Home>Finance>What Happens When A Term Life Insurance Policy Matures?

Finance

What Happens When A Term Life Insurance Policy Matures?

Modified: December 29, 2023

Discover what happens to a term life insurance policy when it matures and how it can impact your financial future. Gain insights on the finance aspect of life insurance expiration.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Term Life Insurance

- What is a Term Life Insurance Policy?

- How Term Life Insurance Works

- The Maturity of a Term Life Insurance Policy

- What Happens When a Term Life Insurance Policy Matures?

- Options for Policyholders

- Option 1: Renew the Policy

- Option 2: Convert to Permanent Life Insurance

- Option 3: Let the Policy Expire

- Factors to Consider When Making a Decision

- Factors Affecting the Premiums

- Assessing Personal Financial Situation

- Evaluating Long-term Needs

- Conclusion

Introduction

Welcome to the world of term life insurance! If you’re unfamiliar with this type of insurance coverage, you’ve come to the right place. This article will provide you with a comprehensive understanding of what happens when a term life insurance policy matures.

Term life insurance is a popular choice for individuals looking for affordable and temporary coverage. It provides financial protection for a specified period, typically ranging from 10 to 30 years. Many people opt for term life insurance to ensure that their loved ones are taken care of in the event of their untimely demise.

However, as with any insurance policy, there comes a point when the term comes to an end. This marks the maturity of the policy, and it’s important for policyholders to be aware of their options at this stage. Whether you’re approaching the maturity date of your policy or simply curious about what lies ahead, this article will guide you through the process.

Understanding the intricacies of term life insurance and the implications of its maturity can be complex. Fear not! We’ll break down the concepts step-by-step, ensuring that you have a clear understanding of the options available to you when the time comes.

So, let’s jump right in and explore what happens when a term life insurance policy reaches its maturity date!

Understanding Term Life Insurance

Before we delve into what happens when a term life insurance policy matures, it’s essential to have a solid understanding of term life insurance itself.

Term life insurance is a type of life insurance that provides coverage for a specific period. Unlike permanent life insurance, such as whole life or universal life, which offers coverage for a lifetime, term life insurance has a predetermined term, usually ranging from 10 to 30 years. This makes it a popular choice for individuals who want coverage during a specific period when their financial obligations and responsibilities are highest.

