Finance

What Is A Debt Investment?

Modified: February 21, 2024

Learn about debt investments and how they can help you grow your finances. Discover the benefits and potential risks of this type of investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where various investment options await those seeking to grow their wealth. One such option is debt investments, a popular and often lucrative avenue for investors. In this article, we will explore the concept of debt investments, discuss the types available, analyze the benefits and risks associated with them, and provide guidance on how to choose the right debt investment for your financial goals.

Debt investment, also known as fixed income investment, involves lending money to a borrower who promises to repay the principal amount along with interest over a specified period. This form of investment is widely utilized by individuals, institutions, and even governments to generate income and preserve capital.

Debt investments can take various forms, including government bonds, corporate bonds, certificates of deposit (CDs), money market funds, and loan notes. Each type offers different risk levels, maturities, and interest rates, allowing investors to diversify their portfolio and tailor their investment strategy to their risk appetite and financial objectives.

One of the key benefits of debt investments is the potential for a steady and predictable income stream. Unlike equity investments, where returns are tied to the performance of the underlying company, debt investments provide a fixed interest rate or coupon payment, ensuring a regular cash flow for investors. Additionally, debt investments are generally considered less volatile than stocks, making them an attractive option for risk-averse individuals or those looking to balance the risk-reward ratio in their portfolio.

However, it’s important to note that debt investments are not without their risks. The main risk associated with this type of investment is credit risk, which refers to the possibility that the borrower may default on their obligations and fail to repay the principal and interest. Default risk varies depending on the creditworthiness of the borrower, with government bonds typically considered the safest option, followed by high-rated corporate bonds and riskier instruments like junk bonds.

Before diving into the world of debt investments, it’s crucial to consider several factors. These include your investment goals and time horizon, risk tolerance, liquidity needs, and overall investment strategy. By understanding these factors and conducting thorough research, you can make informed decisions and choose debt investments that align with your financial objectives.

In the following sections of this article, we will delve deeper into the different types of debt investments, explore their respective pros and cons, and provide guidance on how to select the right investment for you. Additionally, we will walk you through the debt investment process and provide a real-life example to illustrate the concepts discussed.

So, let’s get started and unlock the world of debt investments, where steady income and capital preservation await!

Definition of Debt Investment

Debt investment, also known as fixed income investment, is a financial strategy where individuals or entities lend money to borrowers in exchange for the promise of repayment with interest over a specified period. In simple terms, it involves investing in debt securities or loan arrangements issued by governments, corporations, financial institutions, or even individuals.

When you make a debt investment, you essentially become a creditor to the borrower. The borrower may use the funds to finance various activities such as business expansion, infrastructure development, or personal financial needs. In return, you, as the investor, receive regular interest payments, referred to as coupon payments, throughout the investment term. At the end of the tenure, you are entitled to receive the principal amount originally lent.

Debt investments typically offer a fixed interest rate or yield, which is determined by factors such as the creditworthiness of the borrower, prevailing market conditions, and the duration of the investment. The interest earned on debt investments is often considered a predictable and stable source of income, making them a popular choice for income-oriented investors.

There are various types of debt investments available in the financial markets, each with its own characteristics, risk profile, and potential returns. Some common types of debt investments include:

- Government Bonds: These are debt securities issued by national governments to finance public expenditure. They are considered relatively safe due to the perceived low risk of default. Examples include Treasury bonds in the United States and government bonds issued by countries around the world.

- Corporate Bonds: These debt instruments are issued by corporations to raise capital for business operations or expansion. Corporate bonds typically offer higher interest rates compared to government bonds to compensate for the additional risk associated with corporate borrowers.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks and financial institutions. They have fixed maturity dates and offer a predetermined interest rate, making them a secure option for conservative investors.

- Money Market Funds: These funds invest in short-term debt securities, such as Treasury bills and commercial paper. Money market funds aim to provide stable returns while maintaining high liquidity.

- Loan Notes: Loan notes are debt instruments issued by companies or governments to raise funds from investors. They are similar to bonds but are often offered by smaller entities or in private placements.

Debt investments play a crucial role in the financial ecosystem. They provide a means for borrowers to access capital while offering a reliable and relatively low-risk investment option for individuals and institutions. By investing in debt securities, investors can earn regular income, preserve capital, and diversify their investment portfolio.

