Home>Finance>What Is Better: Debt Consolidation Or Bankruptcy

Finance

What Is Better: Debt Consolidation Or Bankruptcy

Published: December 21, 2023

Find out whether debt consolidation or bankruptcy is a better financial option for you. Explore the pros and cons of each to make an informed decision on managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with overwhelming debt can be a stressful and challenging situation. It can leave individuals feeling trapped, unsure of how to regain control of their finances. In these circumstances, debt consolidation and bankruptcy are two options that can provide much-needed relief. However, it’s crucial to understand the differences between the two and carefully consider which option is best suited to your specific financial situation.

Debt consolidation involves combining multiple debts into a single loan, ideally with a lower interest rate and more manageable monthly payments. On the other hand, bankruptcy is a legal process that allows individuals or businesses to eliminate or restructure their debts, providing a fresh financial start.

Both debt consolidation and bankruptcy have their advantages and disadvantages, and choosing between the two requires careful consideration of several factors, such as the amount and nature of the debt, credit score, income stability, and long-term financial goals.

In this article, we will explore and compare debt consolidation and bankruptcy, examining their pros and cons, how they work, and the factors to consider when making a decision. By gaining a deeper understanding of these options, you can make an informed choice that aligns with your financial needs and goals.

Understanding Debt Consolidation

Debt consolidation is a financial strategy that combines multiple debts into a single loan. This approach aims to simplify the repayment process and potentially reduce the overall interest rate and monthly payments. Instead of making multiple payments to various creditors, a person consolidates their debts into one loan, making a single payment each month to the consolidation company.

Debt consolidation can be accomplished through various methods, such as taking out a personal loan, opening a balance transfer credit card, or using a home equity loan or line of credit. The goal is to secure a consolidation loan with a lower interest rate compared to the existing debts, enabling borrowers to save money over time.

One significant advantage of debt consolidation is the potential to improve one’s credit score. By making regular monthly loan payments, individuals demonstrate responsible financial behavior, which can positively impact their creditworthiness in the long run.

However, it is essential to consider the pros and cons of debt consolidation before committing to this strategy. On the positive side, debt consolidation simplifies bill payments, provides the opportunity to secure a lower interest rate, and may even eliminate the need for dealing with aggressive debt collectors.

On the other hand, debt consolidation may not be suitable for everyone. Some of the potential drawbacks include the possibility of extended repayment terms, which can result in paying more interest over time. Additionally, individuals with a history of mismanaging credit may find it challenging to qualify for a consolidation loan with a favorable interest rate.

In summary, debt consolidation can be an effective approach for individuals looking to streamline their debt repayment and potentially save money on interest payments. However, careful consideration of the pros and cons, along with a thorough assessment of one’s financial situation, is crucial before embarking on this path.

