Finance

What Credit Bureau Does Paypal Use

Published: March 3, 2024

PayPal uses various credit bureaus for credit checks, including Equifax, Experian, and TransUnion. Understanding the credit bureau PayPal uses can help you manage your finances more effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Role of Credit Bureaus in Financial Transactions

- Demystifying the Role of Credit Bureaus

- Unveiling the Interconnection of Financial Services and Credit Reporting

- Navigating the Credit Reporting Landscape in Partnership with PayPal

- Navigating the Intersection of Financial Services and Credit Reporting

Introduction

Understanding the Role of Credit Bureaus in Financial Transactions

Credit bureaus play a pivotal role in the financial landscape, influencing decisions related to lending, creditworthiness, and overall financial stability. These agencies collect and maintain vast amounts of consumer credit information, which is utilized by creditors, lenders, and service providers to assess an individual's creditworthiness. Understanding the function of credit bureaus is crucial for individuals seeking to engage in financial transactions, as it directly impacts their ability to access credit and financial services.

In the context of online payment platforms such as PayPal, the relationship with credit bureaus holds significant relevance. As PayPal facilitates a wide array of financial transactions, including online purchases, money transfers, and business payments, the utilization of credit bureau data becomes integral to its operations. This article aims to delve into the association between PayPal and credit bureaus, shedding light on the specific credit bureau that PayPal utilizes for assessing users' creditworthiness and managing financial risk.

By exploring this dynamic relationship, readers will gain valuable insights into the interplay between financial service providers and credit bureaus, ultimately empowering them to make informed decisions regarding their financial activities. Let's embark on this journey to unravel the intricacies of credit bureaus and their impact on the operations of PayPal.

Understanding Credit Bureaus

Demystifying the Role of Credit Bureaus

Credit bureaus, also known as credit reporting agencies, are entities that compile and maintain financial data on individuals and businesses. Their primary function is to gather information from various sources, such as creditors, lenders, and public records, to create comprehensive credit reports for consumers and credit profiles for businesses. These reports and profiles encompass details regarding individuals’ borrowing and repayment history, outstanding debts, and other relevant financial behaviors.

Equipped with this wealth of data, credit bureaus generate credit scores, which serve as numerical representations of an individual’s creditworthiness. These scores are widely utilized by lenders and service providers to assess the risk associated with extending credit or offering financial services to a particular individual. Moreover, credit bureaus play a crucial role in facilitating efficient and informed decision-making within the financial sector.

Consumers are entitled to access their credit reports from these bureaus, allowing them to review their financial information and identify any discrepancies or inaccuracies. This transparency empowers individuals to take control of their financial health and address any issues that may impact their credit standing.

Furthermore, credit bureaus operate within a regulated framework to ensure the accuracy and fairness of the information they provide. The Fair Credit Reporting Act (FCRA) in the United States, for example, imposes strict guidelines on credit reporting agencies to promote the accuracy and privacy of consumer information. This regulatory oversight aims to safeguard consumers’ rights and maintain the integrity of the credit reporting process.

Understanding the pivotal role of credit bureaus in shaping financial decisions underscores their significance in the realm of personal and business finance. As we navigate the intricacies of financial transactions, the influence of credit bureaus permeates various aspects of our economic lives, shaping opportunities and constraints in the realm of credit and financial services.

The Relationship Between PayPal and Credit Bureaus

Unveiling the Interconnection of Financial Services and Credit Reporting

PayPal, as a leading online payment platform, operates within a dynamic ecosystem where financial transactions intersect with credit reporting mechanisms. The relationship between PayPal and credit bureaus is multifaceted, encompassing aspects of risk management, fraud prevention, and the assessment of users’ creditworthiness.

When individuals engage in financial activities through PayPal, such as making purchases, receiving payments, or accessing credit services, their transactional data may be subject to scrutiny by credit bureaus. This scrutiny serves as a foundational element in PayPal’s risk assessment and decision-making processes, enabling the platform to evaluate the financial behavior and creditworthiness of its users.

Moreover, PayPal collaborates with credit bureaus to enhance the security and integrity of its payment ecosystem. By leveraging credit bureau data, PayPal can identify and mitigate potential fraudulent activities, thereby safeguarding the interests of both users and the platform itself. This proactive approach to risk management underscores the symbiotic relationship between financial service providers like PayPal and credit reporting agencies.

Furthermore, the utilization of credit bureau data enables PayPal to offer tailored financial products and services to its users. Whether it involves extending lines of credit, providing access to financing options, or customizing payment solutions, PayPal leverages credit bureau insights to cater to the diverse financial needs of its user base. This personalized approach not only enriches the user experience but also contributes to the overall financial inclusivity promoted by PayPal.

As users interact with PayPal’s versatile suite of financial tools and services, the interplay between their financial activities and credit bureau data underscores the interconnected nature of modern financial ecosystems. This interconnection underscores the symbiotic relationship between financial service providers and credit bureaus, shaping the landscape of digital finance and online transactions.

Which Credit Bureau Does PayPal Use?

Navigating the Credit Reporting Landscape in Partnership with PayPal

PayPal’s engagement with credit bureaus encompasses a collaborative approach with multiple agencies to gather comprehensive insights into users’ credit profiles. While PayPal does not publicly disclose the specific credit bureau it exclusively utilizes, it is known to work with major credit reporting agencies such as Equifax, Experian, and TransUnion. These prominent credit bureaus play a pivotal role in furnishing PayPal with the necessary credit information to facilitate risk assessment, fraud prevention, and the provision of tailored financial services.

