Finance

How Are Futures Contracts Taxed

Published: December 23, 2023

Learn about the taxation of futures contracts and how it impacts your finances. Find answers to your questions about finance and taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Futures contracts are financial derivatives that allow traders to speculate on the future price movements of various assets, such as commodities, currencies, and stock indexes. These contracts are widely used by investors and speculators to hedge against price fluctuations and to profit from market movements.

While futures trading offers exciting opportunities for financial gain, it is essential to understand the tax implications associated with these contracts. Taxation of futures contracts can be complex, and it is crucial for traders to have a clear understanding of the rules and regulations to avoid any potential pitfalls.

This article aims to provide a comprehensive overview of how futures contracts are taxed, including the calculation of capital gains and losses, the use of mark-to-market accounting, the treatment of Section 1256 contracts, applicable tax rates, reporting requirements, potential deductions, and tax strategies for futures traders.

By gaining a solid understanding of the tax implications of futures trading, traders can make informed decisions and ensure compliance with the tax laws of their respective jurisdictions.

Understanding Futures Contracts

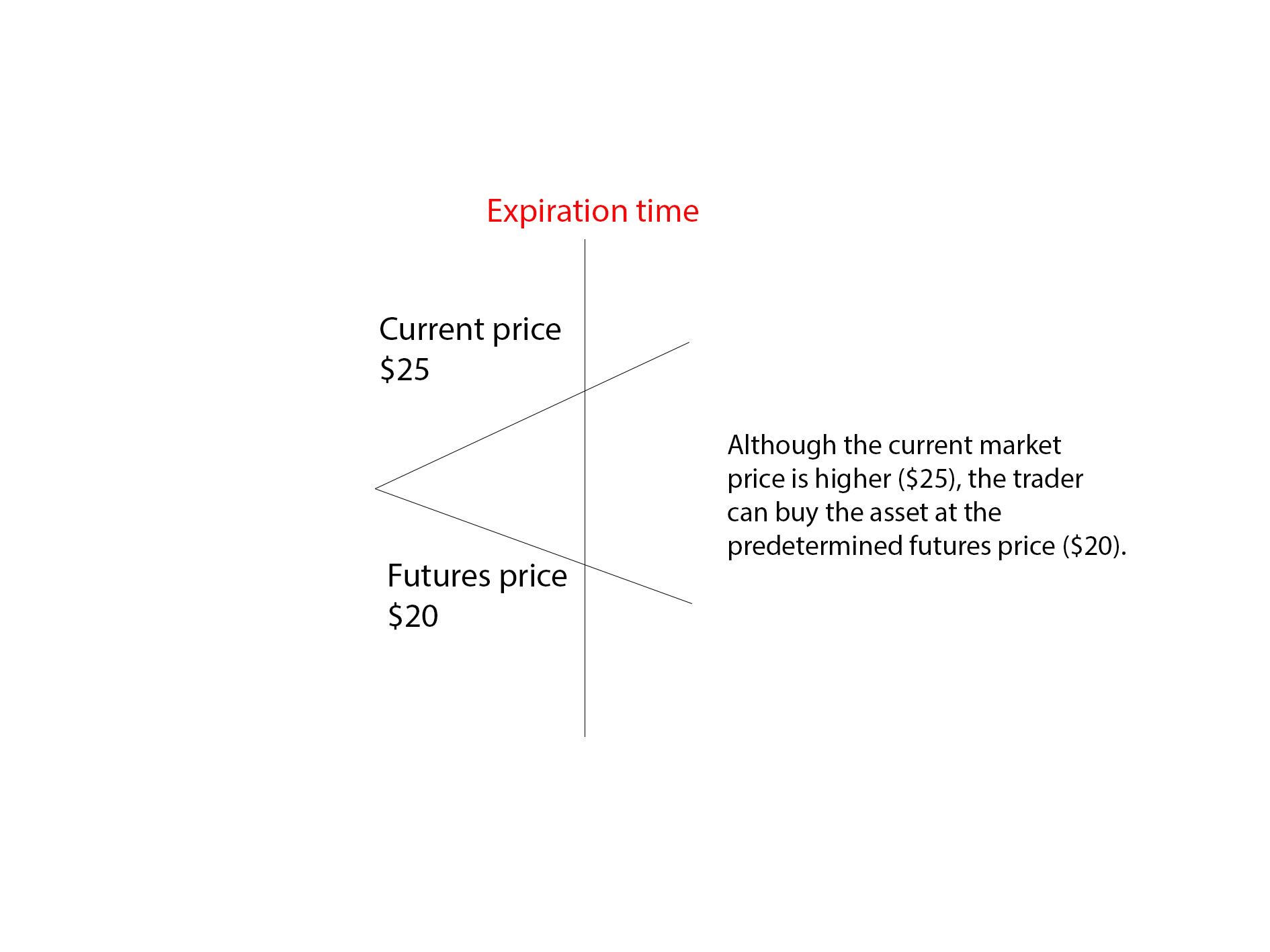

Futures contracts are standardized agreements between two parties to buy or sell an underlying asset at a predetermined price and date in the future. These contracts are traded on exchanges and are subject to specific regulations and contract specifications.

The underlying asset of a futures contract can be diverse, including commodities like oil, gold, or wheat, financial instruments such as currencies or stock indexes, or even intangible assets like interest rates or weather conditions.

When entering into a futures contract, the buyer agrees to purchase the underlying asset, while the seller agrees to deliver the asset at the agreed-upon price and date. The contract specifies the quantity and quality of the asset, as well as other contract terms.

Futures contracts are typically used for two purposes: hedging and speculation. Hedging involves using futures contracts to mitigate the risk of price fluctuations in an underlying asset. For example, a farmer could use futures contracts to hedge against a drop in the price of their crops, protecting their revenue.

