Finance

What Does Credit For Other Dependents Mean

Published: January 8, 2024

Learn what credit for other dependents means in relation to finance and how it can impact your tax situation. Find out if you qualify and how to take advantage of this benefit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Credit for Other Dependents

- Eligibility Criteria for Credit for Other Dependents

- Claiming Credit for Other Dependents on Tax Returns

- Additional Benefits and Considerations for Credit for Other Dependents

- Limitations and Restrictions on Credit for Other Dependents

- Frequently Asked Questions about Credit for Other Dependents

- Conclusion

Introduction

Welcome to our comprehensive guide on the Credit for Other Dependents. Whether you’re a taxpayer hoping to maximize your tax benefits or simply seeking to understand different tax credits, this article will provide you with valuable insights. The Credit for Other Dependents is an important aspect of the U.S. tax system that can potentially save you money.

When it comes to filing tax returns, understanding the available tax credits is crucial. These credits can help reduce your overall tax liability and even result in a higher refund. The Credit for Other Dependents, also known as the Other Dependent Credit, is one such credit that may be applicable to you.

While many taxpayers are familiar with the Child Tax Credit and the Child and Dependent Care Credit, the Credit for Other Dependents is often overlooked. This credit is designed for individuals who have dependents that do not qualify for the Child Tax Credit. By claiming this credit, eligible taxpayers can reduce their tax liability and potentially receive a larger refund.

Throughout the course of this article, we will explore the definition of the Credit for Other Dependents, the eligibility criteria, how to claim it on your tax return, and any additional benefits or considerations. We will also address common questions and concerns that taxpayers may have regarding this credit. By the end, you will have a solid understanding of the Credit for Other Dependents and how it may impact your tax situation.

It’s important to note that tax regulations can be complex, and the information provided in this article is for general guidance purposes only. We recommend consulting with a qualified tax professional or using tax software to ensure that you accurately determine your eligibility for and correctly claim the Credit for Other Dependents.

Now, let’s dive deeper into the Credit for Other Dependents and discover how it can benefit you.

Definition of Credit for Other Dependents

The Credit for Other Dependents is a tax credit that allows eligible taxpayers to claim a non-refundable credit for individuals who are considered dependents but do not meet the criteria for the Child Tax Credit. It was introduced as part of the Tax Cuts and Jobs Act in 2017 and is intended to provide tax relief to taxpayers who have dependents that don’t qualify for other tax credits.

The Credit for Other Dependents covers a broader range of dependents than the Child Tax Credit. While the Child Tax Credit is limited to qualifying children under the age of 17, the Credit for Other Dependents can be claimed for older children, elderly parents, relatives, or other individuals who meet the IRS criteria for dependents.

To be eligible for the Credit for Other Dependents, the dependent must meet the following requirements:

- The dependent must be a U.S. citizen, resident alien, or national.

- The dependent must have a valid Social Security Number or an Individual Taxpayer Identification Number issued by the IRS.

- The dependent must not be eligible to be claimed as a qualifying child for the Child Tax Credit.

- The dependent must have a Gross Income of less than the specified threshold amount set by the IRS.

- The taxpayer must provide more than half of the dependent’s support during the tax year.

It’s important to note that the Credit for Other Dependents is non-refundable. This means that while it can reduce your tax liability, it cannot generate a tax refund if your tax liability is already zero. However, it can still be beneficial in reducing the overall amount you owe in taxes.

Calculating the Credit for Other Dependents is relatively straightforward. As of the 2021 tax year, the credit is $500 per qualifying dependent. This means that if you have multiple dependents who meet the eligibility criteria, you can claim a $500 credit for each qualifying dependent on your tax return.

Next, we will explore the eligibility criteria in more detail to determine if you qualify for the Credit for Other Dependents. Stay tuned!

Eligibility Criteria for Credit for Other Dependents

In order to claim the Credit for Other Dependents on your tax return, you must ensure that both you, as the taxpayer, and the dependent meet the specific eligibility criteria set by the Internal Revenue Service (IRS). Understanding these criteria is essential to determine if you qualify for the credit.

Here are the key eligibility criteria for the Credit for Other Dependents:

- Dependent Relationship: The individual you are claiming the credit for must be considered your dependent according to IRS guidelines. This can include your adult children, elderly parents, relatives, or other individuals who meet the dependency requirements.

