Finance

What Does A Capital Markets Lawyer Do

Modified: February 21, 2024

Discover the role of a Capital Markets Lawyer and how they navigate the complex world of Finance, providing legal expertise and counsel to clients.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

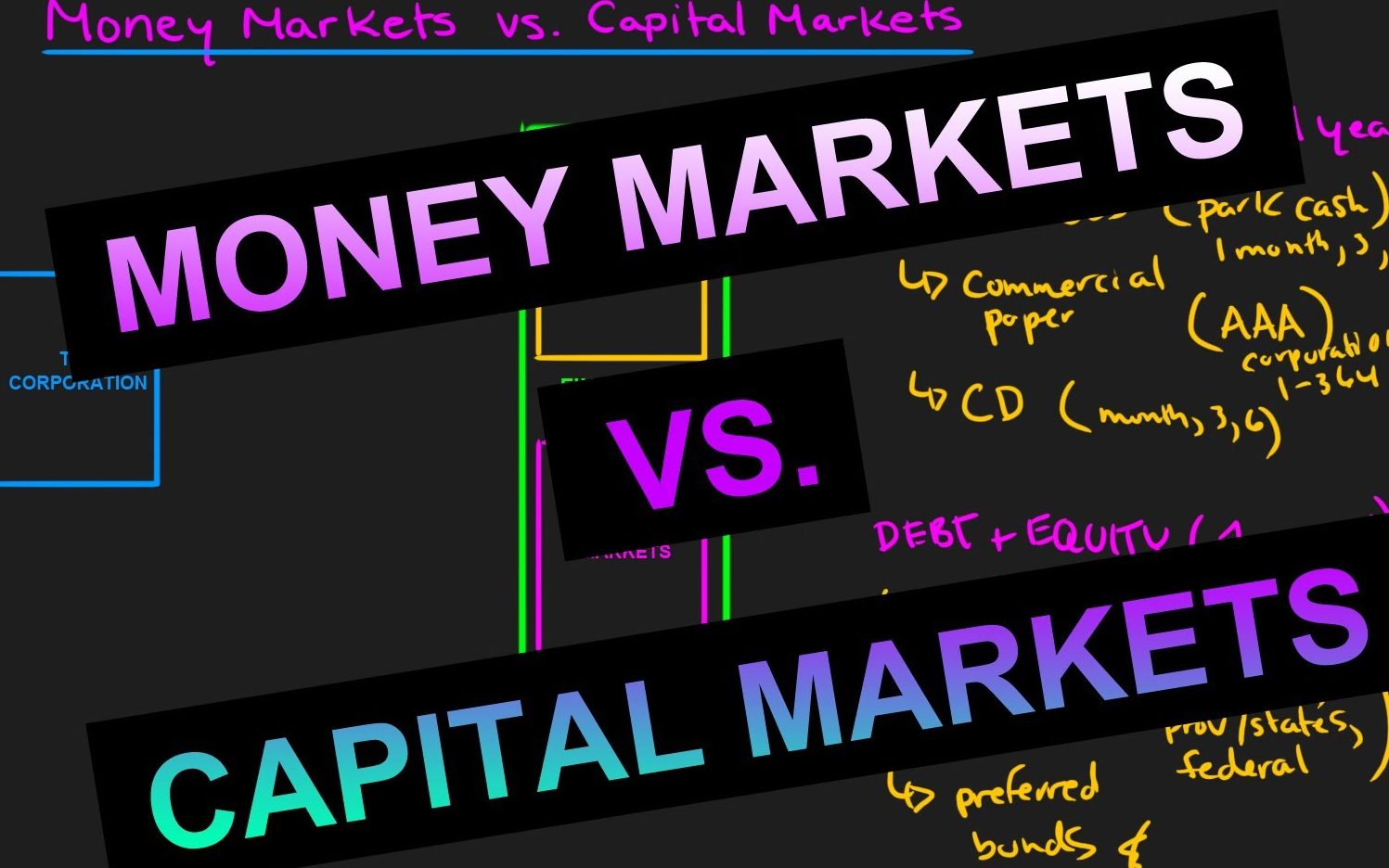

- Overview of Capital Markets

- Role of a Capital Markets Lawyer

- Responsibilities of a Capital Markets Lawyer

- Drafting and Reviewing Legal Documents

- Regulatory Compliance and Legal Research

- Due Diligence and Transaction Support

- Representing Clients in Legal Proceedings

- Key Skills and Qualifications of a Capital Markets Lawyer

- Conclusion

Introduction

Welcome to the world of capital markets and the vital role that lawyers play within this dynamic industry. Capital markets are a critical component of the global economy, facilitating the raising of funds for corporations and governments through the issuance and trading of various financial instruments. Within this complex landscape, a capital markets lawyer serves as a trusted advisor, guide, and advocate for their clients.

