Finance

What Is Credit Access Line

Published: January 13, 2024

Learn about credit access lines and how they can help you manage your finances. Explore the benefits and advantages of having a credit access line for greater financial flexibility.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s fast-paced world, it’s crucial to have access to convenient and flexible financial solutions. One such solution is a credit access line, a tool that can provide individuals with the flexibility to manage their finances efficiently. Whether you’re faced with unexpected expenses or need to fund a major purchase, a credit access line can be a valuable resource.

But what exactly is a credit access line? How does it work, and what are the benefits and drawbacks of using one? In this article, we will explore these questions and more to help you better understand the concept of credit access lines and determine if it’s the right financial tool for you.

A credit access line, sometimes referred to as a credit line or a line of credit, is a revolving credit account that allows individuals to borrow money up to a certain limit. Similar to a credit card, a credit access line gives borrowers the flexibility to access funds as needed, making it an attractive option for those who require variable amounts of money over time.

Unlike a traditional loan, which provides borrowers with a lump sum of money that is repaid over a set period, a credit access line allows borrowers to withdraw funds on an as-needed basis. This means that if you’re approved for a credit access line with a limit of $10,000, you can choose to borrow the full amount or only a portion of it, and you will only be required to repay the amount you’ve borrowed.

One of the key advantages of a credit access line is its flexibility. Unlike a loan where you have to pay interest on the entire borrowed amount, with a credit access line, you only pay interest on the amount you’ve withdrawn. This gives you the freedom to borrow and repay as needed, which can be particularly useful when dealing with fluctuating expenses or unexpected financial emergencies.

Another benefit of credit access lines is that they often have lower interest rates compared to credit cards. This can make them a more cost-effective option for borrowing money, especially if you need to finance a large purchase or consolidate higher-interest debts.

Definition of Credit Access Line

A credit access line is a type of credit facility that provides individuals with a pre-approved credit limit, allowing them to borrow money as needed. It is a form of revolving credit, which means that borrowers have the flexibility to withdraw and repay funds multiple times, as long as they stay within the approved credit limit.

Unlike a traditional loan, where borrowers receive a lump sum of money upfront, a credit access line provides a continuous source of credit that can be accessed whenever required. This makes it a convenient financial tool for managing ongoing expenses, unexpected bills, or even funding larger purchases.

Think of a credit access line as a flexible financial safety net that you can tap into whenever the need arises. It provides you with instant access to funds without the hassle of applying for a new loan each time. Instead, you can simply withdraw from your established credit line whenever you need cash and repay the borrowed amount on a schedule that works for you.

It’s essential to note that a credit access line is not the same as a credit card, although they share similarities. While both options provide ongoing access to credit and a predetermined credit limit, the way funds are accessed and repaid can differ. With a credit card, you make purchases and repay the balance either in full or in minimum payments, whereas a credit access line allows you to borrow cash directly and make repayments according to the terms agreed upon with the lender.

Another key aspect of a credit access line is the interest charged on the borrowed amount. Interest rates can vary depending on the lender and your creditworthiness. Generally, credit access lines tend to have lower interest rates compared to credit cards, making them a more cost-effective borrowing option for those who need access to additional funds.

Keep in mind that credit access lines come in different forms. Some may be secured, where the credit line is backed by collateral such as a home or a vehicle, while others may be unsecured, requiring no collateral but potentially having higher interest rates. The specific terms and conditions of a credit access line will vary depending on the lender and the individual’s credit profile.

How Credit Access Lines Work

Understanding how credit access lines work is essential before deciding to use this financial tool. These lines provide borrowers with a flexible source of credit that can be accessed as needed, offering convenience and control over their finances.

When you are approved for a credit access line, the lender sets a maximum credit limit based on factors such as your credit history, income, and other financial considerations. This credit limit represents the maximum amount of money that you can borrow from the line of credit.

