Home>Finance>The Adjusted Trial Balance Is Typically Used To Prepare Which Financial Statements?

Finance

The Adjusted Trial Balance Is Typically Used To Prepare Which Financial Statements?

Published: December 23, 2023

The adjusted trial balance is a crucial tool in finance that is used to prepare accurate and reliable financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The adjusted trial balance plays a crucial role in the financial accounting process. It serves as a vital tool for preparing the financial statements of a company. Financial statements are essential for internal and external stakeholders, as they provide insights into the financial performance and position of a business.

In this article, we will explore the concept of the adjusted trial balance and its significance in financial reporting. We will also delve into the various financial statements that are prepared using the information derived from the adjusted trial balance.

The adjusted trial balance is a statement that summarizes the balances of all accounts after adjusting their balances for accruals, deferrals, and other adjusting entries. This statement is prepared at the end of the accounting period, typically monthly, quarterly, or annually. It acts as a bridge between the unadjusted trial balance and the financial statements.

The main purpose of the adjusted trial balance is to ensure that the accounting records are accurate and up-to-date before preparing the financial statements. It allows for the identification and correction of any errors or omissions in the accounting data. By adjusting the account balances, the adjusted trial balance provides a more accurate representation of the financial position and performance of the company.

Using the adjusted trial balance, accountants can make informed decisions regarding the recognition, measurement, and presentation of financial information. It helps them in complying with accounting principles and standards, and provides reliable and relevant information for decision-making.

Definition of Adjusted Trial Balance

The adjusted trial balance is a statement or report that shows the balances of all general ledger accounts after adjusting entries have been made at the end of an accounting period. It is an important step in the accounting cycle that ensures the accuracy of financial statements.

Before diving into the definition of the adjusted trial balance, let’s first understand the concept of a trial balance. A trial balance is a summary of all the general ledger account balances, including both debit and credit balances, at a specific point in time. It is created to verify that the total debits equal the total credits in the accounting system.

The adjusted trial balance, on the other hand, is prepared after adjusting entries have been made to the trial balance. Adjusting entries are made to record entries that have not been captured during regular journal entries, such as accruals, deferrals, and estimates.

The purpose of the adjusted trial balance is to ensure that all the accounts have been accurately adjusted and to provide the basis for the preparation of financial statements. It helps to identify any errors or omissions in the accounting records and ensures that the financial statements reflect the true financial position and performance of the company.

When preparing the adjusted trial balance, adjusting entries are made to specific accounts to bring them up to date. For example, if a company has earned revenue but has not yet received payment, an adjusting entry is made to recognize the revenue and create an accounts receivable entry. Similarly, if there is an expense that has been incurred but not yet recorded, an adjusting entry is made to recognize the expense and create a corresponding liability or prepaid expense entry.

The adjusted trial balance is typically arranged in a similar format to the unadjusted trial balance, with accounts listed in the order of their appearance in the financial statements. Each account’s adjusted balance is determined by adding or subtracting the adjusting entries to the unadjusted balance.

In summary, the adjusted trial balance serves as a checkpoint to ensure that all accounts have been properly adjusted and that financial statements accurately reflect the company’s financial activities during the accounting period.

Purpose of the Adjusted Trial Balance

The purpose of the adjusted trial balance is to ensure the accuracy and completeness of the financial statements. It serves as a critical step in the accounting cycle, allowing accountants to make necessary adjustments and corrections before preparing the final financial reports.

One of the main goals of the adjusted trial balance is to correct errors and omissions that may have occurred during the recording of transactions. By making adjusting entries for accruals, deferrals, and estimates, the financial records are brought up to date, ensuring that all revenues and expenses are properly recognized in the correct accounting period.

Another purpose of the adjusted trial balance is to comply with the matching principle. The matching principle states that expenses should be recognized in the same period as the related revenues, ensuring an accurate reflection of the company’s financial performance. The adjusting entries made in the adjusted trial balance help in aligning revenues and expenses properly in accordance with this principle.

The adjusted trial balance also aids in the allocation and recognition of prepaid items and deferred items. Prepaid expenses are expenses that are paid in advance but have not yet been incurred. By making adjusting entries for prepaid expenses, the company can allocate the appropriate amount of expense to the relevant accounting period. Similarly, deferred revenues are revenue that has been received but has not yet been earned. Adjusting the deferred revenue through the adjusted trial balance ensures that revenue is recognized in the correct accounting period.

Furthermore, the adjusted trial balance serves as a guide for preparing the final financial statements, including the income statement, balance sheet, and statement of cash flows. The adjusted balances from the trial balance are used to populate these statements accurately. By ensuring the accuracy of the adjusted trial balance, accountants can have confidence in the reliability of the financial statements that will be used for decision-making by both internal and external stakeholders.

