Home>Finance>What Does “In Millions” Mean On A Balance Sheet?

Finance

What Does “In Millions” Mean On A Balance Sheet?

Published: December 27, 2023

Discover the meaning of "in millions" on a balance sheet in finance. Gain insights into how this term affects financial reporting and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

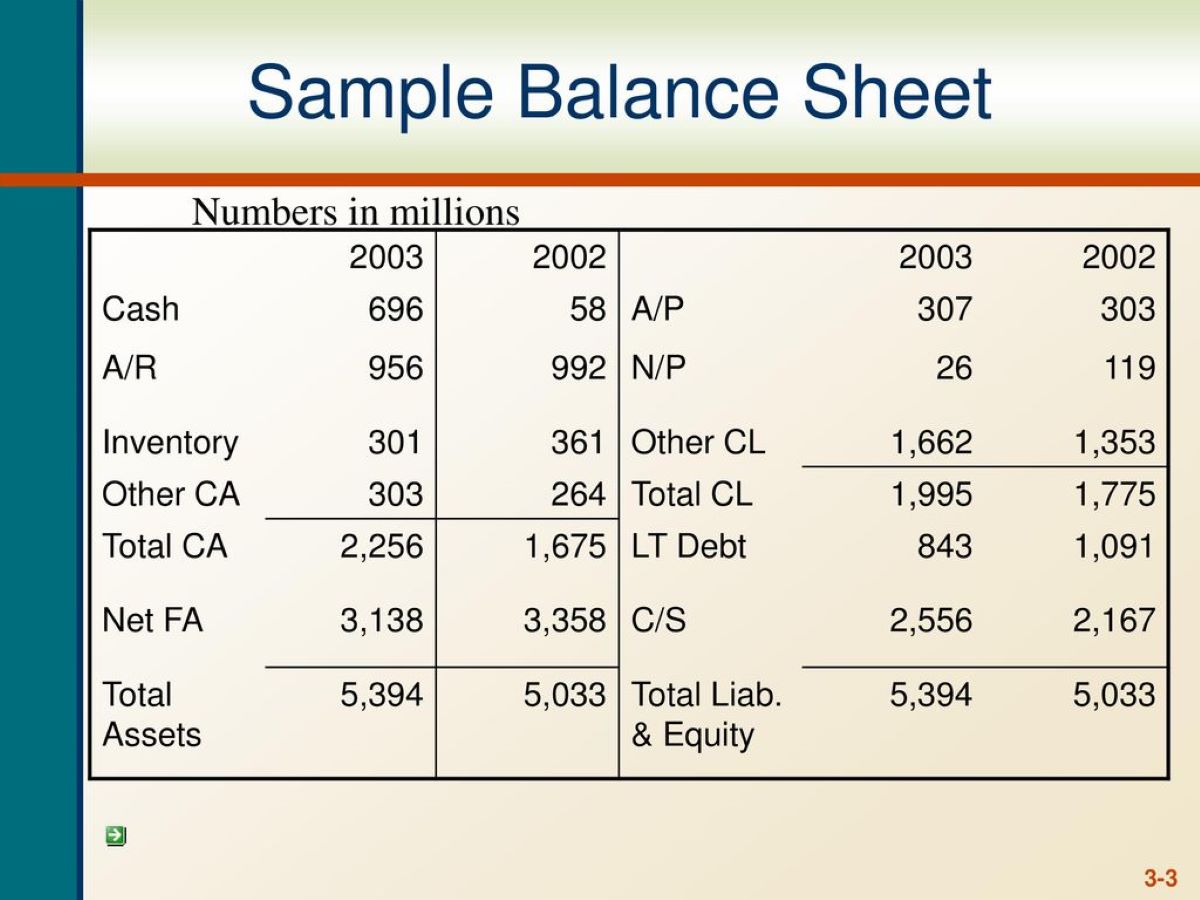

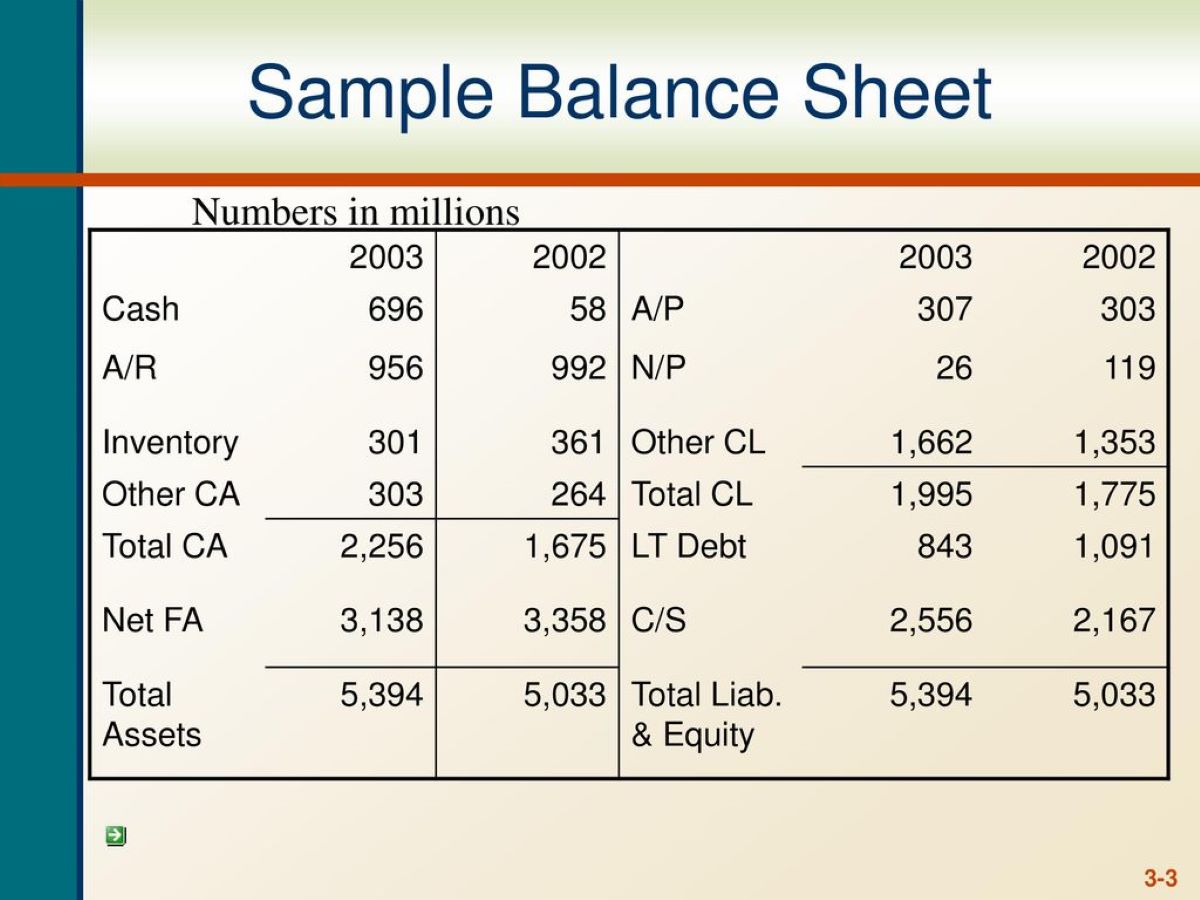

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It highlights the company’s assets, liabilities, and shareholders’ equity. When analyzing a balance sheet, you may come across the term “in millions” used in relation to the values mentioned in the statement.

The phrase “in millions” refers to the scale at which the figures on a balance sheet are represented. It indicates that the values listed are expressed in millions of dollars. This notation is often used by companies to simplify the presentation of their financial information and to provide a clearer picture of their financial standing.

In this article, we will delve deeper into what “in millions” means on a balance sheet, why it is used, and the benefits and limitations of using this notation. We will also provide examples to illustrate how “in millions” is used in balance sheets.

Understanding how to interpret the information presented in a balance sheet is crucial for investors, analysts, and stakeholders. By gaining a comprehensive understanding of the use of “in millions” on a balance sheet, you will be better equipped to analyze financial statements and make informed decisions.

Understanding Balance Sheets

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is one of the three major financial statements, alongside the income statement and cash flow statement. The balance sheet provides valuable information about a company’s assets, liabilities, and shareholders’ equity.

The balance sheet follows a fundamental equation: Assets = Liabilities + Shareholders’ Equity. This equation ensures that the company’s resources (assets) are financed either by debts (liabilities) or by the owners’ investment (shareholders’ equity).

Assets refer to the resources owned or controlled by a company, which can include cash, accounts receivable, inventory, property, equipment, and investments. Liabilities, on the other hand, are the obligations or debts that a company owes to external parties, such as loans, accounts payable, and accrued expenses. Shareholders’ equity represents the residual interest in the assets of the company, after deducting liabilities, and can include items like retained earnings and capital stock.

