Home>Finance>Variance Swap: Definition Vs. Volatility Swap And How It Works

Finance

Variance Swap: Definition Vs. Volatility Swap And How It Works

Published: February 15, 2024

Learn about variance swaps and how they compare to volatility swaps in the world of finance. Gain insights on their definitions, workings, and more.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Introducing Variance Swap: A Guide to Understanding its Definition, Differences Compared to Volatility Swaps, and How It Works

Are you curious to learn about financial instruments that can help you manage risk in your investment portfolio? Look no further – variance swaps might be just what you’re looking for. In this article, we will provide you with a comprehensive understanding of variance swaps and how they differ from volatility swaps. So, fasten your seatbelts as we dive into the world of variance swaps!

Key Takeaways:

- Variance swaps are financial derivatives that allow investors to speculate on or hedge against the volatility of an underlying asset, such as stocks or indices.

- Volatility swaps, on the other hand, are financial contracts that enable investors to trade the future volatility of an underlying asset without owning the asset itself.

The Basics of Variance Swaps:

Before we explore the differences between variance swaps and volatility swaps, let’s start by understanding the fundamentals of variance swaps.

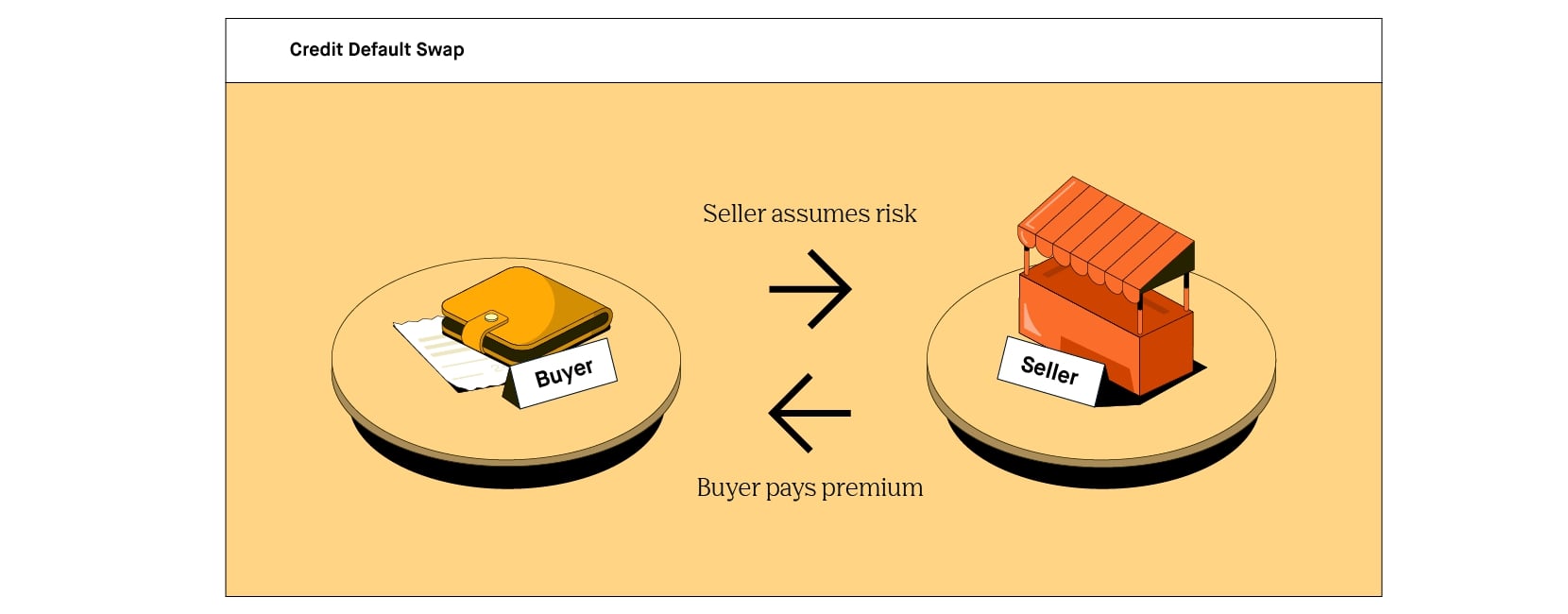

Variance swaps are financial contracts that allow investors to trade the future variance of an underlying asset, like stocks or indices, without owning the asset itself. In simpler terms, investors can speculate on or hedge against the volatility of an asset using variance swaps. The price of a variance swap is determined by the difference between the realized and implied variance of the underlying asset over a specified period. This difference, known as the variance premium, is what investors aim to capture.

Unlike options or futures contracts, variance swaps don’t involve the direct buying or selling of the underlying asset. Instead, investors enter into an agreement where one party pays the other the difference between the realized and implied variance. This structure allows investors to gain exposure to volatility without owning the asset, making variance swaps an efficient tool for risk management.

Differentiating Variance Swaps from Volatility Swaps:

Let’s now look at how variance swaps differ from volatility swaps.

While both variance swaps and volatility swaps are used to trade volatility, there are some key distinctions worth noting:

1. Underlying Measurement:

Variance swaps are based on the future variance of an underlying asset, whereas volatility swaps are based on the future realized volatility.

2. Pricing Methodology:

In variance swaps, the price is determined by the difference between realized and implied variance. On the other hand, volatility swaps are priced based on the difference between realized volatility and the strike or reference volatility.

3. Payoff Structure:

When it comes to payoffs, variance swaps settle in cash, whereas volatility swaps can settle in either cash or the underlying asset itself.

4. Purpose and Market Participants:

Variance swaps are primarily used for hedging or taking speculative positions by institutional investors, hedge funds, and traders. On the other hand, volatility swaps are commonly used by proprietary trading firms and market-makers for arbitrage opportunities or capturing implied volatility.

Conclusion:

Variance swaps offer a unique way for investors to manage risk and speculate on volatility without owning the underlying asset. The flexibility and efficiency of variance swaps make them popular among institutional investors and traders alike. It’s essential to understand the differences between variance swaps and volatility swaps to utilize these financial instruments effectively and make informed investment decisions. Whether you choose to trade variance swaps, volatility swaps, or both, consider your investment goals, risk tolerance, and seek professional guidance if needed.

Key Takeaways:

- Variance swaps allow investors to trade the future variance of an underlying asset without owning it, while volatility swaps allow trading of future realized volatility.

- Variance swaps settle in cash, while volatility swaps can settle in cash or the underlying asset itself.