Home>Finance>What Happens If You Pay The Minimum Payment On A Secured Credit Card

Finance

What Happens If You Pay The Minimum Payment On A Secured Credit Card

Published: February 26, 2024

Learn the consequences of making minimum payments on a secured credit card. Discover how it impacts your finances and credit score. Gain insights on managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Secured credit cards are a valuable financial tool for individuals aiming to build or rebuild their credit. These cards require a security deposit, which acts as collateral and sets the credit limit. One crucial aspect of managing a secured credit card is making regular payments, including the minimum payment. In this article, we will explore the implications of paying only the minimum amount on a secured credit card. Understanding the impact of minimum payments is essential for responsible credit management, as it can significantly influence an individual's financial well-being and credit score.

Paying only the minimum amount on a secured credit card can have both immediate and long-term consequences. While it may provide temporary relief by meeting the basic payment requirement, it can also lead to increased interest charges and prolonged debt repayment. Additionally, it is important to recognize the potential impact on credit scores and overall financial stability. By delving into the intricacies of minimum payments on secured credit cards, we can gain valuable insights into prudent financial management and credit-building strategies. Let's explore this topic in more detail to empower individuals with the knowledge needed to make informed decisions regarding their secured credit card payments.

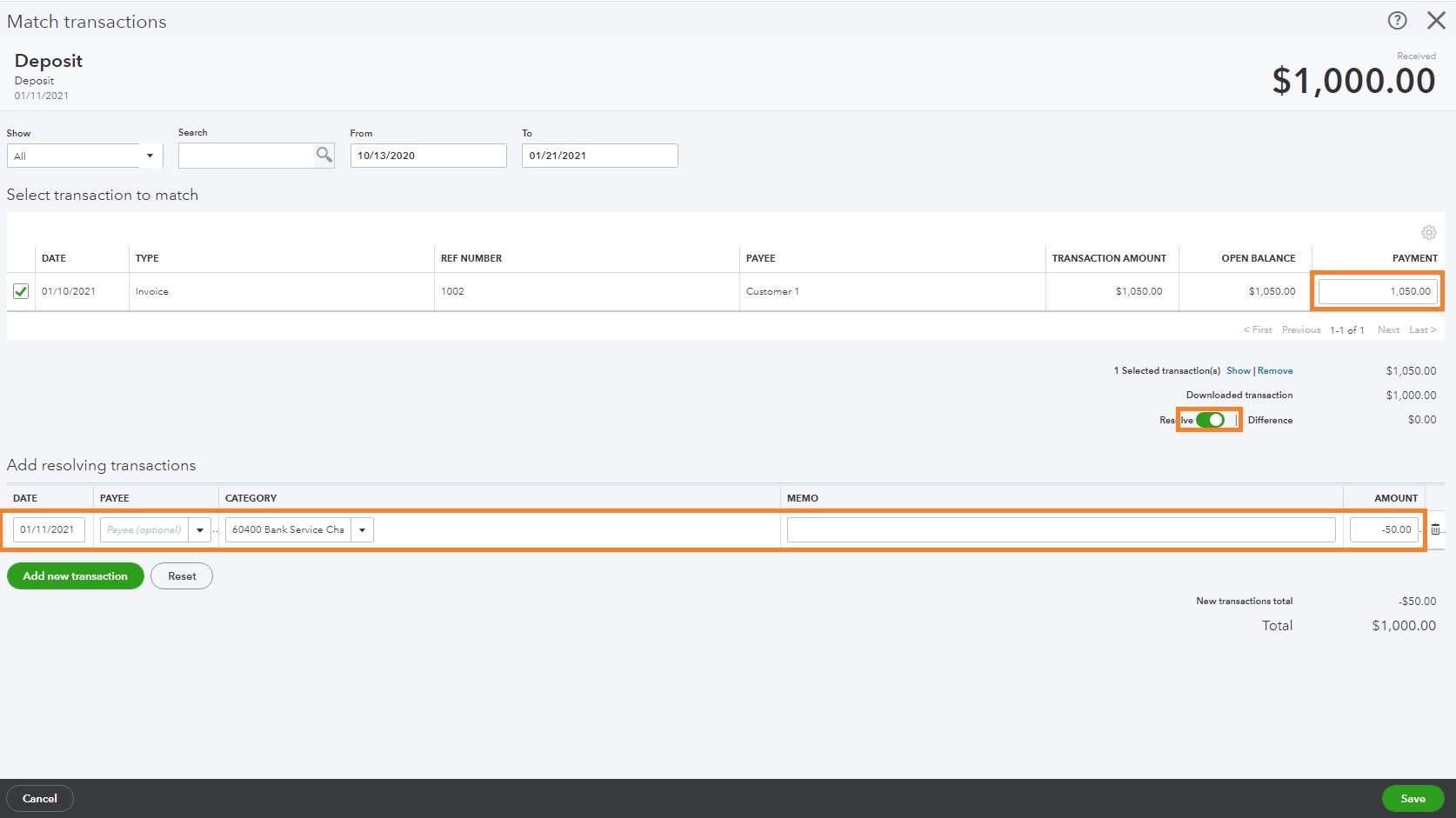

Understanding Minimum Payments on Secured Credit Cards

Minimum payments on secured credit cards represent the lowest amount that cardholders must pay by a specified due date to keep the account in good standing. This minimum payment is typically calculated as a percentage of the outstanding balance, subject to a minimum dollar amount. It is important to note that while paying the minimum can prevent late fees and maintain the account’s active status, it may not be sufficient to make meaningful progress in reducing the overall balance.

When individuals make only the minimum payment on their secured credit cards, a significant portion of the payment goes toward covering the interest accrued on the outstanding balance, with a smaller portion allocated to reducing the principal amount owed. Consequently, this approach often leads to an extended repayment period and higher overall interest costs. Understanding the dynamics of minimum payments is essential for cardholders, as it sheds light on the implications of carrying a balance and the potential long-term financial impact.

Moreover, comprehending the minimum payment structure empowers individuals to make strategic decisions regarding their credit card usage and payment habits. By recognizing the relationship between minimum payments, interest accumulation, and debt reduction, cardholders can proactively manage their finances and work towards achieving greater financial stability. This understanding also underscores the importance of responsible credit utilization and the value of paying more than the minimum whenever possible to expedite debt repayment and minimize interest expenses.

