Home>Finance>What Happens To An Insurance Policy When The Owner Dies?

Finance

What Happens To An Insurance Policy When The Owner Dies?

Published: November 15, 2023

When the owner of an insurance policy passes away, the policy proceeds are typically paid out to the designated beneficiary, providing financial security during a difficult time. Learn more about what happens to insurance policies after the owner's death in this informative article.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Role of Policy Owner in Insurance

- Immediate Actions After the Policy Owner’s Death

- Designating a Beneficiary

- Options for Handling Insurance Proceeds

- Estate Taxes and Insurance Policies

- Probate Process and Insurance Policies

- Collateral Assignments and Premium Financing

- Insurance Policy Ownership and Estate Planning

- Conclusion

Introduction

Dealing with the loss of a loved one is undoubtedly a difficult and challenging time, filled with a myriad of emotional and practical considerations. In the midst of grieving, it is important to address the financial implications of the situation, including the handling of any insurance policies held by the deceased. Understanding what happens to an insurance policy when the owner dies can provide clarity and guidance during this process.

Insurance policies are a vital part of our financial planning, providing protection and security for our loved ones in case of unforeseen events. However, when the policy owner passes away, it raises questions about what happens to the policy and how the policy proceeds will be distributed. This article aims to shed light on these important matters and provide guidance on managing insurance policies after the owner’s death.

While the specific steps may vary depending on the type of insurance policy and the contractual provisions, there are some general considerations that apply in most cases. It is important to note that this article provides a general overview and it is recommended to consult with an estate attorney or financial advisor to navigate through the specifics of your situation.

Next, we will delve into the role of the policy owner in insurance and how it impacts the handling of the policy after their death. Understanding the ownership structure is crucial in determining the subsequent steps that need to be taken.

Understanding the Role of Policy Owner in Insurance

In the realm of insurance, the policy owner plays a crucial role in the administration and management of the policy. The policy owner is the individual who purchases the insurance policy and is responsible for paying the premiums to keep the policy in force. They have the authority to make changes to the policy, such as adding or removing beneficiaries, adjusting coverage amounts, or even surrendering or canceling the policy altogether.

Upon the death of the policy owner, the ownership of the policy needs to be addressed. This is where the concept of a designated beneficiary comes into play. A designated beneficiary is the person or entity named by the policy owner to receive the policy proceeds upon their death. The beneficiary designation is a crucial aspect of an insurance policy as it determines who will receive the benefits and in what proportion.

If the policy owner did not designate a beneficiary or if the designated beneficiary predeceased the policy owner, the policy may become part of the owner’s estate. In this case, the policy proceeds would be subject to probate, which is a legal process for sorting out the deceased person’s assets, debts, and distributing them according to their will or the laws of intestacy if no will is present.

It’s important to review and update beneficiary designations regularly, particularly after major life events such as marriage, divorce, the birth of a child, or the death of a loved one. Failure to do so can result in unintended consequences, such as an ex-spouse receiving the policy proceeds or a loved one being inadvertently excluded.

Furthermore, it’s crucial to ensure that the policy owner has communicated the existence of the policy and its details to their beneficiaries, so that they are aware of its existence and can take the necessary steps to claim the benefits when the time comes.

Now that we have a better understanding of the role of the policy owner in insurance, let’s explore the immediate actions that need to be taken after the policy owner’s death.

Immediate Actions After the Policy Owner’s Death

When the policy owner passes away, there are several important actions that should be taken promptly to ensure a smooth handling of the insurance policy. These steps may vary depending on the specific circumstances, but the following provides a general guideline:

- Notify the insurance company: The first step is to inform the insurance company of the policy owner’s death. Contact the insurance company’s customer service or claims department to initiate the claims process. They will guide you through the necessary steps and documentation required to process the claim.

- Obtain multiple copies of the death certificate: You will likely need to provide multiple copies of the policy owner’s death certificate to the insurance company. It is advisable to obtain several certified copies from the relevant authority, as they may be required for various purposes, such as settling other financial matters or handling estate administration.

