Finance

What Are The Drawbacks On Retirement Planning

Published: January 21, 2024

Discover the drawbacks of retirement planning and how they can impact your finances. Gain insights into managing risks and maximizing your savings for a secure future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Lack of Adequate Savings

- Life Expectancy and Healthcare Costs

- Inflation and Cost of Living

- Market Volatility and Investment Risks

- Limited Access to Retirement Benefits

- Social Security and Pension Concerns

- Changing Retirement Landscape

- Tax Implications and Financial Considerations

- Psychological and Emotional Challenges

- Lack of Financial Literacy and Planning

- Conclusion

Introduction

Retirement planning is a crucial aspect of financial management that individuals need to carefully consider as they approach the later stages of their career. It involves setting aside enough funds to sustain a comfortable lifestyle during the non-working years, allowing individuals to enjoy the fruits of their labor and pursue their interests and dreams. While retirement planning offers numerous benefits, it is important to acknowledge the potential drawbacks and challenges that can arise along the way.

In this article, we will explore some of the drawbacks of retirement planning that individuals should be mindful of. From inadequate savings to market volatility and tax implications, understanding these challenges can help individuals better navigate their retirement journey and make informed decisions about their financial future.

It is worth noting that while these drawbacks should be acknowledged, they should not deter individuals from engaging in retirement planning. With careful consideration and strategic financial management, these challenges can be mitigated, allowing individuals to enjoy a fulfilling and financially secure retirement.

Lack of Adequate Savings

One of the significant drawbacks of retirement planning is the lack of adequate savings. Many individuals fail to save enough money over their working years to support their desired lifestyle during retirement. This can be attributed to various factors such as low income, high expenses, or a lack of financial discipline.

Without sufficient savings, individuals may find themselves facing financial hardships during retirement. They may have to rely on government programs or assistance, downgrade their living standards, or even continue working beyond their desired retirement age.

To mitigate this drawback, it is crucial for individuals to start saving for retirement as early as possible. By implementing a disciplined saving strategy and setting aside a portion of their income consistently, individuals can gradually accumulate a substantial retirement nest egg. Utilizing retirement savings vehicles such as individual retirement accounts (IRAs) or employer-sponsored retirement plans like 401(k)s can also provide tax advantages and facilitate long-term wealth accumulation.

Working with a financial advisor or retirement planner can provide valuable guidance on setting realistic savings goals and developing a personalized savings plan. It is essential to regularly review and adjust savings strategies to account for changing financial circumstances and keep pace with inflation.

While it may require sacrifice and financial discipline, building a healthy retirement savings fund is crucial for a secure and comfortable retirement.

Life Expectancy and Healthcare Costs

Another drawback of retirement planning is the uncertainty surrounding life expectancy and the associated healthcare costs. With advancements in healthcare and improved quality of life, people are living longer than ever before. While increased life expectancy is a positive development, it also means that individuals need to plan for a longer retirement period.

Longer lifespans translate to higher healthcare costs, as age-related illnesses and medical needs become more common. Healthcare expenses, including insurance coverage, medications, doctor visits, and long-term care, can significantly impact retirement savings.

Planning for healthcare costs in retirement is crucial to avoid financial strain and ensure access to necessary medical services. It is essential to research and understand the nuances of Medicare, as well as consider private health insurance options that provide comprehensive coverage.

In addition, individuals should explore long-term care insurance, which can help cover expenses related to assisted living facilities or nursing homes. Early planning and proactive measures can help mitigate the financial burden of healthcare costs in retirement.

Working with a financial advisor or insurance specialist can provide valuable insight into healthcare planning and ensure adequate coverage. Additionally, maintaining a healthy lifestyle and prioritizing preventive care can contribute to overall well-being and potentially reduce healthcare expenses.

While it is impossible to predict future healthcare costs, being aware of the potential financial impact and planning accordingly can help individuals navigate this drawback of retirement planning.