In this article, we will delve into the realm of capital markets and explore the multifaceted responsibilities of a capital markets lawyer. We will uncover the invaluable contributions they make to their clients and the broader financial ecosystem. From drafting legal documents to providing regulatory advice and representing clients in legal proceedings, a capital markets lawyer plays a pivotal role in ensuring compliance, facilitating transactions, and safeguarding the interests of their clients.

Capital markets lawyers operate in a highly regulated environment, where a comprehensive understanding of both legal frameworks and financial instruments is essential. They work closely with investment banks, corporate entities, financial institutions, and regulatory bodies to navigate the complexities of capital markets transactions and ensure compliance with applicable laws and regulations.

So, whether you are aspiring to become a capital markets lawyer or simply curious about the intricacies of this field, buckle up as we take a closer look at the world of capital markets and the crucial role played by these legal professionals.

Overview of Capital Markets

Capital markets are financial markets where individuals, corporations, and governments raise capital by buying and selling various financial instruments. These instruments include stocks, bonds, commodities, derivatives, and currencies, among others. Capital markets provide a platform for the flow of funds between those in need of capital and those with surplus funds to invest.

There are two main types of capital markets: primary markets and secondary markets. In the primary market, newly issued securities are sold for the first time to investors. This process is known as an initial public offering (IPO) and allows companies to raise capital to finance their growth or operations. In the secondary market, existing securities are bought and sold among investors. Examples of secondary markets include stock exchanges, bond markets, and over-the-counter (OTC) markets.

Capital markets are essential for economic growth and development. They facilitate the efficient allocation of capital and provide a means for investors to diversify their portfolios and manage risks. By issuing securities and raising capital, companies can finance investments, expand operations, and fuel innovation. Governments also utilize capital markets to finance public projects and initiatives.

Within the capital markets ecosystem, various participants play crucial roles. Investment banks, also known as underwriters, help companies and governments issue securities and navigate the regulatory requirements. Brokerage firms and stock exchanges facilitate the buying and selling of securities. Institutional investors, such as mutual funds and pension funds, invest significant amounts of capital on behalf of their clients. Retail investors, individuals who invest their own money, also participate in capital markets.

The functioning of capital markets is heavily regulated to ensure transparency, fairness, and stability. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, enforce rules and regulations to protect investors and maintain market integrity.

Now that we have a high-level understanding of capital markets, let’s explore the specific role that capital markets lawyers play in this intricate financial landscape.

Role of a Capital Markets Lawyer

A capital markets lawyer is a legal professional specializing in the complex area of capital markets. They serve as advisors and advocates for clients involved in capital markets transactions, providing guidance on legal issues and ensuring regulatory compliance. Their role is multifaceted and encompasses various responsibilities throughout the life cycle of a capital markets transaction.

One of the primary roles of a capital markets lawyer is to assist their clients in navigating the legal complexities associated with raising capital. They work closely with companies, investment banks, and other parties involved in the issuance of securities such as stocks or bonds. Capital markets lawyers play a pivotal role in drafting and reviewing the legal documents necessary for a successful offering, such as prospectuses, offering memorandums, and subscription agreements. They ensure that these documents comply with applicable regulations and accurately disclose all material information to investors.

Regulatory compliance is another key aspect of a capital markets lawyer’s role. They monitor and interpret regulations and ensure that their clients adhere to the applicable legal frameworks. Capital markets transactions are subject to a wide range of regulatory requirements, including those imposed by securities regulators, stock exchanges, and financial services authorities. Lawyers in this field provide guidance and advice on compliance matters, ensuring that their clients follow the rules and avoid legal pitfalls.

Capital markets lawyers also play a critical role in conducting due diligence and providing transaction support. Due diligence involves a comprehensive investigation of the issuing company’s financial, legal, and operational aspects to identify any potential risks or liabilities. Lawyers analyze agreements, financial statements, corporate governance practices, and other relevant information to ensure that investors have a clear understanding of the investment opportunity.

In addition to their advisory roles, capital markets lawyers may also represent their clients in legal proceedings. In case of disputes or regulatory investigations related to capital markets transactions, lawyers provide legal representation and advocate for their clients’ interests. They may engage in negotiations or litigation to resolve disputes and protect their clients’ rights.