- Contact the policyholder’s financial advisor or estate attorney: If the deceased policy owner had a financial advisor or an estate attorney, it is essential to reach out to them for guidance. They can assist in navigating the intricacies of the policy and ensure that all necessary steps are taken to protect the interests of the beneficiaries.

- Locate and review the policy documents: Locate the original insurance policy documents, as they contain important information regarding the policy’s terms, coverage, and beneficiary designations. Review these documents carefully to understand the policy’s provisions and any specific instructions for filing a claim.

- Review other relevant documents: It is also important to gather and review any other documents that may impact the handling of the policy. This includes wills, trusts, and any legal agreements related to the policy or the estate. These documents may provide additional guidance or instructions regarding the distribution of the policy proceeds.

- Secure the policy proceeds: Depending on the policy’s terms, the insurance company may offer various options for receiving the policy proceeds. These can include a lump-sum payment, periodic payments, or the option to leave the funds with the company and earn interest. Consider your financial needs and consult with a financial advisor to determine the most suitable option for you.

- Communicate with beneficiaries: Reach out to the named beneficiaries of the policy and inform them about the details of the policy and the claims process. Provide them with the necessary information and guidance to ensure they can navigate the process smoothly. It is also important to reassure them that you are available to answer any questions or concerns they may have.

By promptly taking these immediate actions, you can set a solid foundation for managing the insurance policy after the owner’s death. Next, we will explore the importance of designating a beneficiary and how it impacts the distribution of policy proceeds.

Designating a Beneficiary

One of the most critical aspects of an insurance policy is the designation of a beneficiary. The beneficiary is the individual or entity who will receive the policy proceeds upon the death of the policy owner. It is essential to carefully consider and designate a beneficiary to ensure that your intentions are fulfilled and your loved ones are provided for.

When designating a beneficiary, there are a few important considerations to keep in mind:

- Identify your primary and contingent beneficiaries: A primary beneficiary is the person or entity who will receive the policy proceeds upon your death. It is crucial to clearly identify and name your primary beneficiary. Additionally, it is also recommended to designate contingent beneficiaries who would receive the proceeds if the primary beneficiary predeceases you.