Inflation and Cost of Living

An important consideration in retirement planning is the impact of inflation and the rising cost of living. Over time, the purchasing power of money decreases due to inflation, meaning that the same amount of money will buy less in the future than it does today. If individuals do not account for inflation in their retirement planning, they may find it challenging to maintain their desired lifestyle.

Retirement can span several decades, and during that time, the cost of goods and services is likely to increase. Expenses such as housing, healthcare, groceries, and leisure activities are all subject to inflation. Failing to account for these rising costs can lead to a significant erosion of purchasing power and financial strain in retirement.

To combat the impact of inflation, individuals need to plan for long-term price increases and adjust their retirement savings and income accordingly. This may involve investing in assets that have historically outpaced inflation, such as stocks or real estate. Diversifying investments and regularly reviewing and rebalancing the portfolio can help manage risk and maintain purchasing power.

Additionally, individuals can explore options such as inflation-protected securities or annuities that provide income streams adjusted for inflation. By incorporating inflation into retirement planning, individuals can better prepare for the rising cost of living and ensure their financial stability throughout their retirement years.

Market Volatility and Investment Risks

Retirement planning involves investing a portion of savings to generate growth and income over time. However, one of the drawbacks individuals face is the inherent volatility and risks associated with the financial markets.

Financial markets are subject to fluctuation, and investments can experience periods of volatility, potentially resulting in loss of value. This can be particularly concerning for individuals who are approaching or already in retirement, as they may have limited time to recover from significant market downturns.

Unexpected market events, economic downturns, or geopolitical factors can all impact investment returns and disrupt retirement plans. Poor investment choices or excessive risk-taking can also lead to financial setbacks.

To mitigate the impact of market volatility, individuals should adopt a diversified investment approach. Spreading investments across different asset classes, such as stocks, bonds, and real estate, can help reduce exposure to any one specific investment and minimize risk. Regular monitoring and rebalancing of investment portfolios based on changing market conditions are also crucial.

Working with a financial advisor or investment professional can provide valuable guidance in managing investment risks. They can help individuals develop a suitable asset allocation strategy and ensure investments align with retirement goals and risk tolerance.

Additionally, maintaining an emergency fund or cash reserve can help provide a cushion during turbulent market periods and reduce the need to sell investments at inopportune times.

While market volatility and investment risks are inherent in retirement planning, adopting a strategic and disciplined approach to investing can help navigate these challenges and preserve long-term financial stability.

Limited Access to Retirement Benefits

One of the drawbacks of retirement planning is the limited access to retirement benefits for certain individuals. This can occur due to various reasons such as changes in employment patterns, self-employment status, or limited access to employer-sponsored retirement plans.

Many employees are fortunate to have access to retirement benefits through their employers, such as 401(k) plans or pension programs. These benefits often include employer matching contributions, which can significantly boost retirement savings. However, not all employees have access to such plans, especially those working for small businesses or in the gig economy.

For individuals who are self-employed or working in non-traditional employment arrangements, saving for retirement can be more challenging. They may need to rely on individual retirement accounts (IRAs) or other self-funded retirement options, which may not offer the same level of benefits as employer-sponsored plans.

Furthermore, those who have spent a significant portion of their working years as caregivers or in part-time roles may also have limited access to retirement benefits. This can impact their ability to save adequately for retirement and may require additional planning and saving strategies.

To address this drawback, individuals in these situations need to take proactive steps to save for retirement. They can consider contributing to IRAs or exploring simplified employee pension (SEP) plans or solo 401(k)s for self-employed individuals. It is essential to consult with a financial advisor who can provide guidance on choosing the most suitable retirement savings options based on individual circumstances.

While limited access to retirement benefits can pose challenges, it does not mean individuals cannot effectively save for retirement. By exploring alternative retirement savings options and planning strategically, individuals can build a nest egg that will support their future financial needs.