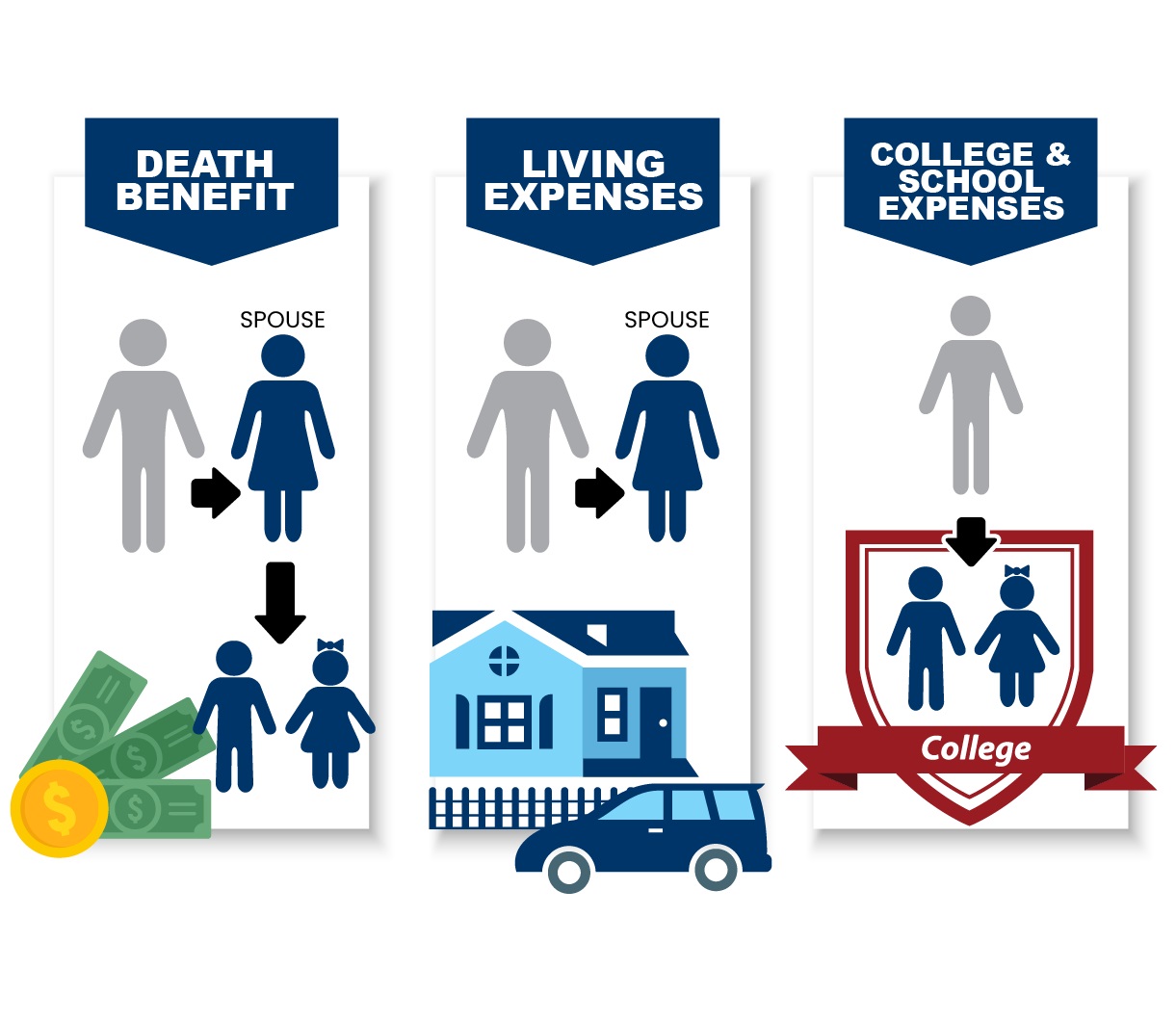

The primary purpose of term life insurance is to provide a death benefit to the beneficiaries in the event of the policyholder’s death during the coverage term. If the policyholder passes away within the term, the beneficiaries will receive the payout, also known as the death benefit. This can help cover financial obligations such as outstanding debts, mortgage payments, education expenses, or even provide a financial safety net for the family’s future.

One of the key advantages of term life insurance is its affordability. In comparison to permanent life insurance options, term life insurance typically has lower premiums, making it an attractive choice for individuals who want a high coverage amount at a more affordable price. Additionally, term life insurance policies are relatively straightforward, without the added investment or cash value components that permanent policies offer.

It’s important to note that term life insurance policies do not accumulate cash value over time. Unlike permanent policies, which have a savings or investment component that grows over the years, term life insurance simply provides coverage during the term. If the policyholder outlives the term, there is no cash value or surrender value. However, this is also why term life insurance premiums are lower than permanent policy premiums since they do not have the investment component.

Now that we have a solid understanding of term life insurance, let’s move on to the intriguing topic of what happens when a policy reaches its maturity date.

What is a Term Life Insurance Policy?

A term life insurance policy is a type of life insurance that provides coverage for a specified period, known as the term. It offers financial protection to the policyholder’s beneficiaries in the event of their death during the term of the policy. Term life insurance is designed to provide a lump-sum payout, also known as the death benefit, to the beneficiaries, helping them maintain financial stability and cover expenses in the policyholder’s absence.

The term of a term life insurance policy can range from as short as 1 year to as long as 30 years, depending on the specific terms and conditions of the policy. Policyholders can select the term based on their individual needs and financial circumstances. Common term lengths include 10, 15, 20, and 30 years.

Unlike permanent life insurance policies, which provide coverage for the lifetime of the policyholder, term life insurance policies have a fixed duration. Once the term is over, the policy expires. This means that if the policyholder outlives the term, there is typically no payout or benefit associated with the policy. However, this also means that term life insurance policies are generally more affordable than permanent policies, making them an attractive option for individuals seeking temporary coverage.

Term life insurance policies offer several advantages. Firstly, they provide a straightforward and easy-to-understand form of life insurance. Policyholders pay a regular premium throughout the term, and in return, their beneficiaries are guaranteed a death benefit if the policyholder passes away during the term. There are no complex investment or savings components involved, making term life insurance accessible to a wide range of individuals.

Secondly, term life insurance policies offer flexibility. Policyholders have the option to choose a term that aligns with their specific needs. For example, if they have young children and want to ensure their financial stability until they are grown and independent, they may opt for a 20-year term. On the other hand, if they have a short-term financial obligation, such as a mortgage or a business loan, they may choose a 10-year term that coincides with the duration of the loan.

Lastly, term life insurance policies allow policyholders to obtain high coverage amounts at a more affordable price compared to permanent policies. Since term life insurance only covers a specific period and does not build cash value over time, the premiums are typically lower. This makes term life insurance an attractive option for individuals who want to protect their loved ones and provide financial security without incurring excessive costs.

