Finance

What Does RTP Mean In Banking

Published: October 13, 2023

Discover the meaning of RTP in banking and its significance in finance. Find out how Real-Time Payments are revolutionizing the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of banking and finance, technology is revolutionizing the way transactions are conducted. One such innovation that has gained significant momentum is Real-Time Payments (RTP). With the advent of RTP, the traditional notion of waiting for hours, or even days, for funds to be transferred is becoming obsolete.

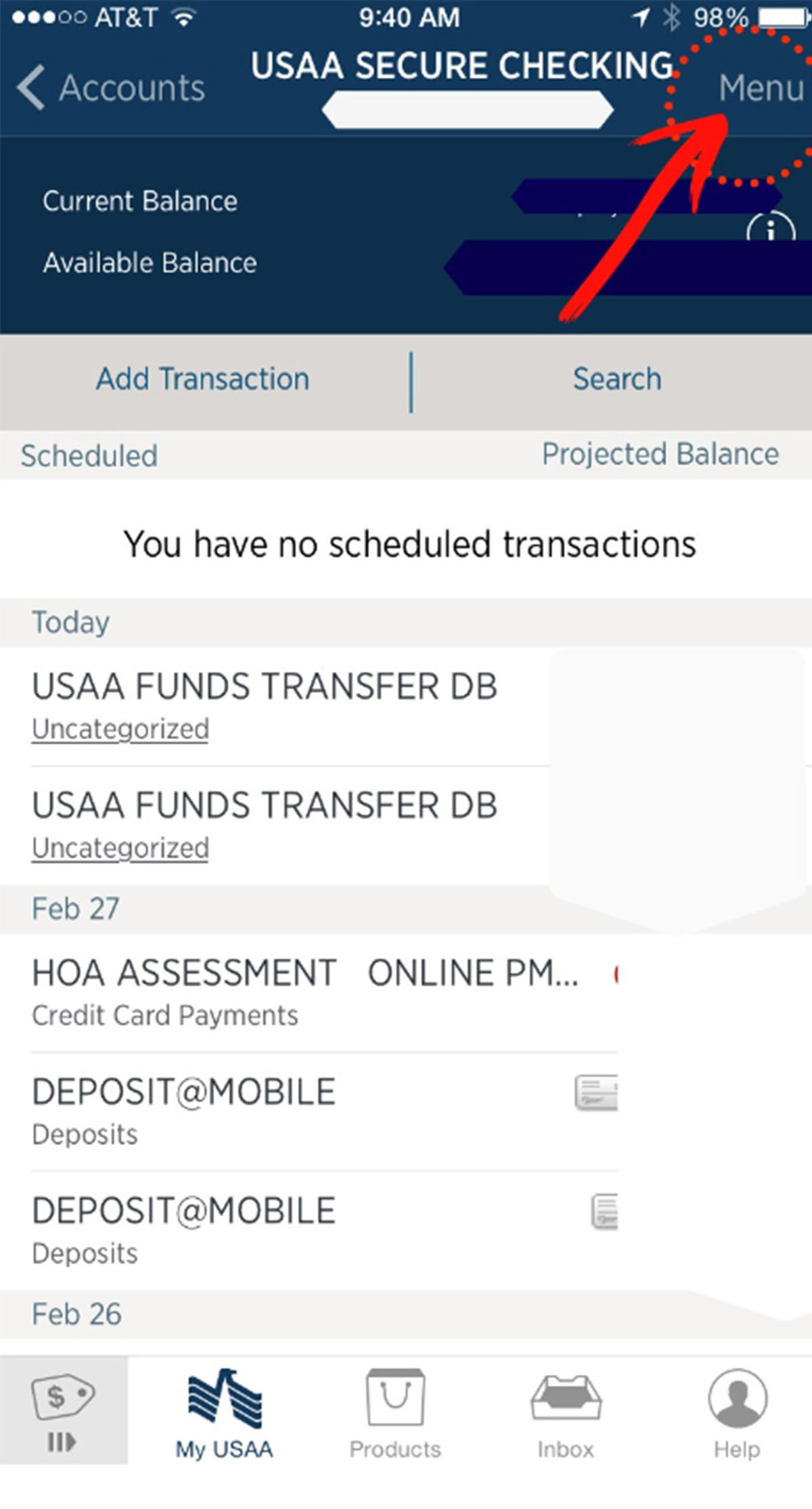

RTP is a banking service that enables instant, 24/7 electronic funds transfers between financial institutions. Unlike traditional payment systems, RTP processes transactions in real-time, ensuring that funds are available to the recipient almost instantly.

