Home>Finance>What Happens When You Cancel A Life Insurance Policy?

Finance

What Happens When You Cancel A Life Insurance Policy?

Published: November 15, 2023

Discover the financial implications of canceling a life insurance policy and understand the potential consequences for your financial future. Stay informed and make the right decisions for your finances with expert advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance Policies

- Types of Life Insurance

- Benefits of Life Insurance

- Reasons for Cancelling a Life Insurance Policy

- Options for Cancelling a Life Insurance Policy

- Consequences of Cancelling a Life Insurance Policy

- Impact on Policyholder’s Coverage

- Process of Cancelling a Life Insurance Policy

- Considerations Before Cancelling a Life Insurance Policy

- Alternatives to Cancelling a Life Insurance Policy

- Conclusion

Introduction

Welcome to the world of life insurance! It’s a financial tool that offers peace of mind and financial protection for you and your loved ones. However, there may come a time when you need to reevaluate your life insurance needs or face unexpected circumstances that make you consider cancelling your policy. But what happens when you cancel a life insurance policy?

In this article, we will explore the ins and outs of cancelling a life insurance policy. We will discuss the different types of life insurance, the benefits it offers, the reasons why someone might consider cancelling their policy, the options available for cancellation, and the consequences that can arise from cancelling a policy. We will also dive into the process of cancelling a life insurance policy, the impact it can have on your coverage, and the important considerations you should keep in mind before making a decision.

Life insurance can be a complex topic, but understanding what happens when you cancel your policy is crucial for making informed decisions about your financial future. By the end of this article, you will have a clear understanding of the implications and options associated with cancelling a life insurance policy, as well as alternative solutions that may be available to you.

So, let’s delve into the world of life insurance and explore what happens when you cancel a policy.

Understanding Life Insurance Policies

Before we dive into the topic of cancelling a life insurance policy, it’s important to have a solid understanding of what life insurance is and how it works.

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums to the insurance company in exchange for a death benefit, which is a lump sum of money paid out to the designated beneficiaries upon the policyholder’s death. This financial safety net provides protection for loved ones and helps to cover expenses such as funeral costs, outstanding debts, and living expenses.

There are several types of life insurance policies available, each with its own features and benefits. The two main categories are:

- Term Life Insurance: This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiaries receive the death benefit. Term life insurance is generally more affordable but does not accumulate cash value.

- Permanent Life Insurance: Unlike term life insurance, permanent life insurance provides coverage for the entire lifetime of the policyholder. It also includes a cash value component that grows over time and can be accessed by the policyholder through withdrawals or loans, depending on the policy’s terms.

Within the category of permanent life insurance, there are further subcategories, such as whole life insurance, universal life insurance, and variable life insurance. These policies differ in terms of flexibility, investment options, and premium payment structures.

Life insurance policies can be an effective way to protect your loved ones financially and provide peace of mind. However, circumstances may arise that lead you to consider cancelling your life insurance policy. In the next sections, we will explore the reasons why someone might contemplate cancelling their policy, the options available for cancellation, and the potential consequences that come with terminating a life insurance policy.

Types of Life Insurance

When it comes to life insurance, there are several different types of policies available. Understanding these options can help you choose the right coverage that aligns with your financial goals and needs. Let’s explore the main types of life insurance:

- Term Life Insurance: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. Term life insurance is typically more affordable and straightforward compared to other types of life insurance policies. However, it does not accrue cash value and only lasts for the specified term period.

- Whole Life Insurance: Whole life insurance is a type of permanent life insurance that provides lifetime coverage with a death benefit. It also accumulates a cash value component over time, which can be accessed by the policyholder through withdrawals or loans. Premiums for whole life insurance policies are generally higher compared to term life insurance, but the policy remains in effect for as long as premiums are paid.

- Universal Life Insurance: Universal life insurance offers flexibility in premium payments, death benefits, and cash value accumulation. Policyholders have the option to adjust the death benefit and premium amounts as their financial circumstances change. The cash value component can also grow over time and can be used for various purposes, such as supplementing retirement income or paying for future premiums.