Now that we understand what a term life insurance policy is, let’s delve into how it actually works.

How Term Life Insurance Works

Understanding how term life insurance works is crucial for policyholders to make informed decisions and maximize the benefits of their coverage. Here’s a breakdown of how term life insurance operates:

1. Policy Purchase: When purchasing a term life insurance policy, the policyholder selects a coverage amount and a specified term. The coverage amount, also known as the death benefit, represents the sum of money that will be paid out to the beneficiaries upon the policyholder’s death.

2. Premium Payments: To keep the policy active, the policyholder is required to pay regular premiums throughout the term of the policy. These premiums can typically be paid monthly, quarterly, semi-annually, or annually. The premium amount is determined based on several factors including the policyholder’s age, health, lifestyle, and the desired coverage amount.

3. Coverage Period: The term of a term life insurance policy defines how long the coverage will be in effect. If the policyholder passes away within the specified term, the beneficiaries will receive the death benefit. However, if the policyholder outlives the term, the coverage expires, and there is no payout.

4. Death Benefit Payout: In the event of the policyholder’s death during the term, the chosen beneficiaries will receive the death benefit as a lump sum payment. The beneficiaries can use this money to cover financial obligations such as funeral expenses, outstanding debts, mortgage payments, educational expenses, or simply provide for their future financial security.

5. Renewal or Expiration: Once the term comes to an end, the policyholder has several options. They can choose to renew the policy for another term, convert it to a permanent life insurance policy, or let it expire. The available options may vary depending on the insurance company and the terms of the policy.

It’s essential to note that term life insurance policies do not accumulate cash value over time, unlike permanent life insurance policies. There is no investment or savings component associated with term life insurance. The primary purpose of term life insurance is to provide a death benefit to the beneficiaries if the policyholder passes away during the term.

Now that we have a solid grasp of how term life insurance works, let’s delve into the maturity of a term life insurance policy and what happens when it reaches that stage.

The Maturity of a Term Life Insurance Policy

The maturity of a term life insurance policy refers to the point at which the policy term comes to an end. It marks the completion of the agreed-upon coverage period and signifies a crucial turning point for both the policyholder and the insurance company.

When a term life insurance policy reaches its maturity date, several important considerations come into play. The policyholder must carefully evaluate their options and make decisions that align with their evolving financial needs and goals.

Unlike permanent life insurance policies, which can provide coverage for the entire lifetime of the policyholder, term life insurance policies have a predetermined term. This means that if the policyholder outlives the term, the policy expires, and there is typically no benefit paid out.

As the maturity date approaches, the insurance company will notify the policyholder regarding the expiration of the policy. It is essential for policyholders to understand their options and take appropriate actions based on their unique circumstances.

It’s important to note that the options available at the maturity of a term life insurance policy may vary depending on the specific insurance company and the terms and conditions of the policy. However, there are usually three main courses of action that policyholders can consider: renewing the policy, converting it to permanent life insurance, or letting it expire.

Each option has its own set of advantages, disadvantages, and financial implications. The policyholder’s decision should be based on their current financial situation and long-term goals.

In the next sections, we will explore these options in more detail and discuss the factors to consider when making a decision. By understanding these options and factors, policyholders can make an informed choice that aligns with their financial needs and provides them with the desired level of coverage and security.

Now, let’s dive into the specific options available to policyholders when a term life insurance policy matures.

What Happens When a Term Life Insurance Policy Matures?

When a term life insurance policy matures, it signifies the end of the policy’s coverage period. At this stage, policyholders have several options to consider based on their individual circumstances and financial goals.

1. Renew the Policy:

One option for policyholders is to renew the policy for another term. This allows them to continue having coverage for a specified period, which is particularly beneficial if their life circumstances or financial obligations have not significantly changed. However, it’s important to note that renewing the policy usually involves a reassessment of the policyholder’s health and may result in higher premiums due to their increased age.

2. Convert to Permanent Life Insurance:

Another option is to convert the term life insurance policy into a permanent life insurance policy. This conversion can provide ongoing coverage for the policyholder’s entire lifetime, along with potential benefits such as cash value accumulation and the ability to borrow against the policy. Converting to permanent life insurance typically requires meeting certain criteria and may involve adjusting the coverage amount and premium structure.

3. Let the Policy Expire:

The final option is to let the policy expire without taking any further action. If the policyholder outlives the term and chooses not to renew or convert the policy, the coverage will end, and there will be no benefit paid out. This option may be suitable for individuals who no longer have a need for life insurance coverage or have made alternative arrangements for their financial security.