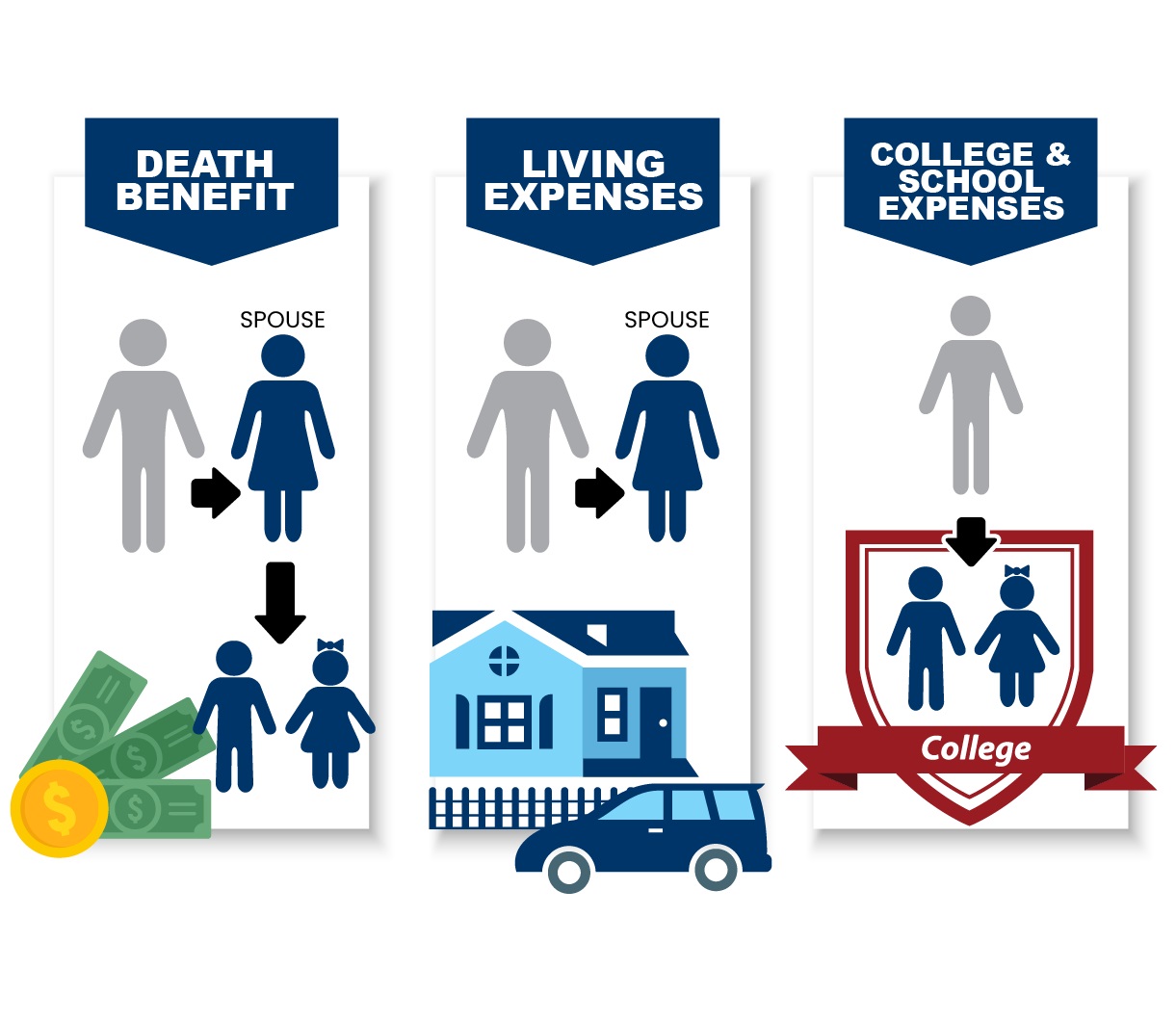

- Consider the needs of your beneficiaries: Take into account the financial needs and circumstances of your beneficiaries when designating them. This could include spouses, children, dependents, or even charitable organizations. Ensure that the policy proceeds will adequately provide for their needs and support their financial well-being.

- Review and update beneficiary designations regularly: Life circumstances can change, such as through marriage, divorce, the birth of a child, or the death of a loved one. It is crucial to review and update your beneficiary designations to reflect these changes. Failure to update beneficiary designations could result in unintended consequences, such as an ex-spouse receiving the policy proceeds or a loved one being inadvertently excluded.

- Consider the impact of estate taxes: Depending on the value of your estate, your policy proceeds could be subject to estate taxes. Consult with a tax advisor or estate planning professional to understand the potential tax implications and consider appropriate strategies to minimize the tax burden on your beneficiaries.

- Communicate your intentions to your beneficiaries: It is important to inform your designated beneficiaries about their status and the details of the policy. This will ensure that they are aware of their role and can take the necessary steps to claim the benefits when the time comes. Open communication can also help prevent misunderstandings or conflicts among beneficiaries.

- Seek professional advice: Given the complex nature of insurance policies and the legal considerations surrounding beneficiary designations, it is advisable to consult with an estate attorney or financial advisor. They can provide personalized guidance based on your specific circumstances and help ensure that your intentions are properly documented and executed.

By thoughtfully designating beneficiaries and keeping your beneficiary designations up to date, you can ensure that your insurance policy’s proceeds are distributed according to your wishes and provide financial security to your loved ones. Next, we will explore the various options for handling insurance proceeds after the policy owner’s death.

Options for Handling Insurance Proceeds

Upon the death of the policy owner, the insurance proceeds from the policy can be handled in different ways, depending on the needs and preferences of the beneficiaries. Here are some options to consider:

- Lump-sum payment: One option is to receive the insurance proceeds as a lump sum. This provides immediate access to the full amount and allows beneficiaries to use the funds as they see fit. It can be particularly beneficial for covering immediate expenses, settling outstanding debts, or making large purchases.