- Taxpayer Identification Numbers: The dependent must have a valid Social Security Number or an Individual Taxpayer Identification Number (ITIN) issued by the IRS. The ITIN is used for individuals who are not eligible to obtain a Social Security Number but need an identification number for tax purposes.

- Gross Income: The dependent must have a Gross Income of less than the specified threshold amount set by the IRS. This threshold can vary each year, so it’s important to refer to the applicable tax year’s guidelines.

- Support Test: You, as the taxpayer, must provide more than half of the dependent’s support during the tax year. This includes financial support for basic necessities such as food, shelter, medical care, and education.

- Not Eligible for Child Tax Credit: The dependent cannot qualify as a qualifying child for the purposes of the Child Tax Credit. This means that the dependent must be older than 17, not live with you for more than half the year, and not be claimed as a dependent on someone else’s tax return.

It’s important to carefully review these eligibility criteria to determine if you meet all the requirements for claiming the Credit for Other Dependents. Failing to meet any of these criteria may result in disqualification for the credit.

Additionally, it’s worth noting that the Credit for Other Dependents is non-refundable. This means that the credit can only reduce your tax liability and cannot generate a refund if you do not owe any taxes. However, it’s still a valuable credit that can significantly lower your overall tax burden.

Now that you understand the eligibility criteria for the Credit for Other Dependents, the next section will guide you on how to claim this credit on your tax return. Stay tuned!

Claiming Credit for Other Dependents on Tax Returns

Claiming the Credit for Other Dependents on your tax return is a straightforward process once you have determined your eligibility. Here are the steps to follow to ensure you claim the credit correctly:

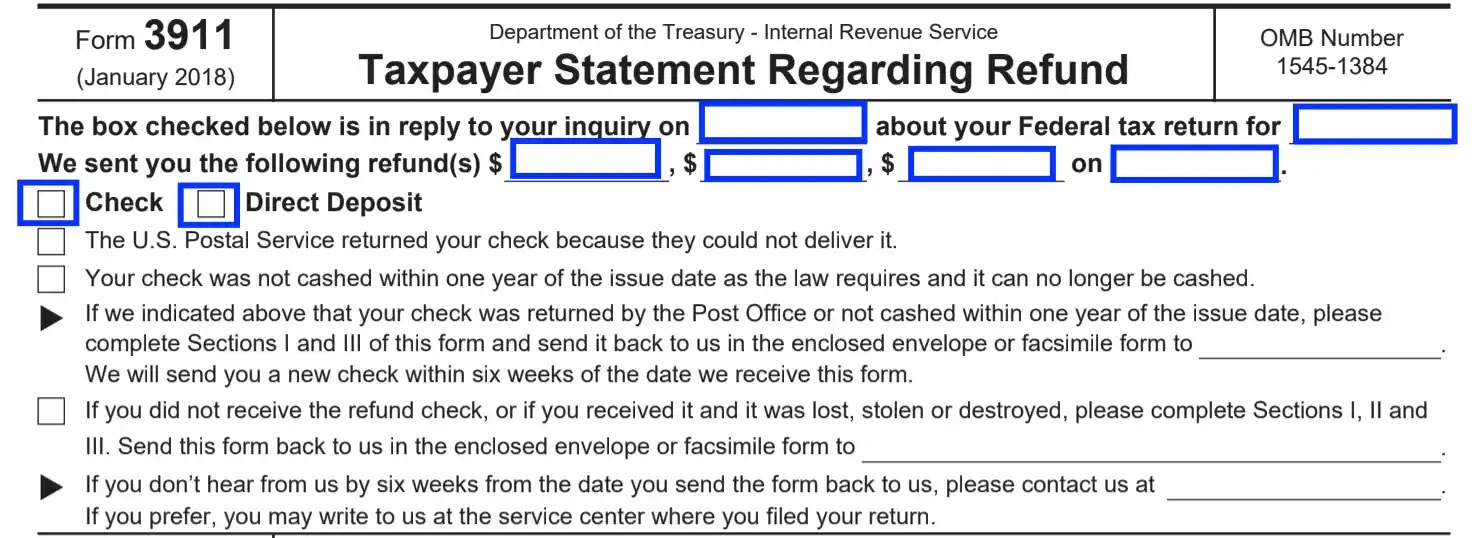

- Complete the Necessary Forms: To claim the Credit for Other Dependents, you need to complete the appropriate tax forms. For most individuals, this will be Form 1040 or Form 1040A. If you are using tax software or seeking assistance from a tax preparer, they will guide you through the process of filling out the necessary forms.