As consumers and businesses increasingly demand faster and more convenient ways to perform financial transactions, RTP offers a range of benefits that make it an attractive option for banks and their customers.

In this article, we will delve into the world of RTP, exploring its definition, the benefits it brings to the banking sector, its implementation strategies, use cases, challenges, and the future it holds.

Definition of RTP

Real-Time Payments (RTP) is a banking service that allows funds to be transferred instantly between financial institutions. Unlike traditional payment systems such as Automated Clearing House (ACH) or wire transfers, which can take hours or even days to process, RTP ensures that funds are available to the recipient in real-time.

RTP operates on a 24/7 basis, meaning that transactions can be initiated and completed at any time of the day, including weekends and holidays. This instantaneous transfer of funds has revolutionized the way individuals and businesses conduct their financial transactions.

At its core, RTP works by leveraging secure payment networks and innovative technology to facilitate the immediate transfer of money. The process begins when an individual or business initiates an RTP transaction, providing the necessary details of the recipient, including their account number or mobile phone number.

Once the transaction is initiated, the funds are immediately debited from the sender’s account and credited to the recipient’s account. The recipient can then use the funds instantly, making it ideal for time-sensitive payments or urgent financial needs.

It is important to note that RTP is not limited to domestic transactions. With the rise of globalization and the interconnectedness of financial systems, RTP enables cross-border payments to be processed in real-time, eliminating the need for intermediaries and reducing transfer costs.

Overall, RTP is transforming the way money moves, making it faster, more efficient, and more convenient for individuals and businesses to conduct their financial affairs.

Benefits of RTP in Banking

RTP offers numerous benefits to banks and their customers, revolutionizing the way financial transactions are conducted. Here are some of the key advantages of implementing RTP in the banking industry:

- Instantaneous transactions: The most significant benefit of RTP is the ability to transfer funds in real-time. This immediate access to funds eliminates the need to wait for traditional clearing processes and provides customers with the convenience of instantaneous transactions.

- Enhanced customer experience: By offering instant payments, banks can significantly enhance the overall customer experience. Whether it’s for retail purchases, bill payments, or peer-to-peer transfers, customers appreciate the speed and convenience of RTP, leading to increased customer satisfaction and loyalty.

- Improved cash flow management: For businesses, RTP is a game-changer when it comes to managing cash flow. With instant access to funds, companies can meet their financial obligations and quickly reconcile their accounts, leading to better cash flow management and improved financial stability.

- Reduced fraud risk: RTP utilizes advanced security measures, including multi-factor authentication and encryption, reducing the risk of fraudulent transactions. By leveraging secure payment networks, banks can ensure the safety and integrity of their customers’ funds, instilling trust and confidence in the system.

- Cost-efficiency: By streamlining payment processes and eliminating the need for manual intervention, RTP offers cost savings for both banks and customers. The reduction in processing time and manual errors results in operational efficiencies, enabling banks to allocate resources effectively and offer competitive pricing to customers.

- Increased operational agility: RTP enables banks to adapt to the evolving needs of customers and the rapidly changing business landscape. By offering instant payments, banks can cater to the demands of time-sensitive transactions and stay ahead of the competition.

Overall, the benefits of RTP in banking are substantial. From providing faster and more convenient transactions to enhancing security and reducing costs, RTP is transforming the way financial institutions operate and improving the overall banking experience for customers.

Implementation of RTP in Banking

The implementation of Real-Time Payments (RTP) in the banking sector involves various steps and considerations to ensure a seamless and efficient process. Here are some key aspects of implementing RTP in banking:

- Infrastructure and Technology: Banks need to invest in robust infrastructure and advanced technology to support RTP. This includes developing or adopting payment systems that can handle real-time transactions, integrating with existing core banking systems, and ensuring high levels of security and reliability.