- Variable Life Insurance: Variable life insurance allows policyholders to allocate their premiums into various investment options, such as stocks, bonds, or mutual funds. The cash value of the policy fluctuates based on the performance of these underlying investments. However, this type of policy carries more investment risk, as the cash value is tied to market performance.

- Indexed Universal Life Insurance: Indexed universal life insurance combines elements of both universal life insurance and indexed investing. The cash value growth is linked to the performance of a specific index, such as the S&P 500. This type of policy provides the opportunity for potential growth while also offering downside protection during market downturns.

Each type of life insurance policy has its own advantages and considerations. It’s important to evaluate your financial situation, risk tolerance, and long-term goals when choosing the right policy for you. Working with a knowledgeable insurance professional can help you navigate through the options and select the most suitable coverage.

Benefits of Life Insurance

Life insurance offers a range of benefits that can provide financial security and peace of mind for you and your loved ones. Let’s explore some of the key advantages of having a life insurance policy:

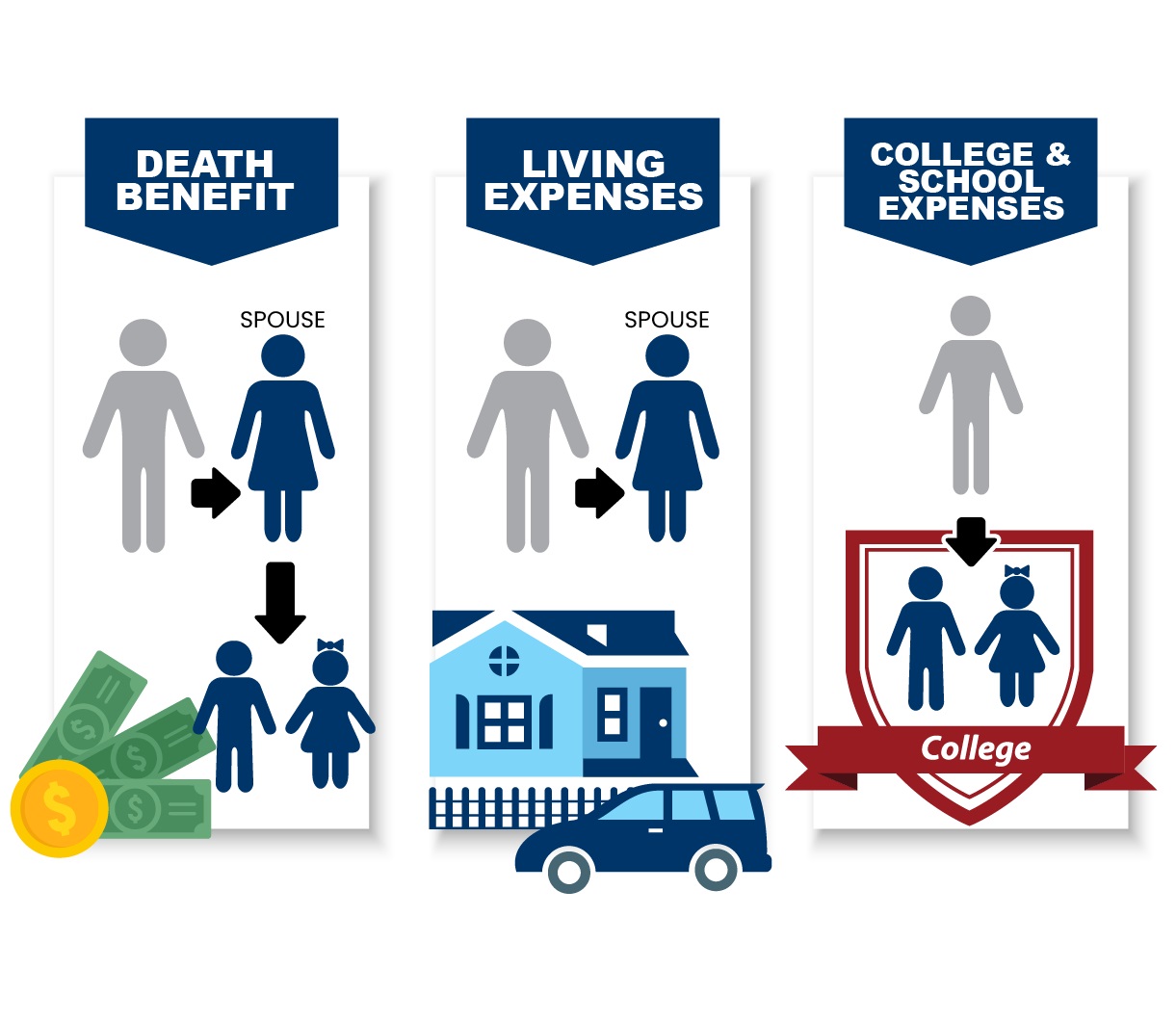

- Death Benefit: The primary benefit of life insurance is the death benefit it provides to your beneficiaries when you pass away. This lump sum payment can help cover funeral expenses, outstanding debts, and provide financial support for your loved ones, ensuring their well-being and stability during a difficult time.

- Income Replacement: Life insurance can serve as a replacement for lost income in the event of your untimely death. This is particularly important if you are the primary breadwinner or if your income significantly contributes to your family’s financial obligations. The death benefit can help maintain your family’s standard of living, cover monthly expenses, and support their financial needs.

- Debt and Estate Planning: Life insurance can play a crucial role in debt and estate planning. It can help cover outstanding debts, such as mortgages, loans, and credit card balances, ensuring that your family is not burdened with financial obligations after you’re gone. Additionally, life insurance proceeds can be used to pay for estate taxes and other expenses related to the transfer of assets.

- Business Continuation: If you own a business, life insurance can be essential for ensuring its continuity in the event of your death. It can provide the necessary funds to buy out your share of the business from your heirs, pay off business debts, and facilitate a smooth transition of ownership.

- Supplemental Retirement Income: Certain types of life insurance policies, such as permanent life insurance, accumulate a cash value component over time. This cash value can be accessed through withdrawals or loans and can provide a supplemental source of income during retirement or in times of financial need.