On the other hand, speculators engage in futures trading to profit from price movements in the underlying asset without the intention of taking physical delivery. Speculators aim to buy low and sell high or sell high and buy low, capitalizing on the price volatility of the asset.

It’s important to note that futures trading involves leverage, meaning traders can control a larger position with a smaller amount of capital. Leverage amplifies both profits and losses, making futures trading a high-risk endeavor.

To facilitate smooth trading, futures exchanges impose margin requirements, which are the minimum amount of capital that traders must deposit to initiate and maintain a futures position. Margin requirements vary based on factors such as the volatility of the underlying asset and the trader’s experience.

Understanding the mechanics of futures contracts is crucial for navigating the complex world of futures trading and comprehending the tax implications associated with these financial instruments.

Taxation of Futures Contracts

When it comes to the taxation of futures contracts, the treatment depends on whether the trading activity is classified as capital gains or business income. The classification is determined based on factors such as the frequency of trading, the intention of the trader, and the level of expertise.

If futures trading is considered a capital gains activity, any profits or losses from the contracts are subject to capital gains tax. Capital gains tax rates vary depending on the holding period of the assets and the individual’s tax bracket. Short-term capital gains, arising from assets held for less than one year, are typically taxed at ordinary income rates, while long-term capital gains, from assets held for more than one year, can benefit from discounted tax rates.

On the other hand, if futures trading qualifies as a business activity, the profits and losses are treated as business income. Business income is subject to the taxpayer’s marginal tax rate, and it may also be subject to self-employment tax in some jurisdictions.

In certain cases, the IRS provides guidelines for determining whether a trader’s activity is classified as capital gains or business income. Traders who meet the criteria for a “trader in securities” as specified by the IRS may be eligible for certain tax benefits, including the ability to deduct trading-related expenses.

It’s worth considering that the tax treatment of futures contracts may also differ depending on whether the trader engages in mark-to-market accounting and if the contracts fall under Section 1256 of the tax code.

