, making it easier to compile the trial balance.

Lastly, the availability of software or spreadsheet tools capable of compiling and calculating the trial balance can save time and effort, providing a more efficient way of ensuring accuracy.

In conclusion, trial balance is a fundamental concept in finance that aids in maintaining accurate accounting records. It not only detects errors but also helps in validating the overall financial statements. By implementing a trial balance and adhering to the necessary requirements, financial professionals can confidently gauge the accuracy of their organization’s financial records. So why not give trial balance a try and bring more balance to your financial endeavors?