Finance

What Does DDA Mean In Banking

Published: October 13, 2023

Learn what DDA means in banking and how it applies to finance. Explore the role of DDA accounts in managing personal and business finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking, where acronyms and abbreviations are a common language. One such acronym that you might have come across is DDA. But what exactly does DDA mean in banking? In this article, we will dive into the definition, functions, benefits, drawbacks, and the overall importance of DDA in the banking sector.

DDA stands for Demand Deposit Account. It is a type of transactional account offered by banks, allowing customers to deposit money and withdraw funds whenever needed. Unlike savings accounts that are primarily used for long-term saving goals, DDA accounts are designed for everyday banking activities.

As financial institutions continue to evolve, DDA accounts have become a cornerstone of the modern banking system. They provide customers with a secure and convenient way to manage their day-to-day finances. Whether it’s paying bills, making purchases, or receiving deposits, DDA accounts play a vital role in simplifying financial transactions.

Throughout this article, we will explore the various functions of DDA accounts, the benefits they offer to customers, as well as some potential drawbacks that need to be considered. We will also highlight the importance of DDA accounts in the banking industry and how they contribute to the efficient functioning of financial institutions.

Definition of DDA

A Demand Deposit Account (DDA) is a type of bank account that allows customers to deposit and withdraw funds on demand. It is also commonly referred to as a checking account or a current account in some regions. What distinguishes a DDA from other types of bank accounts is its emphasis on transactional activity.

In a DDA, customers can write checks, make electronic payments, use debit cards, and conduct various other transactions to access their funds. This makes it a highly versatile account that enables seamless and convenient management of daily financial activities.

Unlike savings accounts that typically offer higher interest rates, DDA accounts often have lower or no interest payments. This is because the primary purpose of a DDA is to facilitate easy access to funds rather than serve as an investment tool. However, some banks may offer interest-bearing DDA accounts, especially for higher balance customers.

One key feature of a DDA is that it allows unlimited withdrawals and deposits. Customers can access their funds whenever they require them, allowing for greater flexibility in managing their financial needs. This makes DDAs an essential component of personal and business banking, providing individuals and companies with the ability to transact efficiently.