Social Security and Pension Concerns

Retirement planning often involves relying on social security benefits and pension income as sources of retirement income. However, there are concerns associated with both of these retirement programs that individuals need to be aware of.

Social Security, a government-funded program, provides a monthly income to eligible individuals upon reaching retirement age. However, the future sustainability of social security has been a topic of concern. With an aging population and a shrinking workforce, there are worries about the program’s ability to continue providing the same level of benefits in the long term. Changes to the eligibility age and potential reductions in benefits could impact individuals’ retirement income expectations.

Pension plans, which often provide a fixed income to retirees, also face challenges. Many traditional pension plans have been phased out or replaced with defined contribution plans like 401(k)s, shifting the responsibility of retirement savings onto individuals. Those with existing pension plans may be subject to underfunding or even company bankruptcies, which can jeopardize the expected pension benefits.

To address these concerns, individuals should take steps to diversify their sources of retirement income. This can include saving and investing through employer-sponsored retirement plans, IRAs, and alternative investments. It is important to regularly review and update retirement plans to account for changes in social security and pension benefits.

Additionally, understanding the rules and regulations around social security and pension benefits is crucial. Working with a financial advisor or retirement specialist can help individuals navigate these programs and make informed decisions about when to claim social security benefits or how to maximize pension income.

Ultimately, individuals should not solely rely on social security or pension income for their retirement needs. Building a comprehensive retirement plan that includes a diversified portfolio and multiple income streams can provide a more secure financial future.

Changing Retirement Landscape

The retirement landscape has undergone significant changes in recent years, posing both opportunities and challenges for individuals planning their retirement. Understanding these changes is essential for successful retirement planning.

One major shift is the trend towards longer working lives. Many individuals are choosing to work beyond the traditional retirement age for various reasons, including financial necessity, enjoyment of work, or the desire to remain active and engaged. This extended working period can impact retirement planning, as it may require individuals to adjust their savings goals and retirement timelines.

Additionally, the concept of retirement itself is evolving. Rather than a sudden exit from the workforce, many individuals are transitioning into phased retirement or exploring alternative work arrangements, such as freelance or part-time work, during their retirement years. This changing landscape offers flexibility and additional income opportunities but requires careful planning to ensure a smooth transition and financial stability.

Another important aspect is the increasing responsibility placed on individuals to fund their own retirements. Traditional employer-sponsored pension plans are becoming less common, shifting the burden of retirement savings onto individuals through defined contribution plans like 401(k)s. This puts more emphasis on personal savings and investment decisions, necessitating financial literacy and strategic planning.

Technological advancements and the rise of the gig economy have also shaped the retirement landscape. The ability to work remotely and access flexible job opportunities offers greater freedom and flexibility in retirement planning. However, it also requires individuals to adapt to changing job markets and embrace digital tools for managing finances and investments.

To navigate the changing retirement landscape effectively, individuals need to stay informed and be proactive. It is crucial to continually educate oneself about retirement planning strategies, investment options, and emerging trends. Seeking guidance from financial professionals, attending retirement planning workshops, or joining online communities can provide valuable insights and support.

Flexibility, adaptability, and ongoing financial planning are key to successfully navigating the changing retirement landscape and ensuring a secure and fulfilling retirement.

Tax Implications and Financial Considerations

When it comes to retirement planning, it is crucial to consider the potential tax implications and other financial considerations that can affect retirement income and overall financial stability.

