Finance

What Does AVP Mean In Banking

Modified: February 21, 2024

Learn what AVP means in banking and how it relates to finance. Gain a better understanding of the financial industry with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of banking, staying ahead of the competition and meeting customer expectations is crucial. As technology continues to advance, banks are constantly seeking innovative ways to improve efficiency, streamline processes, and enhance customer experience. One such advancement is the implementation of Automated Voice Processing (AVP) systems.

AVP, also known as Interactive Voice Response (IVR) systems, have revolutionized the banking industry by automating various tasks and providing a seamless interface between customers and financial institutions. These systems use voice recognition technology to understand and respond to customer inquiries, enabling a faster and more convenient banking experience.

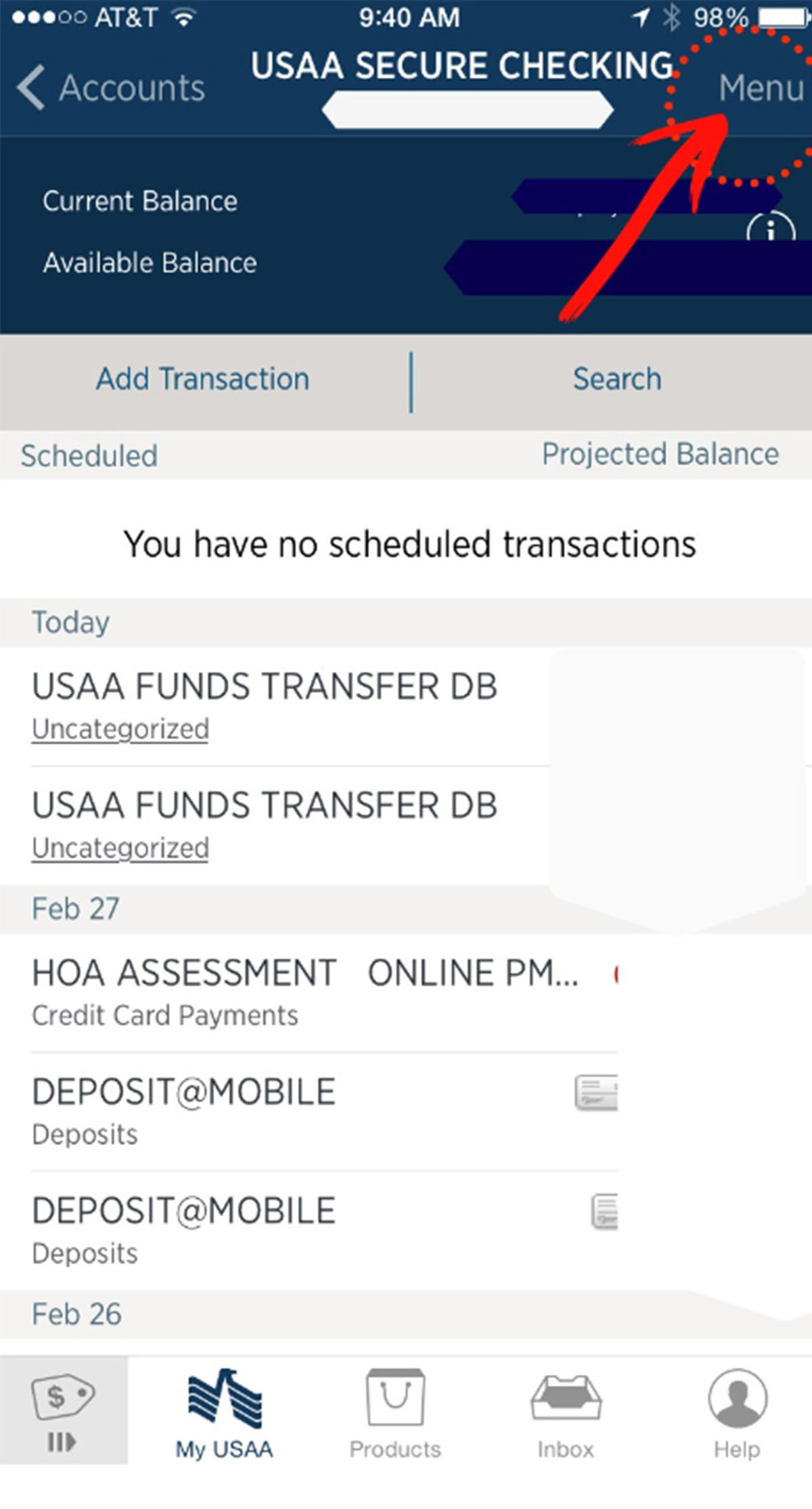

With AVP, customers can perform a wide range of banking activities, such as checking account balances, transferring funds, paying bills, and even opening new accounts, all without having to visit a physical branch or wait on hold to speak with a customer service representative. This technology has not only transformed the way customers interact with their banks but also significantly impacted the efficiency and operations of financial institutions.