Overall, capital markets lawyers play a crucial role in facilitating capital markets transactions and safeguarding the interests of their clients. Their expertise in both legal and financial matters, combined with their understanding of the regulatory landscape, enables them to navigate the complexities of the capital markets effectively.

Now that we have explored the role of a capital markets lawyer, let’s delve into the specific responsibilities they undertake within this field.

Responsibilities of a Capital Markets Lawyer

Capital markets lawyers have a wide range of responsibilities that encompass various aspects of capital markets transactions. Their primary goal is to provide legal advice, ensure regulatory compliance, and protect the interests of their clients. Let’s explore some of the key responsibilities of a capital markets lawyer:

- Drafting and Reviewing Legal Documents: One of the main responsibilities of a capital markets lawyer is drafting and reviewing legal documents related to capital markets transactions. They prepare offering documents, prospectuses, and other securities issuance materials to ensure compliance with regulatory requirements and accurately disclose all relevant information to investors. Lawyers meticulously review these documents to safeguard the interests of their clients and mitigate legal risks.

- Regulatory Compliance and Legal Research: Capital markets transactions are subject to extensive regulations imposed by securities regulators, stock exchanges, and other relevant bodies. Capital markets lawyers are responsible for staying up to date with these regulations and ensuring that their clients comply with them. They conduct legal research to interpret and apply these regulations and provide guidance to their clients on compliance matters.

- Due Diligence and Transaction Support: Capital markets lawyers conduct due diligence investigations to assess the legal and financial aspects of a transaction. They examine contracts, financial statements, corporate governance structures, and other relevant documentation to identify and mitigate potential risks and liabilities. They provide transaction support by assisting with negotiation, structuring deals, and coordinating with other professionals involved in the transaction, such as investment bankers and accountants.

- Preparing and Filing Regulatory Documents: Capital markets transactions often require the preparation and filing of various regulatory documents. Lawyers are responsible for preparing these documents, such as registration statements, filing them with regulatory authorities, and ensuring compliance with the necessary filing deadlines and requirements.

- Client Representation in Legal Proceedings: In the event of disputes or regulatory investigations, capital markets lawyers represent and advocate for their clients’ interests. They may engage in negotiation, mediation, arbitration, or litigation to resolve conflicts and protect their clients’ rights. They provide legal advice, develop strategies, and prepare legal arguments to effectively represent their clients’ positions.

- Advising on Corporate Governance and Compliance: Capital markets lawyers provide guidance on corporate governance matters, including board composition, directors’ duties, and shareholder rights. They advise their clients on compliance with corporate governance regulations and best practices to ensure transparency, accountability, and ethical conduct.

These responsibilities highlight the diverse skill set and expertise required of capital markets lawyers. They must possess a deep understanding of securities laws, financial markets, and corporate finance to effectively navigate the complexities of capital markets transactions. By fulfilling these responsibilities, capital markets lawyers play a critical role in facilitating transactions, protecting clients’ interests, and ensuring the integrity of the capital markets.

Now that we have explored the responsibilities of a capital markets lawyer, let’s dive deeper into some specific tasks these legal professionals undertake in their day-to-day work.

Drafting and Reviewing Legal Documents

A significant responsibility of a capital markets lawyer is the drafting and reviewing of legal documents related to capital markets transactions. These documents play a crucial role in facilitating the issuance of securities, ensuring regulatory compliance, and protecting the interests of all parties involved. Let’s take a closer look at the drafting and reviewing process undertaken by capital markets lawyers:

1. Offering Documents: Capital markets lawyers are responsible for preparing offering documents, such as prospectuses, offering memorandums, and private placement memorandums. These documents provide detailed information about the issuer, the securities being offered, and the terms and conditions of the investment. Lawyers carefully draft these documents to accurately disclose all material information that potential investors need to make informed decisions.

2. Regulatory Disclosures: Capital markets transactions require compliance with various regulatory requirements. Lawyers ensure that all necessary disclosures mandated by regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, are included in the legal documents. They meticulously review the documents to ensure that all relevant information is disclosed accurately and in accordance with the applicable rules and regulations.

3. Subscription Agreements: Subscription agreements outline the terms under which investors purchase securities in a capital markets offering. Capital markets lawyers draft and review these agreements, ensuring that the terms and conditions accurately reflect the intentions and expectations of both the issuer and the investors. They pay close attention to clauses related to purchase price, payment terms, warranties, and representations.