It’s important for policyholders to carefully evaluate their financial situation, long-term goals, and insurance needs when deciding what to do when their term life insurance policy matures. Considerations such as dependents, outstanding debts, financial obligations, and desired legacy should all be taken into account.

Additionally, policyholders should assess the financial implications of each option. Renewing the policy may result in higher premiums due to age, while converting to permanent life insurance may involve increased costs in the form of higher premiums or additional fees. On the other hand, letting the policy expire means losing the potential benefit of ongoing coverage and the ability to leave a legacy or provide financial support to loved ones.

Ultimately, the decision on what to do when a term life insurance policy matures should be based on the policyholder’s individual circumstances and goals. Consulting with a financial advisor or an insurance professional can provide valuable insights and guidance in making the best choice.

Now that we’ve explored the options available, let’s dive deeper into the factors to consider when making a decision.

Options for Policyholders

When a term life insurance policy reaches its maturity date, policyholders have several options to consider. These options can provide flexibility and the opportunity to align their insurance coverage with their changing needs. Let’s explore the three main options available to policyholders:

1. Renew the Policy:

Renewing the policy involves extending the coverage for another term. This option allows policyholders to continue their life insurance coverage and maintain financial protection for their loved ones. Renewing the policy may be the right choice if the policyholder’s financial obligations or responsibilities are expected to continue beyond the original policy term. However, it’s important to note that renewing the policy usually leads to an increase in premiums due to the policyholder’s age. Policyholders should carefully assess the new premium costs and determine if they fit within their budget.

2. Convert to Permanent Life Insurance:

Policyholders also have the option to convert their term life insurance policy into a permanent life insurance policy. This provides the advantage of coverage for the policyholder’s entire lifetime. Converting to permanent life insurance allows policyholders to build cash value over time, which can be accessed through policy loans or withdrawals. Additionally, permanent life insurance policies offer the potential for tax-deferred growth on the cash value component. However, converting your policy may lead to higher premiums since permanent policies tend to be more expensive than term policies. It’s important to carefully consider the financial implications and assess whether the benefits align with your long-term goals.

3. Let the Policy Expire:

The third option is to let the policy expire without taking any further action. This may be a viable option if the policyholder’s circumstances have changed, and they no longer require life insurance coverage. For example, their financial obligations may have decreased, or they may have other means of providing financial security for their loved ones. If the policyholder chooses to let the policy expire, it’s important to ensure that alternative plans are in place to meet any remaining financial needs.

When evaluating these options, policyholders should consider factors such as their current financial situation, long-term goals, and the needs of their dependents. It’s also essential to review the insurance company’s specific terms and conditions regarding renewals and conversions. Consulting with a financial advisor or an insurance professional can provide valuable insights and help policyholders make an informed decision.

Remember, the option chosen should align with your unique circumstances and provide the desired level of coverage and financial security for you and your loved ones.

Now that we’ve explored the options available, let’s dive deeper into the factors to consider when making a decision.

Option 1: Renew the Policy

Renewing a term life insurance policy is the first option available to policyholders when their policy reaches its maturity date. This option allows policyholders to extend their coverage for another term, ensuring continued financial protection for their loved ones. Let’s explore the details of renewing the policy:

1. Assessment of Current Needs:

Before deciding to renew the policy, it’s important for policyholders to assess their current financial situation and needs. Consider factors such as outstanding debts, dependents, ongoing financial obligations, and the need for continued coverage in the event of your passing. If these factors indicate the importance of maintaining life insurance coverage, renewing the policy may be a suitable option.

2. Review of Premiums:

When renewing a term life insurance policy, it’s essential to review the new premium costs. As the policyholder ages, the premiums are likely to increase. It’s crucial to evaluate whether the revised premium amounts align with your budget and financial capabilities. Policyholders should consider the affordability of the new premiums and ensure they can comfortably manage the increased costs associated with the renewed policy.

3. Health Assessment:

Renewing a term life insurance policy may require a health reassessment. Insurance companies often require policyholders to provide updated information about their health status before renewing a policy. Depending on the insurer’s policies, a medical examination or questionnaire may be necessary. The outcome of the health assessment can impact the premium rates and the insurability for the renewed policy. It’s essential to be aware of any health-related requirements or potential changes in premium rates due to the reassessment.

4. Comparison of Options:

When considering renewing a term life insurance policy, it’s advisable to compare the renewal terms with other available insurance options. Factors to consider include the affordability of the new premiums, the length of the renewed term, and the coverage amount. Assessing other insurance products in the market can help policyholders determine if renewing their current policy remains the most suitable choice or if alternative options may better meet their needs and financial goals.