Mark-to-Market Accounting: Traders who elect for mark-to-market accounting treat their futures contracts as if they are bought and sold on a daily basis. At the end of each trading day, the contracts are marked to their market value, and any gains or losses are recognized for tax purposes. This approach eliminates the need to track and report individual transactions, simplifying tax compliance.

Section 1256 Contracts: Section 1256 of the tax code governs the taxation of certain futures contracts, including regulated futures contracts and options on futures contracts. These contracts are subject to a specific tax treatment, which includes a blended tax rate of 60% long-term capital gains and 40% short-term capital gains, regardless of the holding period. Additionally, Section 1256 contracts are subject to certain reporting requirements on IRS Form 6781.

Understanding the tax treatment of futures contracts is crucial for traders to accurately report their income, optimize their tax liability, and comply with the tax laws of their respective jurisdictions. Seeking the guidance of a qualified tax professional is recommended to ensure proper tax planning and adherence to all applicable regulations.

Capital Gains and Losses

When trading futures contracts, the profits and losses are typically treated as capital gains and losses for tax purposes. Capital gains occur when the selling price of an asset is higher than its purchase price, resulting in a profit. On the other hand, capital losses occur when the selling price is lower than the purchase price, resulting in a loss.

Capital gains and losses from futures contracts are classified as either short-term or long-term, depending on the holding period of the assets. In most jurisdictions, if a futures contract is held for one year or less, any resulting gain or loss is considered short-term. If the contract is held for more than one year, the gain or loss is typically considered long-term.

Short-term capital gains are typically taxed at the ordinary income tax rates applicable to the trader’s tax bracket. These rates are usually higher than the tax rates for long-term capital gains, which often benefit from preferential tax treatment.

The tax treatment of long-term capital gains varies depending on the tax laws of each jurisdiction. In some cases, long-term capital gains may be subject to lower tax rates than ordinary income. For example, in the United States, there are three different tax rates for long-term capital gains, depending on the individual’s taxable income.

It’s important to note that capital losses can be used to offset capital gains. If a trader experiences a loss on a futures contract, they can use that loss to reduce their taxable income from other capital gains. This concept is known as capital loss carryover, where any losses that cannot be fully offset in the current year can be carried forward and applied to future tax years.

However, it’s essential to be aware of the specific rules regarding capital loss deductions and carryovers in each jurisdiction. Some jurisdictions may limit the amount of capital loss that can be deducted in a given tax year or restrict the carryover period.

To properly report capital gains and losses from futures contracts, traders are required to maintain accurate records of their transactions. This includes details such as the date of purchase and sale, the price at which the contract was bought or sold, and any associated fees or commissions.

Consulting with a tax professional or utilizing specialized tax software can be beneficial for managing and accurately reporting capital gains and losses from futures trading. It’s essential to stay informed about the specific tax laws and regulations of your jurisdiction to optimize your tax liability and remain compliant with reporting requirements.

Mark-to-Market Accounting

Mark-to-market accounting is a method of valuing assets and recognizing gains or losses on a daily basis. Traders who engage in futures contracts can choose to use mark-to-market accounting for tax purposes. This approach provides simplicity and convenience by eliminating the need to track individual trades and calculate gains or losses when closing positions.

Under mark-to-market accounting, traders treat their futures contracts as if they are bought and sold at the end of each trading day. The contracts are valued at their market price, and any unrealized gains or losses are recognized as taxable income or deductible losses, respectively.

This accounting method requires traders to report the net gain or loss from their futures trading on their tax returns, even if no actual cash has been received or paid. The gains and losses are treated as ordinary income or ordinary losses, regardless of the holding period.

Mark-to-market accounting simplifies the tax reporting process for futures traders, as they only need to report the net income or loss for the tax year, rather than individual transaction details. This can save time and reduce the potential for errors in reporting.

However, it’s worth noting that mark-to-market accounting is not mandatory for traders. It is an election that must be made and consistently applied. Traders who choose not to use mark-to-market accounting will continue to follow the traditional method of reporting gains and losses on individual transactions as they occur.