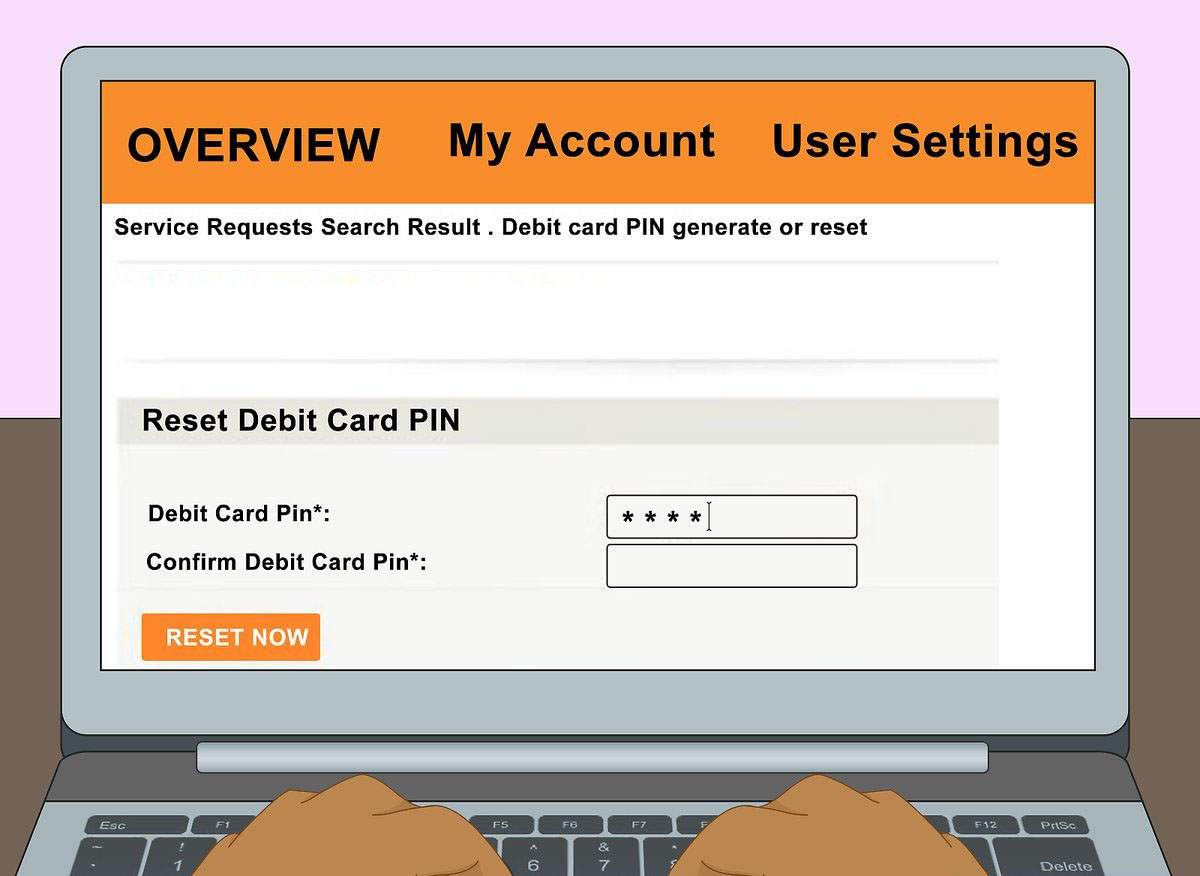

Once the credit access line is established, you have the freedom to withdraw funds up to the approved credit limit. You can make withdrawals either in cash or by using checks or a linked credit card associated with the credit access line. The amount you withdraw becomes part of your outstanding balance, accumulating interest charges that you must repay over time.

Repayment terms for credit access lines can vary, but they typically require minimum monthly payments. The minimum payment is usually a percentage of the outstanding balance or a fixed amount, depending on the terms of your credit agreement. However, it’s important to note that making only the minimum payment will result in a longer repayment period and higher interest charges.