Balance sheets are typically prepared at the end of an accounting period, such as a quarter or a fiscal year. They provide a comprehensive overview of the company’s financial health, liquidity, and its ability to meet short-term and long-term obligations.

When analyzing a balance sheet, it is important to consider various financial ratios, such as the current ratio, debt-to-equity ratio, and return on equity, to gain deeper insights into the company’s financial performance and stability.

Now that we have a basic understanding of balance sheets, let’s explore what the term “in millions” means in relation to the values mentioned on these financial statements.

What Does “In Millions” Mean?

When you encounter the phrase “in millions” on a balance sheet, it refers to the scale at which the numbers are expressed. It signifies that the values listed in the financial statement are multiplied by a factor of one million. This notation is used to simplify the presentation of large figures and make them easier to comprehend.

For example, if a company reports a value of $10,000 under the “Cash and Cash Equivalents” section of a balance sheet, it means that the actual amount of cash held by the company is $10,000,000. The use of “in millions” allows for a more compact representation of large numbers, enabling financial statements to be more reader-friendly.

By using the “in millions” notation, companies can streamline their balance sheet presentations and avoid cluttering the statements with excessive digits. This makes it easier for stakeholders, including investors, analysts, and regulators, to quickly grasp the financial position of the company.

It’s important to note that the use of “in millions” is not limited to balance sheets. This notation can also be found in other financial statements, such as income statements and cash flow statements. By providing values in millions, companies can maintain consistency and enhance comparability across different financial reports.

Now that we understand what “in millions” means, let’s explore why companies choose to use this notation on their balance sheets.

Why Use “In Millions” on a Balance Sheet?

The use of “in millions” on a balance sheet offers several advantages for companies in presenting their financial information. Here are some key reasons why this notation is commonly used:

- Simplification and Clarity: Expressing values in millions allows for a more concise and readable presentation of financial figures. It eliminates the need to display long strings of numbers, making it easier for readers to quickly comprehend the information.

- Standardization: Using “in millions” provides uniformity across different financial statements. Companies often report their financials in millions to maintain consistency and enhance comparability. This makes it easier for investors and analysts to compare the financial performance of different companies.

- Positive Perception: Presenting figures in millions can create a positive impression of the company’s size and financial position. Large numbers can convey a sense of scale and success, which can be beneficial for building investor confidence and attracting potential stakeholders.

- Efficiency in Reporting: When dealing with large amounts of money, it is common for many transactions to occur in millions. Using “in millions” allows for easier recording and reporting of financial activities. It reduces the chances of errors and simplifies the accounting process.

- Global Recognition: The use of “in millions” in financial statements is widely recognized and understood across different regions and markets. It facilitates international comparisons and enables investors from different countries to analyze the financials of a company more effectively.

Overall, using “in millions” on a balance sheet offers a practical and standardized approach to representing financial information. It enhances readability, simplifies the reporting process, and ensures consistency in presenting large figures.

Next, we will explore the benefits and limitations of using “in millions” on a balance sheet.

Benefits of Using “In Millions” on a Balance Sheet

The use of “in millions” on a balance sheet offers several benefits for companies in presenting their financial information. Let’s explore some of these advantages:

- Enhanced Readability: Expressing values in millions simplifies the presentation of large numbers, making it easier for readers to comprehend and compare figures across financial statements. This improves the readability and clarity of the balance sheet, enabling stakeholders to quickly understand the company’s financial position.

- Streamlined Presentation: By using “in millions,” companies can present their balance sheet in a more compact format. This helps to avoid cluttering the statement with excessive digits, creating a cleaner and more visually appealing document.

- Improved Comparability: Standardizing the use of “in millions” enhances comparability between companies. It allows investors and analysts to easily compare the financial performance and positions of different organizations. This is particularly useful when conducting industry comparisons or evaluating potential investment opportunities.

- Time-Saving: The use of “in millions” reduces the need for manual conversions and computations. Companies can directly present financial values in millions, saving time and effort in the preparation of balance sheets.

- Facilitates Decision Making: The simplified representation of figures in millions enables stakeholders to make faster and more informed decisions. By quickly grasping the financial magnitude of different items, investors and analysts can assess the company’s overall financial health and performance more effectively.

By utilizing “in millions” on a balance sheet, companies can improve the readability, comparability, and overall usability of their financial information. This ultimately benefits both internal and external stakeholders by providing a clearer picture of the company’s financial position.