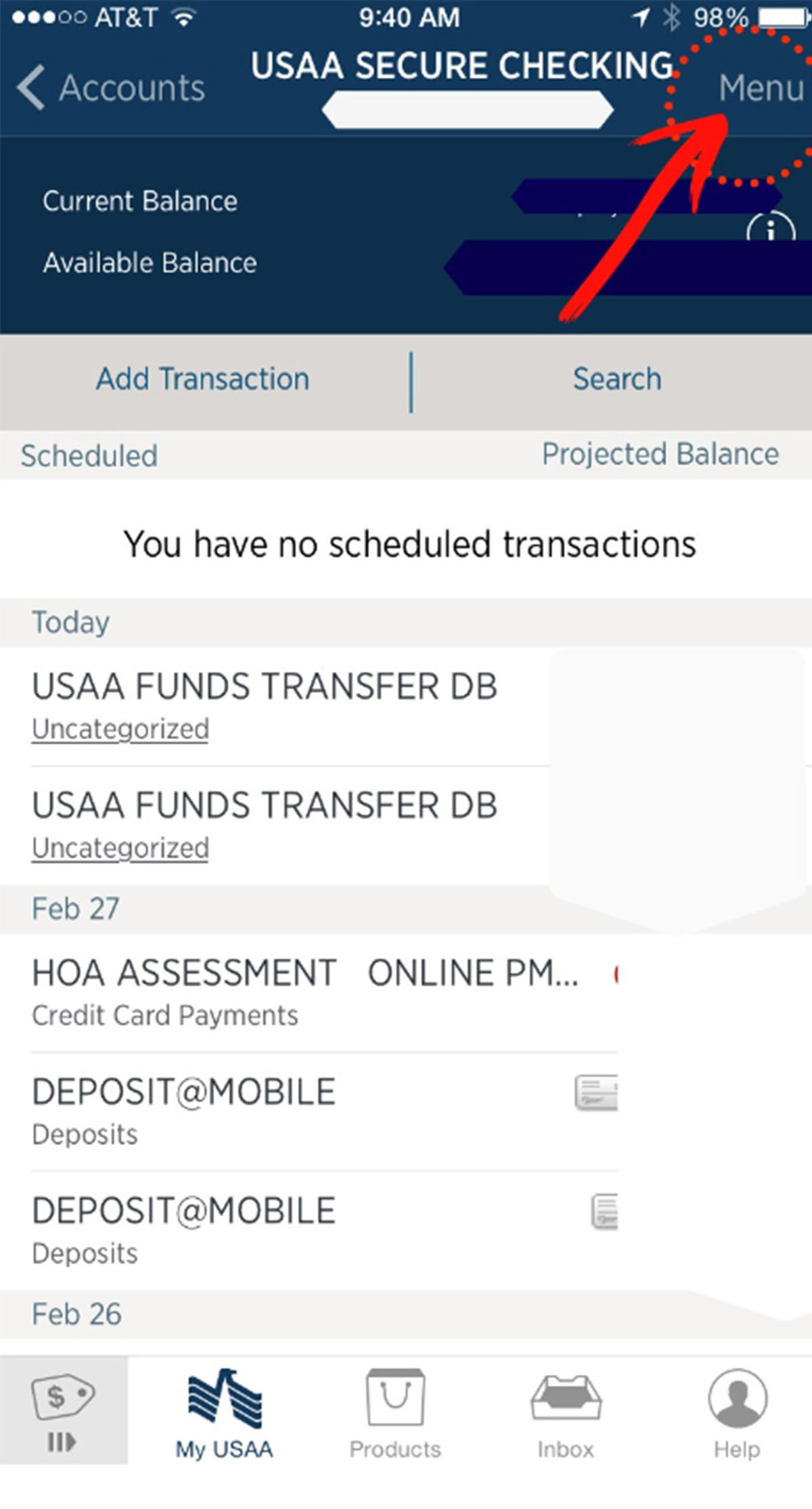

DDA accounts are typically linked to other banking services such as online banking, mobile banking, and electronic fund transfers. This integration enables customers to monitor their account balances, review transaction history, and perform various banking operations at their convenience.

Overall, DDA accounts serve as a convenient and flexible financial tool that supports everyday banking transactions. By providing easy access to funds and a range of transactional capabilities, DDAs empower individuals and businesses to manage their finances effectively.

Functions of DDA in Banking

Demand Deposit Accounts (DDAs) play several crucial functions in the banking sector. Let’s explore some of the key functions:

- Deposits and Withdrawals: The primary function of a DDA is to allow customers to deposit and withdraw funds. Customers can deposit money into their DDA through various channels, such as cash deposits at ATMs, in-branch deposits, and electronic transfers. Similarly, they can withdraw funds through checks, ATM withdrawals, debit card transactions, or online transfers. This function ensures that customers can access their money easily and conveniently.

- Check Writing: DDAs enable customers to write checks to make payments to individuals or businesses. Check writing provides a traditional and widely accepted method of paying bills, making purchases, or transferring money to others. While electronic payment methods have gained popularity, check writing remains a significant function of DDAs, especially for certain transactions and target recipients.

- Online and Mobile Banking: DDA accounts are integrated with online and mobile banking platforms, allowing customers to access their accounts remotely. Through secure online portals and mobile applications, customers can view account balances, monitor transactions, transfer funds, and even manage automatic bill payments. These digital banking functions provide convenience and flexibility, enabling customers to manage their finances anytime and anywhere.

- Overdraft Facilities: Many DDAs provide overdraft facilities, allowing customers to withdraw more funds than their available balance. Overdrafts can be useful in emergencies or when unexpected expenses arise, preventing transactions from being declined due to insufficient funds. However, it’s important to note that overdrafts typically come with fees and interest charges.

- Direct Deposits: DDAs offer the convenience of direct deposit services, where funds such as salaries, benefits, or tax refunds can be directly deposited into the account by employers or government entities. This eliminates the need for physical checks and speeds up the availability of funds.