- Provide Dependents’ Information: When completing the tax forms, make sure to accurately provide the required information for each dependent you are claiming the credit for. This includes their full name, relationship to you, and their valid Social Security Number or ITIN.

- Calculate the Credit: The Credit for Other Dependents is a fixed amount per qualifying dependent. As of the 2021 tax year, the credit amount is $500 per dependent. Multiply the number of qualifying dependents by $500 to determine the total credit amount you can claim.

- Include the Credit on Your Tax Return: Once you have calculated the credit amount, make sure to properly include it on the appropriate line of your tax return. This will vary depending on the form you are using, so carefully review the instructions provided by the IRS or consult a tax professional to ensure accuracy.

- Review and File Your Tax Return: Before submitting your tax return, carefully review all the information provided, including the claimed Credit for Other Dependents. Double-check for any errors or omissions to avoid potential issues with the IRS. Once you are satisfied with the accuracy of your tax return, submit it to the IRS either electronically or by mail.

It’s crucial to note that the Credit for Other Dependents is a non-refundable credit. This means that it can only reduce your tax liability and cannot result in a refund if your tax liability is already zero.

Lastly, keep in mind that tax laws and regulations are subject to change. It’s always advisable to check the latest guidelines and instructions provided by the IRS or consult with a tax professional to ensure you are claiming the Credit for Other Dependents correctly and taking full advantage of all available tax benefits.

Now that you know how to claim the Credit for Other Dependents, let’s explore the additional benefits and considerations related to this tax credit.

Additional Benefits and Considerations for Credit for Other Dependents

Claiming the Credit for Other Dependents can provide you with several additional benefits and considerations beyond reducing your overall tax liability. Here are some important factors to keep in mind:

- More Flexibility in Claiming Dependents: The Credit for Other Dependents allows you to claim dependents who may not meet the criteria for the Child Tax Credit. This means that you can still receive a tax benefit for supporting older children, elderly parents, relatives, or other individuals who depend on you financially.

- Increased Tax Savings: By claiming the Credit for Other Dependents, you can potentially increase your tax savings. The $500 credit per qualifying dependent can make a significant difference in reducing your overall tax liability and potentially result in a larger tax refund.

- Helps Offset the Cost of Supporting Dependents: Supporting dependents can be financially demanding. The Credit for Other Dependents can help offset some of these costs by providing a credit that recognizes your financial responsibility for their well-being.

- Availability for Non-Traditional Families: The Credit for Other Dependents is not limited to traditional nuclear families. It can be claimed by individuals in various family structures, such as single parents, blended families, or taxpayers supporting other individuals who meet the dependency requirements.

- Interaction with Other Tax Credits: It’s important to consider how the Credit for Other Dependents interacts with other tax credits you may be eligible for. While you cannot claim both the Child Tax Credit and the Credit for Other Dependents for the same dependent, you may still be able to claim other applicable credits, such as the Earned Income Tax Credit or the Child and Dependent Care Credit.

- Review of Income and Dependency Changes: It’s crucial to review your income and dependency situation each year to determine if you still qualify for the Credit for Other Dependents. Changes in income or dependency status can impact your eligibility for the credit, so it’s important to stay informed and adjust your tax planning accordingly.

Remember that each taxpayer’s situation is unique, and it’s advisable to consult with a tax professional to ensure you make the most of the available tax benefits and credits.

Now, let’s address some frequently asked questions related to the Credit for Other Dependents to provide you with further clarity.

Limitations and Restrictions on Credit for Other Dependents

While the Credit for Other Dependents can be a valuable tax credit, it’s important to be aware of its limitations and restrictions. Understanding these limitations will help you accurately assess your eligibility and make informed decisions when filing your tax return. Here are the key limitations and restrictions to consider:

- Non-Refundable Credit: The Credit for Other Dependents is a non-refundable credit, meaning it can only reduce your tax liability. If the credit exceeds your tax owed, it will not result in a refund. However, it can still significantly lower your overall tax burden.

- Income Threshold: The dependent’s Gross Income must be below the specified threshold amount determined by the IRS. If the dependent’s income exceeds this threshold, they will not qualify for the credit. Make sure to refer to the applicable tax year’s guidelines to determine the income limits.

