Finance

Waterfall Concept Definition

Published: February 17, 2024

Discover the concept of waterfall in finance and learn how it influences investment strategies. Gain insights on its benefits and drawbacks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Waterfall Concept: A Practical Guide to Managing Your Finances

Managing your finances can often feel like navigating through uncharted waters. There are numerous factors to consider, from budgeting and saving to investing and planning for the future. It’s no wonder that many people find themselves overwhelmed and unsure of where to begin. That’s where the waterfall concept comes in. In this article, we’ll explore the waterfall concept and how it can be applied to effectively manage your finances.

Key Takeaways:

- The waterfall concept is a practical approach to managing finances that involves prioritizing and allocating funds based on their importance.

- By implementing the waterfall concept, you can ensure that you cover your essential expenses first and allocate money towards savings, investments, and other financial goals.

Understanding the Waterfall Concept

Imagine a beautiful waterfall cascading down a mountain. The water flows seamlessly from one level to another, with no wastage or misdirection. In the same way, the waterfall concept involves prioritizing and directing your finances to ensure a smooth and efficient flow towards your financial goals.

Here’s how you can apply the waterfall concept to effectively manage your finances:

- Take stock of your income: Begin by assessing your income sources and understanding how much money you have available to allocate towards your financial goals.

- Allocate towards essential expenses: Start by covering your essential expenses, such as rent/mortgage, utilities, groceries, and debt payments. These are necessities that must be prioritized and accounted for.

- Create an emergency fund: Next, allocate a portion of your income towards building an emergency fund. This fund should ideally cover at least three to six months’ worth of living expenses, providing you with a safety net in case of unexpected financial setbacks.

- Save for short-term goals: Once your essential expenses and emergency fund are taken care of, direct a portion of your income towards short-term goals. This could include saving for a vacation, purchasing a new gadget, or any other short-term aspirations you may have.

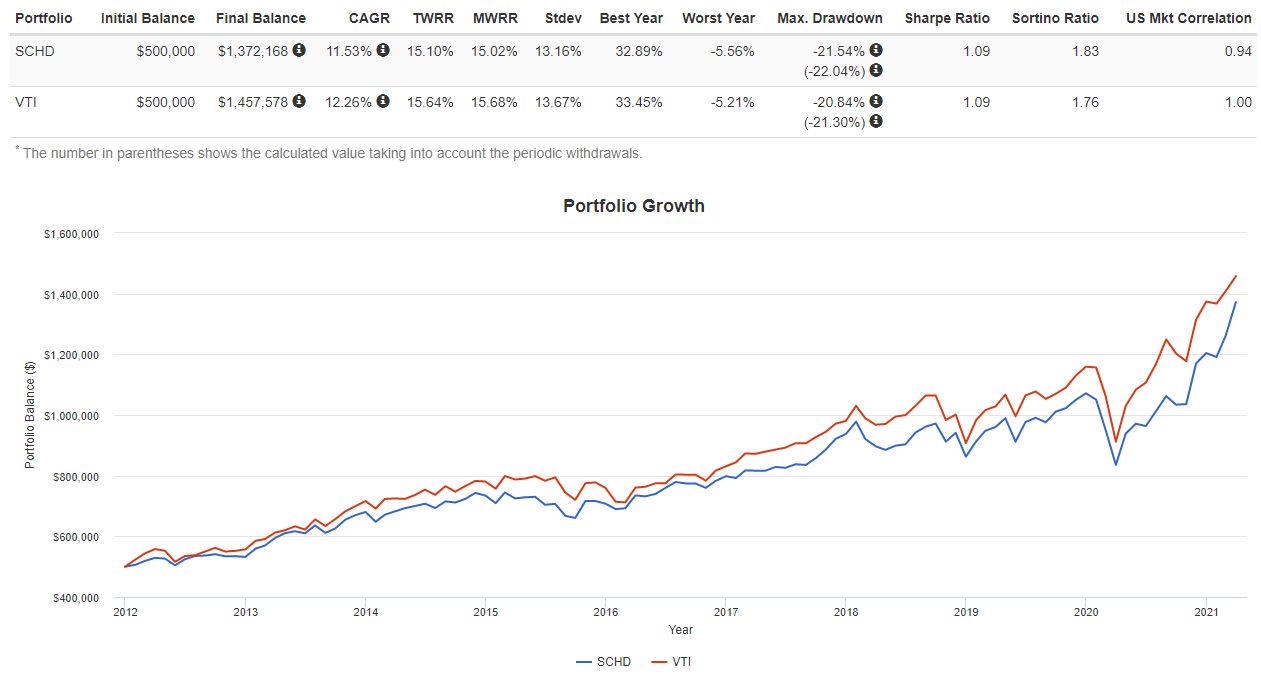

- Invest for long-term goals: With your essential expenses, emergency fund, and short-term goals covered, it’s time to focus on long-term goals such as retirement. Allocate a portion of your income towards investments that will grow over time and help secure your financial future.

- Review and adjust: Regularly review your financial plan and adjust your allocations as needed. Life circumstances, goals, and priorities can change, so it’s essential to adapt your financial strategy accordingly.

The waterfall concept provides a structured approach to managing your finances and ensures that your money is allocated efficiently towards your goals. By taking care of your essential expenses first and then directing funds towards savings, investments, and other objectives, you can gain control over your financial future.

Conclusion

Managing your finances doesn’t have to be overwhelming. By implementing the waterfall concept, you can take a practical approach to allocate your money wisely and effectively. Prioritizing your essential expenses, building an emergency fund, and saving and investing towards your short and long-term goals are key aspects of this concept. Remember to regularly review and adjust your financial plan to stay on track. With the waterfall concept as your guide, you can gain financial control and plan a secure future.