- Bill Payment: DDAs facilitate bill payments by allowing customers to set up automatic payments for recurring bills. This ensures that bills are paid on time and helps customers avoid late payment fees or penalties. Additionally, many banks offer online bill payment services, enabling customers to make one-time payments to individual vendors or service providers.

The functions of DDA accounts make them versatile and essential tools for individuals and businesses. With the ability to make deposits and withdrawals, write checks, conduct online and mobile banking, utilize overdraft facilities, receive direct deposits, and make bill payments, DDAs offer a comprehensive range of functions to meet the diverse needs of customers in the banking sector.

Benefits of DDA for Customers

Demand Deposit Accounts (DDAs) offer numerous benefits for customers. Let’s take a look at some of the advantages customers can enjoy by having a DDA:

- Convenience: DDAs provide customers with unparalleled convenience in managing their daily financial activities. They can easily deposit and withdraw funds through various channels, such as ATMs, branches, and online transfers. This accessibility ensures that customers can handle their financial needs effectively and efficiently.

- Liquidity: DDAs offer high liquidity, allowing customers to access their funds whenever needed. Whether it’s for making purchases, paying bills, or covering unexpected expenses, customers can have immediate access to their funds through checks, debit cards, or electronic transactions.

- Flexibility: With a DDA, customers have the flexibility to choose from a wide range of transactional options. They can write checks, make online payments, set up automatic bill payments, and even use mobile banking apps for seamless account management. This flexibility empowers customers to conduct transactions in a way that suits their preferences and lifestyle.

- Security: DDAs provide a secure way to store and manage funds. Banks have robust security measures in place to protect customer accounts from fraud, unauthorized access, and identity theft. Additionally, customers have the option to monitor their accounts regularly through online and mobile banking platforms to identify and report any suspicious activity.

- Direct Deposit: Many employers offer direct deposit services, which allow employees to have their salaries directly deposited into their DDA. This eliminates the need to physically collect and deposit paychecks, providing added convenience and ensuring timely availability of funds.

- Record-Keeping: DDAs offer a built-in record-keeping system that helps customers track their financial transactions. Through regular account statements and online transaction histories, customers can easily monitor their spending, review deposits and withdrawals, and maintain accurate financial records.

Overall, the benefits of having a DDA include convenience, liquidity, flexibility, security, direct deposit capabilities, and efficient record-keeping. By providing these advantages, DDAs enhance the financial management experience for customers and simplify their everyday banking activities.

Drawbacks of DDA for Customers

While Demand Deposit Accounts (DDAs) offer numerous benefits, it’s important to consider some potential drawbacks that customers may encounter. Here are a few of the drawbacks associated with DDAs:

- Account Fees: Some DDAs may have fees associated with certain services or account maintenance. This can include monthly maintenance fees, transaction fees, overdraft fees, or fees for using out-of-network ATMs. Customers should be aware of these fees and consider them when choosing a DDA.

- Minimum Balance Requirements: Many banks require customers to maintain a minimum balance in their DDA to avoid monthly service fees or other penalties. Falling below the minimum balance may result in additional charges or downgraded account features. Customers should be aware of these requirements and evaluate whether they can maintain the minimum balance consistently.

- Overdraft Fees: While overdraft facilities in DDAs can provide temporary financial relief, using this option often incurs fees. Customers who frequently rely on overdraft facilities can end up paying significant charges over time, which can affect their overall financial health. It is therefore important to use overdrafts judiciously and be mindful of the associated costs.

- Potential for Fraud: Just like any other financial account, DDAs carry the risk of fraud and unauthorized transactions. Customers must remain vigilant, regularly monitor their account activity, and report any suspicious or fraudulent transactions promptly. While banks have security measures in place, customers also play a crucial role in protecting their account information and maintaining safe banking practices.

- Limited Interest Earnings: Unlike savings accounts or other investment options, DDAs generally offer lower interest rates or no interest at all. This means that customers may not earn significant interest income on the funds deposited in their DDA. If maximizing interest earnings is a priority for customers, they may need to explore other account types or investment vehicles.

