Finance

How Do Credit Default Swaps Work

Published: March 4, 2024

Learn how credit default swaps function in the finance industry, including their role in managing credit risk and their impact on financial markets. Understanding the mechanics of credit default swaps is crucial for anyone involved in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Basics of Credit Default Swaps

Credit default swaps (CDS) have been a significant topic of discussion in the financial world, especially after the 2008 global financial crisis. These financial instruments are a type of derivative that allows investors to protect themselves against the risk of default on bonds or other types of debt. At the same time, they can also be used for speculative purposes.

CDS are essentially insurance contracts against the default of a borrower. They provide a way for investors to hedge against the potential loss of their investment in fixed income securities. Understanding the mechanics of credit default swaps is crucial for anyone involved in the financial markets, as they play a pivotal role in managing credit risk.

In this article, we will delve into the intricacies of credit default swaps, exploring the parties involved, how they work, their pricing and valuation, as well as the associated risks. By gaining a comprehensive understanding of these instruments, investors and financial professionals can make informed decisions regarding their use and implications in the broader financial landscape.

What Are Credit Default Swaps?

Credit default swaps (CDS) are financial derivatives that enable investors to mitigate the risk of default on debt instruments. They function as a form of insurance against the non-payment of debt, providing protection to the buyer in the event of a credit event, such as default or restructuring. Essentially, a credit default swap transfers the credit risk of a fixed income security from the holder of the security to the CDS seller.

Unlike traditional insurance, where the insured party must possess an insurable interest in the underlying asset, credit default swaps can be purchased by investors who do not necessarily own the underlying debt. This feature has made CDS a popular tool for speculation and hedging in the financial markets.

When an investor purchases a credit default swap, they are essentially buying protection against the possibility of a bond issuer defaulting on its debt obligations. In exchange for this protection, the buyer of the CDS makes periodic payments, often referred to as the “spread,” to the seller of the swap. If a credit event occurs, the seller of the CDS compensates the buyer for the loss incurred due to the default.

It’s important to note that credit default swaps are traded over-the-counter (OTC), meaning they are not transacted on organized exchanges. This OTC nature allows for greater flexibility in customizing the terms of the CDS contracts, but it also introduces counterparty risk, as the creditworthiness of the CDS seller becomes a critical factor.

Overall, credit default swaps serve as a crucial risk management tool in the realm of fixed income investing, offering investors the ability to hedge against credit risk and potentially enhance their investment strategies through the utilization of these derivative instruments.