It is important to note that debt investments carry their own set of risks. The primary risk is credit risk, which refers to the possibility that the borrower may default on their repayment obligations. Other risks include interest rate risk, inflation risk, and currency risk, depending on the specific characteristics of the investment and the prevailing market conditions.

In the following sections, we will explore the benefits and risks associated with debt investments in more detail. Additionally, we will provide guidance on how to evaluate and select the right debt investments based on your individual financial goals, risk tolerance, and investment horizon.

Types of Debt Investments

Debt investments come in various forms, offering investors a wide range of options to choose from based on their investment objectives and risk tolerance. Let’s explore some of the common types of debt investments:

- Government Bonds: These are debt securities issued by national governments to finance public spending. They are considered one of the safest forms of debt investments since they are backed by the full faith and credit of the government. Government bonds come in different maturities, from short-term T-bills to long-term bonds, and generally offer lower interest rates compared to riskier investments.

- Corporate Bonds: Corporate bonds are debt securities issued by corporations to raise capital for various purposes, such as expanding operations or funding new projects. Unlike government bonds, corporate bonds carry higher risk since they are dependent on the financial strength and creditworthiness of the issuing company. Corporate bonds can be classified into investment-grade bonds, which are issued by companies with a higher credit rating, and high-yield bonds (also known as junk bonds), which are issued by companies with lower credit ratings but offer higher yields to compensate for the increased risk.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks and financial institutions. They have fixed maturities ranging from a few months to several years and offer a fixed interest rate. CDs are considered relatively safe investments since they are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States. However, they typically offer lower returns compared to other debt instruments.

- Money Market Funds: Money market funds are mutual funds that invest in short-term debt securities, such as Treasury bills, certificates of deposit, and commercial paper. These funds aim to provide liquidity and stability in the short term while offering higher yields than traditional savings accounts or CDs. Money market funds are often used as a cash management tool for investors looking for low-risk options with some potential for returns.

- Municipal Bonds: Municipal bonds are debt securities issued by state and local governments to fund public projects, such as infrastructure development or education initiatives. Municipal bonds are appealing to investors due to their tax advantages. The interest earned from most municipal bonds is tax-free at the federal level, and in some cases, may also be exempt from state and local taxes.

- Loan Notes: Loan notes are debt instruments issued by companies, governments, or other entities to raise capital directly from investors. They are similar to bonds but are often issued by smaller entities or in private placements. Loan notes can offer attractive returns but may carry higher risk compared to traditional bonds since they may not have credit ratings or the same level of liquidity.

These are just a few examples of the many types of debt investments available in the market. Each type has its own characteristics, risk profile, and potential returns. It is important to conduct thorough research and consider your investment goals and risk tolerance before selecting the most suitable debt investment for your portfolio.

In the next sections, we will explore the benefits and risks associated with debt investments to provide you with a comprehensive understanding of this investment strategy.

Benefits of Debt Investments

Debt investments offer several advantages for investors looking to diversify their portfolio and generate predictable income. Let’s explore some of the key benefits of investing in debt instruments:

- Steady Income Stream: One of the primary benefits of debt investments is the potential for a steady and predictable income stream. Unlike equity investments, where returns may fluctuate based on the performance of a company, debt investments provide investors with fixed interest payments. This makes them particularly attractive for income-oriented investors who rely on regular cash flow.

- Preservation of Capital: Debt investments are generally considered less volatile compared to equity investments. The borrower is obligated to repay the principal amount at the maturity of the investment, providing a level of certainty for investors in terms of capital preservation. This makes debt investments an attractive option for risk-averse individuals or those looking to balance the risk-reward ratio in their portfolio.

- Portfolio Diversification: Including debt investments in your portfolio can help diversify your investment holdings and reduce overall risk. Debt instruments have a different risk profile compared to stocks and other equity investments. By diversifying across asset classes, such as stocks, bonds, and cash equivalents, investors can potentially minimize the impact of market downturns on their overall portfolio.

- Potential for Higher Yields: While debt investments are generally considered lower risk compared to equities, certain types of debt instruments, such as high-yield bonds or emerging market debt, can offer higher yields to compensate for the additional risk. This can be appealing for investors who are willing to take on a slightly higher level of risk in exchange for potentially higher returns.