It’s important to consult with a tax professional to determine whether mark-to-market accounting is the right choice for your specific trading circumstances. Factors such as the frequency of trading, the level of expertise, and the potential tax benefits or drawbacks should be taken into consideration.

Additionally, mark-to-market accounting is subject to certain rules and limitations. For example, if an individual or entity engages in futures trading as part of a partnership or S corporation, special rules may apply. There may also be restrictions on the use of losses generated under mark-to-market accounting for individuals who are not active traders.

Understanding the implications and requirements of mark-to-market accounting is crucial for futures traders who prefer a simplified approach to tax reporting and want to streamline their compliance with tax regulations.

Section 1256 Contracts

Section 1256 contracts refer to specific types of futures contracts that are subject to a distinct tax treatment under the United States tax code. These contracts include regulated futures contracts and options on futures contracts traded on designated exchanges.

One of the key features of Section 1256 contracts is the blended tax rate that applies to gains and losses realized from these contracts. The blended tax rate consists of 60% long-term capital gains and 40% short-term capital gains, regardless of the actual holding period.

This tax treatment can be advantageous for futures traders as it offers potentially lower tax rates on gains compared to ordinary income tax rates. Furthermore, it simplifies tax reporting by eliminating the need to differentiate between short-term and long-term capital gains and losses.

Traders who engage in Section 1256 contracts are required to report their gains and losses on IRS Form 6781, regardless of whether they elect mark-to-market accounting. This form allows traders to consolidate their transactions and calculate their net gain or loss from Section 1256 contracts, which is then treated as 60% long-term and 40% short-term capital gains.

It’s important to note that while Section 1256 contracts offer tax advantages, they are also subject to specific rules and requirements. For example, they are marked to market at year-end, meaning any unrealized gains or losses are recognized and reported on the trader’s tax return.

It’s crucial for traders to fully understand the criteria for contracts to qualify under Section 1256, as not all futures contracts are eligible for this special tax treatment. Traders should consult with a tax professional or refer to the IRS guidelines to determine whether their contracts fall under Section 1256.

While Section 1256 contracts are primarily applicable to U.S taxpayers, it’s important for individuals in other jurisdictions to familiarize themselves with the equivalent rules and regulations pertaining to similar tax treatments for futures contracts within their respective countries.

By understanding the tax advantages and reporting requirements of Section 1256 contracts, futures traders can optimize their tax liability and accurately comply with the tax laws applicable to their trading activities.

Tax Rate for Futures Contracts

The tax rate for futures contracts depends on various factors, including the classification of the trading activity, the holding period of the contracts, and the trader’s tax bracket.

If futures trading is classified as a capital gains activity, the tax rate will depend on whether the gains are short-term or long-term. Short-term capital gains are typically taxed at the ordinary income tax rates applicable to the trader’s tax bracket. These rates can range from relatively low to higher rates for individuals in higher income brackets.

On the other hand, long-term capital gains from futures contracts may benefit from discounted tax rates. Generally, long-term capital gains are taxed at rates that are lower than ordinary income tax rates. The specific long-term capital gains tax rates vary depending on the tax laws of each jurisdiction and may be based on the taxpayer’s taxable income.

It’s important to note that long-term capital gains are typically derived from futures contracts held for more than one year. Traders who engage in frequent trading and hold contracts for shorter durations may find that their gains are subject to higher short-term capital gains tax rates.

Furthermore, if futures trading is considered a business activity, the profits generated from the contracts are typically subject to the trader’s marginal tax rate. This rate corresponds to the individual’s tax bracket and is usually higher than long-term capital gains rates.

It’s important for traders to consult with a tax professional or familiarize themselves with the tax laws of their jurisdiction to determine the precise tax rates applicable to their specific trading activities.

Additionally, it’s worth considering that tax rates and regulations can change over time. Taxpayers should stay informed about any updates or amendments to the tax laws that may affect the tax rates for futures contracts.