- Partnerships and Collaboration: Banks often need to collaborate with payment processors, technology providers, and other financial institutions to establish the necessary networks and connections for RTP. These partnerships help facilitate interoperability and ensure that customers can send and receive real-time payments across different banking platforms.

- Regulatory Compliance: Banks must ensure compliance with relevant regulatory frameworks when implementing RTP. This involves understanding and adhering to guidelines set by central banks or regulatory authorities, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, to maintain the integrity and security of the payment ecosystem.

- Customer Education: As RTP is a relatively new concept for many customers, banks play a crucial role in educating their clients about the benefits and functionalities of real-time payments. Clear communication and user-friendly interfaces help customers understand how to initiate and receive RTP transactions, ensuring a smooth onboarding experience.

- Testing and Risk Management: Prior to launching RTP services, banks need to conduct rigorous testing to ensure system robustness and security. This includes simulating various transaction scenarios, testing interoperability with partner banks, and implementing risk management protocols to prevent fraud and mitigate potential operational risks.

- Scalability and Future-proofing: Implementing RTP requires considering scalability and future-proofing the systems to accommodate the growing demand for real-time payments. Banks need to anticipate increased transaction volumes and stay abreast of technological advancements to ensure that their RTP infrastructure can support the evolving needs of customers.

By addressing these implementation aspects, banks can successfully integrate RTP into their operations, offering customers the benefits of instant and secure transactions, while also staying compliant with regulatory requirements.

Use Cases of RTP in Banking

Real-Time Payments (RTP) in banking has opened up a plethora of innovative use cases that cater to the evolving needs of customers and businesses. Here are some of the key use cases of RTP:

- P2P Transfers: RTP allows individuals to instantly transfer money to friends, family, or colleagues. Whether it’s splitting a bill at a restaurant, reimbursing a friend, or sending money for a special occasion, RTP makes peer-to-peer transfers quick and convenient.

- Retail Payments: With RTP, customers can make instant payments for their online and in-store purchases. Whether it’s buying clothes, groceries, or electronics, customers no longer have to wait for their payments to settle, allowing for a smooth and seamless shopping experience.

- Bill Payments: RTP simplifies the process of paying bills. Customers can instantly settle their utility bills, mortgage payments, credit card bills, and other invoices, ensuring that their accounts remain up to date and avoiding any late fees or disruptions in services.

- Instant Loan Disbursement: Banks can use RTP to disburse loans instantly to qualified individuals or businesses. This enables borrowers to access funds quickly, facilitating time-sensitive transactions, business operations, or addressing emergency financial needs.

- International Payments: RTP has the potential to revolutionize cross-border payments. By enabling instant transfers between different countries, businesses can facilitate faster international trade, while individuals can send money to family members or make time-sensitive payments abroad with ease.

- Business-to-Business (B2B) Payments: RTP enables businesses to make quick and secure payments to their suppliers, contractors, and other business partners. This accelerates the supply chain and enhances business relationships by ensuring timely payments and reduced administrative burden.

- Emergency Funds: RTP provides a lifeline during emergencies. Whether it’s a medical emergency or natural disaster, individuals can receive instant funds from their friends, family, or even humanitarian organizations, helping them address urgent financial needs promptly.

These use cases highlight the versatility and transformative potential of RTP in various aspects of banking. From everyday transactions to critical financial needs, RTP offers a wide range of applications that cater to the dynamic requirements of customers and businesses alike.

Challenges in Implementing RTP in Banking

Despite the numerous benefits, implementing Real-Time Payments (RTP) in the banking sector is not without its challenges. Here are some of the key obstacles that banks may encounter when adopting RTP:

- Infrastructure Upgrades: RTP requires substantial investments in upgrading existing banking infrastructure to support real-time transaction processing. This includes enhancing core banking systems, integrating with payment networks, and ensuring scalability to handle increased transaction volumes.

- Interoperability: Achieving interoperability between different banks and financial institutions poses a challenge when implementing RTP. Harmonizing technical standards, protocols, and interfaces is essential to facilitate seamless transactions across different platforms and networks.

- Security Risks: With the instant nature of RTP, banks need to employ robust security measures to prevent fraud and protect customer data. Implementing strong authentication protocols, encryption techniques, and monitoring systems is crucial to ensure the integrity and security of real-time transactions.