Renewing a term life insurance policy can provide peace of mind and ongoing financial protection. It allows policyholders to continue offering a safety net for their loved ones in the event of their untimely demise. However, it is important to carefully evaluate the new premium costs, reassess health requirements, and weigh the benefits against other available insurance options.

When making the decision to renew the policy, consult with a knowledgeable insurance professional or financial advisor who can provide guidance and help navigate the renewal process. Their expertise and insights can ensure that policyholders make an informed decision that aligns with their current situation and long-term goals.

Now that we’ve explored the option of renewing the policy, let’s move on to discussing the next option available to policyholders.

Option 2: Convert to Permanent Life Insurance

When a term life insurance policy matures, policyholders have the option to convert their policy to permanent life insurance. This conversion allows policyholders to transition from temporary coverage to lifelong protection with additional benefits. Let’s delve into the details of converting a term life insurance policy to permanent life insurance:

1. Lifelong Coverage:

The standout advantage of converting to permanent life insurance is that it provides coverage for the policyholder’s entire lifetime. Unlike term life insurance, which offers coverage for a specific period, permanent life insurance offers lifelong protection. This means that as long as the policyholder pays the premiums, their beneficiaries will receive a death benefit when the policyholder passes away, regardless of when that occurs.

2. Cash Value Accumulation:

Permanent life insurance policies, such as whole life or universal life insurance, have a cash value component. This means that a portion of the premiums paid goes towards building a cash value within the policy. Over time, the cash value grows tax-deferred and can be accessed through policy loans or withdrawals. The ability to accumulate cash value can provide policyholders with a potential source of funds for various financial needs during their lifetime.

3. Adjustments in Premiums and Coverage:

When converting from term life insurance to permanent life insurance, the premiums and coverage amounts will likely be adjusted. Permanent life insurance policies generally have higher premiums compared to term policies due to their lifelong coverage and cash value accumulation. It’s important to carefully review the revised premium costs and ensure they fit within your budget and financial capabilities. Additionally, consider whether the adjusted coverage amount aligns with your current and future financial obligations.

4. Policy Conversion Options:

Insurance companies may have specific policies and guidelines regarding conversions from term to permanent life insurance. It’s crucial to review these terms and understand the conversion options available to you. Some policies may offer a guaranteed conversion option, allowing policyholders to convert their policy without a medical examination. Others may have limitations or restrictions on the conversion process. Understanding these details can help facilitate a smooth transition from a term to a permanent policy.

Converting a term life insurance policy to permanent life insurance provides an opportunity for long-term financial security and various benefits, such as lifelong coverage and cash value accumulation. However, it’s important to carefully consider the revised premium costs, the adjusted coverage amounts, and the financial implications associated with permanent life insurance. Assessing your financial goals and long-term needs is crucial in determining whether converting to permanent life insurance is the right choice for you.

When considering this option, consult with a knowledgeable insurance professional or financial advisor who can provide guidance tailored to your specific circumstances. They can help evaluate the feasibility and benefits of converting your policy and assist you in making an informed decision.

Now that we have explored converting to permanent life insurance, let’s move on to discussing the final option available to policyholders.

Option 3: Let the Policy Expire

When a term life insurance policy matures, policyholders have the option to let the policy expire without taking any additional action. This option may be suitable for individuals whose circumstances have changed, and they no longer require life insurance coverage. Let’s explore the details of letting a term life insurance policy expire:

1. Assessing Financial Situations:

Prior to deciding to let the policy expire, it is important to assess your current financial situation. Consider factors such as outstanding debts, financial obligations, and the level of financial security provided for your loved ones. If your financial situation has significantly improved, or you have alternative means of providing financial support for your dependents, the need for life insurance coverage may have diminished.

2. Evaluating Existing Coverage:

Review any existing life insurance coverage you may have, such as employer-sponsored group life insurance or personal permanent life insurance policies. Assess whether these coverage options provide adequate protection for your specific needs and if they can serve as a viable alternative if you let the term life insurance policy expire. If you have sufficient coverage from other sources, letting the policy expire may be a reasonable decision.

3. Impact on Beneficiaries:

Consider the impact of letting the policy expire on your beneficiaries. Evaluate whether they have alternative sources of financial support or assets that can provide for their future needs in the event of your passing. If you have taken steps to ensure their financial well-being, such as setting up trusts or investment accounts, letting the policy expire may not have a substantial impact on their long-term financial security.

4. Future Insurance Needs:

Take into account any potential future insurance needs. While you may not require life insurance coverage at present, it’s important to consider if your circumstances might change in the future. Life events such as marriage, starting a family, or acquiring new financial obligations may necessitate reevaluating your insurance needs. If there is a likelihood that you will require coverage in the future, keeping the policy or exploring alternative insurance options may be prudent.