- Installment payments: Instead of receiving a lump sum, beneficiaries may choose to receive the proceeds in installments over a specified period of time. This option provides a regular income stream and can help with long-term financial planning. It may be suitable for beneficiaries who prefer a steady and predictable cash flow.

- Trust or custodial account: Setting up a trust or custodial account can be a wise choice, especially if there are minor beneficiaries or individuals who may not be capable of managing a large sum of money on their own. The trust or custodial account can hold the insurance proceeds, and a trustee or custodian will oversee the management and distribution of the funds according to the terms outlined in the trust agreement.

- Charitable donations: If the policy owner had a philanthropic inclination, one option is to designate a charitable organization as the beneficiary of the policy proceeds. This allows for a legacy of giving and can have positive tax implications for the estate.

- Purchase an annuity: Another option is to use a portion or all of the insurance proceeds to purchase an annuity. An annuity provides a regular income stream over a specified period or for the beneficiary’s lifetime. This can help ensure long-term financial security and provide a steady source of income.

- Invest the funds: Depending on the financial goals and risk tolerance of the beneficiaries, investing the insurance proceeds in stocks, bonds, or other investment vehicles may be an option. It is important to seek the advice of a financial advisor to determine the appropriate investment strategy based on the specific circumstances and objectives.

It is essential to carefully evaluate and consider the financial needs, goals, and circumstances of the beneficiaries before deciding on the best option for handling the insurance proceeds. Consulting with a financial advisor or estate planning professional can provide valuable insights and guidance in making an informed decision.

Next, we will explore the implications of estate taxes on insurance policies and how they are handled after the policy owner’s death.

Estate Taxes and Insurance Policies

When it comes to insurance policies and estate taxes, it’s important to understand the potential implications and how they are handled after the policy owner’s death. Here are some key considerations:

Insurance policies generally provide a tax-free death benefit to the beneficiaries. This means that the proceeds from the policy are typically not subject to income tax. However, they may be included in the policy owner’s estate for estate tax purposes.

Estate taxes are taxes imposed on the transfer of a deceased person’s estate to their heirs or beneficiaries. The tax is based on the total value of the assets owned by the deceased at the time of death. While not all estates are subject to estate taxes, those that exceed a certain threshold set by the government may be subject to taxation.

When it comes to insurance policies, if the policy owner has any incidents of ownership over the policy, such as the ability to change beneficiaries or borrow against the policy’s cash value, then the policy proceeds may be included in their taxable estate. This means that if the value of the estate exceeds the estate tax exemption amount, the insurance proceeds could be subject to estate taxes.

However, there are strategies available to minimize the impact of estate taxes on insurance policies:

- Irrevocable Life Insurance Trust (ILIT): By transferring ownership of the policy to an ILIT, the policy proceeds are removed from the policy owner’s taxable estate. The ILIT becomes the owner of the policy, and the proceeds are directed to the trust for the benefit of the beneficiaries.

- Gifting the policy: Another strategy is to gift the policy to the beneficiaries during the policy owner’s lifetime. By doing so, the policy proceeds are no longer considered part of the policy owner’s estate and may be exempt from estate taxes. It’s important to consult with a tax advisor or estate planning professional to understand the potential gift tax implications.

- Using a life insurance trust: A life insurance trust can be utilized to hold and administer the insurance policy for the benefit of the beneficiaries. By placing the policy in a trust, the proceeds can be safeguarded and distributed according to the terms of the trust, potentially avoiding estate taxes.

It’s crucial to consult with an estate planning attorney or tax advisor with expertise in estate taxes to assess your specific situation and explore appropriate strategies to minimize the impact of estate taxes on insurance policies. They can provide guidance on the best course of action based on your personal circumstances and objectives.

Next, we will explore the probate process and how it relates to insurance policies after the policy owner’s death.