- Relatively Liquid: Many debt instruments, such as government bonds and corporate bonds, trade in active secondary markets. This provides investors with the flexibility to sell their investments and access liquidity when needed. However, it’s important to note that some debt instruments, like CDs or certain loan notes, may have specific maturity dates and limited liquidity.

- Tax Advantages: Certain debt investments, such as municipal bonds, offer tax advantages that can enhance after-tax returns. The interest earned from municipal bonds is often exempt from federal income tax, and in some cases, may also be free from state and local taxes. This can be particularly beneficial for investors in higher tax brackets.

It’s important to note that while debt investments offer attractive benefits, they also come with certain risks and considerations. Investors should carefully evaluate the creditworthiness of the borrower, assess the potential for default, and consider factors such as interest rate fluctuations and inflation when making investment decisions.

In the next section, we will explore the risks associated with debt investments to provide you with a comprehensive understanding of the potential downsides.

Risks of Debt Investments

While debt investments can provide stability and income, they are not without risks. Investors should be aware of the potential downsides associated with debt instruments. Let’s examine some of the key risks involved:

- Credit Risk: Credit risk is the most significant risk associated with debt investments. It refers to the possibility that the borrower may default on their repayment obligations, resulting in a loss of principal and missed interest payments. The creditworthiness of the borrower plays a crucial role in determining the risk level of the investment. Government bonds are generally considered to have low credit risk, while corporate bonds issued by less creditworthy companies carry higher credit risk.

- Interest Rate Risk: Interest rate risk is the risk that changes in interest rates can affect the value of fixed-income securities. When interest rates rise, bond prices typically fall, and vice versa. Therefore, if interest rates increase after investing in a fixed-rate bond, the value of the bond in the market may decrease. This can potentially lead to capital losses if the bond needs to be sold before maturity.

- Inflation Risk: Inflation risk refers to the possibility that the purchasing power of future interest and principal payments may be eroded by inflation. If the rate of inflation exceeds the interest rate earned on the debt investment, the real value of the returns may decline over time. This risk is particularly relevant for long-term debt investments with fixed interest rates.

- Liquidity Risk: While many debt instruments are relatively liquid, allowing investors to buy or sell them in secondary markets, some may have limited liquidity. This means that there may not be an active market to buy or sell the investment at favorable prices. For example, certain loan notes or private placements may have restrictions on transferability and can be challenging to sell before maturity.

- Call Risk: Call risk applies to certain bonds that have callable features, meaning the issuer has the right to redeem the bond before its maturity date. If interest rates decline, issuers may choose to call their bonds and refinance at lower rates, resulting in investors receiving their principal earlier than expected and potentially reinvesting at lower yields.

- Default Risk: Default risk is a subset of credit risk and specifically refers to the chance that the borrower will fail to make timely principal and interest repayments. This risk is more common with lower-rated corporate bonds or debt investments in emerging markets where political or economic instability may impact the repayment ability of the borrower.

It’s essential for investors to carefully evaluate the risk profile of debt investments before making investment decisions. This involves assessing the creditworthiness of the issuer, understanding the terms and conditions of the investment, and considering the potential impact of economic factors such as interest rates and inflation.

In the next section, we will discuss several factors to consider before making a debt investment, helping you make informed decisions and mitigate potential risks.

Factors to Consider Before Making a Debt Investment

Before investing in debt instruments, it’s crucial to carefully evaluate several factors to ensure the investment aligns with your financial goals and risk tolerance. Let’s discuss some key factors to consider:

- Investment Objectives: Clarify your investment objectives and understand the role debt investments will play in your overall portfolio. Determine whether you are seeking regular income, capital preservation, or a balance between the two. This will help guide your decision-making process and the types of debt investments that are most suitable for you.

- Time Horizon: Consider your investment time horizon, as it will influence the choice of debt instruments. Short-term goals may be better suited for investments with shorter durations, such as government bonds or money market funds, while longer-term goals may allow for investments with higher potential returns and possibly greater risk, such as corporate bonds.

- Risk Tolerance: Assess your risk tolerance and comfort level with potential fluctuations in the value of your investments. If you have a low risk tolerance, you may want to focus on investment-grade government or corporate bonds. For those with a higher risk tolerance, high-yield bonds or emerging market debt may be considered.

