Finance

What Women Want In Retirement Planning

Published: January 21, 2024

Discover what women prioritize in retirement planning. Explore how to effectively manage finances and invest wisely to achieve financial security in retirement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retirement planning is a crucial aspect of financial management that everyone should prioritize. However, it is especially important for women to pay attention to their retirement needs and ensure they are adequately prepared. With longer life spans and unique financial challenges, women need to take a proactive approach to retirement planning to ensure a secure and fulfilling future.

Historically, women have faced numerous barriers to financial independence and stability, such as pay inequalities and career interruptions due to caregiving responsibilities. These factors can have a significant impact on their ability to save and invest for retirement. Therefore, it is essential for women to understand their specific needs and take appropriate steps to overcome these challenges.

In this article, we will delve into the key factors that women should consider when planning for retirement. From financial stability to social connections and empowerment, understanding these elements will empower women to take control of their financial futures and make informed decisions that align with their goals and aspirations.

Importance of Retirement Planning for Women

Retirement planning plays a critical role in securing a comfortable and fulfilling future for women. While retirement planning is important for everyone, it holds particular significance for women due to several factors that are unique to them.

One of the primary reasons why retirement planning is crucial for women is the gender pay gap. On average, women tend to earn less than men over their lifetime, resulting in lower Social Security benefits and reduced savings for retirement. This disparity makes it even more crucial for women to start planning early and contribute consistently towards their retirement funds.

Another important consideration for female retirees is longevity. Women generally have longer life expectancies than men, which means they will require more funds to sustain their lifestyle during retirement. Without proper planning and preparation, women may risk outliving their savings and facing financial struggles in their later years.

Furthermore, women often face unique financial challenges such as career interruptions to accommodate caregiving responsibilities for children or elderly parents. These interruptions can impact their ability to accumulate assets, save for retirement, and potentially hinder career advancement opportunities. By implementing a sound retirement plan, women can mitigate the financial impact of these interruptions and ensure their long-term financial security.

In addition to financial stability, retirement planning also provides women with flexibility and control over their lives. With a well-executed retirement plan, women have the freedom to make choices that align with their goals and desired lifestyle. Whether it’s pursuing new hobbies, traveling, or starting a second career, proper retirement planning allows women to enjoy their post-working years to the fullest.

Lastly, retirement planning provides an opportunity for women to foster social connections and seek support. Engaging in retirement communities, joining clubs or organizations, and participating in volunteer work can help women maintain an active social life and find a sense of purpose post-retirement. These connections can also provide emotional support and a sense of belonging, which are crucial for a fulfilling retirement.

Overall, retirement planning is fundamental for women to achieve financial security, maintain control over their lives, navigate unique challenges, and find fulfillment in their golden years. By taking early and proactive steps towards retirement planning, women can ensure a comfortable and enjoyable retirement lifestyle.

Financial Stability

Financial stability is a core aspect of retirement planning for women. As women tend to earn less over their lifetimes due to the gender pay gap, it is essential to create a solid financial foundation for retirement.

One of the key elements of financial stability is saving and investing. Women should prioritize building an emergency fund to cover unexpected expenses and contribute regularly to retirement accounts, such as 401(k)s or individual retirement accounts (IRAs). Automating these contributions can help ensure consistency and growth over time.

Additionally, women should consider diversifying their investment portfolios to increase their chances of higher returns. By spreading investments across different asset classes, such as stocks, bonds, and real estate, women can mitigate risk and maximize potential earnings.

Another crucial aspect of financial stability is managing debt. Women should aim to pay off high-interest debts, such as credit cards or student loans, as much as possible before entering retirement. Reducing debt not only lowers monthly expenses but also frees up funds for saving and investing.

Women should also take advantage of retirement planning tools and strategies that are available to them. Consulting with a financial advisor who specializes in retirement planning can provide personalized guidance and advice tailored to individual circumstances and goals.

Lastly, it is essential for women to stay informed about their financial situation and make necessary adjustments as circumstances change. Regularly reviewing and updating retirement plans, taking into account factors such as income changes, life events, and shifting priorities, will help ensure that financial stability is maintained over the long term.

By prioritizing financial stability throughout their working years, women can build a solid retirement nest egg and feel more secure about their financial future.

Flexibility and Control

Flexibility and control are vital aspects of retirement planning for women, as they provide the freedom to make choices that align with their goals and desired lifestyle.