Parties Involved in Credit Default Swaps

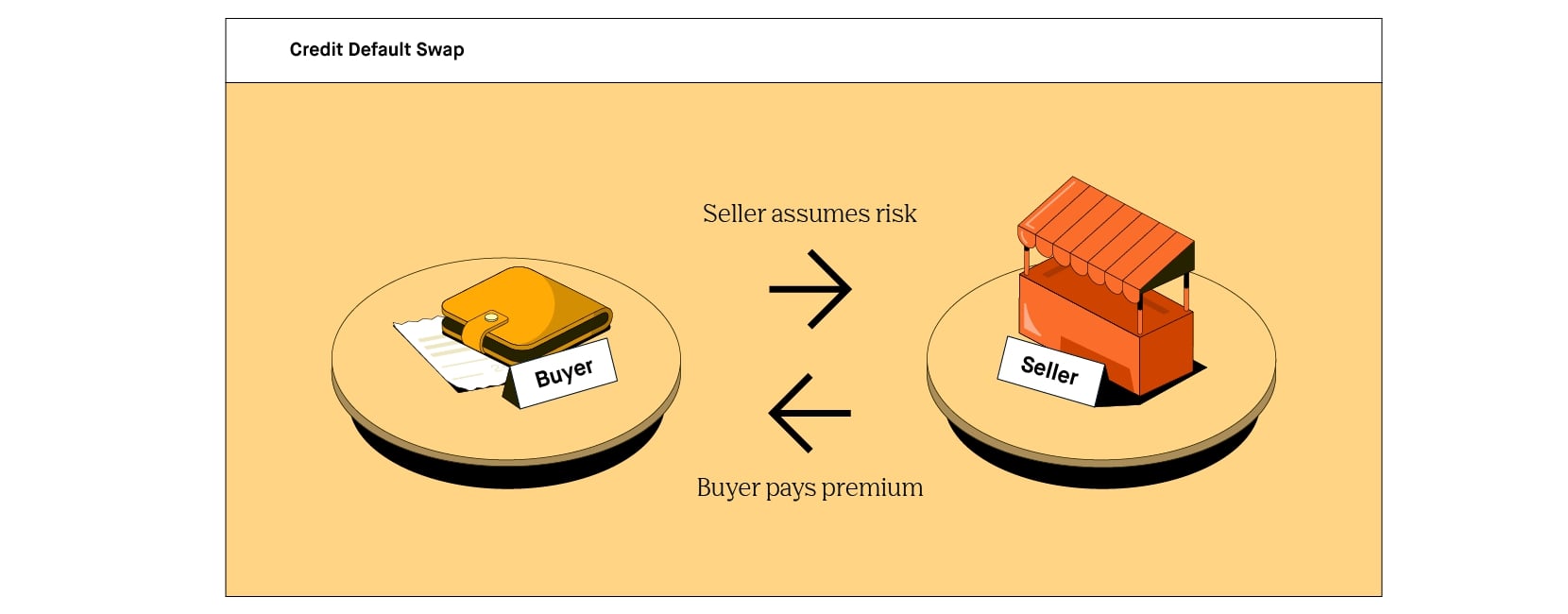

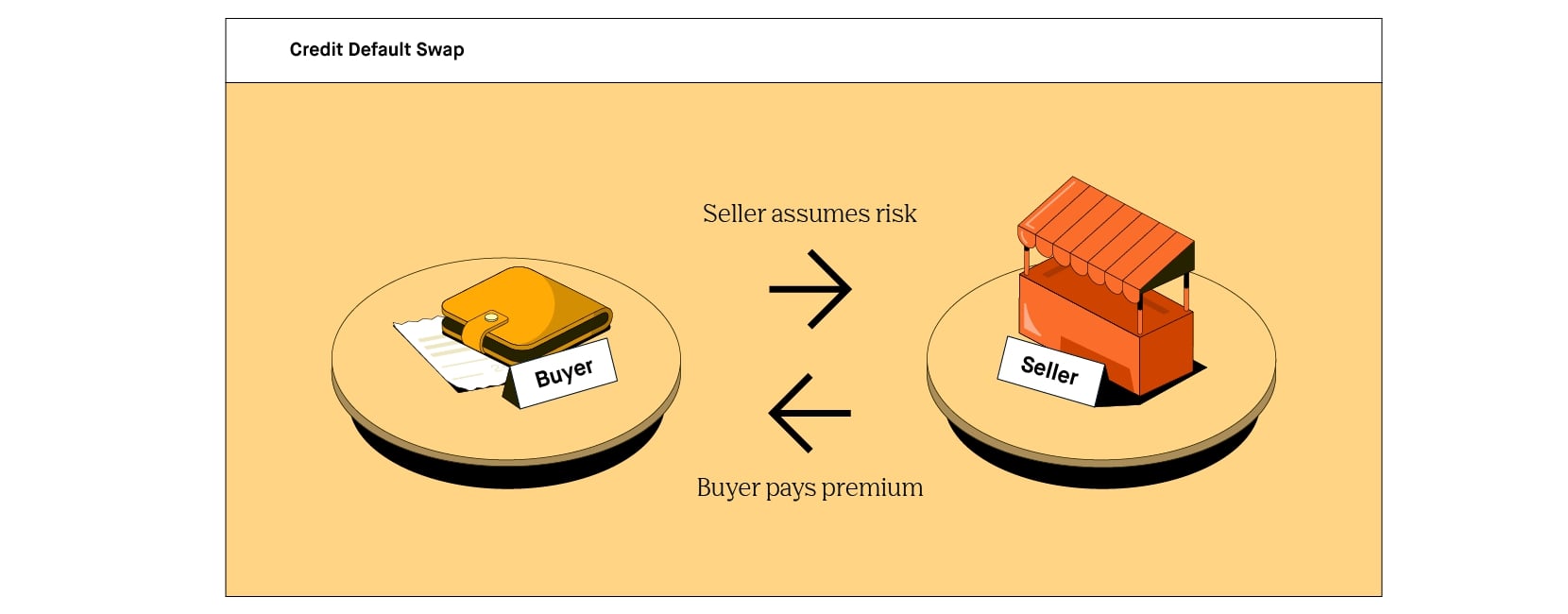

Understanding the dynamics of credit default swaps involves recognizing the key parties involved in these derivative contracts. There are typically two primary participants in a credit default swap transaction: the protection buyer and the protection seller.

1. Protection Buyer: The protection buyer, also known as the “long” position, is the party seeking protection against the credit risk associated with a particular debt instrument. This entity could be an investor holding the underlying bond or a speculator aiming to hedge against potential credit events. The protection buyer makes regular payments to the protection seller, known as the “premium” or “spread,” in exchange for the protection provided by the credit default swap.

2. Protection Seller: The protection seller, often referred to as the “short” position, is the party assuming the risk of the underlying debt instrument defaulting. In return for receiving the premium payments from the protection buyer, the protection seller agrees to compensate the buyer in the event of a credit event, such as a default or restructuring. The protection seller effectively underwrites the credit risk associated with the underlying security, assuming the obligation to make a payment if a credit event occurs.

It’s important to note that while these are the primary parties involved in a standard credit default swap, there can be variations and additional entities in more complex CDS transactions. These may include entities acting as intermediaries, facilitators, or guarantors, depending on the specific terms and structures of the credit default swap contract.

Understanding the roles and motivations of the protection buyer and seller is essential for comprehending the risk transfer and hedging aspects of credit default swaps. By delineating the responsibilities and incentives of each party, market participants can gain insights into the functioning and implications of these derivative instruments within the broader financial ecosystem.