- Creditworthiness: Evaluate the creditworthiness of the issuer or borrower. This can be assessed through credit ratings provided by reputable credit rating agencies. High credit ratings indicate lower default risk, while lower ratings suggest a higher risk of default. Consider the trade-off between risk and potential returns when selecting debt investments.

- Interest Rates and Yield: Take into account prevailing interest rates and the potential yield of the debt investment. Higher interest rates generally increase the returns on debt instruments, but they may also lead to a decrease in the market value of existing bonds. Assess the potential yield relative to the associated risks to determine if the investment is suitable for your financial goals.

- Market Conditions: Analyze the current economic and market conditions. Economic factors such as inflation, central bank policies, and GDP growth rates can impact the performance of debt investments. Consider the potential impact of these factors on the issuer’s ability to meet its repayment obligations.

- Liquidity: Determine the liquidity needs of your investment. If you require immediate access to your funds, prioritize investments that offer high liquidity, such as government bonds or actively traded corporate bonds. If you have a longer-term investment horizon, you may be more willing to consider less liquid investments with potentially higher returns.

By considering these factors and conducting thorough research, you can make more informed decisions when selecting debt investments. It’s essential to strike a balance between risk and potential returns and align your investments with your financial goals and risk tolerance.

In the next section, we will provide guidance on how to choose the right debt investment based on your individual circumstances and investment preferences.

How to Choose a Debt Investment

Choosing the right debt investment requires careful consideration of your financial goals, risk tolerance, and investment preferences. Here are some key steps to help you in the decision-making process:

- Define Your Investment Objectives: Clearly identify your investment objectives and what you hope to achieve through your debt investment. Are you looking for regular income, capital preservation, or a combination of both? Understanding your objectives will help you narrow down the options and select the most suitable debt investment.

- Evaluate Risk and Return: Assess the risk and potential return of the debt investment options available to you. Consider the creditworthiness of the issuer, as reflected in credit ratings. Evaluate the yield or interest rate offered by the investment and ensure it aligns with your expectations and risk tolerance. Higher returns often come with higher risks, so strike a balance that suits your comfort level.

- Diversify Your Portfolio: Diversification is key to managing risk in your investment portfolio. Consider including a mix of different types of debt instruments with varying risk profiles. This can help mitigate the impact of any individual investment’s underperformance and provide stability to your overall portfolio.

- Assess Liquidity Needs: Determine your liquidity requirements and choose debt investments accordingly. If you anticipate needing quick access to your funds, prioritize investments that offer high liquidity, such as government bonds or actively traded corporate bonds. If you have a longer-term investment horizon and can afford to lock your funds for a longer period, consider investments with less liquidity but potentially higher returns.

- Research and Due Diligence: Conduct thorough research on the potential debt investments you are considering. Review the financial health and stability of the issuer, their track record, and any relevant news or developments that may impact the investment. Analyze the macroeconomic factors that may affect the issuer’s ability to meet its repayment obligations.

- Consider Tax Implications: Take into account the tax implications of your debt investment. Certain debt instruments, such as municipal bonds, may offer tax advantages where the interest earned is exempt from federal, and in some cases, state and local taxes. Factor in the potential tax efficiency of the investment when making your decision.

- Seek Professional Advice: If you are unsure about selecting the right debt investment, consider consulting a financial advisor or investment professional. They can provide personalized advice based on your individual circumstances, goals, and risk tolerance. A professional can help you navigate the complexities of the debt market and make informed investment decisions.

Remember that choosing a debt investment requires careful analysis and ongoing monitoring. Market conditions and the financial health of the issuer can change over time. Regularly review your investments and make adjustments as necessary to ensure they continue to align with your investment goals and risk appetite.

In the next section, we will walk you through the debt investment process, providing you with a clear understanding of how it works.

Understanding the Debt Investment Process

The debt investment process involves several key steps that investors need to understand before engaging in this type of investment. Let’s walk through the process step by step:

- Educate Yourself: Begin by gaining a solid understanding of debt investments. Familiarize yourself with different types of debt instruments, their characteristics, and associated risks. Learn about key concepts such as credit ratings, interest rates, and maturity dates to make informed investment decisions.

- Set Investment Goals: Determine your investment objectives, whether it’s generating regular income, preserving capital, or growth. Consider your risk tolerance and time horizon as these factors will guide your debt investment strategy.