- Charitable Giving: Life insurance can also be used as a tool for philanthropy. By naming a charity as a beneficiary of your policy, you can leave a lasting impact and support causes that are important to you.

It’s important to note that the benefits of life insurance can vary depending on the type of policy you choose and your individual circumstances. Consulting with a financial advisor or insurance professional can help you understand the specific advantages of different policies and tailor your coverage to meet your unique needs and goals.

Reasons for Cancelling a Life Insurance Policy

While life insurance provides numerous benefits, there are several reasons why someone might consider cancelling their life insurance policy:

- Financial Constraints: Changes in financial circumstances, such as job loss or a decrease in income, may make it challenging to continue paying life insurance premiums. The policyholder may have to prioritize immediate financial needs and decide to cancel their policy to free up funds.

- Change in Coverage Needs: As life circumstances evolve, it’s essential to reassess your coverage needs. If you no longer have dependents or your financial obligations have reduced significantly, you may feel that the coverage amount provided by your current policy is excessive. In such cases, cancelling the policy and seeking a more suitable coverage option may make financial sense.

- Policy Lapses: In some instances, policyholders may unintentionally let their policies lapse due to missed premium payments. If the policyholder fails to reinstate the policy within the grace period provided by the insurance company, the policy may be terminated.

- Health Concerns: Some individuals may choose to cancel their life insurance policies if they develop health conditions that render them ineligible for coverage or cause their premiums to increase significantly. Without the ability to afford the higher premiums, cancelling the policy may become the only viable option.

- Alternative Financial Solutions: Life insurance policies can also be cancelled if the policyholder finds alternative financial solutions that serve their needs better. They may opt for investment vehicles or savings accounts that offer higher returns or greater flexibility.

It’s important to carefully evaluate your reasons for cancelling a life insurance policy. While cancelling may provide short-term financial relief, it also means forfeiting the benefits and protection the policy offers. Consider consulting with a financial advisor or insurance professional before making a decision to ensure that you fully understand the implications and explore alternative options that may be available to you.

Options for Cancelling a Life Insurance Policy

If you find yourself considering the cancellation of your life insurance policy, there are several options available to you:

- Surrendering the Policy: Surrendering your life insurance policy involves contacting your insurance company and formally terminating the contract. Upon surrender, you will no longer be obligated to pay premiums, and the policy’s cash value (if applicable) will be paid out to you. However, it’s important to note that surrendering the policy means forfeiting the death benefit and any future coverage.