- Regulatory Compliance: RTP introduces regulatory challenges that banks must navigate. Compliance with financial regulations, anti-money laundering laws, and user identification requirements adds complexity to the implementation process. Banks need to stay up to date with evolving regulatory frameworks to ensure adherence and mitigate compliance risks.

- Customer Adoption: Educating customers about the benefits and usage of RTP can be a hurdle. Many individuals may be accustomed to traditional payment methods and may not fully understand or trust the real-time payment concept. Banks must invest in customer education and user-friendly interfaces to encourage widespread adoption of RTP.

- Resistance to Change: Integrating RTP into existing banking systems may face resistance from internal stakeholders. Banks need to address concerns and build internal support to drive the necessary changes and investments required for successful implementation.

Overcoming these challenges requires careful planning, collaboration with industry partners, and continuous innovation. By addressing infrastructure needs, ensuring security, compliance, and customer adoption, banks can successfully implement RTP and leverage its benefits for their customers.

Future of RTP in Banking

The future of Real-Time Payments (RTP) in the banking industry is promising, with significant advancements and opportunities on the horizon. Here are some key factors that contribute to the future growth and evolution of RTP:

- Global Adoption: As the need for instant and efficient payment solutions grows worldwide, more countries are expected to adopt RTP. This global adoption will facilitate seamless cross-border transactions, improving international trade and financial inclusion.

- Integration with Emerging Technologies: RTP can further benefit from integration with emerging technologies such as blockchain, artificial intelligence, and Internet of Things (IoT). These technologies can enhance transaction security, automate processes, and enable innovative use cases, accelerating the growth of RTP in banking.

- New Market Entrants: The rise of fintech startups and non-traditional players in the banking industry has introduced new competition and innovation. These agile and technology-focused companies are well-positioned to leverage RTP, revolutionizing payment experiences and challenging traditional banking models.

- Request-to-Pay (RTP): Request-to-Pay, a feature that allows individuals or businesses to request payments from others, is gaining traction in the RTP space. This functionality simplifies payment requests, streamlines invoicing processes, and provides a more intuitive way for users to send and receive payments.

- Enhanced Payment Services: RTP offers avenues for banks to develop additional services on top of real-time transactions. Integration with loyalty programs, financial management tools, and value-added services can further enhance the customer experience and increase engagement with RTP.

- Standardization and Interoperability: Continued efforts towards standardization and interoperability will be crucial for the future of RTP. Establishing common technical standards and protocols will promote seamless connectivity between different banks and payment systems, creating a more integrated and efficient payment ecosystem.

- Internet of Payments (IoP): The convergence of IoT and real-time payments is expected to pave the way for the Internet of Payments (IoP). Connected devices, such as smart appliances and wearable devices, will enable automatic and frictionless payments, transforming the way transactions are initiated and processed.

The future of RTP in banking holds immense potential to revolutionize the way individuals and businesses conduct their financial affairs. As technology continues to advance, regulations evolve, and consumer expectations shift, RTP will play a pivotal role in shaping the future of payments.

Conclusion

In conclusion, Real-Time Payments (RTP) is transforming the banking industry by enabling instant and seamless transactions between financial institutions. With its ability to process payments in real-time, RTP offers a range of benefits for both banks and their customers.

The implementation of RTP in banking requires investments in infrastructure and technology, collaboration with industry partners, and compliance with regulatory frameworks. However, the potential rewards far outweigh the challenges.

RTP offers a multitude of use cases, including peer-to-peer transfers, retail and bill payments, international transactions, and business-to-business payments. These applications cater to the evolving needs of individuals and businesses, providing faster, more convenient, and secure payment options.

Looking ahead, the future of RTP in banking is bright. The global adoption of RTP, integration with emerging technologies, and the rise of new market entrants will drive further innovation in the payment ecosystem. Standardization, interoperability, and the evolution of features like Request-to-Pay will enhance the user experience and broaden the possibilities for RTP.

As banks continue to prioritize customer-centric solutions and adapt to the changing landscape, RTP will play a central role in shaping the future of payments. With its potential to streamline processes, enhance financial inclusivity, and provide greater convenience, RTP is poised to revolutionize the way we transact and interact with money.