Over the years, AVP systems have evolved from basic menu-driven voice response systems to more sophisticated platforms that integrate with other banking applications and utilize artificial intelligence (AI) and natural language processing (NLP). These advancements have further enhanced the capabilities of AVP systems, allowing them to understand complex commands and provide personalized responses.

In this article, we will explore the definition of AVP, its evolution in the banking industry, the benefits it offers, the challenges associated with its implementation, real-world use cases, regulatory considerations, and the future of AVP in banking.

Definition of AVP

Automated Voice Processing (AVP) refers to the use of voice recognition technology and interactive voice response systems to automate various banking processes and enable customer self-service. AVP allows customers to interact with a bank’s systems using voice commands and receive real-time responses.

AVP systems typically consist of a combination of hardware and software components that work together to provide a seamless and user-friendly experience. These systems use automatic speech recognition (ASR) technology to convert spoken words into text and natural language understanding (NLU) algorithms to interpret the meaning behind the customer’s intent.

With AVP, customers can access their accounts, perform transactions, and obtain information without the need for human interaction. They simply need to speak their commands or questions into their phone or other voice-enabled devices, and the AVP system will respond accordingly.

The core functionality of AVP includes features such as account balance inquiries, transaction history, fund transfers, bill payments, loan applications, and general banking information. Some advanced AVP systems even offer voice biometrics for secure authentication, allowing customers to access their accounts using their voiceprint.

The aim of AVP is to provide customers with a convenient and efficient way to interact with their banks. By reducing the reliance on traditional channels such as branches or call centers, AVP minimizes wait times and offers 24/7 access to banking services. Additionally, AVP systems can handle a large volume of customer inquiries simultaneously, resulting in faster response times and improved customer satisfaction.

It’s important to note that AVP should not be confused with automated phone systems that rely solely on touch-tone responses. AVP utilizes advanced voice recognition technology to understand natural language commands, providing a more conversational and intuitive experience for customers.

Evolution of AVP in Banking

The evolution of Automated Voice Processing (AVP) in the banking industry has been driven by technological advancements and the changing demands of customers. Over the years, AVP has gone through several stages of development, transforming from basic voice response systems to sophisticated AI-powered platforms.

In the early days, AVP systems were primarily used for simple tasks like providing pre-recorded information and menu options. Customers would navigate through a series of touch-tone prompts to access basic account details or perform limited transactions. This marked the first step towards self-service banking and reducing reliance on human interaction.

As voice recognition technology improved, AVP systems evolved to support more complex interactions. Natural Language Processing (NLP) algorithms were incorporated to understand and respond to conversational commands, offering a more intuitive and user-friendly experience. Customers could now speak their queries and receive personalized responses, such as account balances or transaction history, in real-time.

The next significant leap in AVP was the integration of artificial intelligence (AI) capabilities. This allowed banks to leverage machine learning algorithms to analyze customer data, identify patterns, and offer personalized recommendations. AI-powered AVP systems could proactively suggest financial products, provide budgeting tips, and even detect fraudulent activities.

Furthermore, advancements in voice biometrics technology enabled secure authentication using customers’ unique vocal characteristics. This eliminated the need for traditional security measures like PINs or passwords, making AVP systems not only convenient but also more secure.

In recent years, AVP has continued to evolve with the emergence of voice-activated smart devices like Amazon Echo and Google Home. Banks have integrated their AVP systems with these devices, enabling customers to perform banking tasks using voice commands from the comfort of their homes. This has brought a new level of convenience and accessibility, as customers can now manage their finances while cooking, cleaning, or even driving.