- Partial Surrender: If you have a permanent life insurance policy with a cash value component, you may have the option to make a partial surrender. This allows you to withdraw a portion of the policy’s cash value while keeping the policy in force with a reduced death benefit. Keep in mind that this may affect the policy’s long-term growth potential.

- Policy Loan: Some permanent life insurance policies allow policyholders to take out a loan against the cash value of the policy. This option allows you to access funds without cancelling the policy. However, it’s important to repay the loan to prevent interest charges and keep the policy in force.

- Conversion: If you have a term life insurance policy, there may be options to convert it into a permanent life insurance policy. This conversion allows you to maintain coverage while adjusting the policy to better suit your changing needs. Keep in mind that conversion may require additional premiums, and the new policy’s terms and conditions may differ.

- Policy Replacement: If you are considering cancelling your life insurance policy due to dissatisfaction with the coverage or its cost, it may be worth exploring other insurance providers or policies. You can compare quotes and coverage options to find a policy that better aligns with your needs and financial situation before cancelling your current policy.

Before proceeding with any of these options, it’s crucial to carefully review the terms and conditions of your policy and consult with a financial advisor or insurance professional. They can provide guidance on the potential consequences, costs, and alternatives associated with cancelling your life insurance policy.

Remember, life insurance serves as a valuable safety net and financial protection for you and your loved ones. Explore all available options and make an informed decision that aligns with your overall financial goals and circumstances.

Consequences of Cancelling a Life Insurance Policy

While cancelling a life insurance policy may seem like a straightforward decision, it’s important to understand the potential consequences that can arise from terminating your coverage:

- Loss of Death Benefit: The most significant consequence of cancelling a life insurance policy is the loss of the death benefit. If you pass away after cancelling your policy, your beneficiaries will not receive the financial support provided by the policy’s payout. This can leave your loved ones financially vulnerable, especially if they rely on the death benefit to cover expenses or maintain their standard of living.

- No Cash Value Accumulation: If you cancel a permanent life insurance policy that has accumulated cash value over time, you will lose access to these funds. This can be a significant financial setback, as the policy’s cash value can serve as a supplemental source of income or an emergency fund.

- Higher Future Premiums: If you decide to reapply for life insurance coverage in the future, your premiums are likely to be higher than what you were previously paying. This is because your age and health conditions may have changed, resulting in a higher risk profile for insurers. Cancelling your policy means forfeiting the rates and terms you secured when you initially purchased the coverage.

- Limited Coverage Options: Depending on your age and health, trying to obtain new life insurance coverage after cancelling a policy may prove challenging. Insurability can diminish over time, and you may face difficulty in finding affordable coverage or securing coverage at all, especially if your health has deteriorated since your previous policy.

- Loss of Long-Term Benefits: Permanent life insurance policies offer long-term benefits beyond the death benefit, such as the potential to build cash value and access funds for various financial needs. Cancelling the policy means forfeiting these long-term benefits and the potential growth that the policy could have provided.

Before cancelling a life insurance policy, carefully consider these consequences and evaluate whether there are alternative solutions that may better address your concerns. Exploring options like adjusting coverage amounts, converting policies, or seeking guidance from a financial advisor can help you make a well-informed decision that aligns with your financial goals while preserving the protection and benefits offered by life insurance.

Remember, life insurance is designed to provide financial security and peace of mind for you and your loved ones. It’s essential to weigh the potential consequences against your current needs and long-term objectives before deciding to cancel your policy.

Impact on Policyholder’s Coverage

When a policyholder cancels a life insurance policy, it naturally has an immediate impact on their coverage. Here are some key factors to consider regarding the impact on the policyholder’s coverage:

- Loss of Death Benefit: The most significant impact of cancelling a life insurance policy is the loss of the death benefit. The death benefit is the primary purpose of life insurance, providing financial protection to the policyholder’s beneficiaries in the event of their passing. Cancelling the policy means forfeiting this benefit, leaving loved ones without the financial support that it would have provided.