- Research Debt Instruments: Research various debt instruments available in the market. Understand the features, terms, and conditions of each instrument, such as the interest rate, maturity, and creditworthiness of the issuer. Compare different options and evaluate their risk and return profiles.

- Perform Due Diligence: Conduct thorough due diligence on the issuer of the debt instrument. Review the issuer’s financial statements, credit rating, and any other relevant information. Evaluate the issuer’s ability to fulfill their repayment obligations and assess the potential risks involved.

- Build a Diversified Portfolio: Construct a well-diversified portfolio by investing in a mix of debt instruments. Allocate your investments across different issuers, sectors, and types of debt to spread risk. Diversification helps mitigate the impact of any individual investment’s performance on your overall portfolio.

- Place Your Investment: Once you have identified the debt instrument that aligns with your investment goals, open an account with a brokerage firm or financial institution that offers access to that particular investment. Follow their instructions to place your investment, which may involve submitting an application or purchasing the debt instrument through a trading platform.

- Monitor Your Investments: Regularly monitor the performance of your debt investments. Stay informed about any news or updates that may affect the issuer or the market conditions. Keep track of interest payments and the maturity date of each instrument to manage your cash flow and make informed decisions about reinvesting or selling the investments.

- Review and Adjust: Periodically review your debt investment portfolio to ensure it continues to align with your investment goals and risk tolerance. Adjust your investments as needed based on changes in market conditions, your financial situation, and your investment objectives.

It’s important to note that the debt investment process requires ongoing attention and evaluation. Stay informed about changes in interest rates, economic indicators, and creditworthiness of issuers to make informed decisions about your portfolio.

In the next section, we will provide a real-life example of a debt investment to illustrate how these investments work in practice.

Example of a Debt Investment

To illustrate how a debt investment works, let’s consider an example of investing in corporate bonds.

Suppose an investor, Sarah, has a moderate risk tolerance and is seeking a steady income stream. After conducting research and evaluating her options, she decides to invest in corporate bonds issued by a reputable multinational company in the technology sector.

Sarah purchases $10,000 worth of corporate bonds with a coupon rate of 5% per annum and a maturity period of 5 years. This means that Sarah will receive an annual interest payment of $500 (5% of $10,000) from the company for the duration of the bond’s term.

Each year, Sarah will receive her interest payment through the bond’s coupon rate. At the end of the 5-year period, she will also receive her principal investment of $10,000. This provides her with a predictable income stream and the assurance that her initial investment will be repaid by the company at maturity.

Throughout the investment period, Sarah diligently monitors the financial health of the company, keeping an eye on any news or updates that may affect the company’s ability to meet its debt obligations. This allows her to assess the credit risk associated with the investment and make informed decisions.

If Sarah had invested in government bonds instead, she might have received a lower interest rate compared to corporate bonds. However, government bonds are generally considered to have lower credit risk as they are backed by the government’s ability to tax and print money. This trade-off between risk and return is an important consideration when selecting debt investments.

In this example, Sarah benefits from the steady income provided by the corporate bonds and the potential preservation of her capital. Furthermore, by diversifying her investment portfolio to include both stocks and debt investments, Sarah minimizes her overall risk exposure and achieves a more balanced portfolio.

It’s worth noting that this example is a simplified representation and that the actual mechanics of a debt investment can vary. Debt investments come in different forms, with varying interest rates, maturities, and credit ratings. Investors should carefully evaluate the specific terms and conditions of each investment before making their decisions.

Remember, conducting thorough research, assessing risk, and staying informed are crucial when engaging in debt investments. By doing so, investors like Sarah can make informed investment decisions and potentially achieve their financial goals.