The evolution of AVP in banking has been driven by the increasing demand for self-service and personalized experiences. As customers become more tech-savvy and expect instant access to information and services, banks are investing in AVP to meet these expectations. The integration of AI, NLP, and voice recognition technologies has transformed AVP into a powerful tool that enhances efficiency, improves customer experience, and drives overall digital transformation in the banking industry.

Benefits of AVP

The implementation of Automated Voice Processing (AVP) systems in banking comes with a multitude of benefits for both financial institutions and customers. Let’s explore some of the key advantages:

- Improved Customer Experience: AVP allows customers to access banking services and information 24/7, eliminating the need to wait for assistance or visit a physical branch. Customers can perform transactions, check account balances, and get instant answers to their queries through a seamless and user-friendly voice interface. This convenience improves customer satisfaction and loyalty.

- Cost Savings and Efficiency: AVP significantly reduces the need for human resources, as many simple and repetitive tasks can be automated. By leveraging voice recognition and natural language processing technologies, banks can handle a high volume of customer interactions simultaneously, resulting in faster response times and increased operational efficiency. This leads to cost savings and allows staff to focus on more complex and value-added tasks.

- Personalization: AVP systems can be integrated with customer databases and AI algorithms, enabling personalized interactions. Banks can analyze customer data and provide tailored recommendations and offers based on individual financial needs and preferences. This personalization fosters deeper customer engagement and strengthens the bank-customer relationship.

- Enhanced Security: AVP systems can incorporate voice biometrics technology for secure authentication. Voiceprints are unique to individuals, making them a reliable form of identification. By utilizing voice recognition, banks can minimize the risk of fraudulent activities and provide a more secure banking environment for customers.

- Cost Savings and Efficiency: AVP significantly reduces the need for human resources, as many simple and repetitive tasks can be automated. By leveraging voice recognition and natural language processing technologies, banks can handle a high volume of customer interactions simultaneously, resulting in faster response times and increased operational efficiency. This leads to cost savings and allows staff to focus on more complex and value-added tasks.

- Data Insights: AVP systems capture valuable data during customer interactions. Banks can analyze this data to gain insights into customer behavior, preferences, and pain points. These insights can then be used to improve products and services, develop targeted marketing campaigns, and enhance overall business strategies.

The benefits of AVP extend beyond these examples, and they continue to evolve as technology advances. By embracing voice-driven automation, banks can stay ahead of the competition, deliver exceptional customer experiences, and drive innovation in the banking industry.

Challenges of AVP Implementation

While Automated Voice Processing (AVP) systems offer numerous benefits, their implementation in banking also presents certain challenges. These challenges need to be addressed to ensure a successful and seamless integration of AVP. Let’s explore some of the key challenges:

- Accuracy and Reliability: AVP systems heavily rely on voice recognition technology to understand and interpret customer commands. However, variations in pronunciation, accents, background noise, and speech patterns can sometimes cause inaccuracies or misinterpretations. Banks need to invest in robust voice recognition algorithms and constantly improve their models to ensure accurate and reliable system responses.

- Security Concerns: While AVP systems can enhance security through voice biometrics, there are still concerns about data privacy and fraud prevention. Banks need to implement strong security measures to protect sensitive customer information and ensure secure authentication and encryption protocols are in place to prevent unauthorized access.

- Complexity of Integration: Integrating AVP systems with existing banking infrastructure can be complex and time-consuming. Banks need to ensure compatibility with legacy systems, data management platforms, and third-party applications. Smooth integration requires thorough planning, testing, and coordination with IT teams and service providers.

- Customer Adoption and Education: Some customers may be hesitant to adopt AVP systems due to unfamiliarity or mistrust of technology. Banks need to educate customers about the benefits of AVP, provide clear instructions on how to use the system, and offer support channels for those who require assistance. Promoting the ease and convenience of AVP can help overcome customer resistance and encourage adoption.

- Maintaining Human Touch: While AVP systems aim to automate banking processes, it is crucial to strike a balance between automation and personalized customer interaction. Some customers may still prefer to speak with a human representative for complex or sensitive matters. Banks need to provide the option for customers to easily switch from AVP to human assistance when necessary, ensuring a seamless transition and maintaining a human touch in customer service.

- Regulatory Compliance: Banks operate in a highly regulated environment, and AVP systems must comply with various regulatory requirements, such as data protection, privacy laws, and industry standards. Banks must ensure that AVP systems adhere to these regulations to protect customer data and maintain legal compliance.