4. Underwriting Agreements: When investment banks are involved in an offering, underwriting agreements are drafted to outline the terms of the underwriting arrangement between the issuer and the underwriters. Capital markets lawyers play a crucial role in negotiating and drafting these agreements, ensuring that the rights and obligations of all parties involved are adequately addressed.

5. Legal Opinions: Capital markets lawyers are often called upon to provide legal opinions on various aspects of the transaction. These opinions communicate the lawyer’s professional assessment of the legal validity, enforceability, and compliance of the transaction and the related legal documents. Lawyers meticulously review the facts and documents relevant to the transaction to issue a well-supported legal opinion.

6. Due Diligence Materials: In the due diligence phase of a capital markets transaction, lawyers collect and review a vast array of documents and information. They play a crucial role in organizing and preparing these materials for review by investors and regulatory authorities. Lawyers ensure that the due diligence materials are comprehensive, accurate, and reflect the true state of the issuer’s affairs.

Throughout the drafting and reviewing process, capital markets lawyers must exhibit meticulous attention to detail, strong analytical skills, and a deep understanding of securities laws and regulations. They must also ensure that the legal documents align with the overall transaction structure and objectives.

By skillfully drafting and reviewing legal documents, capital markets lawyers provide their clients with the confidence that all necessary legal requirements have been met, minimizing the risk of potential legal disputes and ensuring a smooth and efficient capital markets transaction.

Now that we have explored the drafting and reviewing of legal documents, let’s move on to the next aspect of a capital markets lawyer’s responsibilities – regulatory compliance and legal research.

Regulatory Compliance and Legal Research

Ensuring regulatory compliance is a critical responsibility of a capital markets lawyer. Capital markets transactions are subject to a complex web of rules and regulations imposed by securities regulators, stock exchanges, and other relevant bodies. Lawyers in this field must have a deep understanding of these regulations and stay updated on changes to ensure their clients’ compliance. Let’s delve into the role of capital markets lawyers in regulatory compliance and legal research:

1. Interpreting and Applying Regulations: Capital markets lawyers must interpret and apply a myriad of regulations to guide their clients through the compliance landscape. They analyze securities laws, rules and regulations imposed by regulatory bodies, and guidance from regulatory authorities. By doing so, lawyers can advise clients on how to structure their transactions and offerings in a manner that complies with applicable laws and regulations.

2. Providing Compliance Advice: Capital markets lawyers play a crucial role in providing compliance advice to their clients. They assist in identifying and understanding the requirements imposed by securities regulators, stock exchanges, and other relevant bodies. Lawyers provide guidance on issues such as disclosure requirements, insider trading regulations, market manipulation, and corporate governance practices.

3. Conducting Legal Research: In order to effectively navigate the regulatory landscape, capital markets lawyers engage in extensive legal research. They stay up to date on new regulations, regulatory interpretations, and case law developments. Lawyers analyze legal precedents and rulings to gain insights into how regulations have been interpreted and enforced. This research helps them develop strategies and provide accurate advice to their clients.

4. Compliance Training and Education: Capital markets lawyers may also be involved in conducting compliance training sessions and educating their clients and colleagues about the relevant laws and regulations. They help raise awareness of compliance requirements and promote a culture of compliance within organizations. Lawyers also keep clients informed about changes in regulations that may impact their businesses or transactions.

5. Preparing Regulatory Filings: Capital markets transactions often require various regulatory filings. Lawyers assist clients in preparing these filings, such as registration statements and disclosure documents, and ensure compliance with filing deadlines and requirements imposed by regulatory bodies. Lawyers meticulously review these filings to ensure accuracy, completeness, and adherence to regulatory standards.

By actively staying abreast of changing regulations, engaging in legal research, and providing guidance on regulatory compliance, capital markets lawyers help their clients navigate the complex and ever-evolving regulatory landscape. Their expertise in interpreting and applying regulations is essential for facilitating compliant transactions and reducing legal risks.

In the next section, we will explore how capital markets lawyers contribute to the due diligence process and provide transaction support.

Due Diligence and Transaction Support

Capital markets lawyers play a crucial role in conducting due diligence and providing transaction support during capital markets transactions. Due diligence is a comprehensive examination of the legal, financial, and operational aspects of a transaction to identify potential risks and liabilities. Let’s explore how capital markets lawyers contribute to the due diligence process and provide transaction support:

1. Legal Due Diligence: Capital markets lawyers conduct legal due diligence to assess the legal risks and implications associated with the transaction. They review contracts, agreements, corporate governance practices, regulatory filings, and other relevant legal documents. Lawyers identify any potential legal issues or liabilities that may impact the transaction and advise their clients accordingly.

