Home>Finance>Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed

Finance

Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed

Published: February 15, 2024

Learn about the definition, pros, and cons of variable interest rates in finance, and discover how they compare to fixed rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed

Welcome to our Finance category where we dive deep into various financial topics to help you make informed decisions. In this post, we will explore the world of variable interest rates, their definition, pros and cons, and how they compare to fixed interest rates. If you’ve ever wondered how these rates work and their impact on your finances, read on to discover all the essential details.

Key Takeaways:

- Variable interest rates fluctuate over time based on changes in the prevailing market conditions.

- Pros of variable interest rates include the potential for savings during periods of low interest rates.

- Cons of variable interest rates include the uncertainty and the potential for higher payments when rates increase.

What Are Variable Interest Rates?

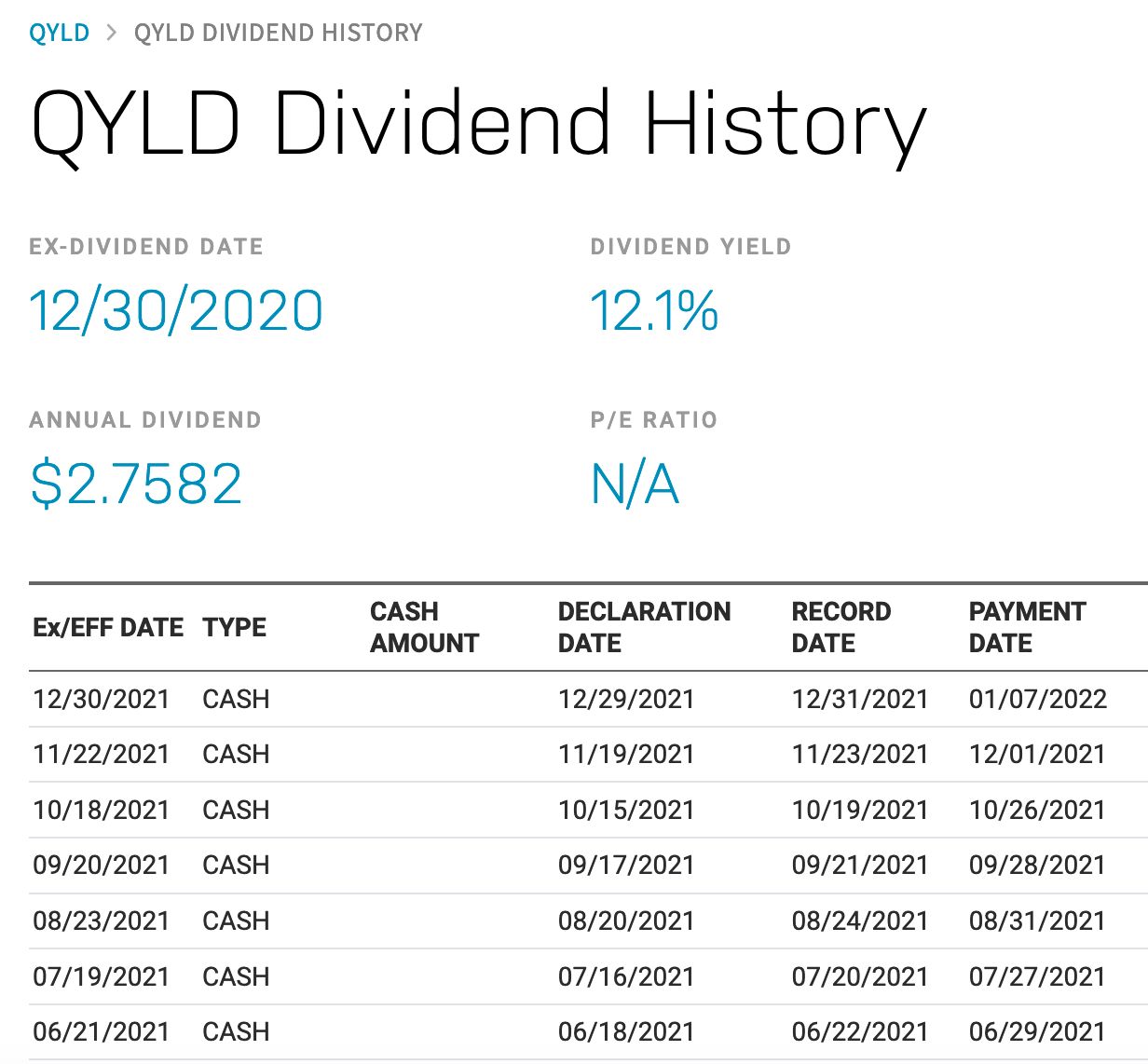

A variable interest rate, also known as an adjustable-rate or floating-rate, is an interest rate on a loan or financial product that changes over time. Unlike a fixed interest rate, which remains constant for the duration of the loan, a variable rate can increase or decrease in response to changes in key economic factors, such as the prime rate or government policies.

Variable interest rates are commonly used in mortgages, credit cards, and certain types of loans. These rates typically have two components: a benchmark index, such as the prime rate, and a margin, which is an additional percentage added on top of the index to determine the total interest rate. As the benchmark index fluctuates, so does the total interest rate.

The Pros of Variable Interest Rates

Variable interest rates can offer several advantages if managed wisely. Here are some key pros:

- Potential for Savings: During periods of low interest rates, you may benefit from lower monthly payments, which can free up cash flow for other financial goals.

- Flexibility: Variable rates provide flexibility for borrowers who expect their financial situation to change in the near future, such as those planning to sell their home relatively soon or refinance their loan.

- Lower Initial Rates: In some cases, variable interest rates may begin at a lower rate compared to fixed rates, providing an initial period of lower payments.

The Cons of Variable Interest Rates

While variable interest rates can offer advantages, it’s essential to consider the potential drawbacks as well. Here are a few cons to keep in mind:

- Uncertainty: With variable interest rates, there is uncertainty regarding future payments, as rates can increase at any time, leading to higher monthly payments.

- Financial Risk: If interest rates rise significantly, your budget might be negatively impacted, potentially causing financial strain.

- Complexity: Variable rates can introduce complexities, such as the need to monitor market conditions and assess the impact of potential rate changes on your overall financial situation.

Variable vs. Fixed Interest Rates

Now that we’ve explored the pros and cons of variable interest rates let’s briefly compare them to fixed interest rates.

Variable Interest Rates:

- Fluctuate over time based on prevailing market conditions.

- Provide potential savings during periods of low rates.

- Offer flexibility but come with uncertainty and financial risk.

- Might be suitable for borrowers who plan to sell or refinance in the near future.

Fixed Interest Rates:

- Remain constant for the duration of the loan.

- Provide stability and predictability for budgeting purposes.

- May result in higher initial rates compared to variable rates.

- Suitable for borrowers who value security and prefer long-term financial planning.

Ultimately, the choice between variable and fixed interest rates depends on your specific financial situation, risk tolerance, and your expectations for the future.

We hope this post has helped you gain a better understanding of variable interest rates. Remember to carefully evaluate your options and consult with financial professionals before making any financial decisions. Stay tuned for more informative posts to empower you on your financial journey!