Finance

What Does Balance Transfer Mean

Published: February 18, 2024

Learn what balance transfer means in finance and how it can help you manage your debt more effectively. Discover the benefits and potential drawbacks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Balance Transfer

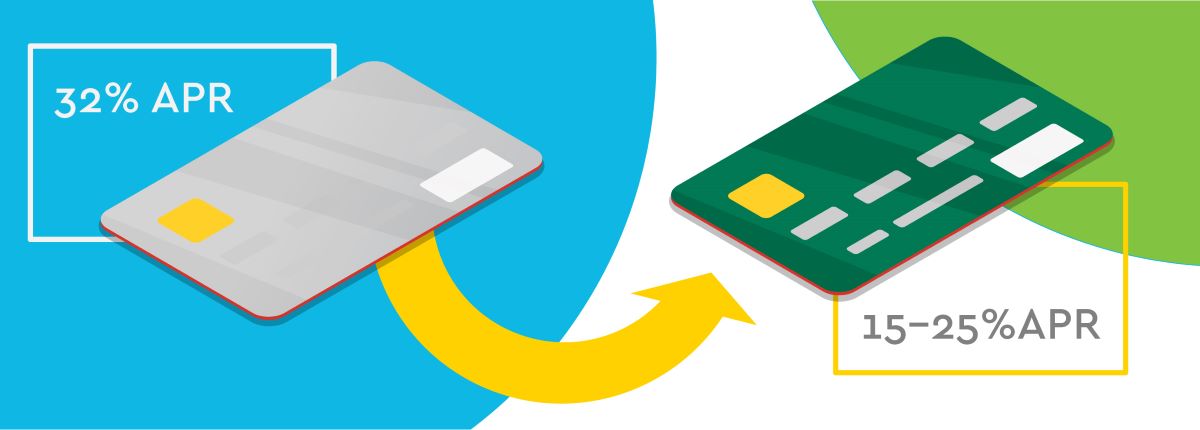

When it comes to managing personal finances, understanding the concept of balance transfer can be incredibly beneficial. This financial tool allows individuals to move existing credit card debt to a new card with a lower interest rate, potentially saving them money and helping to pay off debt more efficiently. By comprehending the intricacies of balance transfer, one can make informed decisions to improve their financial well-being.

Balance transfer is a strategic maneuver that can provide relief from high-interest debt, offering an opportunity to consolidate and restructure financial obligations. This process involves transferring the existing balance from one credit card to another, often with a promotional interest rate that is significantly lower than the current rate. This can result in substantial savings on interest payments, allowing individuals to allocate more funds towards reducing their principal debt.

Understanding the nuances of balance transfer involves delving into the mechanics of how it works, the potential benefits it offers, and the considerations that should be taken into account before proceeding with a transfer. By gaining a comprehensive understanding of this financial tool, individuals can harness its potential to alleviate debt burdens and achieve greater financial stability.

Understanding Balance Transfer

Balance transfer is a financial strategy that allows individuals to move their outstanding credit card debt from one card to another, typically with a lower interest rate. This process can be an effective way to manage and reduce debt, offering the potential for significant interest savings and simplified payment structures.

When a balance transfer is initiated, the existing debt from one credit card is transferred to a new card, often with a promotional period featuring a reduced or 0% annual percentage rate (APR). This can provide a temporary reprieve from high-interest charges, allowing individuals to focus on paying down their principal balance without accruing additional interest expenses.

It’s important to note that balance transfers are not limited to credit card debt; they can also encompass other types of debt, such as personal loans or lines of credit. However, for the purpose of this discussion, the focus will primarily be on credit card balance transfers.

By gaining a clear understanding of balance transfer, individuals can leverage this financial tool to their advantage. It’s crucial to be aware of the potential impact on credit scores, the fees associated with transfers, and the importance of responsible financial management during and after the transfer process.

Furthermore, comprehending the eligibility criteria for balance transfer offers, the duration of promotional rates, and the implications of missed or late payments can empower individuals to make informed decisions about utilizing this strategy to improve their financial standing.

How Balance Transfer Works

Understanding the mechanics of how balance transfer works is essential for individuals considering this financial strategy. The process typically begins with researching and identifying a credit card offering a favorable balance transfer promotion, such as a low or 0% introductory APR for a specified period. Once a suitable card is selected, the cardholder can initiate the transfer by providing the necessary details to the new credit card issuer.

Upon approval, the new credit card issuer pays off the outstanding balance on the existing card, effectively assuming the debt. The amount transferred is then reflected as a new balance on the recipient card, subject to the terms and conditions of the balance transfer offer. It’s important to be mindful of any transfer fees that may apply, as these can impact the overall cost-effectiveness of the transfer.

During the promotional period, which could range from several months to over a year, the transferred balance is subject to the reduced or 0% APR, allowing the cardholder to make payments without accruing additional interest charges. This presents an opportunity to allocate more funds towards reducing the principal balance, accelerating the journey towards debt freedom.