Letting a term life insurance policy expire can be a reasonable choice for individuals whose financial circumstances no longer necessitate coverage. By assessing your financial situation, evaluating existing coverage, considering the impact on beneficiaries, and anticipating future insurance needs, you can make an informed decision about letting the policy expire.

It’s important to note that if you decide to let the policy expire, ensure that alternative plans and provisions are in place to meet any remaining financial needs. Consulting with a financial advisor or an insurance professional can provide valuable insights and help navigate the decision-making process.

Now that we have explored letting the policy expire, let’s move on to discussing the factors to consider when making a decision among these options.

Factors to Consider When Making a Decision

When the maturity date of a term life insurance policy approaches, policyholders are faced with important decisions regarding the future of their coverage. To make an informed decision, it’s crucial to consider various factors that can impact the choice among renewing the policy, converting to permanent life insurance, or letting it expire. Here are key factors to evaluate:

1. Financial Situation:

Assess your current financial situation, including outstanding debts, ongoing financial obligations, and the financial needs of your dependents. Consider whether you have the means to continue paying premiums or if you may require a different financial strategy. It’s essential to choose an option that aligns with your financial capabilities and provides the necessary financial security for your loved ones.

2. Health and Insurability:

Consider your health and insurability when making a decision. If your health has deteriorated since purchasing the term life insurance policy, renewing the policy or converting it to permanent life insurance may be a more viable option. However, if your health is excellent, you may have more choices available to you. Take into account the impact of health considerations on premiums, as some options may be subject to a health reassessment.

3. Long-Term Goals:

Evaluate your long-term goals and financial aspirations. Do you prioritize lifelong coverage or cash value accumulation? If you foresee the need for ongoing financial protection or potential access to cash value, converting to permanent life insurance may be the most suitable option. Conversely, if your long-term financial goals are already being met through other means, letting the policy expire can be a reasonable decision.

4. Beneficiaries and Dependents:

Consider the needs of your beneficiaries and dependents. Are they financially dependent on you, or are there alternative sources of support available to them? Evaluate the potential impact of your decision on their financial well-being and future needs. Ensuring their long-term financial security should be a primary concern when deciding the future of your life insurance coverage.

5. Affordability:

Assess the affordability of premiums associated with each option. Review the revised premium amounts for renewing the policy or converting to permanent insurance. Ensure that these premiums fit within your budget and overall financial plan. Striking a balance between adequate coverage and affordable premiums is essential to maintain financial stability while protecting your loved ones.

6. Future Insurance Needs:

Anticipate any potential future insurance needs. Consider life events such as marriage, starting a family, or acquiring new financial obligations that may necessitate coverage in the future. If there is a likelihood of needing coverage down the road, it may influence your decision to renew, convert, or let the policy expire. Be mindful of your long-term financial goals and the potential impact on future insurance needs.

By carefully weighing these factors, policyholders can make an informed decision regarding the future of their term life insurance policy. Consulting with a financial advisor or an insurance professional can provide valuable guidance tailored to your specific circumstances and objectives.

Remember that the optimal decision may depend on your unique situation, financial goals, and the needs of your beneficiaries. Take the time to evaluate all relevant factors before making a final decision.

Now that we’ve explored the key factors to consider, let’s wrap up our discussion.

Factors Affecting the Premiums

When it comes to life insurance, premiums play a significant role in determining the cost of coverage. Several factors influence the premiums associated with term life insurance policies. Understanding these factors is crucial in evaluating the affordability and long-term implications of the coverage. Let’s delve into the key factors that can affect life insurance premiums:

1. Age:

One of the primary factors that impact life insurance premiums is the age of the policyholder. Generally, younger individuals pay lower premiums compared to older individuals. This is because younger policyholders are considered less likely to pass away during the term of the policy, resulting in a lower risk for the insurance company.

2. Health and Medical History:

The health of the policyholder plays a significant role in determining life insurance premiums. Insurance companies typically evaluate the policyholder’s health through a medical examination or review of medical records. Conditions such as high blood pressure, diabetes, and obesity may lead to higher premiums, as they are associated with increased health risks. Additionally, a history of serious illnesses or chronic conditions may result in higher premium costs.

3. Lifestyle Factors:

Lifestyle choices and habits can influence life insurance premiums. Factors such as tobacco use, excessive alcohol consumption, and participation in high-risk activities like extreme sports or dangerous occupations may increase premium costs. Insurance companies consider such lifestyle factors as they can impact the policyholder’s overall health and longevity.