One of the unique aspects of credit access lines is that as you make repayments, the funds become available for you to borrow again. For instance, if you had a credit access line with a $10,000 limit and borrowed $2,500, your available credit would decrease to $7,500. But as you repay the borrowed amount, let’s say $1,000, your available credit would increase back to $8,500.

Interest is charged on the outstanding balance of a credit access line, and the rate can vary depending on factors such as your creditworthiness and prevailing market conditions. The interest is typically calculated on a daily or monthly basis, and the total interest charges are added to your outstanding balance.

It’s crucial to carefully manage your credit access line to avoid overspending and accumulating too much debt. Responsible use involves borrowing only what you need, making timely and consistent repayments, and keeping your credit utilization ratio low. By doing so, you can maintain a good credit standing and have access to this financial tool whenever you need it.

Benefits of Credit Access Lines

Using a credit access line can offer several benefits that make it an attractive option for individuals seeking flexible borrowing solutions. Here are some of the key advantages of credit access lines:

- Flexibility: One of the primary benefits of a credit access line is its flexibility. Unlike traditional loans, where you receive a lump sum upfront, a credit access line allows you to borrow funds as needed up to your approved credit limit. This provides you with the freedom to have immediate access to cash whenever unexpected expenses arise or when you’re planning larger purchases.

- Variable Borrowing Amounts: Credit access lines give you the ability to borrow varying amounts. Unlike a fixed loan, where you must borrow the entire sum, a credit access line allows you to borrow only what you need. This can be helpful for managing unpredictable expenses and can save you money on interest by avoiding unnecessary borrowing.

- Lower Interest Rates: Credit access lines often come with lower interest rates compared to credit cards and other forms of unsecured borrowing. This can make them a cost-effective option for accessing funds when compared to high-interest credit card debt or personal loans. By taking advantage of lower interest rates, you can save money on interest charges and potentially pay off your debt faster.

- Easy Access to Funds: Once you have a credit access line established, accessing funds is quick and convenient. Whether you need cash or prefer to use checks or a linked credit card, you can easily tap into your available credit whenever required. This can be particularly beneficial in emergencies or unexpected situations where immediate access to funds is crucial.

- Credit Building Opportunity: Using a credit access line responsibly and making timely payments can help you build a positive credit history. By demonstrating responsible borrowing behavior, such as making consistent repayments and keeping your credit utilization ratio low, you can improve your credit score. This, in turn, can open doors to obtaining better loan terms and interest rates in the future.

It’s important to note that while credit access lines offer numerous benefits, it’s crucial to use them responsibly. It’s easy to become reliant on credit and fall into a cycle of debt. Therefore, it’s essential to borrow only what you can afford to repay and make regular, on-time payments to maintain your credit standing.

Drawbacks of Credit Access Lines

While credit access lines can be beneficial for many individuals, it’s important to be aware of the potential drawbacks associated with using this financial tool. Understanding the downsides can help you make informed decisions and use credit access lines responsibly. Here are some of the drawbacks to consider:

- Unrestricted Access to Credit: One of the drawbacks of credit access lines is that they can provide easy and unrestricted access to credit. This means that if you’re not careful, you may be tempted to overspend or borrow more than you can afford to repay. It’s crucial to exercise discipline and use credit wisely to avoid accumulating excessive debt.

- Potential for High-Interest Charges: While credit access lines typically have lower interest rates compared to credit cards, the interest charges can still be significant if you carry a balance for an extended period. If you only make minimum payments, interest can accumulate, making it more challenging to pay off the debt. It’s essential to be mindful of your repayment strategy and aim to pay off the borrowed amount as quickly as possible.

- Variable Interest Rates: The interest rates on credit access lines can be variable, meaning they can change over time. Variable interest rates can make it challenging to predict and budget for your monthly payments. It’s essential to monitor the interest rate and be prepared for potential fluctuations that may impact the cost of borrowing.