Conclusion

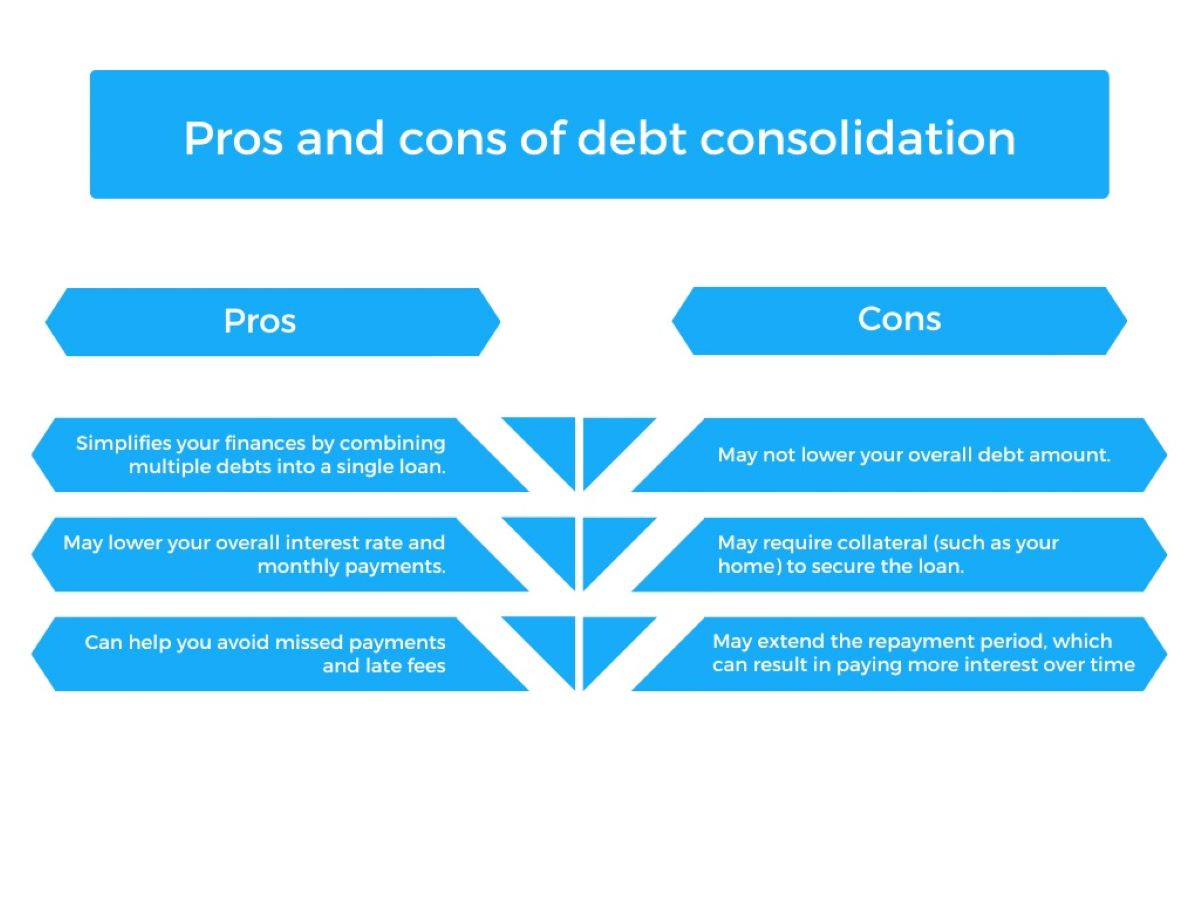

Debt investments are a vital component of a well-rounded investment portfolio, offering a range of benefits such as steady income, capital preservation, and portfolio diversification. However, they also come with their share of risks and considerations.

In this article, we explored the definition of debt investments and discussed various types, including government bonds, corporate bonds, certificates of deposit, money market funds, and loan notes. We examined the benefits of debt investments, such as a predictable income stream and potential for higher yields, as well as the risks involved, including credit risk, interest rate risk, and liquidity risk.

Before venturing into debt investments, it is crucial to consider several factors such as investment objectives, time horizon, risk tolerance, and liquidity needs. By evaluating these factors and conducting thorough research, investors can make informed decisions and select debt investments that align with their financial goals.

We also discussed the process of choosing a debt investment and highlighted the importance of analyzing risk and return, diversifying portfolios, and seeking professional advice when needed. Additionally, we provided a step-by-step understanding of the debt investment process, from education and goal setting to monitoring and adjusting investments over time.

Finally, we presented an example of a debt investment, showcasing how an investor might choose to invest in corporate bonds to achieve a steady income stream and preserve capital.

In conclusion, debt investments offer the potential for stable income, capital preservation, and diversification. However, investors should carefully evaluate risks, perform due diligence, and monitor their investments to make informed decisions and mitigate potential downsides. With the right research, knowledge, and risk management, debt investments can play a valuable role in an individual’s or institution’s overall investment strategy.