Probate Process and Insurance Policies

When a policy owner passes away, the handling of insurance policies may intersect with the probate process. Probate is the legal process of administering a deceased person’s estate, including settling debts, distributing assets, and resolving any legal matters. Here’s how the probate process relates to insurance policies:

Generally, life insurance policies are designed to bypass the probate process. This means that the policy proceeds are typically paid directly to the named beneficiaries, bypassing the need for court involvement. By doing so, the beneficiaries can receive the insurance proceeds more quickly and without the complexities and delays of probate.

However, there are some situations where insurance policies may become subject to probate:

- No named beneficiary: If the policy owner did not designate a beneficiary or if all designated beneficiaries have predeceased the policy owner, the policy proceeds may become part of the owner’s estate. In this case, the policy would be subject to the probate process, and the proceeds will be distributed according to the terms of the will or the laws of intestacy if no will is present.

- Estate named as the beneficiary: It’s not uncommon for policy owners to name their estate as the beneficiary of their insurance policy. In this situation, the policy proceeds will become part of the estate and go through the probate process. It’s worth noting that this approach may have unintended consequences, such as incurring estate taxes or delaying the distribution of funds to the beneficiaries.

- Disputes over the policy: If there are disputes or challenges regarding the validity or interpretation of the insurance policy, these issues may need to be resolved through the probate court. This can delay the distribution of the policy proceeds and result in additional legal expenses.

It’s important to note that the probate process can vary depending on the jurisdiction and the complexity of the estate. In some cases, it may be advisable to consult with an estate attorney to navigate through the probate process, especially when there are complex legal issues or disputes involved.

It’s worth emphasizing that one of the advantages of life insurance policies is their ability to provide a prompt payment to beneficiaries without going through probate. By ensuring that a designated beneficiary is named and regularly reviewing and updating beneficiary designations, policy owners can help streamline the process and ensure a smooth transfer of insurance proceeds to their loved ones.

Next, we will explore collateral assignments and premium financing and their relation to insurance policy ownership and estate planning.

Collateral Assignments and Premium Financing

Collateral assignments and premium financing are financial strategies that can be employed in relation to insurance policy ownership and estate planning. These approaches can provide flexibility and access to funds while maintaining the value of the policy. Let’s explore them further:

A collateral assignment is a method of using a life insurance policy as collateral for a loan. In this arrangement, the policy owner grants a lender the right to receive a portion or all of the policy’s death benefit as repayment for the loan. Collateral assignments are commonly used for estate planning purposes, business succession planning, or to fund buy-sell agreements.

By utilizing a collateral assignment, the policy owner can access the financial value of the policy while still keeping it intact. It’s important to note that any outstanding loan amount, plus accrued interest, will be deducted from the policy’s death benefit upon the policy owner’s death, reducing the amount ultimately received by the beneficiaries.

Premium financing, on the other hand, is a method of covering the ongoing premiums of an insurance policy through a loan. This strategy is typically employed when the policy owner does not have sufficient liquid capital to pay the premiums but has sufficient assets to serve as collateral for the loan. The policy itself acts as collateral, and the borrowed funds are used to cover the premium payments.

Premium financing allows policy owners to maintain their insurance coverage without having to liquidate other assets to pay the premiums. It can be particularly useful in cases where the policy owner expects future liquidity through inheritance, the sale of a business, or other expected windfalls.

However, it’s important to carefully consider the terms and conditions of premium financing arrangements. Interest rates, loan requirements, and the impact on the policy’s cash value and death benefit should all be thoroughly evaluated. Seeking guidance from a financial advisor or insurance specialist experienced in premium financing can help determine if this strategy is suitable for your unique financial circumstances.

Both collateral assignments and premium financing can provide policy owners with the flexibility and liquidity they need for various financial planning and estate planning objectives. However, it’s crucial to fully analyze the risks and benefits of these strategies and consult with professionals to ensure they align with your overall financial goals.

In the next section, we will discuss the importance of insurance policy ownership in the context of estate planning.