4. Gender:

Gender is another influential factor in determining life insurance premiums. On average, women tend to have longer life expectancies than men, which can result in lower premiums for female policyholders. This is because insurance companies base premiums on actuarial tables that consider the life expectancy of various demographic groups.

5. Coverage Amount and Term Length:

The coverage amount and term length selected for a term life insurance policy also affect the premiums. Generally, higher coverage amounts and longer terms result in higher premiums. Policyholders should assess their needs and financial capabilities to strike a balance between adequate coverage and affordability.

6. Family Medical History:

The medical history of the policyholder’s immediate family may impact life insurance premiums. Conditions such as heart disease, cancer, and other hereditary illnesses in the family may lead to higher premium costs, as they can increase the risk of the policyholder developing similar health issues in the future.

7. Underwriting and Insurability:

Each insurance company has its own underwriting guidelines and processes for assessing risk and determining premiums. Their evaluation of factors such as health, lifestyle, and medical history can vary, leading to different premium rates. Policyholders with excellent health and favorable risk profiles may be eligible for lower premiums from certain insurers compared to others.

It’s important to note that these factors can vary across insurance companies, and the weight given to each factor may differ as well. Additionally, rates and premiums are subject to change over time.

Understanding the factors that affect life insurance premiums allows policyholders to make better-informed decisions when selecting coverage and evaluating pricing options. Consulting with an insurance professional can provide valuable insights and guidance tailored to your specific circumstances in order to secure the best coverage at an affordable premium rate.

Now that we’ve explored the factors influencing premiums, let’s conclude our discussion.

Assessing Personal Financial Situation

When it comes to life insurance, assessing your personal financial situation is a crucial step in determining the right coverage for your needs. Evaluating your financial circumstances allows you to align your life insurance coverage with your current and future financial goals. Here are key factors to consider when assessing your personal financial situation:

1. Income and Expenses:

Take a comprehensive look at your income and expenses to gauge your financial stability. Evaluate your monthly income, including earnings from employment, investments, and any other sources. On the expense side, consider recurring bills, debt payments, family obligations, and discretionary spending. This assessment helps you determine how life insurance premiums will fit into your budget and ensure that you can comfortably afford the coverage.

2. Outstanding Debts:

Consider any outstanding debts you have, such as a mortgage, car loans, student loans, or credit card debt. Assess the remaining balances, interest rates, and the impact they may have on your overall financial obligations. Life insurance can help cover these debts in the event of your passing, ensuring that your loved ones are not burdened with financial liabilities.

3. Dependents and Loved Ones:

Evaluate the financial needs of your dependents and loved ones. Consider the number of dependents, their current ages, and their future financial requirements. This may include costs for education, healthcare, housing, and day-to-day living expenses. Assessing the financial well-being of your dependents allows you to determine the appropriate coverage amount to provide for their needs in your absence.

4. Future Financial Goals:

Take into account your future financial goals and aspirations. Consider milestones you want to achieve, such as retirement planning, funding higher education for children, starting a business, or leaving a legacy. Life insurance can play a role in helping you achieve these goals by providing a financial safety net or acting as an investment tool through permanent life insurance policies with cash value accumulation.

5. Existing Assets and Insurance:

Evaluate your existing assets, such as savings accounts, investments, and retirement accounts. Assess how these assets contribute to your financial security and the potential role they may play in supporting your dependents in the event of your passing. Additionally, consider any existing life insurance coverage you may have, such as employer-sponsored policies or personal permanent life insurance.

6. Risk Tolerance:

Understand your risk tolerance when it comes to financial matters. Consider your comfort level with potential fluctuations in investments, the need for stability in your coverage, and how you want to pass on wealth to your beneficiaries. This assessment will help guide you in deciding between term life insurance and permanent life insurance options, as well as determining the appropriate coverage amount.

Assessing your personal financial situation empowers you to make informed decisions when selecting life insurance coverage. By considering your income, expenses, outstanding debts, dependents, future goals, existing assets, and risk tolerance, you can determine the coverage amount, policy type, and premium levels that align with your needs and priorities.

Remember that assessing your personal financial situation should be an ongoing process. As your circumstances change, it’s important to review and adjust your life insurance coverage to ensure that it continues to adequately protect your loved ones and support your financial goals.

If you need assistance in assessing your personal financial situation or understanding how life insurance fits into your broader financial plan, consult with a financial advisor who can provide tailored guidance and help you make the best decisions for your specific needs.

Now that we’ve explored assessing personal financial situations, let’s conclude our discussion.