- Dependence on Technology: DDAs heavily rely on technology for various banking activities, such as online banking, mobile banking, and electronic payments. While this provides convenience, it also means that customers need to have reliable internet access and be comfortable using technology. Additionally, technological glitches or system failures can temporarily disrupt access to funds or services.

It is essential for customers to be aware of these potential drawbacks and carefully consider them when choosing and using a DDA. By understanding the limitations and taking appropriate precautions, customers can make informed decisions that align with their financial goals and needs.

Importance of DDA in Banking Sector

Demand Deposit Accounts (DDAs) hold significant importance in the banking sector for several reasons. Let’s explore the key reasons why DDAs are crucial for both customers and financial institutions:

- Financial Inclusion: DDAs play a vital role in promoting financial inclusion by providing individuals and businesses with accessible banking services. DDAs allow individuals to deposit and manage their funds, make payments, and access banking services without restrictions. This inclusivity helps bridge the gap between the banked and unbanked population, allowing more people to participate in the formal financial system.

- Liquidity Management: DDAs provide financial institutions with better liquidity management capabilities. Since DDAs are transactional accounts, banks can utilize the funds held in these accounts to meet customer cash withdrawal demands and facilitate transactions. This efficient liquidity management enables banks to provide seamless and uninterrupted banking services to their customers.

- Customer Relationships: DDAs serve as a key touchpoint for banks to establish and nurture relationships with their customers. By offering DDAs, banks can gain a deeper understanding of their customers’ financial needs, behaviors, and preferences. This valuable insight allows banks to personalize their services, offer relevant products, and build long-lasting customer relationships.

- Revenue Generation: While DDAs themselves may not generate substantial interest income for banks, they serve as a foundation for revenue generation in other ways. Banks can cross-sell additional products and services to DDA holders, such as loans, credit cards, investment accounts, and insurance. This diversified revenue stream strengthens the overall financial position of the bank.

- Stability: DDAs contribute to the stability of the banking sector by providing a reliable source of deposits for financial institutions. These stable deposits form a significant portion of a bank’s funding base, which can be utilized for lending and investments. This stability helps banks maintain their operations, support economic growth, and mitigate financial risks.

- Efficient Transactions: DDAs enable seamless and efficient financial transactions for customers and businesses. Through various channels like checks, debit cards, and online transfers, DDAs facilitate quick and secure fund transfers, bill payments, and merchant transactions. The efficiency of these transactions positively impacts the overall economy by promoting commerce and trade.

The importance of DDAs in the banking sector is evident in their ability to drive financial inclusion, support liquidity management, foster customer relationships, generate revenue, contribute to stability, and facilitate efficient financial transactions. These accounts are the backbone of everyday banking, providing individuals and businesses with the necessary tools to manage their finances effectively and participate in the broader economy.

Conclusion

Demand Deposit Accounts (DDAs) play a vital role in the banking sector by providing customers with convenient and accessible means to manage their day-to-day financial activities. Throughout this article, we have explored the definition, functions, benefits, drawbacks, and the overall importance of DDAs.

DDAs offer customers a wide range of functions, including deposits and withdrawals, check writing, online and mobile banking, overdraft facilities, direct deposits, and bill payments. These functions provide customers with the flexibility, convenience, and security they need to manage their finances effectively.

Customers also benefit from DDAs through their convenience, liquidity, flexibility, security, direct deposit capabilities, and built-in record-keeping systems. However, customers should be aware of potential drawbacks, such as account fees, minimum balance requirements, overdraft fees, the potential for fraud, limited interest earnings, and dependence on technology.

In the banking sector, DDAs are of utmost importance. They contribute to financial inclusion, liquidity management, building customer relationships, revenue generation, stability, and facilitating efficient transactions. DDAs form the foundation of the banking system, empowering individuals and businesses to participate in the formal financial system, manage their funds, engage in commerce, and support economic growth.

In conclusion, DDAs serve as an essential tool for individuals and businesses in their financial journey. They facilitate seamless transactions, provide flexibility, and offer convenient access to funds. However, customers should carefully consider the potential drawbacks and choose a DDA that aligns with their financial goals and needs. With proper knowledge and understanding, customers can leverage the benefits of DDAs while mitigating any associated risks.