- Eligibility as a Dependent: The dependent you are claiming the credit for must meet the IRS guidelines for dependency. This includes factors such as the relationship to the taxpayer, support provided, and residency status. Ensuring that the dependent meets these criteria is crucial to claim the credit accurately.

- Not Dual Claiming: It’s important to note that you cannot claim the same dependent for both the Child Tax Credit and the Credit for Other Dependents. You must determine which credit is more beneficial for your situation and claim accordingly.

- Proof of Support: To claim the Credit for Other Dependents, you may need to provide documentation or proof of the support you provided to the dependent. This can include records of financial assistance, receipts for expenses, or other relevant documents. It’s important to keep detailed records to support your claim.

It’s essential to thoroughly review the IRS guidelines and consult with a tax professional to ensure compliance with all limitations and restrictions related to the Credit for Other Dependents. Failing to meet these requirements could result in errors, penalties, or delays in processing your tax return.

Additionally, it’s worth noting that tax laws and regulations may change over time. It’s important to stay updated on any updates or modifications to the rules governing the Credit for Other Dependents to ensure accurate filing.

Now that we have discussed the limitations and restrictions, let’s address some frequently asked questions related to the Credit for Other Dependents.

Frequently Asked Questions about Credit for Other Dependents

Here are some commonly asked questions regarding the Credit for Other Dependents:

- 1. Can I claim the Credit for Other Dependents if I am also claiming the Child Tax Credit?

- 2. Can I claim the Credit for Other Dependents if I have a child under the age of 17?

- 3. Can I claim the Credit for Other Dependents for my elderly parent who lives with me?

- 4. Can I claim the Credit for Other Dependents for my sibling who is a full-time college student?

- 5. Can I claim the Credit for Other Dependents if my dependent has their own income?

- 6. Can I claim the Credit for Other Dependents if I am claiming the Earned Income Tax Credit (EITC)?

No, you cannot claim the same dependent for both the Child Tax Credit and the Credit for Other Dependents. You need to determine which credit is more beneficial for your situation and claim accordingly.

No, the Credit for Other Dependents is specifically for dependents who do not qualify for the Child Tax Credit. If you have a child under the age of 17 who meets the criteria for the Child Tax Credit, you should claim that credit instead.

Yes, if you provide more than half of your elderly parent’s support and they meet the dependency requirements set by the IRS, you may be eligible to claim the Credit for Other Dependents for them.

Yes, you may be able to claim the Credit for Other Dependents for a sibling who meets the dependency requirements, even if they are a full-time college student. Make sure to review the IRS guidelines to determine if they qualify as a dependent.

It depends on the dependent’s income. The dependent must have a Gross Income below the threshold amount set by the IRS to be eligible for the Credit for Other Dependents.

Yes, you can claim both the Credit for Other Dependents and the Earned Income Tax Credit (EITC) if you meet the eligibility requirements for both credits. Consult the IRS guidelines or a tax professional to determine your eligibility for both credits.

Please note that these answers are for general guidance and may not cover every individual’s unique circumstances. It’s always recommended to consult with a tax professional or refer to IRS guidelines for specific questions related to your tax situation.

Now, let’s wrap up our discussion on the Credit for Other Dependents.

Conclusion

As we conclude our comprehensive guide on the Credit for Other Dependents, we hope that you now have a solid understanding of this tax credit and how it can benefit you as a taxpayer. The Credit for Other Dependents provides an opportunity to receive a tax benefit for supporting dependents who may not qualify for the Child Tax Credit.

Throughout this article, we have explored the definition of the Credit for Other Dependents, the eligibility criteria, and the process of claiming the credit on your tax return. We have also discussed the additional benefits and considerations, as well as the limitations and restrictions associated with this credit.

Remember to carefully review the IRS guidelines and consult with a tax professional to ensure accurate and compliant claiming of the Credit for Other Dependents. Tax laws and regulations change periodically, so it’s important to stay updated on any modifications that may impact your eligibility for this credit and other related tax benefits.

By understanding the qualifications and proper procedures for claiming the Credit for Other Dependents, you can potentially reduce your tax liability, increase your tax savings, and offset some of the costs of supporting dependents.

We hope that this guide has provided you with valuable insights into the Credit for Other Dependents. As always, it’s best to seek personalized advice from a tax professional to optimize your specific tax situation and ensure you are taking full advantage of available tax credits and deductions.

Thank you for reading, and best of luck as you navigate the complexities of the tax system and pursue financial well-being for yourself and your dependents.