- Potential Impact on Credit Score: While responsible use of credit access lines can have a positive impact on your credit score, mismanagement can lead to a negative impact. If you consistently carry a high balance or make late payments, it can lower your credit score and make it more challenging to obtain credit in the future.

- Fees and Charges: Credit access lines may come with fees and charges, such as annual fees, transaction fees, or cash advance fees. These fees can add to the overall cost of borrowing and should be considered when evaluating the value and affordability of a credit access line.

It’s important to review the terms and conditions of the credit access line agreement carefully. Understanding the potential drawbacks can help you make informed decisions about whether a credit access line aligns with your financial goals and abilities. Use credit access lines responsibly, borrow only what you need, and develop a repayment plan to avoid falling into a cycle of debt.

How to Qualify for a Credit Access Line

Qualifying for a credit access line requires meeting certain criteria set by lenders. While specific requirements can vary among financial institutions, there are common factors that lenders consider when evaluating applications. Here are some key factors that may influence your eligibility for a credit access line:

- Credit History: Lenders typically assess your credit history to determine your creditworthiness. They will review your credit report, which includes information about your payment history, debt levels, and any previous delinquencies. A strong credit history with a good credit score increases your chances of qualifying for a credit access line.

- Income and Employment: Lenders want to ensure that you have a stable source of income to repay the borrowed funds. They may request proof of employment and income, such as pay stubs or tax returns. A steady and sufficient income reassures lenders that you can meet your repayment obligations.

- Debt-to-Income Ratio: Lenders also assess your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower debt-to-income ratio demonstrates better financial stability and increases your chances of qualifying for a credit access line.

- Collateral: Some credit access lines may be secured, meaning they are backed by collateral such as a home or vehicle. If you opt for a secured credit access line, the lender may consider the value and condition of the collateral in the approval process. Collateral provides added security for lenders, increasing your chances of approval.

- Payment History: Lenders want assurance that you have a history of making timely payments on your debts. Late payments or delinquencies on previous loans or credit cards may negatively impact your eligibility for a credit access line.

It’s essential to check with different lenders to understand their specific requirements and eligibility criteria for a credit access line. Each lender may have their own set of guidelines, and one lender’s decision may differ from another’s. It’s also important to note that meeting the eligibility criteria does not guarantee approval, as lenders consider multiple factors when assessing creditworthiness.

To maximize your chances of qualifying for a credit access line, it’s important to maintain a good credit history by consistently making payments on time, managing your debts responsibly, and keeping your credit utilization ratio low. Regularly reviewing your credit report and addressing any inaccuracies or discrepancies can also improve your creditworthiness and increase your chances of obtaining a credit access line.

Tips for Using a Credit Access Line Responsibly

While credit access lines offer flexibility and convenience, it’s important to use them responsibly to avoid falling into a cycle of debt. Here are some tips for using a credit access line responsibly:

- Borrow Only What You Need: It’s crucial to borrow only the amount you actually need. Resist the temptation to borrow the maximum limit just because it’s available to you. Carefully assess your financial situation and borrow responsibly to avoid accumulating excessive debt.

- Create a Repayment Plan: Before borrowing from your credit access line, create a repayment plan. Determine how much you can afford to repay each month and develop a timeline to pay off the borrowed amount. By sticking to a repayment plan, you can avoid carrying a balance for an extended period and minimize interest charges.

- Make Timely Payments: Paying your credit access line bills on time is crucial to maintaining a good credit score and avoiding late payment fees. Set up reminders or automatic payments to ensure that you never miss a payment deadline.

- Avoid Maximum Credit Utilization: While credit access lines provide access to a certain credit limit, it’s advisable to keep your credit utilization ratio low. A high credit utilization ratio can negatively impact your credit score. Aim to use only a portion of your available credit to demonstrate responsible borrowing behavior.

- Monitor Interest Rates: If your credit access line has a variable interest rate, keep an eye on any rate fluctuations. Rising interest rates can impact the cost of borrowing and increase your monthly payments. Be prepared for potential changes and budget accordingly.