How Credit Default Swaps Work

Credit default swaps operate through a straightforward yet impactful mechanism, facilitating risk management and speculation within the financial markets. The process of how credit default swaps work involves several key steps that elucidate the dynamics of these derivative instruments.

1. Agreement and Premium Payments: The process begins with the protection buyer and seller entering into a credit default swap agreement. The protection buyer agrees to make regular premium payments to the protection seller, typically based on the notional value of the underlying debt instrument. These payments compensate the protection seller for assuming the credit risk associated with the underlying security.

2. Occurrence of Credit Event: If a credit event, such as a default, occurs with the underlying debt instrument, the protection buyer can claim the face value of the bond from the protection seller. This payment is made to compensate for the loss incurred due to the credit event. The protection buyer essentially receives the protection amount agreed upon in the credit default swap contract.

3. Settlement of the CDS Contract: Upon the occurrence of a credit event, the protection seller is obligated to fulfill their payment obligation to the protection buyer. The settlement may involve the physical delivery of the underlying bond or a cash payment equivalent to the loss incurred by the protection buyer due to the credit event.

It’s important to highlight that credit default swaps can also be unwound or traded before the occurrence of a credit event. Investors can enter into or exit CDS positions by selling their contracts to other market participants, thereby managing their exposure to credit risk or capitalizing on speculative opportunities.

The flexibility and risk management capabilities offered by credit default swaps have made them integral to the functioning of the fixed income markets, allowing investors to tailor their risk profiles and optimize their investment strategies in response to evolving market conditions and credit dynamics.