2. Financial Due Diligence: In collaboration with financial experts, capital markets lawyers assess the financial aspects of the transaction. They review financial statements, analyze financial projections, and examine the financial health of the parties involved. Lawyers ensure that the financial representations in the transaction are accurate and aligned with the requirements of investors and regulatory bodies.

3. Risk Assessment: Capital markets lawyers assess the risks and liabilities associated with the transaction. They analyze legal and regulatory compliance, potential litigation risks, intellectual property rights, environmental issues, and any other factors that may impact the transaction’s success. Lawyers help clients understand and mitigate these risks by providing legal strategies and recommendations.

4. Coordinating with Other Professionals: Capital markets transactions involve various professionals, such as investment bankers, accountants, and financial advisors. Lawyers collaborate closely with these professionals to ensure a seamless and well-coordinated transaction. They work together to gather and analyze the necessary information, review legal and financial documents, and develop strategies to address any issues that arise during the due diligence process.

5. Transaction Structuring and Negotiation: Capital markets lawyers contribute to the structuring of the transaction and negotiation of terms. They work closely with clients to identify their objectives and tailor the transaction to meet their needs. Lawyers help negotiate agreements, contracts, and pricing terms, ensuring that the legal requirements and interests of all parties are appropriately addressed.

6. Transaction Documentation: Lawyers provide support in preparing and reviewing transaction-related documents. They draft and negotiate contracts, agreements, and other legal documentation required for the transaction’s execution. Lawyers ensure that these documents accurately reflect the terms of the transaction and protect the interests of their clients.

By conducting due diligence and providing transaction support, capital markets lawyers help their clients navigate the complexities and risks associated with capital markets transactions. Their contributions during this phase are crucial for the successful execution of the transaction, ensuring that legal and financial considerations are appropriately addressed.

Now that we have explored the role of capital markets lawyers in due diligence and transaction support, let’s move on to the section where we will discuss how they represent their clients in legal proceedings.

Representing Clients in Legal Proceedings

Capital markets lawyers are often called upon to represent their clients in legal proceedings related to capital markets transactions. These legal proceedings may include disputes, regulatory investigations, or enforcement actions. Let’s delve into how capital markets lawyers advocate for their clients before courts, regulatory bodies, and other forums:

1. Dispute Resolution: In the event of disputes arising from capital markets transactions, capital markets lawyers represent their clients’ interests in negotiations, mediation, arbitration, or litigation. They analyze the legal issues at hand, develop legal strategies, and aim to resolve disputes in the most advantageous manner for their clients. Lawyers may engage in settlement negotiations or, if necessary, advocate for their clients’ position in court or in front of an arbitration panel.

2. Regulatory Investigations: When regulatory bodies initiate investigations into potential violations of securities laws or regulations, capital markets lawyers guide their clients through the process. They collaborate with clients to respond to inquiries, provide necessary documents and information, and ensure compliance with the investigation process. Lawyers leverage their knowledge of securities laws and regulations to defend their clients and mitigate potential penalties or sanctions.

3. Enforcement Actions: Capital markets lawyers represent clients in enforcement actions brought by regulatory bodies or government agencies. They advise clients on responding to enforcement inquiries, prepare legal defenses, and advocate on their behalf during administrative hearings or court proceedings. Lawyers strive to protect their clients’ rights and minimize the potential impact of enforcement actions.

4. Legal Advice and Strategy: Capital markets lawyers provide expert legal advice and develop strategies to protect their clients’ interests, both during legal proceedings and to proactively mitigate potential legal risks. They analyze the facts, applicable laws, and regulations, and leverage their knowledge of legal precedents to develop robust legal arguments. Lawyers offer strategic guidance to their clients, advising them on the best courses of action in light of the legal proceedings they are involved in.

5. Legal Research and Preparation: Capital markets lawyers conduct in-depth legal research to support their clients’ positions in legal proceedings. They analyze relevant case law, statutes, regulations, and legal principles to develop persuasive arguments and legal strategies. Lawyers prepare the necessary legal documentation, such as petitions, pleadings, motions, and briefs, ensuring that they are accurate, complete, and aligned with applicable legal standards.

When representing clients in legal proceedings, capital markets lawyers leverage their expertise in securities laws, regulations, and litigation strategies. They advocate for their clients, aiming to protect their interests, mitigate legal risks, and achieve the best possible outcomes.