Retirement planning allows women to have the flexibility to retire on their own terms. By saving diligently and making wise investment decisions, women can potentially retire earlier or work part-time in their later years. This flexibility gives them the opportunity to pursue other interests, spend more time with loved ones, or explore new career paths.

Having control over retirement finances is also crucial for women. By taking an active role in financial decision-making, such as budgeting and managing investments, women can ensure that their needs and goals are met. This control empowers women to make sound financial choices, adapt to changing circumstances, and effectively navigate unexpected challenges.

Furthermore, retirement planning provides women with the ability to maintain their standard of living and enjoy the lifestyle they desire. By conducting a thorough assessment of current and future expenses, including healthcare costs and potential long-term care needs, women can make informed decisions about saving and investing to support their desired retirement lifestyle.

In addition to financial flexibility and control, retirement planning also allows women to prioritize self-care and well-being. Retirement provides an opportunity to focus on personal health, hobbies, and interests that may have been neglected due to work and family responsibilities. Whether it’s pursuing physical fitness, engaging in creative endeavors, or traveling, women can design their retirement years to reflect their own unique desires and aspirations.

Lastly, retirement planning empowers women to leave a meaningful legacy. By incorporating charitable giving or estate planning into their retirement strategy, women can contribute to causes they care about and make a positive impact on future generations.

Ultimately, flexibility and control in retirement planning enable women to live life on their own terms, make choices that align with their values and priorities, and create a fulfilling and balanced retirement lifestyle.

Longevity and Healthcare

Longevity and healthcare are significant factors that women must consider when planning for retirement. Women tend to live longer than men, and this extended lifespan requires careful consideration of healthcare needs and associated costs.

With longer life expectancies, women must ensure they have sufficient financial resources to cover healthcare expenses in retirement. This includes budgeting for regular medical check-ups, prescription medications, and potential long-term care costs.

Long-term care insurance is an important consideration for women, as it can provide coverage for services such as nursing home care or in-home assistance if the need arises. By planning for potential long-term care needs, women can protect their assets and reduce the burden on themselves and their families.

Women should also take steps to prioritize their overall health and well-being to mitigate the risk of chronic illnesses and medical expenses in retirement. Adopting healthy lifestyle habits such as regular exercise, a balanced diet, and preventive care can go a long way in promoting longevity and reducing healthcare costs.

Furthermore, it is crucial for women to understand and take advantage of healthcare benefits available to them, such as Medicare. Familiarizing themselves with the various parts of Medicare, as well as supplemental insurance options, can help women make informed decisions and ensure adequate healthcare coverage during retirement.

In addition to healthcare considerations, it is important for women to address end-of-life planning. This includes creating a will, designating power of attorney, and outlining healthcare preferences through advance directives. Taking these steps ensures that women’s wishes are respected and helps alleviate potential stress and uncertainty for loved ones in the future.

By carefully considering longevity and healthcare needs when planning for retirement, women can be better prepared to navigate the challenges and uncertainties that may arise, and maintain their quality of life throughout their longer retirement years.

Social Connections and Support

Social connections and support play a vital role in a fulfilling retirement for women. As women transition from their working years to retirement, maintaining strong social connections becomes even more crucial for their overall well-being.

Retirement can bring about significant changes in daily routines and social interactions. For many women, leaving behind colleagues and workplace connections can leave a void in their social lives. Therefore, it is important to proactively seek out new social connections and support systems.

Engaging in activities and joining clubs or organizations that align with personal interests can help women build new friendships and expand their social networks. Participating in hobby groups, book clubs, volunteering, or taking classes can provide opportunities to meet like-minded individuals and foster meaningful connections.

Retirement communities and senior centers are another avenue for social connections and support. These communities offer a range of activities, events, and support services designed to promote social engagement and combat loneliness. By participating in organized group outings or attending social events, women can find companionship and build a sense of community.

Family and friends also play a vital role in providing social connections and support during retirement. Maintaining strong relationships with loved ones and nurturing those bonds can provide emotional well-being and a sense of belonging. Regularly spending quality time with family and close friends can help combat feelings of isolation and enhance overall life satisfaction.

In addition, joining support groups specifically tailored to retirement transitions or common interests can provide a supportive and understanding environment. Sharing experiences, challenges, and advice with others who are going through similar life stages can be incredibly beneficial and create lasting friendships.

Retirement offers an excellent opportunity for women to explore their passions, pursue new hobbies, and invest time in activities that bring them joy. By actively seeking out social connections and support systems, women can enrich their retirement experience, maintain a sense of belonging, and enjoy the camaraderie of others.