Insurance Policy Ownership and Estate Planning

Insurance policy ownership plays a vital role in estate planning, as it can have significant implications for the distribution of assets, minimizing taxes, and ensuring the financial security of loved ones. Here are some key considerations regarding insurance policy ownership and estate planning:

1. Ownership structures: The way in which an insurance policy is owned can impact its taxation and the control over its proceeds. Depending on your goals and circumstances, you may choose to own the policy individually, jointly with a spouse, or through a trust. Each ownership structure has its advantages and considerations that should be evaluated in the context of your estate plan.

2. Estate tax considerations: As mentioned earlier, the value of an insurance policy may be included in your taxable estate for estate tax purposes. Therefore, if you have a large estate, the death benefit of the policy may push the total value of your estate over the tax exemption threshold. Proper estate planning, such as using irrevocable trusts or gifting strategies, can help minimize estate taxes and preserve the policy’s proceeds for your beneficiaries.

3. Beneficiary designations: Designating beneficiaries is a crucial aspect of insurance policy ownership. By naming beneficiaries, you can ensure that the policy proceeds are distributed in accordance with your wishes, bypassing the probate process and potential delays in the distribution of assets. It’s important to review and update beneficiary designations regularly to reflect any changes in your personal circumstances.

4. Coordination with your overall estate plan: The ownership of insurance policies should be aligned with your broader estate planning goals. This includes coordinating beneficiary designations with the terms of your will, trust, and other estate planning documents. Working with an experienced estate planning attorney can ensure that your insurance policies are integrated into your estate plan effectively.

5. Consideration for special needs beneficiaries: If you have a dependent with special needs, careful thought should be given to how the insurance policy is owned and structured. A special needs trust may be a suitable option to manage and protect the policy proceeds while preserving eligibility for government benefits.

6. Regular review and updates: Life is dynamic, and changes in your personal life, such as marriage, divorce, births, or deaths in the family, may necessitate updates to your insurance policy ownership and beneficiary designations. Regularly reviewing your insurance policies as part of your overall estate planning process ensures that they align with your current wishes and objectives.

Estate planning is a complex and highly individualized process. Given the importance of insurance policy ownership within this framework, seeking guidance from an estate planning attorney or financial advisor experienced in estate planning can help navigate the intricacies and ensure that your insurance policies are optimally structured to achieve your desired goals.

Finally, let’s conclude our discussion on insurance policies and their handling after the owner’s death.

Conclusion

Managing insurance policies after the death of the policy owner is a critical aspect of financial planning and estate administration. Understanding the impact of policy ownership, beneficiary designations, and the options for handling insurance proceeds is essential in ensuring a smooth transition of assets and the financial security of your loved ones.

By designating a beneficiary and keeping beneficiary designations up to date, you can ensure that the policy proceeds are distributed according to your wishes and avoid potential conflicts or unintended consequences. Promptly notifying the insurance company and taking immediate actions after the policy owner’s death, such as obtaining multiple copies of the death certificate and contacting relevant professionals, can expedite the claims process and facilitate efficient handling of the policy.

Consideration should also be given to the potential impact of estate taxes on insurance policies. Depending on the value of the estate, proper planning and the utilization of strategies like irrevocable trusts or gifting can help minimize the potential tax burden on the policy proceeds.

Collateral assignments and premium financing offer additional financial planning options, providing flexibility and access to funds while keeping the insurance policy intact. However, it is essential to carefully assess the associated risks and consult with professionals to ensure these strategies align with your financial goals.

Overall, insurance policy ownership should be viewed holistically within the estate planning process. Coordinating your insurance policies with your broader estate plan, regularly reviewing and updating beneficiary designations, and seeking professional advice can help ensure that your loved ones are financially protected and your intended legacy is fulfilled.

In conclusion, by understanding the role of policy ownership, taking immediate actions after the policy owner’s death, designating beneficiaries, exploring different options for handling insurance proceeds, considering estate taxes, and incorporating insurance policies into comprehensive estate planning, you can navigate the complexities of insurance policy management during times of loss and preserve the financial well-being of your loved ones.