By harnessing the data provided by these credit bureaus, PayPal can gain a holistic view of users’ credit histories, outstanding debts, and overall creditworthiness. This comprehensive understanding empowers PayPal to make informed decisions regarding credit offerings, payment processing, and risk management within its platform.

Moreover, the collaboration with multiple credit bureaus enables PayPal to leverage diverse datasets and verification mechanisms, enhancing the accuracy and reliability of the credit information utilized in its operations. This multi-faceted approach underscores PayPal’s commitment to robust risk management and the delivery of inclusive financial solutions to its global user base.

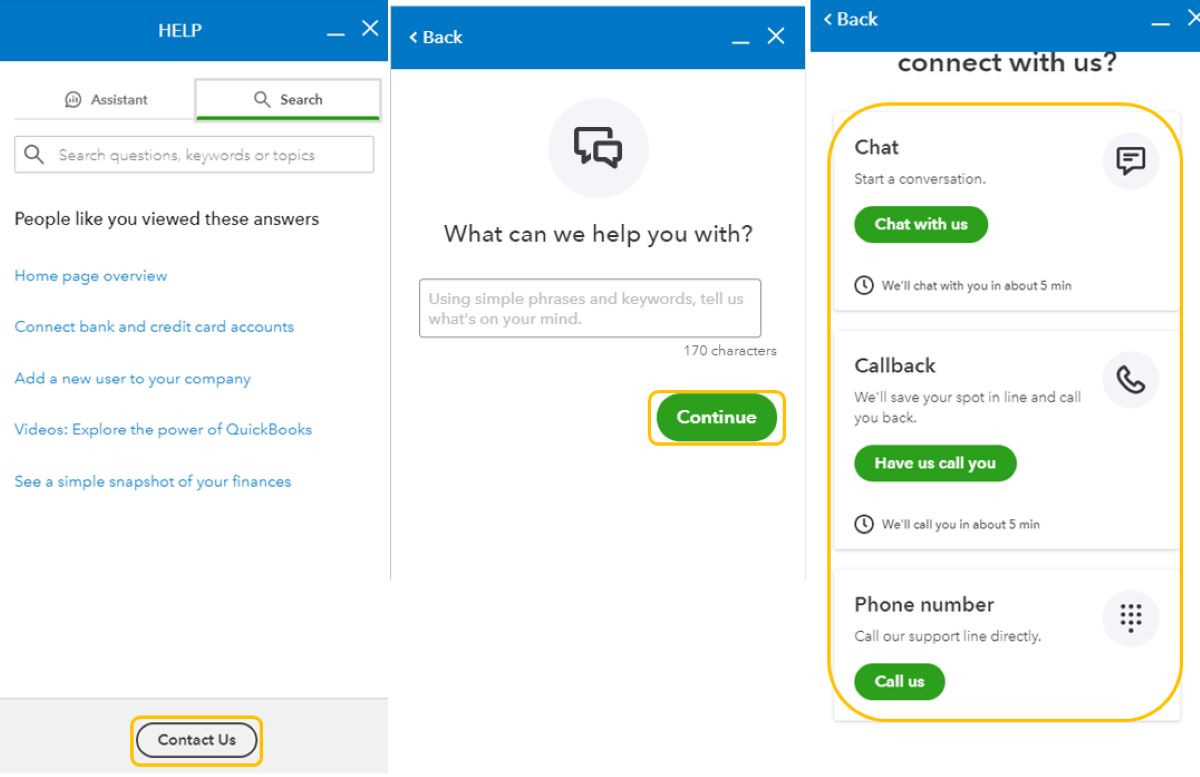

It is important to note that while PayPal interfaces with various credit bureaus, users retain the right to access their credit reports from these agencies, allowing them to review and monitor their credit information. This transparency aligns with regulatory standards and empowers users to actively manage their financial standing while engaging with PayPal’s diverse range of financial services.

As the digital finance landscape continues to evolve, the collaboration between PayPal and credit bureaus remains integral to the seamless functioning of online payments, credit provisioning, and risk mitigation. The amalgamation of credit bureau data with PayPal’s innovative financial solutions underscores the convergence of traditional credit reporting mechanisms with modern digital payment ecosystems, shaping a dynamic and inclusive financial environment for users worldwide.

Conclusion

Navigating the Intersection of Financial Services and Credit Reporting

Exploring the intricate relationship between PayPal and credit bureaus unveils the interconnected nature of modern financial ecosystems. As individuals engage in diverse financial activities through PayPal’s platform, the utilization of credit bureau data becomes instrumental in shaping risk assessment, fraud prevention, and the provision of tailored financial services.

The symbiotic collaboration between PayPal and major credit reporting agencies such as Equifax, Experian, and TransUnion underscores the platform’s commitment to leveraging comprehensive credit information for informed decision-making. This partnership empowers PayPal to offer personalized financial solutions while upholding robust risk management standards, thereby enhancing the overall user experience and financial inclusivity.

Furthermore, the transparency and regulatory compliance inherent in this collaboration underscore the importance of consumer empowerment and data privacy within the realm of digital finance. Users retain the right to access their credit reports and oversee their financial information, fostering a sense of control and accountability in their financial interactions with PayPal.

As the digital finance landscape continues to evolve, the synergy between financial service providers and credit bureaus remains integral to shaping a dynamic and inclusive financial environment for users worldwide. The amalgamation of credit bureau data with innovative financial solutions not only enhances the efficiency and security of online transactions but also paves the way for greater financial empowerment and accessibility.

In essence, the collaboration between PayPal and credit bureaus exemplifies the convergence of traditional credit reporting mechanisms with cutting-edge digital payment ecosystems, heralding a new era of seamless and secure financial interactions for individuals and businesses alike.