It’s crucial for individuals engaging in balance transfers to adhere to the terms of the promotional offer, including making timely payments and refraining from using the new card for additional purchases that could exacerbate debt. Failure to comply with the terms could result in the forfeiture of the promotional APR and the imposition of standard interest rates on the transferred balance.

By understanding the procedural aspects of balance transfer, individuals can navigate the process with confidence, maximize the benefits of promotional rates, and work towards achieving financial stability and freedom from high-interest debt.

Benefits of Balance Transfer

Embracing a balance transfer strategy can yield several compelling benefits for individuals seeking to manage and reduce their debt effectively. Some of the key advantages of utilizing balance transfer include:

- Interest Savings: By transferring high-interest credit card debt to a card offering a lower or 0% introductory APR, individuals can save a substantial amount on interest charges. This can result in more funds being allocated towards paying down the principal balance, expediting the journey towards debt freedom.

- Consolidation and Simplification: Consolidating multiple credit card balances onto a single card through a balance transfer can streamline debt management. This simplification can make it easier to track and manage payments, potentially reducing the likelihood of missed deadlines and associated penalties.

- Financial Breathing Room: The temporary relief from high-interest charges during the promotional period can provide individuals with breathing room to focus on reducing their debt without the burden of accruing additional interest expenses. This can contribute to a sense of financial empowerment and control.

- Credit Score Improvement: Effectively managing and reducing debt through a balance transfer can have a positive impact on credit scores. By demonstrating responsible repayment behavior and lowering credit utilization, individuals may see enhancements in their credit standing over time.

- Opportunity for Debt Repayment Strategy: The reduced or 0% APR offered during the promotional period presents an opportunity to implement a strategic debt repayment plan. By channeling payments towards the principal balance, individuals can make significant progress in eliminating debt.

It’s important to note that while balance transfer offers compelling advantages, individuals should approach this strategy with careful consideration and a commitment to responsible financial management. Understanding the potential benefits can empower individuals to make informed decisions about leveraging balance transfer as a tool for achieving financial stability and reducing debt burden.

Considerations Before Making a Balance Transfer

Before embarking on a balance transfer, individuals should carefully evaluate a range of considerations to ensure that this financial strategy aligns with their goals and circumstances. Some key factors to ponder include:

- Transfer Fees: It’s essential to assess the transfer fees associated with the new credit card. While some cards may offer promotional APRs, they may impose a fee for transferring the balance, impacting the overall cost-effectiveness of the transfer. Calculating the potential savings against the transfer fee can provide clarity on the value of the transfer.

- Promotional Period Duration: Understanding the duration of the promotional APR period is crucial. Individuals should assess whether the allocated time frame aligns with their ability to repay the transferred balance effectively. It’s important to note the standard APR that will apply after the promotional period concludes.

- Credit Score Impact: Initiating a balance transfer may have implications for credit scores. While the transfer itself may not directly impact credit scores, the new credit inquiry and the utilization of the new card could influence credit ratings. Individuals should consider the potential effects on their credit standing before proceeding with a transfer.

- Responsible Financial Management: It’s imperative to approach balance transfer with a commitment to responsible financial management. This entails refraining from accruing additional debt on the new card, making timely payments, and diligently working towards reducing the transferred balance within the promotional period.

- Existing Card Management: After transferring the balance, individuals should consider the management of their existing credit card. It may be advisable to refrain from closing the old account, as this could impact credit utilization and the overall credit profile.

By carefully evaluating these considerations, individuals can make informed decisions about whether a balance transfer aligns with their financial objectives and capabilities. It’s essential to approach this strategy with a clear understanding of the potential implications and a commitment to responsible financial conduct.

Conclusion

In conclusion, the concept of balance transfer represents a valuable tool for individuals seeking to manage and reduce their debt effectively. By comprehending the intricacies of this financial strategy, individuals can make informed decisions to improve their financial well-being and work towards achieving greater stability.

Balance transfer offers the potential for significant interest savings, simplified debt management through consolidation, and temporary relief from high-interest charges. It presents an opportunity for individuals to strategically repay their debt, potentially improving credit scores and fostering a sense of financial empowerment.

However, it’s essential for individuals to approach balance transfer with careful consideration and a commitment to responsible financial management. Evaluating factors such as transfer fees, promotional period duration, credit score impact, and existing card management can provide clarity on the suitability of this strategy for individual circumstances.

By understanding the potential benefits and considerations associated with balance transfer, individuals can harness this financial tool to their advantage, working towards a future free from the burden of high-interest debt and achieving a more secure financial position.

Overall, balance transfer represents a proactive approach to debt management, offering individuals the potential to save on interest expenses, simplify their financial obligations, and pave the way towards a brighter financial future.