Evaluating Long-term Needs

When considering life insurance, it’s essential to evaluate your long-term needs to ensure that you choose the right coverage for your financial goals. Long-term needs assessment helps you determine the duration, amount, and type of life insurance that best suits your circumstances. Here are key aspects to consider when evaluating your long-term needs:

1. Duration of Coverage:

Determine how long you anticipate needing life insurance coverage. Consider your financial obligations and the length of time they will last. For example, if you have young children, you may want coverage until they become financially independent. Additionally, assess any outstanding debts, such as a mortgage or business loan, and consider when you expect to pay them off. Evaluating the duration of your financial obligations helps you select an appropriate term length for your life insurance policy.

2. Financial Dependents:

Evaluate the financial needs of your dependents over the long term. Consider the number of dependents, their current ages, and future milestones such as education expenses or wedding costs. Determine the financial support they would require in the event of your passing, accounting for inflation and changing circumstances. Assessing the long-term financial dependency of your loved ones helps determine the appropriate coverage amount to provide for their needs.

3. Income Replacement:

Consider the amount of income that would need to be replaced if you were to pass away. Evaluate your current income, future earning potential, and any factors that may impact future income, such as promotions or career changes. Assessing the income replacement needs of your family helps ensure that they can maintain their standard of living and cover expenses in your absence, such as housing costs, daily expenses, and future financial aspirations.

4. Financial Goals:

Assess your long-term financial goals and how life insurance can help you achieve them. Consider milestones such as retirement planning, funding higher education for your children, or leaving a financial legacy for future generations. Life insurance policies, especially permanent life insurance that builds cash value, can serve as a financial tool to support these goals. Evaluating how life insurance aligns with your broader financial objectives can guide you in selecting the appropriate type and amount of coverage.

5. Estate Planning and Taxes:

Consider the potential impact of taxes and estate planning on your long-term financial needs. Evaluate whether there is a need for liquidity to cover estate taxes or other expenses related to transferring your assets to your beneficiaries. Life insurance can play a valuable role in estate planning, providing a source of funds to cover these costs and ensuring the smooth transfer of your wealth to the next generation.

6. Changing Circumstances:

Anticipate any potential changes in your personal circumstances that may affect your long-term needs. Factors such as marriage, divorce, or starting a business can alter your financial obligations and the level of protection needed for your loved ones. Regularly reassess your long-term needs to ensure that your life insurance coverage remains adequate and aligned with your evolving circumstances.

Evaluating your long-term needs allows you to select life insurance coverage that provides the right level of protection and support for your future financial goals. By considering the duration of coverage, financial dependents, income replacement, financial goals, estate planning, and potential changes in circumstances, you can make an informed decision about the type and amount of life insurance that best fits your needs.

If you require assistance in evaluating your long-term needs or navigating the complexities of life insurance, consult with a financial advisor or life insurance professional who can provide personalized guidance tailored to your specific situation.

Now that we’ve explored evaluating long-term needs, let’s conclude our discussion.

Conclusion

Understanding what happens when a term life insurance policy matures is essential for policyholders looking to make informed decisions about their coverage. The maturity of a term life insurance policy marks a vital turning point, providing policyholders with options to consider based on their unique circumstances and financial goals.

Renewing the policy offers the continuation of coverage for another term, allowing policyholders to maintain financial protection for their loved ones. However, this option may come with increased premiums due to age. Converting the policy to permanent life insurance provides lifelong coverage and potential benefits such as cash value accumulation, but it may require higher premiums. On the other hand, letting the policy expire is suitable for individuals whose financial situations have changed and no longer require life insurance coverage.

When making a decision, policyholders need to assess factors such as their financial situation, health, long-term goals, dependents, affordability, and future insurance needs. Evaluating personal financial situations allows policyholders to align coverage with their current and future financial goals, while assessing long-term needs ensures that the coverage meets the needs of dependents and future obligations.

It’s crucial to consider factors that affect premiums, such as age, health, lifestyle choices, coverage amount, and underwriting guidelines. By understanding these factors, policyholders can have a clearer picture of the cost associated with their life insurance coverage.

When evaluating options and assessing personal and long-term financial situations, consulting with a financial advisor or insurance professional can provide valuable insights and guidance to make an informed decision. Their expertise and knowledge will aid in selecting the coverage that best aligns with individual needs and financial goals.

In conclusion, understanding the maturity of a term life insurance policy and the available options is vital for policyholders. By carefully considering personal circumstances, evaluating long-term needs, and assessing factors such as premiums and financial goals, policyholders can make confident decisions to protect their loved ones and build a financially secure future.

Remember, life insurance is an essential component of a comprehensive financial plan, providing peace of mind and ensuring that the ones you care about will be safeguarded financially in the event of your passing. Regularly review and reassess your coverage to adapt to changing circumstances and guarantee that it continues to meet your evolving needs.