Addressing these challenges requires careful planning, investment in technology, ongoing monitoring, and continuous improvement. By proactively tackling these issues, banks can harness the full potential of AVP systems and deliver enhanced customer experiences.

Use Cases of AVP in Banking

Automated Voice Processing (AVP) systems have found numerous applications in the banking industry, revolutionizing the way customers interact with financial institutions. Let’s explore some of the key use cases of AVP:

- Account Information: AVP allows customers to inquire about their account balances, transaction history, and other account-related information using voice commands. This provides instant access to vital account details, eliminating the need to visit a branch or log in to online banking platforms.

- Fund Transfers and Payments: AVP enables customers to transfer funds between their accounts, make bill payments, and set up recurring payments using voice commands. This streamlined process increases efficiency and reduces the time and effort required for financial transactions.

- Credit Card Services: Customers can use AVP systems to check their credit card balances, review recent transactions, and make credit card payments. This functionality improves credit card management and simplifies the payment process for customers.

- Account Opening: AVP facilitates the account opening process for new customers. Customers can provide their personal information and answer verification questions through voice commands, streamlining the onboarding process and reducing paperwork.

- Loan Applications and Status: AVP systems allow customers to inquire about loan eligibility, initiate loan applications, and check the status of their loan applications through voice interactions. This expedites the loan process and provides customers with real-time updates on their loan applications.

- Customer Support and FAQs: AVP can provide automated responses to commonly asked questions, helping customers troubleshoot issues and find answers without the need for human intervention. This reduces wait times and increases self-service options for customers.

- Security and Authentication: AVP utilizes voice biometrics for secure customer authentication. Voiceprints are unique to individuals, enhancing security and eliminating the need for traditional PINs or passwords. This strengthens the overall security of customer accounts.

- Personalized Recommendations: AVP systems can leverage artificial intelligence algorithms to analyze customer data and provide personalized recommendations for products and services. Customers can receive targeted offers and suggestions based on their financial needs and preferences, enhancing their overall banking experience.

These are just a few examples of how AVP is transforming the banking industry. Each use case contributes to improved customer experience, streamlined processes, and increased efficiency. As AVP technology continues to advance, we can expect even more innovative applications to emerge.

AVP Regulations and Compliance

As with any technology implemented in the banking industry, Automated Voice Processing (AVP) systems are subject to regulations and compliance requirements to ensure the protection of customer data and maintain a secure banking environment. Let’s explore some of the key considerations for AVP regulations and compliance:

- Data Privacy and Protection: AVP systems handle sensitive customer information and must adhere to data privacy regulations, such as the General Data Protection Regulation (GDPR). Banks need to take appropriate measures to secure and protect customer data, including encryption, access controls, and data retention policies.

- Consent and Opt-Out: AVP systems often record customer interactions for quality assurance and training purposes. Banks must obtain customer consent for recording these interactions and provide an option for customers to opt out if desired. Compliance with consent and opt-out requirements is crucial to respect customer privacy rights.

- Transparency and Disclosure: Banks using AVP systems must clearly communicate to customers how their data will be collected, processed, and stored. Transparency and disclosure obligations ensure that customers are aware of how their information is being used and give them the opportunity to make informed decisions about engaging with the AVP system.

- Call Recording Laws: AVP systems that record customer interactions may be subject to call recording laws, which vary by jurisdiction. Banks need to comply with these laws, which may require notifying customers of the recording, obtaining consent, or adhering to specific retention periods for recorded calls.

- Accessibility Requirements: AVP systems need to comply with accessibility standards to ensure equal access for individuals with disabilities. Banks should consider incorporating features such as speech-to-text capabilities, voice prompts, and user-friendly interfaces that accommodate the needs of all customers.

- Regulatory Reporting: Banks must accurately report and document the use of AVP systems to regulatory authorities, as required by applicable regulations. This includes providing information on how customer data is collected, used, and stored within the AVP system, as well as any security measures implemented to protect customer information.

- Third-Party Vendor Compliance: Banks that engage third-party vendors for AVP system implementation need to ensure that these vendors adhere to regulatory requirements. It is crucial to have appropriate contractual agreements and due diligence processes in place to monitor and manage compliance of the vendors.

Staying up to date with evolving regulations and compliance requirements is essential for banks implementing AVP systems. By maintaining compliance, banks can build trust with customers, mitigate risks, and ensure the proper protection of customer data.