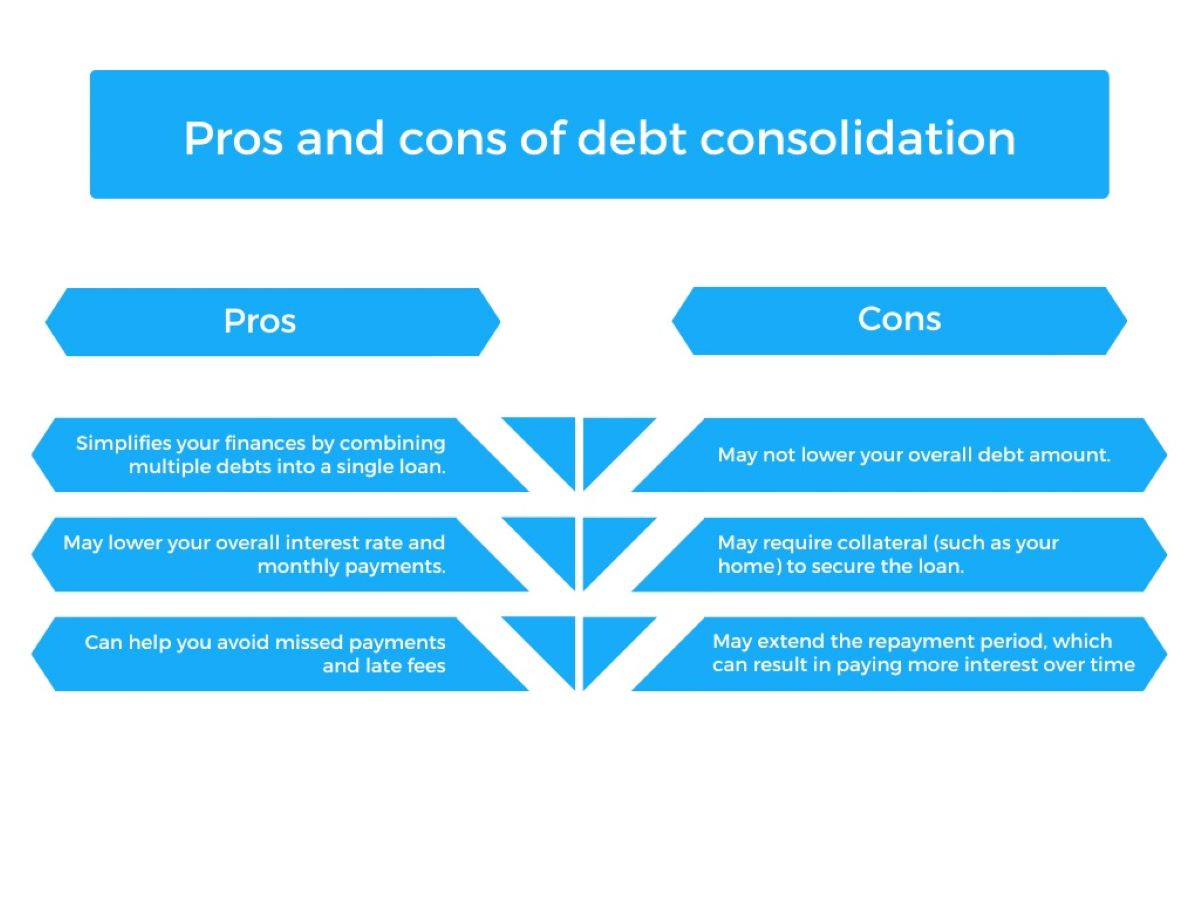

Pros and Cons of Debt Consolidation

Debt consolidation can be a viable solution for individuals seeking to simplify their debt repayment process and potentially save money on interest payments. However, it is important to weigh the advantages and disadvantages of this approach before committing to it. Let’s explore the pros and cons of debt consolidation:

Pros of Debt Consolidation:

- Simplifies repayment: Instead of managing multiple debt payments, debt consolidation combines them into one monthly payment, making it easier to stay organized and avoid missing payments.

- Potential interest rate reduction: By consolidating debts, individuals have the opportunity to secure a lower interest rate, which can result in savings over time.

- Stops creditor harassment: Debt consolidation can put an end to relentless debt collection calls and correspondence, providing individuals with peace of mind.

- Potential credit score improvement: Consistently making on-time payments towards a consolidated loan can positively impact credit scores, demonstrating responsible financial behavior.

Cons of Debt Consolidation:

- Extended repayment period: While debt consolidation can lower the monthly payments, it may also extend the overall repayment period, resulting in paying more interest in the long-run.

- Eligibility and interest rate challenges: Individuals with a poor credit history or low credit score may find it difficult to qualify for a consolidation loan with a favorable interest rate.

- No reduction in debt amount: Debt consolidation does not reduce the overall debt amount. It simply combines debts into one loan, making it more manageable.

- Potential fees and costs: Some debt consolidation options may come with fees or costs associated with the loan, so it’s essential to carefully review the terms and conditions.

When considering debt consolidation, it’s crucial to evaluate your specific financial situation, including the amount of debt, interest rates, credit score, and overall financial goals. Consulting with a financial advisor or debt consolidation professional can help you make an informed decision regarding debt consolidation or alternative debt management strategies.

How Debt Consolidation Works

Debt consolidation works by combining multiple debts into a single loan, typically with a lower interest rate and more manageable monthly payments. Here’s a step-by-step breakdown of how the debt consolidation process typically works:

- Evaluate your debts: Start by assessing your current debts, including outstanding balances, interest rates, and minimum monthly payments. This will provide you with a clear picture of your financial situation.

- Research debt consolidation options: Explore different debt consolidation options available to you, such as personal loans, balance transfer credit cards, or home equity loans/lines of credit. Compare interest rates, fees, and terms to determine which option best suits your needs.

- Apply for a consolidation loan: Once you’ve chosen a debt consolidation option, you’ll need to apply for a loan. This typically involves providing relevant financial information, such as income verification and credit history, to the lender.