Overall, the purpose of the adjusted trial balance is to provide a clear and accurate picture of a company’s financial position and performance. It allows for specific adjustments to be made, ensuring that all financial transactions are properly recorded and reported in accordance with accounting principles and standards.

Financial Statements Prepared using the Adjusted Trial Balance

The adjusted trial balance serves as the foundation for the preparation of essential financial statements. These financial statements provide valuable information about a company’s financial performance, position, and cash flows. Let’s explore the key financial statements that are prepared using the information derived from the adjusted trial balance.

1. Income Statement: The income statement, also known as the profit and loss statement, reports a company’s revenues, expenses, gains, and losses over a specific period of time, typically a month, quarter, or year. The adjusted trial balance provides the necessary account balances to determine the revenue and expense figures for the income statement. By subtracting total expenses from total revenues, the income statement reveals the net income or net loss for the period.

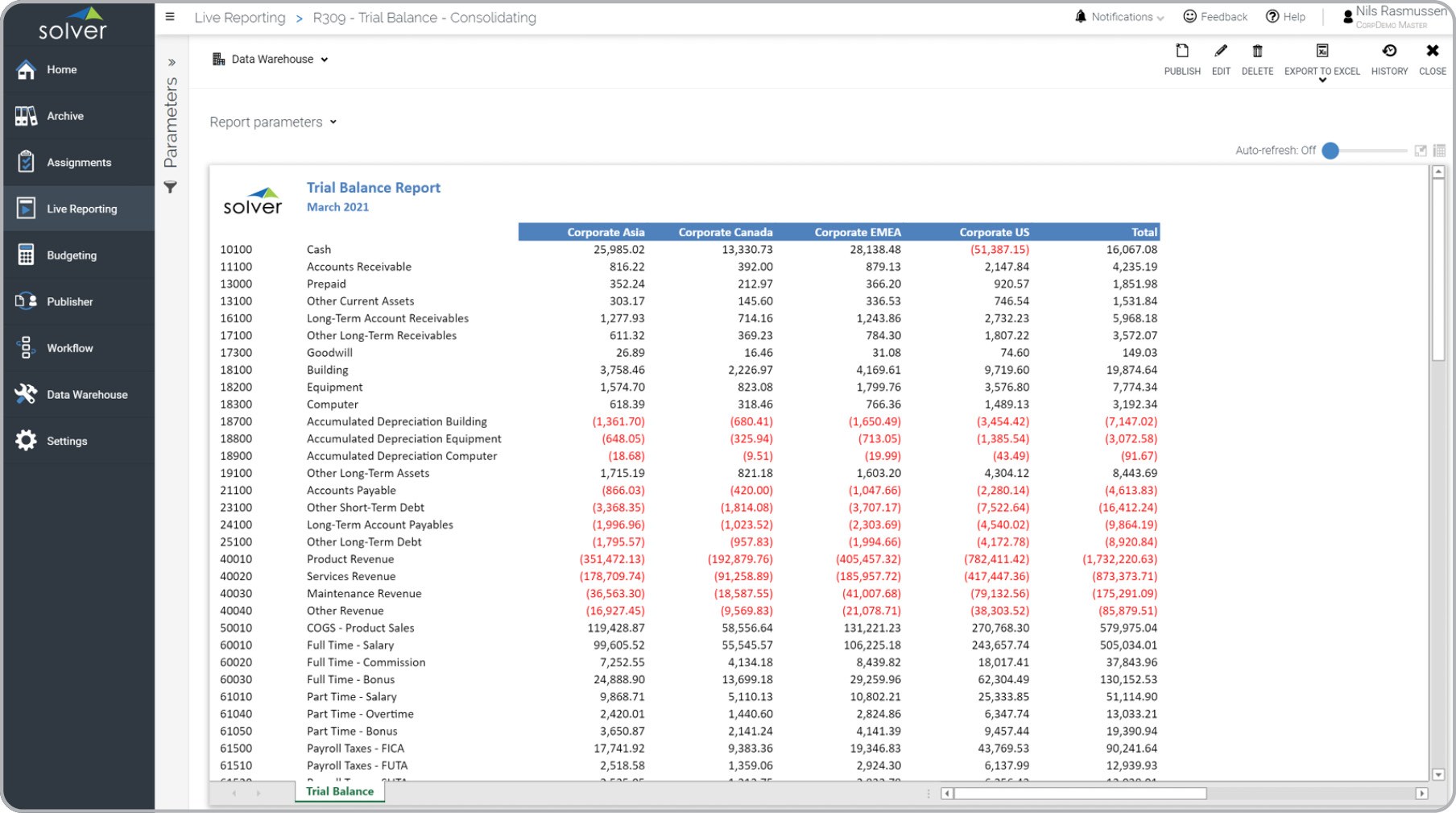

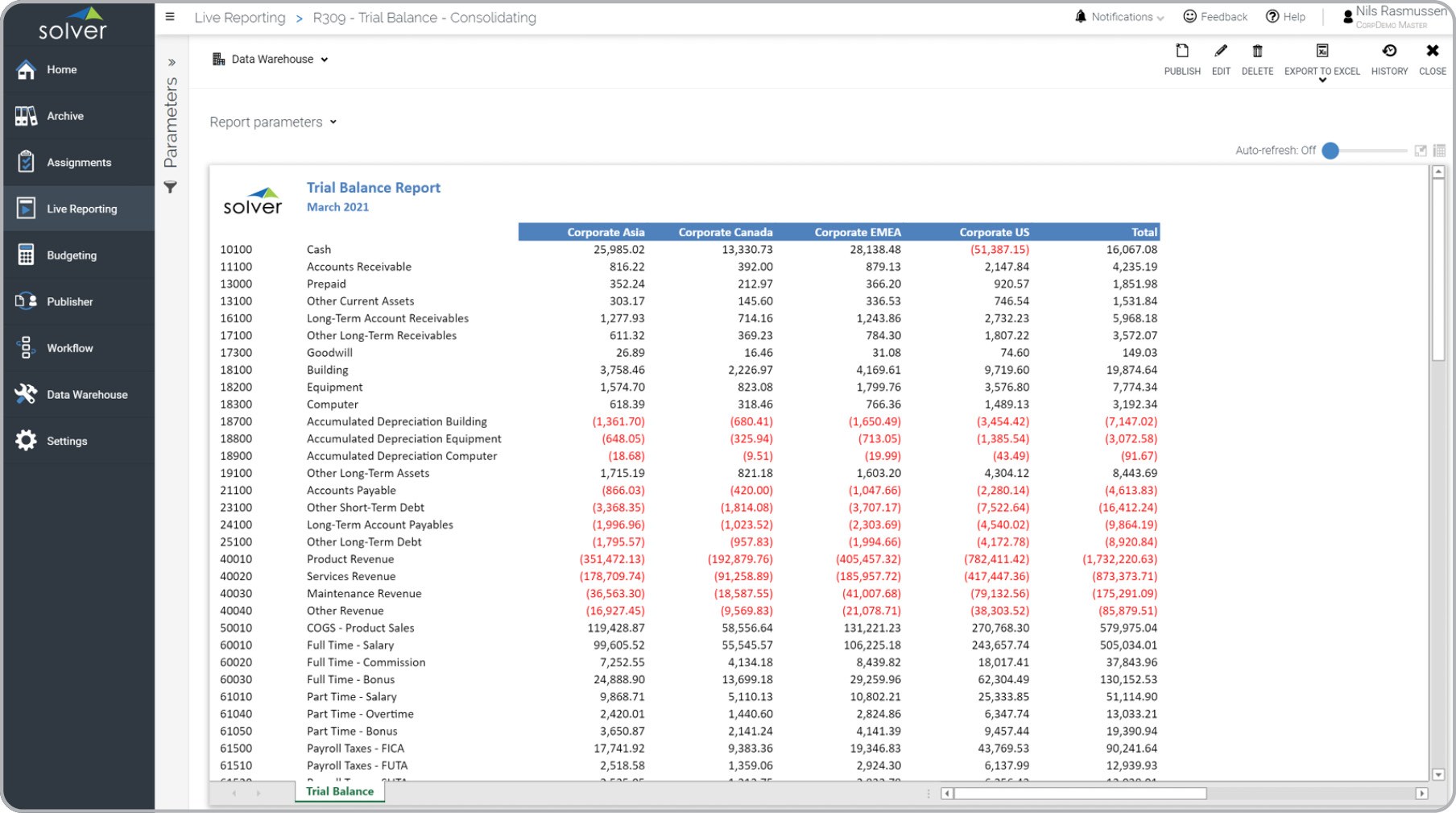

2. Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It consists of three main sections: assets, liabilities, and equity. The adjusted trial balance supplies the account balances needed to calculate the total assets, total liabilities, and shareholders’ equity. The balance sheet highlights a company’s assets, including both current and long-term assets, its liabilities, and shareholders’ equity, providing insights into its financial strength and stability.