Pricing and Valuation of Credit Default Swaps

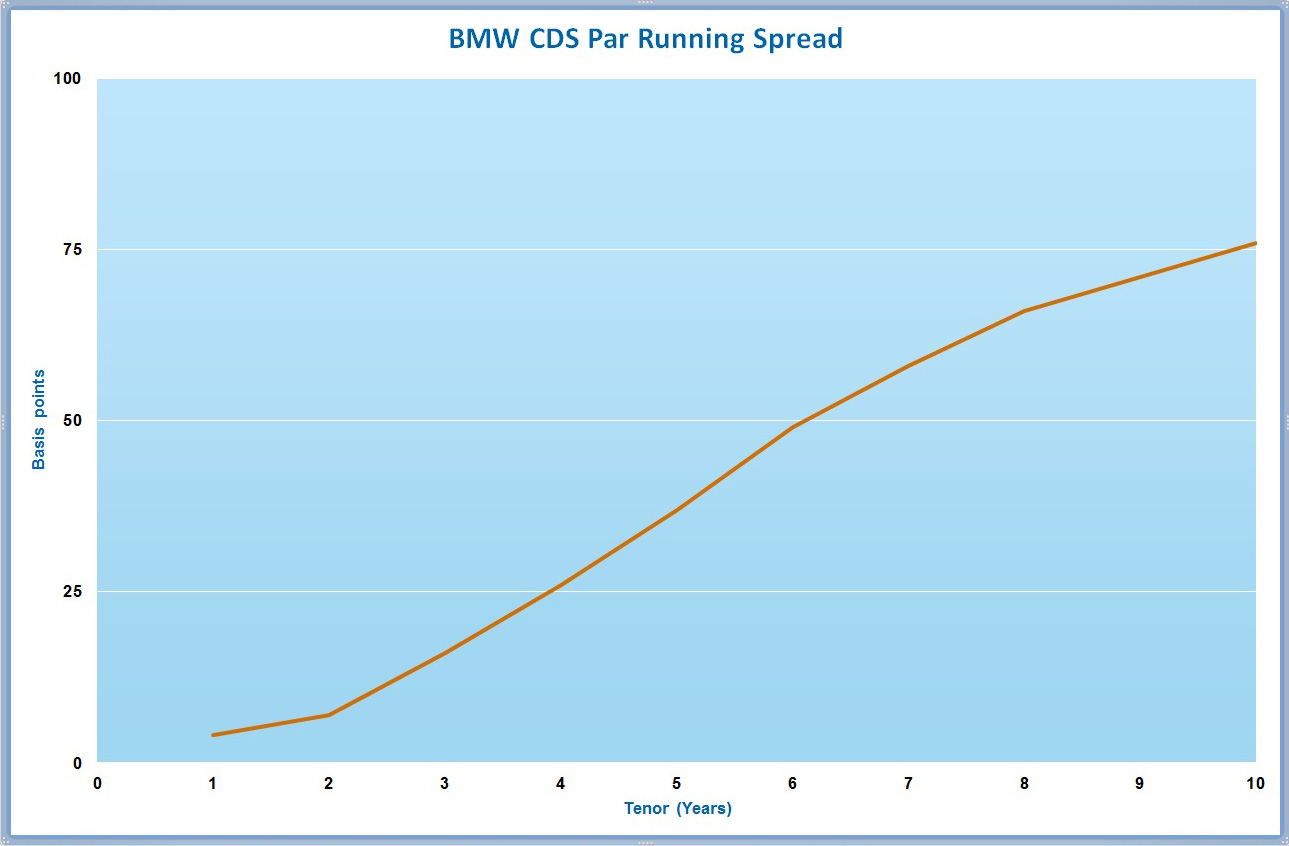

The pricing and valuation of credit default swaps (CDS) are pivotal aspects that influence their attractiveness to market participants and their effectiveness as risk management tools. Understanding how CDS are priced and valued provides insights into the intricate mechanisms that underpin these derivative instruments.

Determinants of CDS Pricing: The pricing of credit default swaps is influenced by various factors, including the creditworthiness of the underlying bond issuer, prevailing market interest rates, the term of the CDS contract, and the overall market sentiment regarding credit risk. Additionally, the supply and demand dynamics for credit protection impact the pricing of CDS spreads, reflecting the perceived credit risk associated with the underlying debt instrument.

Valuation of CDS Contracts: The valuation of credit default swaps involves assessing the present value of the future cash flows associated with the swap, considering the probability of a credit event occurring and the magnitude of potential losses. Valuation models, such as the standard present value framework and more advanced probability-based models, are utilized to estimate the fair value of CDS contracts, incorporating market expectations and credit risk metrics.