By understanding the applicable tax rates for futures contracts, traders can effectively plan their tax strategies, optimize their tax liability, and ensure compliance with the tax laws of their respective jurisdictions.

Reporting Requirements

Proper reporting of futures trading activity is crucial to ensure compliance with tax laws and regulations. Traders must fulfill specific reporting requirements to accurately report their income and transactions related to futures contracts.

When it comes to reporting futures trading on tax returns, traders must provide detailed information about their transactions, including the date of purchase and sale, the quantity of contracts traded, the price at which the contracts were bought or sold, and any associated fees or commissions.

Traders in the United States are required to report their gains and losses from futures contracts on IRS Form 6781, which is specifically designed for reporting gains and losses from Section 1256 contracts. The details provided on this form should include the trader’s name, taxpayer identification number, and a breakdown of the gains and losses realized from futures contracts.

In addition to Form 6781, traders may also need to file other tax forms, depending on their specific circumstances. For example, they may be required to file Schedule D (Capital Gains and Losses) if they have gains or losses from non-1256 contracts or other investment activities.

It’s important to maintain accurate records of all trades and transactions related to futures contracts. Traders should keep a record of trade confirmations, account statements, and other documentation that supports their reported gains or losses.

Traders should also be aware of reporting requirements specific to their jurisdiction. In some countries, additional forms or schedules may be required to report futures trading activity. It’s crucial to consult with a tax professional or refer to the tax regulations of your jurisdiction to ensure compliance with all reporting obligations.

Failure to fulfill reporting requirements accurately and on time can result in penalties, fines, or potential audits by tax authorities. Traders should take their reporting obligations seriously and seek guidance if they are unsure about any aspect of reporting their futures trading activity.

By staying informed about the reporting requirements and keeping organized records, futures traders can fulfill their tax obligations effectively and maintain compliance with the tax laws and regulations of their respective jurisdictions.

Deductions and Expenses

Futures traders may be eligible for deductions and expense allowances that can help lower their taxable income. These deductions and expenses are meant to account for the costs associated with conducting their trading activities. However, it’s important to note that the availability of deductions and the specific rules governing them may vary depending on the tax laws of each jurisdiction.

Here are some common deductions and expenses that futures traders may be able to consider:

- Trading-related expenses: These include brokerage fees, commissions, platform fees, and data subscriptions directly related to executing trades. Traders can typically deduct these expenses as business expenses if their futures trading activities are classified as a business. However, if trading is considered an investment activity, these expenses may be subject to limitations.

- Education and research expenses: Costs incurred for educational materials, trading courses, seminars, or subscriptions to financial news platforms and research services may be deductible. Traders can deduct these expenses to the extent that they are necessary and directly related to their trading activities.

- Home office expenses: Traders who have a dedicated space in their home primarily used for trading purposes may be eligible for a home office deduction. This deduction allows them to deduct a portion of their rent, mortgage interest, utilities, and other expenses associated with maintaining their home office.

- Technology and equipment: Expenses related to computers, software, data feeds, and other technology or equipment used for trading purposes may be deductible as business expenses. Traders should keep records and receipts to support these deductions.

- Professional services: Fees paid to tax professionals, accountants, or legal advisors for tax planning or assistance in relation to futures trading activities may be deductible.

It’s important to note that the eligibility and deductibility of these expenses may depend on the trader’s specific circumstances and the tax laws of their jurisdiction. Traders should consult with a tax professional to determine the applicable deductions and expenses available to them.

When claiming deductions and expenses, traders should ensure that they keep accurate records and documentation to support their claims. This includes invoices, receipts, bank statements, and any other relevant documentation.

It’s worth mentioning that some jurisdictions may have limitations or restrictions on certain deductions or expense allowances for futures traders. Traders should thoroughly understand the tax laws and regulations of their jurisdiction to ensure compliance and maximize their eligible deductions and expense allowances.