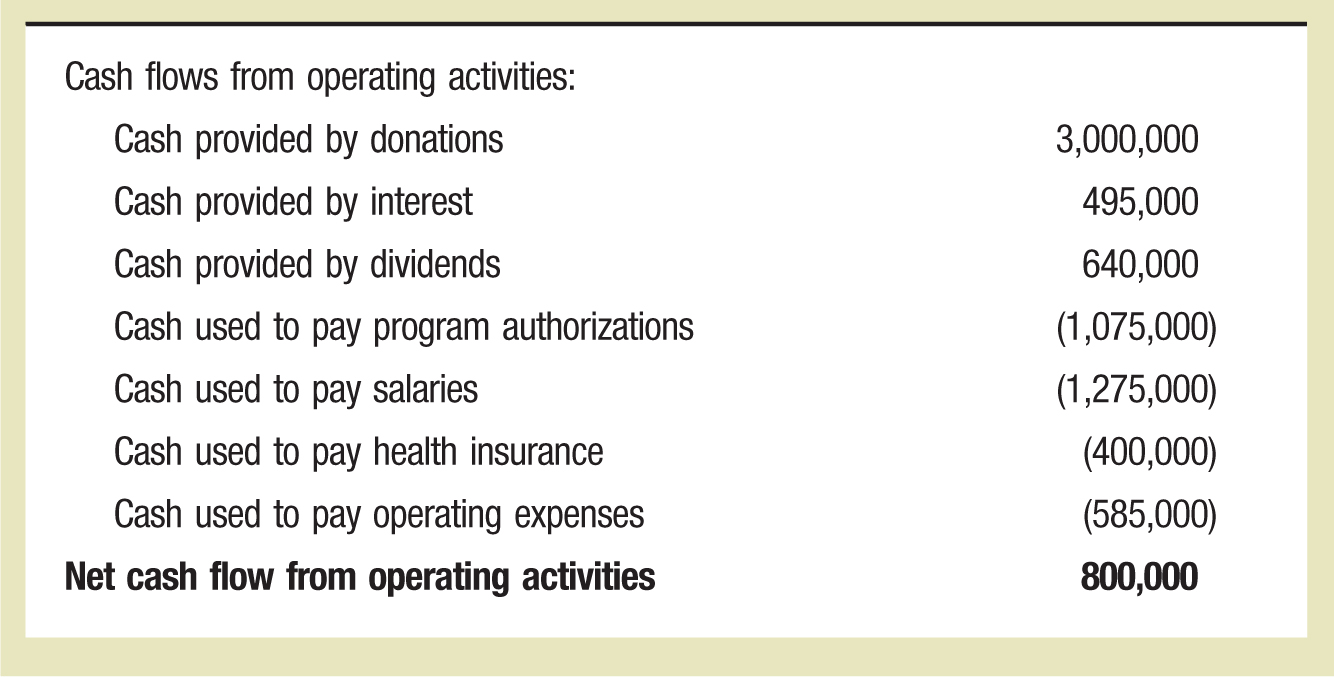

3. Statement of Cash Flows: The statement of cash flows showcases a company’s cash inflows and outflows from its operating, investing, and financing activities over a specific period. The adjusted trial balance plays a crucial role in preparing the cash flow statement by providing the necessary account balances related to cash flows. This statement helps assess a company’s ability to generate cash and manage its cash flows effectively.

4. Retained Earnings Statement: The retained earnings statement shows the changes in a company’s retained earnings balance over a specific period. It begins with the beginning balance of retained earnings, adds net income from the income statement, and deducts any dividends or distributions to shareholders. The adjusted trial balance is integral in calculating the net income figure used in the retained earnings statement.

These financial statements serve different purposes and provide insights into various aspects of a company’s financial performance and position. They allow stakeholders, such as investors, creditors, and managers, to evaluate the company’s financial health, make informed decisions, and assess its profitability and liquidity.

The adjusted trial balance ensures that the information used in these financial statements is accurate and reliable. It serves as a critical link between the accounting records and the preparation of financial statements, providing a solid foundation for financial analysis and decision-making.

Conclusion

The adjusted trial balance is an essential tool in the financial accounting process. It aids in the preparation of accurate and reliable financial statements, which are vital for assessing a company’s financial performance and position. Through adjusting entries, the adjusted trial balance ensures that revenues and expenses are properly recorded, prepaid and deferred items are appropriately allocated, and errors and omissions are rectified.

The purpose of the adjusted trial balance is to provide a checkpoint for the accuracy and completeness of the accounting records. It serves as a bridge between the unadjusted trial balance and the final financial statements, allowing accountants to make necessary adjustments before presenting the company’s financial information to stakeholders.

The financial statements prepared using the adjusted trial balance, including the income statement, balance sheet, statement of cash flows, and retained earnings statement, provide valuable insights into a company’s financial performance, position, and cash flows. These statements serve as a foundation for decision-making by investors, creditors, and management.

Overall, the adjusted trial balance is a critical part of the accounting cycle, ensuring the accuracy of financial records and the integrity of financial statements. It enables businesses to comply with accounting principles and standards, provide reliable information, and make informed decisions based on a clear understanding of their financial position and performance.

By utilizing the adjusted trial balance effectively, organizations can maintain transparency, credibility, and trustworthiness in their financial reporting, promoting confidence among stakeholders and facilitating sound financial management.