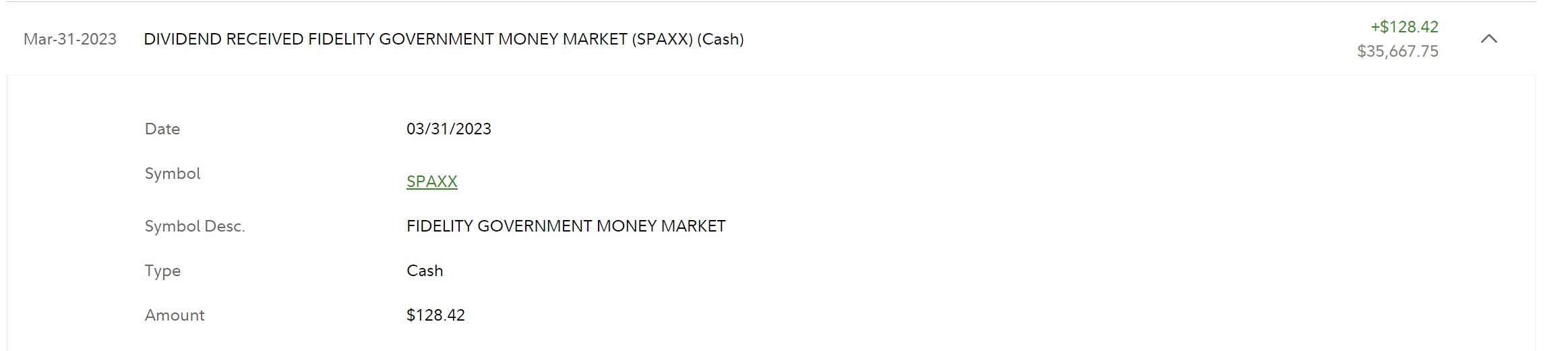

One important aspect is the tax treatment of retirement savings and withdrawals. Contributions made to traditional 401(k)s and traditional IRAs are typically tax-deductible, providing individuals with immediate tax benefits. However, the withdrawals from these accounts during retirement are subject to ordinary income tax. On the other hand, Roth 401(k)s and Roth IRAs are funded with after-tax dollars, allowing for tax-free withdrawals in retirement.

Understanding the tax implications of different retirement accounts is essential for effective tax planning and managing retirement income. Individuals should assess their current and future tax brackets to determine the most tax-efficient withdrawal strategies and maximize their available income during retirement.

Additionally, individuals should consider the impact of required minimum distributions (RMDs) from retirement accounts. RMDs are mandatory withdrawals that individuals must take from their retirement accounts starting at a certain age (currently 72 for most retirement accounts). Failing to take the required distributions can result in substantial tax penalties. Planning for RMDs is important to ensure compliance with IRS regulations and avoid unnecessary tax liabilities.

Other financial considerations in retirement planning include budgeting for healthcare expenses, estimating post-retirement living expenses, and factoring in potential changes in lifestyle and leisure activities. It is important to create a comprehensive retirement budget that incorporates all anticipated expenses, including housing, healthcare, travel, and leisure, to ensure that retirement savings are sufficient to cover these costs.

Furthermore, individuals should take into account the potential impact of inflation on their retirement funds. As the cost of goods and services increases over time, the purchasing power of retirement savings can erode. Adjusting retirement income streams and investment strategies to account for inflation can help sustain the desired standard of living during retirement.

To navigate the complex tax and financial landscape of retirement planning, it is advisable to seek guidance from a qualified tax advisor or financial planner. They can help individuals develop a comprehensive tax strategy and provide insights on optimizing retirement income and minimizing tax liabilities.

Considering these tax implications and financial considerations as part of the retirement planning process is crucial for building a solid financial foundation and ensuring a comfortable and secure retirement.

Psychological and Emotional Challenges

Retirement planning not only encompasses financial aspects but also involves navigating psychological and emotional challenges that can arise during the transition from a working life to retirement.

One significant psychological challenge is the adjustment to a new routine and lifestyle. After years of having a structured work schedule and defined roles and responsibilities, retirement can bring a sense of emptiness or loss of purpose. Many individuals find it challenging to adapt to the newfound freedom and free time, leading to feelings of restlessness or even depression.

Building a fulfilling retirement requires careful consideration of how to fill the void left by work. Individuals should explore new hobbies, interests, or volunteering opportunities that provide a sense of purpose and fulfillment. Engaging in social activities and establishing a strong support network can also help combat loneliness and maintain mental well-being during retirement.