Overall, nurturing social connections and seeking support during retirement is essential for women to thrive, maintain a sense of purpose, and enhance their overall well-being.

Balancing Responsibilities

Retirement planning for women often involves navigating the delicate balance between various responsibilities—financial, family, and personal obligations. It is crucial to strike a harmonious equilibrium to ensure a smooth transition into retirement.

One of the key challenges women face in retirement planning is managing caregiving responsibilities. Women are more likely to take on the role of caregiving for children, grandchildren, or aging parents. Planning for retirement requires considering the financial implications of these responsibilities and how they may impact savings and investment strategies.

Women need to allocate time and resources to care for their loved ones while also prioritizing their own financial well-being. This may involve seeking assistance from other family members, exploring community resources, or considering professional caregivers to lighten the caregiving load.

Another aspect of balancing responsibilities is incorporating the needs and aspirations of partners or spouses into retirement plans. Collaborating with your partner to synchronize retirement timelines, align financial goals, and discuss individual desires can foster a harmonious retirement journey.

Furthermore, maintaining a healthy work-life balance leading up to retirement is crucial. It is important for women to avoid burnout and excessive stress as they navigate their careers and prepare for life after work. Setting boundaries, delegating tasks, and prioritizing self-care can greatly assist in achieving a healthy balance.

When planning for retirement, it is also essential for women to address estate planning and ensure their financial affairs are in order. This includes creating wills, establishing durable powers of attorney, and designating beneficiaries. Taking these steps provides peace of mind and simplifies the process for loved ones in the future.

Lastly, finding personal fulfillment and pursuing individual passions is an important part of balancing responsibilities in retirement. Women should make time for activities and hobbies that bring joy and fulfillment. Engaging in personal interests not only enhances well-being but also allows for personal growth and self-expression.

Striking a balance between financial responsibilities, caregiving obligations, and personal well-being is an ongoing process. Regularly reassessing priorities, communicating openly with loved ones, and seeking professional guidance can help women navigate this balancing act and enjoy a fulfilling retirement.

Empowerment and Education

Empowerment and education are essential aspects of retirement planning for women. By staying informed and taking an active role in their financial future, women can make informed decisions and feel empowered throughout their retirement journey.

Financial empowerment begins with understanding personal finances and setting clear goals for retirement. Women should take the time to assess their current financial situation, including income, savings, and investments. By creating a comprehensive budget, women can determine how much they need to save and invest to achieve their desired retirement lifestyle.