Future of AVP in Banking

The future of Automated Voice Processing (AVP) in banking is promising, with continued advancements and innovations on the horizon. As technology evolves and customer expectations change, AVP is poised to play an even more significant role in transforming the banking industry. Here are some key aspects to consider for the future of AVP:

- Enhanced Natural Language Processing (NLP): AVP systems will continue to improve their NLP capabilities, allowing for more accurate and nuanced understanding of customer commands and inquiries. Advanced NLP algorithms will enable AVP systems to comprehend complex language structures and respond in a more conversational and human-like manner.

- Integration with Emerging Technologies: AVP will be integrated with emerging technologies such as artificial intelligence (AI), machine learning (ML), and chatbots to provide more intelligent and personalized customer interactions. These technologies will enable AVP systems to learn from customer behavior, analyze data, and anticipate customer needs, further enhancing the customer experience.

- Expanded Use of Voice Biometrics: Voice biometrics will become more prevalent as a secure and convenient form of customer authentication. AVP systems will employ advanced voice recognition technologies to authenticate customers using their unique voiceprints, eliminating the need for traditional passwords or PINs.

- Seamless Omnichannel Experience: AVP will be seamlessly integrated with other banking channels, including online banking platforms, mobile applications, and smart devices. Customers will be able to switch between channels while maintaining continuity in their interactions, allowing for a truly omnichannel banking experience.

- Advanced Customer Insights: AVP systems will leverage AI and ML algorithms to analyze customer data in real-time. Banks will be able to gain deeper insights into customer behavior, preferences, and financial needs, enabling them to offer personalized recommendations and tailored banking solutions.

- Increased Automation and Process Efficiency: AVP will continue to automate more banking processes, reducing manual intervention and streamlining operations. Banks will benefit from increased process efficiency, cost savings, and improved turnaround times for customer requests and transactions.

- Integration with Internet of Things (IoT): AVP will be integrated with IoT devices to enable voice-controlled banking interactions in smart homes and connected devices. Customers will be able to perform banking tasks using voice commands through devices like smart speakers, wearables, and cars, providing convenience and accessibility.

- Further Regulatory Compliance: As AVP technology evolves, regulators will likely introduce new requirements and guidelines to ensure the responsible and ethical use of these systems. Banks will need to stay updated on these regulations and ensure compliance to protect customer data and maintain trust.

The future of AVP in banking holds immense potential to transform the way customers interact with financial institutions. By leveraging cutting-edge technologies and embracing customer-centric approaches, banks can deliver personalized experiences, improve operational efficiency, and stay at the forefront of digital innovation.

Conclusion

The implementation of Automated Voice Processing (AVP) systems in the banking industry has revolutionized the way customers interact with financial institutions. AVP has transformed from basic voice response systems to sophisticated platforms that leverage voice recognition, natural language processing, and artificial intelligence. These advancements have led to improved customer experiences, increased operational efficiency, and enhanced security measures.

The benefits of AVP in banking are significant. Customers now have the convenience of 24/7 access to banking services, reduced wait times, and the ability to perform various transactions using voice commands. AVP has also enabled personalized recommendations, seamless integration with other banking channels, and enhanced data insights. Banks have seen cost savings, improved customer satisfaction, and streamlined processes through the adoption of AVP.

However, the implementation of AVP does come with challenges. Ensuring accuracy and reliability of voice recognition technology, addressing security concerns, and maintaining a human touch in customer interactions are just a few of the obstacles that need to be overcome. Furthermore, banks must comply with data privacy regulations, consent requirements, and accessibility standards when incorporating AVP systems.

Looking ahead, the future of AVP in banking is promising. Enhanced natural language processing, integration with emerging technologies, expanded use of voice biometrics, seamless omnichannel experiences, and advanced customer insights are some of the exciting possibilities. Banks must adapt and evolve with these advancements, ensuring regulatory compliance and delivering exceptional customer experiences.

In conclusion, AVP systems have played a pivotal role in transforming the banking industry, providing customers with convenient self-service options and streamlining banking operations. The continued evolution of AVP will lead to even more personalized, efficient, and secure interactions between customers and financial institutions. As technology advances, banks must embrace AVP and its potential to revolutionize the way they serve their customers, ultimately driving digital transformation and shaping the future of banking.