Another psychological challenge is the fear of running out of money or experiencing financial insecurity in retirement. Concerns about insufficient savings or the possibility of unforeseen expenses can lead to anxiety and stress. It is essential for individuals to regularly review their financial plans and seek professional guidance to ensure their retirement savings are on track.

Estate planning and considering long-term care options are also important psychological considerations. Planning for the future and making decisions regarding inheritance, healthcare proxies, and end-of-life care can be emotionally taxing but crucial for peace of mind and ensuring one’s wishes are met.

Moreover, the transition from a professional identity to that of a retiree can be challenging. Many individuals derive a sense of self-worth and identity from their careers. Retirement may require redefining oneself and establishing new sources of identity and self-esteem. This process may involve exploring personal passions, pursuing educational opportunities, or engaging in creative endeavors.

Overall, understanding and addressing the psychological and emotional aspects of retirement planning are as important as the financial considerations. Planning for a satisfying and meaningful retirement should involve regular self-reflection, open communication with loved ones, and a proactive approach to maintaining mental and emotional well-being.

Lack of Financial Literacy and Planning

A common drawback in retirement planning is the lack of financial literacy and planning skills among individuals. Many people do not possess the necessary knowledge and understanding of personal finance to effectively manage their retirement savings and make informed decisions.

Without a solid foundation in financial literacy, individuals may struggle to navigate the complexities of retirement planning. They may not be aware of the various retirement savings vehicles available to them, the tax implications of different investment strategies, or the importance of diversification and risk management.

Lack of financial planning can also result in poor savings habits and inadequate retirement funds. Without a clear plan and defined goals, individuals may not save enough or make the necessary adjustments to their lifestyles to accommodate future retirement needs.

To address this drawback, individuals should actively seek out opportunities to improve their financial literacy. This can include reading books or attending workshops on personal finance, enrolling in online courses, or working with a financial advisor to gain a better understanding of retirement planning principles.

It is essential to create a comprehensive retirement plan that takes into account factors such as desired retirement age, income requirements, and investment strategies. Regularly reviewing and updating the plan as circumstances change is also crucial to ensure that retirement goals can be met.

Developing a budget and tracking expenses can also contribute to better financial planning. By understanding spending patterns and identifying areas for potential savings, individuals can allocate more funds towards retirement savings and reduce unnecessary expenses.

In addition to personal financial literacy, it is important to involve loved ones in the retirement planning process. Discussing financial goals and expectations with family members can lead to increased support and accountability, as well as ensure that all parties are on the same page when it comes to retirement plans.

By addressing the lack of financial literacy and planning, individuals can take greater control of their retirement journey, make more informed decisions, and ultimately increase their chances of achieving a comfortable and secure retirement.

Conclusion

Retirement planning is a crucial aspect of financial management that requires careful consideration and strategic decision-making. While there are drawbacks and challenges associated with retirement planning, being aware of these hurdles can help individuals navigate their retirement journey more effectively.

From the lack of adequate savings to the uncertainties of life expectancy, healthcare costs, and inflation, individuals must proactively address these challenges to ensure a secure future. The volatility of financial markets and investment risks also require individuals to adopt a diversified approach and seek professional guidance to safeguard their retirement funds.

Other considerations, such as limited access to retirement benefits, changes in the retirement landscape, tax implications, and emotional adjustments, demand comprehensive planning and proactive measures to overcome potential obstacles.

By staying informed, seeking financial literacy, and enlisting the help of professionals, individuals can mitigate these drawbacks and build a solid foundation for their retirement. Creating a comprehensive retirement plan, regularly reviewing and adjusting financial strategies, and maintaining open communication with loved ones are essential steps in achieving a fulfilling and financially secure retirement.

While the road to retirement may have its challenges, with careful planning, financial discipline, and a proactive mindset, individuals can overcome these obstacles and enjoy a comfortable and fulfilling retirement journey.