By taking advantage of eligible deductions and properly tracking expenses, futures traders can potentially reduce their taxable income and optimize their tax liability.

Tax Strategies for Futures Traders

Implementing effective tax strategies can help futures traders optimize their tax liability and maximize their after-tax profits. Here are some tax strategies that traders may consider:

- Keep accurate and organized records: Maintaining meticulous records of all transactions, including trade confirmations, account statements, and supporting documentation, is essential for accurate tax reporting. Organized records make it easier to identify gains and losses, track expenses, and provide the necessary documentation during tax filing.

- Understand the tax classification: Traders should have a clear understanding of how their futures trading activity is classified for tax purposes – whether as capital gains or as a business income. This classification can significantly impact the applicable tax rates, deductions, and reporting requirements.

- Evaluate tax-efficient account structures: Exploring the use of tax-efficient account structures, such as individual retirement accounts (IRAs) or qualified retirement plans, can help defer or minimize taxes on futures trading profits. Traders should consult with a financial advisor or tax professional to determine the suitability and eligibility of such accounts.

- Take advantage of retirement contributions: Contributing to retirement accounts can provide tax deductions or tax deferrals, depending on the account type and jurisdiction. By making regular contributions to retirement accounts, traders can reduce their taxable income while potentially growing their retirement savings.

- Consider deferring gains: Traders who anticipate substantial gains can explore deferring those gains into the following tax year. This strategy allows them to delay the tax liability, potentially benefiting from lower tax rates or utilizing losses in the subsequent year.

- Harvest tax losses: Traders should actively monitor their positions and consider harvesting tax losses by selling losing positions before year-end. These losses can be used to offset gains realized during the tax year, reducing overall tax liability.

- Utilize Section 1256 contracts: Traders should understand the advantages of Section 1256 contracts and determine whether their trades qualify for this tax treatment. By utilizing Section 1256 contracts, traders can take advantage of a blended tax rate that can result in potentially lower tax liabilities on gains.

- Consult with a tax professional: Engaging the services of a qualified tax professional who specializes in futures trading can provide valuable guidance and advice. They can help traders navigate the complex tax rules, identify potential deductions, and develop tailored tax strategies to optimize their tax outcomes.

It’s important for traders to stay informed about the tax laws and regulations of their jurisdiction, as tax rules may change over time. By proactively implementing tax strategies and seeking professional guidance, futures traders can effectively manage their tax obligations, minimize tax burdens, and enhance their overall financial outcomes.

Conclusion

Understanding the tax implications of futures trading is crucial for traders to navigate the complexities of tax laws, minimize tax liabilities, and ensure compliance with reporting requirements. By grasping the key concepts and considerations surrounding the taxation of futures contracts, traders can make informed decisions and implement effective tax strategies.

Futures traders should be aware of the classification of their trading activity, whether as capital gains or business income, as this classification determines the applicable tax rates, deductions, and reporting obligations. Mark-to-market accounting and Section 1256 contracts can also impact the tax treatment, offering potential advantages and simplifying reporting for traders.

Maintaining accurate and organized records, understanding eligible deductions and expenses, and exploring tax-efficient account structures are essential components of effective tax planning. Traders should also consider deferring gains, harvesting tax losses, and leveraging retirement contributions to optimize their tax outcomes.

Consulting with a tax professional who specializes in futures trading is highly recommended. They can provide personalized guidance, assist with tax planning, and ensure compliance with the tax laws and reporting obligations of the relevant jurisdiction.

It’s important to note that tax laws and regulations may vary between jurisdictions, and they can change over time. Staying informed and up to date with the tax rules and seeking professional advice are keys to maintaining compliance and maximizing tax benefits.

In conclusion, by thoroughly understanding the tax implications, implementing sound tax strategies, and focusing on proper reporting, futures traders can optimize their tax liability, effectively manage their tax obligations, and ultimately enhance their financial success in the dynamic world of futures trading.