- Get approved and receive the funds: If your loan application is approved, you’ll receive the funds necessary to pay off your existing debts. Depending on the consolidation method, the lender may either distribute the funds directly to your creditors or deposit them into your bank account for you to manage.

- Pay off your debts: With the consolidation loan funds in hand, you can now pay off your existing debts in full. This eliminates your multiple creditors and leaves you with only one loan to repay.

- Make regular monthly payments: Going forward, you’ll have a new loan with a single monthly payment. It’s important to make these payments on time and in full to maintain the benefits of debt consolidation.

- Stick to your budget and financial goals: Debt consolidation should be accompanied by a commitment to proper financial management. Develop a realistic budget and stick to it, while also addressing any spending habits that contributed to your initial debt accumulation.

Remember, debt consolidation is not a magical solution to eliminate debt overnight. It is a strategic approach that simplifies repayment and potentially reduces interest rates. The success of debt consolidation relies on responsible financial habits, including consistent loan payments and a commitment to staying debt-free in the future.

Understanding Bankruptcy

Bankruptcy is a legal process that allows individuals or businesses to obtain relief from overwhelming debt. It is a last resort for those who are unable to repay their creditors. Bankruptcy provides a fresh financial start by either eliminating or restructuring debt, depending on the type of bankruptcy filed.

When an individual files for bankruptcy, a court automatically issues a stay, which is a legal order that stops creditors from taking further collection actions. This provides debtors with immediate relief from harassment, garnishments, and other legal actions taken by creditors.

There are several types of bankruptcy, but the most common ones for individuals are Chapter 7 and Chapter 13 bankruptcy.

Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, Chapter 7 involves the sale of non-exempt assets to pay off creditors. Any remaining eligible debts are typically discharged. However, not all debts can be discharged in Chapter 7 bankruptcy, such as student loans and certain tax debts.

Chapter 13 Bankruptcy: Chapter 13 bankruptcy allows individuals with a steady income to create a repayment plan to pay off their debts over a period of three to five years. This type of bankruptcy is often suitable for those who want to keep their assets and catch up on missed payments, such as mortgage or car loan arrears.

It is important to note that bankruptcy has serious consequences and should not be entered into lightly. While it provides a fresh financial start, it will also have a significant impact on your creditworthiness. A bankruptcy filing stays on your credit report for several years, making it difficult to obtain credit in the future.

Bankruptcy may also require individuals to attend credit counseling and financial education courses to learn responsible financial management skills. Additionally, certain assets may be at risk of being sold or liquidated to repay creditors, depending on the type of bankruptcy filed.

It is advisable to consult with a bankruptcy attorney or financial advisor to fully understand the implications, eligibility requirements, and potential alternatives before deciding to pursue bankruptcy as a debt relief option.

Pros and Cons of Bankruptcy

Bankruptcy is a legal process that offers individuals and businesses relief from overwhelming debt. While it provides a fresh financial start, it is essential to carefully consider the advantages and disadvantages of bankruptcy before proceeding. Let’s explore the pros and cons of bankruptcy:

Pros of Bankruptcy:

- Debt discharge: Bankruptcy can eliminate certain types of debt, providing individuals with a clean slate and the opportunity to start afresh financially.

- Protection from creditors: Once bankruptcy is filed, an automatic stay is issued, halting all collection efforts and legal actions by creditors against the debtor. This gives individuals a temporary reprieve from creditor harassment.

- Asset retention: Depending on the type of bankruptcy filed, individuals may be able to keep some or all of their assets, such as their home or car, by restructuring their payments through a repayment plan.

- Opportunity for financial education: Bankruptcy often requires individuals to attend credit counseling and financial education courses, which can help them develop better money management skills for the future.

Cons of Bankruptcy:

- Negative impact on credit: Bankruptcy remains on a person’s credit report for several years, making it challenging to obtain credit in the future and potentially resulting in higher interest rates on loans.

- Potential loss of assets: Depending on the type of bankruptcy filed, individuals may be required to sell or surrender certain assets to repay creditors, albeit with exemptions provided by law.

- Difficulty obtaining new credit: After bankruptcy, it may be challenging to obtain new credit, and any available credit may come with higher interest rates or stricter terms.

- Emotional and social consequences: Bankruptcy can create emotional distress and social stigma due to the associated perception of financial failure among some individuals.

Bankruptcy should always be considered as a last resort for those who are genuinely unable to repay their debts. It is crucial to consult with a bankruptcy attorney or financial advisor to fully understand the implications, consequences, and potential alternatives before deciding to pursue bankruptcy as a debt relief option.