- Immediate Termination of Coverage: Once a policy is cancelled, the coverage ends immediately. There is no longer any financial protection or safety net for the policyholder or their beneficiaries. This can have serious consequences, especially if there are outstanding debts or financial obligations that were dependent on the policy’s coverage.

- Loss of Cash Value: If the cancelled policy has a cash value component, surrendering the policy means losing access to the accumulated cash value. This can be a significant loss, as the cash value can serve as a source of funds for various financial needs, such as supplementing retirement income or funding emergencies.

- Change in Future Insurability: Cancelling a life insurance policy can impact future insurability. Health conditions or changes in circumstances may make it difficult to obtain new coverage or result in higher premiums. The policyholder may face challenges in securing similar coverage or may need to settle for a different type of policy with less favorable terms.

- Loss of Long-Term Benefits: Permanent life insurance policies offer additional benefits beyond the death benefit, such as the potential for cash value growth and access to loans or withdrawals. Cancelling the policy means forfeiting these long-term benefits and the potential financial advantages they provide.

It is essential for policyholders to carefully evaluate the impact on their coverage before deciding to cancel a life insurance policy. Consider alternative options, such as adjusting coverage amounts or exploring conversion opportunities, to better align with your changing needs while still maintaining some form of financial protection.

Remember to consult with a financial advisor or insurance professional who can provide guidance based on your specific circumstances. They can help you consider the potential implications and explore alternative solutions that best address your financial goals while preserving the vital coverage that life insurance provides.

Process of Cancelling a Life Insurance Policy

When considering the cancellation of a life insurance policy, it’s important to understand the process involved. While the specific procedures may vary between insurance companies, here is a general overview of the steps typically taken to cancel a life insurance policy:

- Review the Policy: Start by thoroughly reviewing your life insurance policy. Take note of any cancellation provisions, such as the notice period required or any fees or penalties involved.

- Contact your Insurance Company: Reach out to your insurance company’s customer service department or your insurance agent directly. Inform them of your intention to cancel the policy and request guidance on the cancellation process. They will provide you with the necessary instructions and any paperwork that needs to be filled out.

- Send a Written Request: Most insurance companies require a written request to cancel a policy. Write a formal letter or complete the cancellation form provided by the insurer. Include details like your policy number, policyholder’s name, and the effective date of cancellation.

- Return the Policy Documents: In some cases, insurance companies may require you to return the original policy documents. Follow the instructions provided by the insurer to ensure the proper return of these documents.

- Confirm Cancellation: Once your written request is received by the insurance company, they will process the cancellation and send you a confirmation. This confirmation will serve as proof that the policy has been terminated.

- Verify Automatic Premium Payments: If you have set up automatic premium payments through your bank account or credit card, ensure that these arrangements are cancelled as well to avoid any unnecessary deductions from your account.

It’s important to adhere to any specific cancellation provisions outlined in your policy to avoid any complications or misunderstandings. Keep copies of all communication with the insurance company for your records.

After cancelling your policy, be aware that the termination is permanent, and you will no longer have the benefits and protections provided by the life insurance coverage. Consider alternative insurance options or financial solutions to address your changing needs and ensure you have adequate financial protection in place.

Always consult with a financial advisor or insurance professional to fully understand the implications of cancelling your policy and to explore any alternatives that may be available to you.

Considerations Before Cancelling a Life Insurance Policy

Before making the decision to cancel your life insurance policy, it’s important to carefully evaluate the following considerations:

- Financial Needs: Assess your current financial situation and analyze whether cancelling the policy aligns with your short-term and long-term financial goals. Consider your outstanding debts, dependents’ financial needs, and any potential financial hardships that may arise in the future.

- Insurance Needs: Consider whether cancelling the policy will leave you without adequate coverage. Evaluate your current and future insurance needs based on your family’s financial security, outstanding debts, funeral expenses, and income replacement requirements.

- Alternative Solutions: Before cancelling your policy, explore alternative options. For example, you may be able to adjust the coverage amount, convert the policy into a different type of insurance, or change certain policy features to better align with your changing needs.

- Impact on Dependents: Think about how cancelling the policy may impact your dependents or loved ones. Will they have sufficient financial protection without the death benefit provided by the policy? Consider their financial well-being and any future financial obligations they may have.

