Finance

Microeconomics Definition, Uses, And Concepts

Published: December 25, 2023

Learn the definition, uses, and key concepts of microeconomics in finance. Discover how microeconomics applies to financial decision-making and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Microeconomics: Definition, Uses, and Key Concepts

When it comes to the vast world of finance, one topic that often takes center stage is microeconomics. In simple terms, microeconomics deals with the behavior and decision-making of individuals, households, and businesses in the market. It focuses on how these economic actors allocate their resources and interact with each other to satisfy their needs and wants. So, what exactly is microeconomics, and why is it important in the field of finance? Let’s dive deeper into this fascinating subject.

Key Takeaways:

- Microeconomics analyzes individual economic agents and their interactions.

- It helps understand how supply and demand affect prices and quantities in a market.

Understanding the Definition of Microeconomics

Microeconomics can be defined as the study of individual economic agents and their decision-making process within a market economy. It delves into the behavior of consumers, producers, and resource owners, examining how they allocate their limited resources to maximize their own self-interest. By analyzing individual choices, microeconomics provides invaluable insights into the larger workings of the economy as a whole.

Uses of Microeconomics

Microeconomics is a fundamental tool used in various aspects of finance and business. Here are some key uses:

- Pricing Strategies: Microeconomic analysis helps businesses determine optimal pricing strategies based on supply and demand factors within a particular market. Understanding consumer preferences, elasticity of demand, and cost structures allows companies to set prices that maximize profitability while staying competitive.

- Policy Development: Governments use microeconomics to develop policies that aim to promote economic efficiency and welfare. Policymakers consider concepts such as market competition, externalities, and income distribution to regulate markets effectively and address market failures.

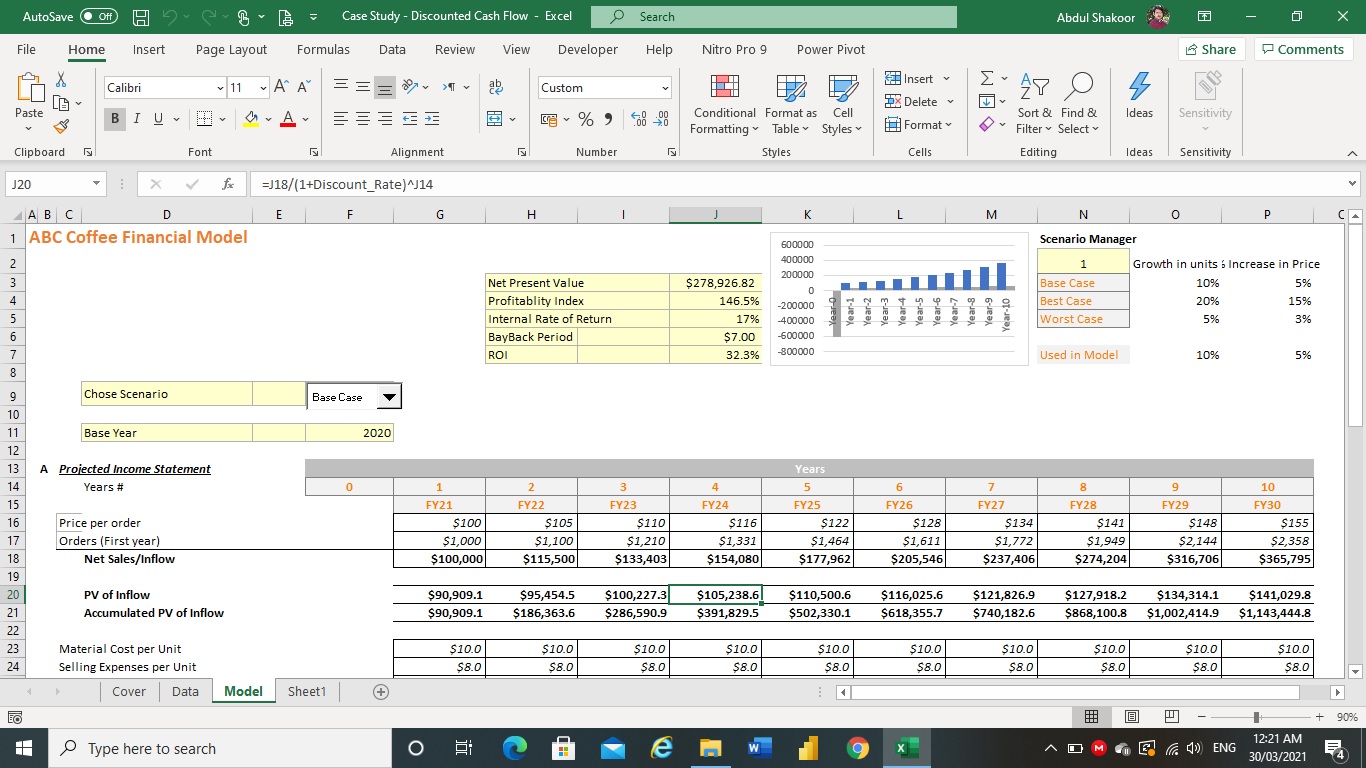

- Investment Decisions: Microeconomics guides investors in evaluating potential investment opportunities. Analysis of market trends, consumer behavior, and competitive landscape helps investors make informed choices, mitigating risks and maximizing returns.

- Business Planning: Entrepreneurs and managers utilize microeconomic principles to make strategic business decisions. By understanding demand patterns, cost structures, and competitive forces, businesses can determine the viability of new ventures, optimize production, and gain a competitive edge.

Key Concepts in Microeconomics

Several key concepts form the foundation of microeconomic analysis. Understanding these concepts is crucial for comprehending the intricacies of individual decision-making and market dynamics. Here are three important concepts:

- Supply and Demand: The relationship between supply and demand is a central concept in microeconomics. It explores how these two driving forces interact to determine prices and quantities in a market. The law of demand states that as the price of a good or service rises, the quantity demanded decreases, while the law of supply suggests that as the price of a good or service rises, the quantity supplied increases.

- Opportunity Cost: The concept of opportunity cost refers to the value of the next best alternative forgone when a choice is made. Due to scarcity, individuals and businesses must make trade-offs between different options. Understanding opportunity cost enables decision-makers to assess the true cost of their choices and make more informed decisions.

- Market Equilibrium: Market equilibrium occurs when the quantity demanded equals the quantity supplied at a specific price. This balance between supply and demand leads to an efficient allocation of resources. When markets are in equilibrium, there is no tendency for prices or quantities to change, unless influenced by external factors.

By grasping these and other essential concepts, individuals can gain a deeper understanding of the behavior and decisions made by economic agents, leading to more informed financial decisions.

As we’ve explored, microeconomics plays a vital role in finance and business. From shaping pricing strategies to informing investment decisions, understanding the principles of microeconomics is essential for success in today’s dynamic markets. Whether you are an entrepreneur, investor, or policymaker, a solid grasp of microeconomic principles is a valuable asset for navigating the complex world of finance.