Now that we have explored how capital markets lawyers represent their clients in legal proceedings, let’s move on to the section where we will discuss the key skills and qualifications required for this specialized field.

Key Skills and Qualifications of a Capital Markets Lawyer

Being a successful capital markets lawyer requires a unique set of skills and qualifications due to the complex and ever-evolving nature of the field. Let’s explore some key skills and qualifications necessary for capital markets lawyers:

1. Deep Understanding of Securities Laws and Regulations: Capital markets lawyers must have a thorough knowledge and understanding of securities laws, regulations, and industry standards. They must keep up with the latest developments and changes in these legal frameworks to ensure compliance and provide accurate advice to their clients.

2. Strong Analytical and Problem-Solving Skills: Capital markets lawyers encounter complex legal issues that require strong analytical and problem-solving skills. They must be able to analyze large volumes of information, identify legal risks, and develop creative and practical strategies to address them. Lawyers need to think critically, analyze various perspectives, and provide solutions tailored to their clients’ needs.

3. Excellent Communication and Negotiation Skills: Effective communication is crucial for capital markets lawyers. They must be able to clearly articulate complex legal concepts to clients, colleagues, and other parties involved in transactions. Lawyers need strong written and oral communication skills to draft contracts, negotiate terms, and advocate for their clients’ interests in legal proceedings.

4. Attention to Detail: Capital markets transactions involve intricate legal documents that require meticulous attention to detail. Lawyers must scrutinize contracts, prospectuses, and regulatory filings to ensure accuracy, completeness, and compliance with legal and regulatory requirements.

5. Financial Acumen: A solid understanding of finance and accounting principles is essential for capital markets lawyers. They need to navigate financial statements, analyze financial projections, and grasp the complexities of various financial instruments. Lawyers must be able to collaborate effectively with financial experts and understand the financial implications of legal decisions.

6. Business and Commercial Awareness: Capital markets lawyers need to have a keen sense of the business and commercial aspects of transactions. They must be able to understand their clients’ objectives, industry dynamics, and the broader market context in which the transactions take place. Lawyers must be commercially minded, aligning legal advice with their clients’ business goals.

7. Professionalism and Ethical Conduct: Capital markets lawyers are entrusted with protecting their clients’ interests while upholding the highest standards of professionalism and ethical conduct. They must maintain client confidentiality, avoid conflicts of interest, and adhere to the codes of conduct and ethics established by legal regulatory bodies.

8. Continuous Learning and Adaptability: Given the dynamic nature of capital markets, lawyers must be adaptable and committed to lifelong learning. They should stay updated on legal and regulatory developments, market trends, and industry best practices. Continuous learning ensures that lawyers are equipped to provide the most up-to-date and valuable advice to their clients.

These key skills and qualifications form the foundation for a successful career as a capital markets lawyer. By possessing these traits and continuously honing their expertise, lawyers can navigate the complexities of capital markets and effectively guide their clients through the legal landscape.

Now that we have explored the key skills and qualifications of a capital markets lawyer, let’s conclude our discussion.

Conclusion

Capital markets lawyers play a vital role in the dynamic and complex world of capital markets. They provide essential legal guidance, ensure regulatory compliance, and protect the interests of their clients throughout the various stages of a capital markets transaction. From drafting and reviewing legal documents to conducting due diligence, representing clients in legal proceedings, and providing transaction support, capital markets lawyers possess a unique skill set that enables them to navigate the intricacies of the financial landscape.

These legal professionals must possess a deep understanding of securities laws and regulations, combined with strong analytical, communication, and negotiation skills. They must be detail-oriented, financially astute, and strategically minded. Moreover, capital markets lawyers must adhere to high standards of professionalism and ethics, continuously adapt to evolving regulations and industry trends, and stay updated on the latest legal developments.

Through their expertise and advocacy, capital markets lawyers contribute to the integrity and efficiency of capital markets. They facilitate capital raising, ensure compliance with regulatory requirements, and protect the interests of clients and investors.

Whether in drafting legal documents, conducting due diligence, representing clients in legal proceedings, or providing compliance advice, capital markets lawyers are instrumental in navigating the legal intricacies of capital markets transactions. They serve as trusted advisors and advocates, leveraging their knowledge and skills to guide their clients through the challenges and complexities of the financial world.

In conclusion, capital markets lawyers play a critical role in the success and integrity of capital markets. Their comprehensive understanding of legal frameworks, combined with their business acumen and advocacy skills, ensures that capital markets transactions are conducted with transparency, compliance, and protection of all parties involved.