- Health Considerations: Assess your health status and potential future insurability. If your health has changed since you initially purchased the policy, cancelling it may impact your ability to obtain a new policy or result in higher premiums if you decide to obtain coverage again in the future.

- Professional Guidance: Seek advice from a financial advisor or insurance professional before making a final decision. They can assess your specific circumstances, consider your financial goals, and guide you on the potential implications of cancelling your policy, as well as explore alternative solutions that may better serve your needs.

It’s important to carefully weigh the potential consequences and benefits before cancelling your life insurance policy. Assess your financial needs, evaluate alternative options, and seek professional guidance to ensure that you are making an informed decision that aligns with your overall financial goals and objectives.

Remember, life insurance provides valuable protection and financial security for you and your loved ones. It may be beneficial to explore ways to adjust the policy rather than cancelling it entirely, as maintaining some form of coverage can offer peace of mind and ensure financial stability.

Alternatives to Cancelling a Life Insurance Policy

If you’re considering cancelling your life insurance policy, it’s important to explore alternative options before making a final decision. Here are some alternatives to consider:

- Adjusting the Coverage: Instead of cancelling the policy, you may be able to adjust the coverage amount to better align with your current needs. This can help reduce premiums while still providing a level of financial protection for your loved ones.

- Conversion: If you have a term life insurance policy and are considering cancellation, check if your policy offers the option to convert it to a permanent life insurance policy. This conversion allows you to maintain coverage while adjusting the policy to better suit your changing needs, such as by extending the coverage period or building cash value.

- Reducing Premium Payments: Some permanent life insurance policies may have options to reduce premium payments while maintaining coverage. This can be achieved through adjustments in the death benefit or by utilizing accumulated cash value to cover premium costs.

- Term Extension: If you have a term life insurance policy that is about to expire, consider extending the term if available. This will provide continued coverage for a specific period without the need to purchase a new policy or undergo additional underwriting.

- Rider Additions: Riders are additional policy features that can be added to enhance your coverage. Instead of cancelling the policy, explore the availability of riders that can better serve your needs, such as riders for critical illness or disability coverage.

- Supplemental Coverage: If you’re considering cancelling your policy due to changing needs or inadequate coverage, explore the option of obtaining supplemental insurance. This can provide additional coverage to fill any gaps in your existing policy and ensure comprehensive financial protection.

Each individual’s financial situation is unique, and the alternatives to cancelling a life insurance policy will depend on your specific circumstances. It’s crucial to consult with a financial advisor or insurance professional who can assess your needs, evaluate the alternatives, and guide you in making an informed decision.

Remember that life insurance is designed to provide financial security and peace of mind. Before opting to cancel your policy, carefully analyze the alternatives available and consider how they can help you meet your evolving financial goals while still maintaining some form of protection for your loved ones.

Conclusion

Cancelling a life insurance policy is a significant decision that should not be taken lightly. While there may be circumstances that make you consider cancelling, it’s crucial to thoroughly evaluate the consequences and alternatives before reaching a final decision.

Life insurance provides financial protection, peace of mind, and a safety net for your loved ones. The death benefit offered by a life insurance policy can cover funeral expenses, outstanding debts, and provide income replacement for your family. Cancelling the policy means forfeiting these benefits, leaving your loved ones financially vulnerable.

Before cancelling, consider alternative solutions such as adjusting coverage amounts, converting policies, or exploring riders to better meet your changing needs. These options can help tailor your coverage to align with your current financial situation and future goals, without completely cancelling the policy.

A professional financial advisor or insurance specialist can guide you through the process and help you understand the implications of cancelling your policy. They can assess your specific circumstances, evaluate potential alternatives, and provide expert advice based on your needs and objectives.

Remember, life insurance plays a crucial role in protecting your loved ones and ensuring their financial stability in the face of unexpected events. Before cancelling your policy, carefully consider all factors and make an informed decision that best serves your long-term financial well-being.

Financial needs and circumstances can change over time, so it’s important to regularly review your life insurance coverage and make adjustments when necessary. By staying informed, exploring alternatives, and seeking professional guidance, you can make sound decisions that meet your financial goals while still maintaining the vital protection and benefits that life insurance provides.