Impact of Paying Only the Minimum Payment

Opting to pay only the minimum amount on a secured credit card can have far-reaching consequences that extend beyond the immediate billing cycle. While it may provide temporary relief by meeting the basic payment requirement, this approach often leads to increased interest charges and a prolonged timeline for debt repayment. By making only the minimum payment, cardholders primarily allocate funds towards covering the interest accrued on the outstanding balance, resulting in minimal progress in reducing the principal amount owed.

One significant impact of paying only the minimum on a secured credit card is the escalation of overall interest costs. As interest continues to accrue on the remaining balance, individuals may find themselves paying a substantial amount in interest over time, substantially increasing the total cost of their purchases. This can be particularly detrimental for individuals seeking to build or rebuild their credit, as it may hinder their financial progress and limit their ability to access more favorable credit terms in the future.

Furthermore, paying only the minimum amount can prolong the debt repayment timeline, potentially leading to a cycle of persistent debt. Cardholders may find themselves carrying a balance for an extended period, making it challenging to achieve financial freedom and stability. Additionally, the prolonged debt repayment process can impact individuals’ credit scores, as high credit utilization and extended debt duration can negatively influence creditworthiness and overall financial health.

Understanding the impact of paying only the minimum payment on a secured credit card is crucial for individuals seeking to make informed decisions about their financial well-being. By recognizing the long-term implications of this approach, cardholders can develop proactive strategies to manage their credit responsibly, minimize interest expenses, and expedite their journey towards financial freedom and improved creditworthiness.

Risks of Paying Only the Minimum Payment

Opting to pay only the minimum amount on a secured credit card entails several inherent risks that can significantly impact an individual’s financial stability and credit profile. One of the primary risks is the accumulation of high-interest charges over time. When cardholders make only the minimum payment, a substantial portion of the payment is allocated towards covering interest, resulting in a slower reduction of the principal balance. This perpetuates the cycle of debt and leads to increased overall interest costs, potentially burdening individuals with long-term financial repercussions.

Another risk associated with paying only the minimum amount is the potential negative impact on credit scores. Carrying a high balance relative to the credit limit, known as high credit utilization, can adversely affect credit scores. By consistently paying only the minimum, individuals may find it challenging to lower their credit utilization ratio, which is a key factor in determining creditworthiness. Consequently, this can hinder their ability to qualify for favorable loan terms, mortgages, or other credit products in the future.