However, it is essential to be aware of the limitations that come with using “in millions” on a balance sheet. Let’s explore these limitations in the next section.

Limitations of Using “In Millions” on a Balance Sheet

While the use of “in millions” on a balance sheet offers several advantages, it is important to consider the limitations associated with this notation. Here are some key limitations to keep in mind:

- Lack of Precision: Using “in millions” reduces the level of detail provided in financial statements. Although it simplifies the representation of large numbers, it can lead to a loss of precision. Stakeholders may not have a precise understanding of the exact value of the items listed on the balance sheet.

- Ignores Smaller Values: By expressing values in millions, smaller numbers may become less noticeable or insignificant. This can result in a lack of visibility for smaller assets, liabilities, or equity components, which could still be relevant and impactful to understanding the financial position of the company.

- Limited Context: Merely presenting values in millions may not provide sufficient context for stakeholders to fully understand the financial performance or position of a company. Supplementary information and analysis may be required to provide a deeper understanding of the numbers and their implications.

- Potential Misinterpretation: The use of “in millions” can sometimes lead to misinterpretation or miscommunication if stakeholders misunderstand the scale at which the figures are presented. It is crucial for companies to provide clear explanations and ensure that stakeholders understand the context in which the values are expressed.

- Regional Differences: While “in millions” is widely understood and recognized, different regions may have varying conventions for representing numerical values. It is important for companies with global operations to be mindful of this and provide appropriate disclosures to avoid confusion or potential misinterpretation.

Despite these limitations, the use of “in millions” remains a common practice on balance sheets. It is important for stakeholders to be aware of both the benefits and limitations in order to effectively interpret the financial information provided.

Now, let’s explore some examples to illustrate how “in millions” is used on balance sheets.

Examples of “In Millions” on Balance Sheets

To further understand how “in millions” is used on balance sheets, let’s take a look at some examples:

Example 1:

Assets:

Cash and Cash Equivalents: $10,000 (in millions)

Accounts Receivable: $5,500 (in millions)

Inventory: $8,200 (in millions)

Liabilities:

Accounts Payable: $6,500 (in millions)

Short-Term Debt: $3,000 (in millions)

Long-Term Debt: $12,500 (in millions)

Shareholders' Equity:

Retained Earnings: $15,700 (in millions)

Capital Stock: $3,500 (in millions)

In this example, the values on the balance sheet are expressed in millions. This notation simplifies the presentation of large figures, making it easier for stakeholders to quickly understand the financial position of the company.

Example 2:

Assets:

Cash and Cash Equivalents: $250

Accounts Receivable: $175

Inventory: $310

Liabilities:

Accounts Payable: $120

Short-Term Debt: $90

Long-Term Debt: $400

Shareholders' Equity:

Retained Earnings: $600

Capital Stock: $200

In this example, the values on the balance sheet are expressed in thousands. While “in millions” is a common notation, companies may choose to express values in different scales based on the size and nature of their operations. It is important to carefully review the balance sheet and related disclosures to understand the specific scale used.

These examples illustrate how “in millions” is used to simplify balance sheet presentations and enhance readability. They provide stakeholders with a clear view of the company’s financial position without overwhelming them with excessive digits.

Finally, let’s summarize the key points discussed in this article.

Conclusion

The use of “in millions” on a balance sheet simplifies the presentation of large numbers, making financial statements more reader-friendly. It allows stakeholders to quickly grasp the company’s financial position and compare it with other organizations effectively. The benefits of using “in millions” include enhanced readability, streamlined presentation, improved comparability, efficiency in reporting, and global recognition.

However, it is important to be aware of the limitations associated with this notation. The use of “in millions” may lack precision, ignore smaller values, provide limited context, potentially lead to misinterpretation, and be subject to regional differences. Stakeholders should carefully interpret the information and supplement it with additional analysis, if needed.

Overall, understanding the meaning and implications of “in millions” on a balance sheet is crucial for investors, analysts, and stakeholders. It allows for a better understanding of a company’s financial health and facilitates informed decision-making.

As you analyze balance sheets, keep in mind that the use of “in millions” is just one aspect of financial reporting. Achieving a comprehensive understanding of a company’s financial position requires considering other factors such as industry trends, risk analysis, and future prospects. Furthermore, it is important to consult professionals or financial experts when interpreting financial statements for investment or business decisions.

By utilizing the information provided in this article, stakeholders can gain a deeper understanding of “in millions” on balance sheets and navigate the world of finance with confidence.