- Avoid Cash Advances: While credit access lines allow cash withdrawals, it’s best to avoid using them for cash advances. Cash advances often come with higher interest rates and additional fees. If possible, consider other alternatives, such as using a debit card or taking out a personal loan, to meet your cash needs.

- Regularly Review Your Credit Report: Monitoring your credit report is important to ensure its accuracy and identify any potential issues. Regularly reviewing your credit report allows you to dispute any errors or fraudulent activities promptly. A clean and accurate credit report is essential for maintaining good credit health.

By following these tips, you can maximize the benefits of a credit access line while avoiding the potential pitfalls. Remember, responsible use of credit is essential for maintaining a healthy financial position and achieving your long-term financial goals.

Alternatives to Credit Access Lines

While credit access lines can be a useful tool for managing your finances, they may not be the ideal choice for everyone. Depending on your financial situation and needs, there are alternative options that you can consider. Here are some alternatives to credit access lines:

- Credit Cards: If you need short-term financing or prefer the convenience of a credit card, utilizing a credit card can be an alternative to a credit access line. Credit cards provide a revolving credit limit that allows for flexible borrowing. However, it’s crucial to use credit cards responsibly, pay off the balance in full each month, and avoid accumulating high-interest debt.

- Personal Loans: Personal loans are another option if you need a larger sum of money for a specific purpose, such as home renovations or debt consolidation. Personal loans offer fixed repayment terms and predictable monthly payments. They may have higher interest rates compared to credit access lines, but they provide a structured repayment plan that can be helpful for budgeting.

- HELOCs (Home Equity Line of Credit): If you own a home, a home equity line of credit (HELOC) can be an alternative to a credit access line. HELOCs allow you to borrow against the equity in your home. They typically come with lower interest rates compared to unsecured lines of credit. However, keep in mind that using your home as collateral means the risk of losing your home if you cannot make the required payments.

- Emergency Savings Fund: Building an emergency savings fund is a proactive way to manage unexpected expenses. Having an accessible fund for emergencies can help you avoid relying on credit access lines or other forms of credit. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

- Negotiating Payment Plans: If you’re facing financial difficulties, it’s worthwhile to reach out to creditors to explore the possibility of negotiating payment plans. Many lenders and service providers are willing to work with you to develop a more manageable repayment arrangement. This can help you avoid using credit access lines or accumulating additional debt.

It’s important to carefully consider your financial situation, needs, and borrowing preferences when choosing alternatives to credit access lines. Assess the terms, interest rates, and repayment options of each alternative to make an informed decision that aligns with your financial goals and capabilities.

Remember, responsible borrowing and financial management are key to maintaining a healthy financial position and achieving long-term financial stability.

Conclusion

Credit access lines can be a valuable financial tool for managing expenses and providing flexibility when needed. They offer the convenience of accessing funds on an as-needed basis, allowing borrowers to have control over their financial situation. However, it’s crucial to use credit access lines responsibly to avoid falling into a cycle of debt.

Throughout this article, we have explored the definition and functionality of credit access lines, the benefits, drawbacks, and responsible usage tips. When using a credit access line, it’s important to borrow only what you need, create a repayment plan, and make timely payments to minimize interest charges. Monitoring your credit report, maintaining a good credit history, and considering alternatives when necessary are all part of responsible financial management.

Remember, credit access lines are not suitable for everyone. Depending on your needs, preferences, and financial situation, alternative options such as credit cards, personal loans, home equity lines of credit (HELOCs), emergency savings funds, or negotiating payment plans may be more suitable. It’s essential to assess the pros and cons of each borrowing option and choose the one that aligns with your goals and financial capacity.

Ultimately, responsible borrowing and financial management are vital for maintaining a healthy financial position and achieving long-term financial stability. By using credit access lines wisely and considering other alternatives, you can make informed decisions and take control of your financial future.