Market Dynamics and Liquidity: The liquidity of the CDS market and prevailing market conditions also play a significant role in the pricing and valuation of credit default swaps. Market participants consider the depth of the CDS market, bid-ask spreads, and transaction volumes when assessing the fair value of CDS contracts, as these factors influence the ease of entering into or unwinding CDS positions.

Overall, the pricing and valuation of credit default swaps are multifaceted processes that integrate credit risk assessments, market dynamics, and financial modeling techniques. By comprehending the intricacies of CDS pricing and valuation, investors and financial institutions can make informed decisions regarding the utilization of these derivative instruments in their investment and risk management strategies.

Risks Associated with Credit Default Swaps

Credit default swaps (CDS) offer valuable risk management capabilities, but they also entail inherent risks that warrant careful consideration by market participants. Understanding the potential risks associated with CDS is essential for effectively navigating the complexities of these derivative instruments and making informed investment decisions.

1. Credit Risk: While CDS are designed to mitigate credit risk, they also introduce counterparty risk, particularly for the protection buyer. If the protection seller defaults or becomes unable to fulfill their obligations in the event of a credit event, the protection buyer may face significant losses, thereby amplifying credit risk rather than mitigating it.

2. Liquidity Risk: The liquidity of the CDS market can impact the ease of entering into or exiting CDS positions. Limited liquidity may result in wider bid-ask spreads and challenges in unwinding CDS contracts, potentially exposing investors to liquidity risk and impeding their ability to manage their credit risk exposure effectively.

3. Basis Risk: Basis risk arises from the potential mismatch between the underlying debt instrument and the credit default swap used for hedging purposes. Variations in the credit characteristics or terms of the CDS contract and the actual underlying debt can lead to basis risk, diminishing the effectiveness of the hedge and exposing investors to residual credit risk.

4. Legal and Regulatory Risks: The legal and regulatory environment surrounding credit default swaps can impact their risk profile. Changes in regulations, legal interpretations, or the enforceability of CDS contracts can introduce uncertainty and legal risk, influencing the overall risk assessment and usage of these derivative instruments.

5. Market and Systemic Risks: Credit default swaps are interconnected with broader market dynamics and systemic risks. Adverse market conditions, economic downturns, or systemic financial crises can impact the creditworthiness of multiple entities simultaneously, leading to heightened credit risk and potential challenges in managing CDS positions effectively.

By acknowledging and evaluating these risks, market participants can adopt risk mitigation strategies, such as diversification, thorough counterparty assessments, and ongoing monitoring of market conditions, to prudently manage the risks associated with credit default swaps and optimize their risk-return profiles within their investment portfolios.

Conclusion

Credit default swaps (CDS) occupy a significant role in the realm of financial markets, offering a mechanism for managing credit risk, hedging against potential defaults, and engaging in speculative strategies. As derivative instruments, CDS provide valuable risk management capabilities, but they also introduce complexities and inherent risks that necessitate careful consideration by market participants.

Understanding the mechanics of credit default swaps, including the parties involved, pricing and valuation dynamics, and associated risks, is crucial for investors, financial institutions, and regulatory authorities. The ability to navigate the intricacies of CDS empowers market participants to make informed decisions regarding risk management, investment strategies, and regulatory frameworks.

While credit default swaps have been instrumental in facilitating risk transfer and optimizing investment portfolios, they have also been subject to scrutiny and regulatory reforms in the aftermath of past financial crises. Striking a balance between leveraging the risk management benefits of CDS and mitigating their potential downsides is essential for fostering a resilient and transparent financial ecosystem.

As the financial landscape continues to evolve, credit default swaps will remain a focal point of discussions surrounding risk management, market stability, and regulatory oversight. Market participants are encouraged to stay abreast of developments in the CDS market, uphold robust risk management practices, and engage in responsible utilization of these derivative instruments to uphold the integrity and stability of the broader financial system.

By fostering a comprehensive understanding of credit default swaps and their implications, market participants can navigate the intricacies of these instruments with prudence and foresight, contributing to a more resilient and adaptive financial marketplace.