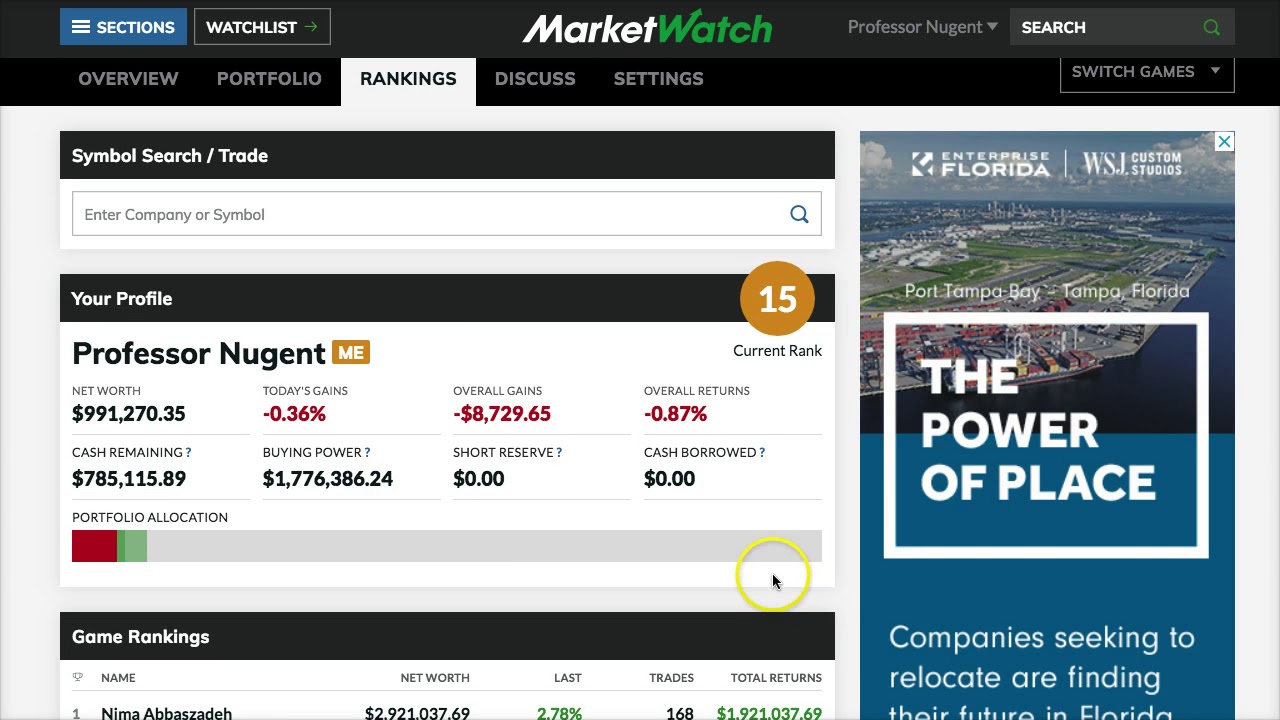

Education plays a pivotal role in retirement planning. By increasing financial literacy, women can make informed decisions about saving, investing, and managing their retirement funds. Taking advantage of resources such as workshops, seminars, and online courses can provide valuable insights into retirement planning strategies and money management.

It is crucial for women to become familiar with the various retirement savings options available to them. Understanding the benefits and eligibility criteria for retirement accounts, such as 401(k)s, IRAs, or pension plans, enables women to make informed decisions about where to allocate their funds for maximum growth.

Another empowering aspect of retirement planning is addressing potential risks and contingencies. Women should evaluate the need for insurance coverage, such as health insurance, long-term care insurance, or life insurance, to protect their financial well-being and provide for their loved ones.

Furthermore, empowering women in retirement planning involves fostering a mindset of independence and self-reliance. By cultivating investment knowledge and actively participating in financial decision-making, women can assert control over their money and make choices that align with their values and goals.

Continued education and adaptation are essential throughout the retirement years. Women should stay informed about changes in tax laws, investment strategies, and retirement policies that may affect their financial plans. Regularly reviewing and adjusting retirement strategies ensures that they remain aligned with individual goals and changing circumstances.

Women should also consider engaging the services of a financial advisor who specializes in retirement planning. Working with an advisor can provide valuable guidance, personalized advice, and peace of mind, knowing that their retirement plans are being managed effectively.

Ultimately, empowerment and education are the keys to ensuring that women approach retirement planning with confidence, knowledge, and control over their financial future. With the right tools and information, women can make informed decisions, overcome challenges, and achieve the fulfilling retirement they aspire to.

Conclusion

Retirement planning is a crucial undertaking for women that requires careful consideration of their unique needs and circumstances. By prioritizing key elements such as financial stability, flexibility and control, longevity and healthcare, social connections and support, balancing responsibilities, and empowerment through education, women can pave the way for a secure and fulfilling retirement.

Financial stability is paramount in retirement planning, considering factors such as the gender pay gap, longevity, and career interruptions. By saving diligently, diversifying investments, managing debt, and seeking professional advice, women can cultivate a solid financial foundation for retirement.

Flexibility and control provide women the opportunity to retire on their own terms, pursue passions, and make choices aligned with their desired lifestyle. By actively balancing responsibilities, engaging in end-of-life planning, and nurturing social connections and support systems, women can create the fulfilling retirement they envision.

Longevity and healthcare considerations are crucial as women typically live longer than men. By planning for healthcare expenses, exploring long-term care options, maintaining healthy lifestyles, and understanding Medicare and insurance options, women can ensure their well-being and financial security during retirement.

Building and maintaining strong social connections and seeking support are essential for women’s well-being in retirement. Engaging in activities, joining retirement communities, maintaining family and friend relationships, and participating in support groups contribute to a sense of belonging and fulfillment in the golden years.

Balancing responsibilities, such as caregiving and managing personal obligations, requires careful planning and communication. By ensuring financial well-being, collaborating with partners, and prioritizing self-care, women can achieve a healthy work-life balance and navigate the complexities of retirement.

Empowerment through education is key to successful retirement planning. By increasing financial literacy, understanding retirement savings options, addressing risks, and staying informed, women can make informed decisions and assert control over their financial future.

In conclusion, retirement planning is a vital undertaking for women to ensure a secure, rewarding, and fulfilling future. By addressing the specific considerations and focusing on key areas mentioned above, women can navigate the complexities of retirement with confidence, paving the way for a joyous and prosperous post-working life.