Moreover, the habit of making minimum payments can create a cycle of persistent debt, wherein individuals continually carry a balance from month to month. This not only prolongs the debt repayment timeline but also limits financial flexibility and the ability to pursue other essential financial goals. Additionally, it can lead to a sense of financial strain and make it challenging to break free from the cycle of debt accumulation, impacting overall financial well-being.

Furthermore, there is a risk of incurring additional fees and penalties when consistently paying only the minimum amount. While meeting the minimum payment requirement may prevent immediate late fees, it does not eliminate the potential for other fees, such as over-limit fees or penalty interest rates, especially if the credit limit is fully utilized. These additional charges can further exacerbate the financial burden and impede individuals’ progress towards achieving financial freedom.

Understanding the risks associated with paying only the minimum payment on a secured credit card is paramount for individuals aiming to manage their finances prudently. By recognizing these risks, individuals can proactively develop strategies to minimize interest costs, expedite debt repayment, and cultivate healthy credit habits, ultimately fostering greater financial resilience and stability.

Tips for Managing Minimum Payments on Secured Credit Cards

Effectively managing minimum payments on secured credit cards is essential for maintaining financial stability and fostering responsible credit management. By implementing strategic practices, individuals can navigate the complexities of minimum payments and work towards improving their creditworthiness. Here are some valuable tips for managing minimum payments on secured credit cards:

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due. By allocating additional funds towards reducing the principal balance, individuals can expedite debt repayment and minimize interest charges, ultimately saving money in the long run.

- Monitor Credit Utilization: Keep a close eye on credit utilization, aiming to keep balances well below the credit limit. Maintaining a low credit utilization ratio can positively impact credit scores and demonstrate responsible credit management to potential lenders.

- Create a Payment Schedule: Establish a consistent payment schedule to ensure that minimum payments are made punctually. Setting up automatic payments or calendar reminders can help individuals stay on top of their credit card obligations and avoid potential late fees.

- Strategically Allocate Funds: When faced with financial constraints, consider allocating available funds towards high-interest credit card balances. Prioritizing payments on cards with higher interest rates can yield greater interest savings over time.

- Build an Emergency Fund: Cultivate a financial safety net by setting aside funds for unexpected expenses. Having an emergency fund can mitigate the need to rely solely on credit cards for unforeseen costs, reducing the risk of accumulating high balances.

- Regularly Review Statements: Take the time to review credit card statements thoroughly, verifying transactions and ensuring accuracy. Promptly addressing any discrepancies or unauthorized charges can safeguard against potential financial losses.

- Seek Credit Limit Increases: As financial stability improves, consider requesting credit limit increases on secured credit cards. A higher credit limit can lower the credit utilization ratio, potentially benefiting credit scores and enhancing overall financial flexibility.

- Explore Credit-Building Resources: Leverage educational resources and financial counseling services to gain insights into effective credit-building strategies. Understanding the nuances of credit management can empower individuals to make informed decisions and achieve long-term financial goals.

By implementing these tips, individuals can navigate the nuances of managing minimum payments on secured credit cards, fostering responsible credit behaviors, and working towards sustained financial well-being and creditworthiness.

Conclusion

Managing minimum payments on secured credit cards is a critical aspect of responsible credit management and financial well-being. By gaining a comprehensive understanding of the impact of paying only the minimum amount, individuals can make informed decisions to mitigate potential risks and cultivate healthy credit habits. It is essential to recognize that while meeting the minimum payment requirement is crucial for maintaining an active account and avoiding late fees, it may not suffice to make meaningful progress in reducing the overall balance.

Opting to pay only the minimum amount on a secured credit card can lead to increased interest charges, prolonged debt repayment, and potential negative effects on credit scores. The accumulation of high-interest costs and the perpetuation of a cycle of persistent debt underscore the significance of proactive credit management strategies. By paying more than the minimum, monitoring credit utilization, and establishing consistent payment schedules, individuals can navigate the complexities of minimum payments and work towards achieving greater financial resilience.

Furthermore, leveraging credit-building resources, regularly reviewing statements, and strategically allocating funds can empower individuals to make informed financial decisions and cultivate healthy credit behaviors. It is crucial to approach credit card usage with prudence and foresight, aiming to minimize interest expenses, expedite debt repayment, and ultimately enhance creditworthiness.

By implementing these tips and recognizing the potential implications of paying only the minimum amount, individuals can proactively navigate the nuances of managing minimum payments on secured credit cards. This proactive approach fosters financial stability, cultivates responsible credit habits, and paves the way for sustained progress towards achieving long-term financial goals and improved creditworthiness.