Types of Bankruptcy

Bankruptcy is a legal process that offers individuals and businesses relief from overwhelming debt. There are several types of bankruptcy, each designed to address different financial situations and provide specific benefits. Understanding the different types of bankruptcy can help individuals choose the most appropriate option based on their circumstances. Here are the most common types of bankruptcy:

Chapter 7 Bankruptcy:

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is the most common type of bankruptcy for individuals. It involves the sale of non-exempt assets to repay creditors. Any remaining eligible debts are typically discharged, providing individuals with a fresh financial start. However, not all debts can be discharged in Chapter 7 bankruptcy, such as student loans, child support, and certain tax debts.

Chapter 13 Bankruptcy:

Chapter 13 bankruptcy is often referred to as a wage earner’s plan. It allows individuals with a steady income to create a repayment plan to pay off their debts over a period of three to five years. This type of bankruptcy is suitable for those who want to keep their assets and catch up on missed payments, such as mortgage or car loan arrears. At the end of the repayment plan, any remaining eligible debts are discharged.

Chapter 11 Bankruptcy:

Chapter 11 bankruptcy is primarily designed for businesses and individuals with significant assets or income. It allows them to reorganize their debts and develop a plan to repay creditors while continuing operation. This type of bankruptcy is complex and usually involves a considerable amount of negotiation with creditors. Chapter 11 bankruptcy is commonly used by large corporations seeking to restructure and continue their operations.

Chapter 12 Bankruptcy:

Chapter 12 bankruptcy is specifically designed for family farmers and fishermen. Its purpose is to allow them to restructure their debts and develop a feasible repayment plan based on their seasonal income. Chapter 12 bankruptcy provides unique benefits tailored to the specific needs and challenges faced by agricultural and fishing industries.

It is crucial to consult with a bankruptcy attorney or financial advisor to determine the most suitable type of bankruptcy for your situation. They can provide guidance based on your financial circumstances, assets, income, and debt obligations.

How Bankruptcy Works

Bankruptcy is a legal process that provides individuals or businesses with relief from overwhelming debt. It involves the intervention of a court to either eliminate or restructure debt, depending on the type of bankruptcy filed. Here’s a step-by-step overview of how bankruptcy typically works:

- Evaluation and counseling: Individuals or businesses considering bankruptcy typically start by seeking financial counseling from a certified credit counselor. This step helps assess their financial situation and explore alternatives to bankruptcy.

- Filing the bankruptcy petition: The bankruptcy process begins by filing a petition with the appropriate bankruptcy court. This includes providing detailed financial information, such as income, assets, debts, and a list of creditors.

- Automatic stay: Once the bankruptcy petition is filed, an automatic stay is issued, which legally prohibits creditors from engaging in collection activities. This provides immediate relief from harassment, garnishments, and other legal actions taken by creditors.

- Meeting of creditors: A meeting of creditors, also known as a 341 meeting, is scheduled where the debtor, creditors, and bankruptcy trustee meet. The debtor must answer questions regarding their financial situation and assets under oath.

- Bankruptcy trustee’s role: A bankruptcy trustee is appointed to oversee the bankruptcy case. Their primary responsibility is to review the debtor’s financial information, ensure compliance with bankruptcy laws, and distribute any available assets to creditors, if applicable.

- Debt discharge or repayment plan: Depending on the type of bankruptcy filed (Chapter 7 or Chapter 13), different processes occur. In Chapter 7 bankruptcy, eligible debts are typically discharged at the end of the process. In Chapter 13 bankruptcy, a repayment plan is developed, allowing the debtor to repay their debts over a specified period of time.

- Financial management course: After filing for bankruptcy, debtors are usually required to complete a financial management course. This course aims to equip individuals with the necessary skills and knowledge to manage their finances responsibly in the future.

- Bankruptcy discharge: Once the bankruptcy process is completed, and all requirements have been fulfilled, a bankruptcy discharge is issued. This formally eliminates qualifying debts and relieves the debtor from further legal obligation for those debts.

It is important to note that the bankruptcy process can differ depending on the type of bankruptcy filed and the jurisdiction in which it is filed. Consulting with a bankruptcy attorney is highly recommended to have a clear understanding of the specific steps, legal obligations, and potential consequences associated with bankruptcy.

Factors to Consider in Choosing between Debt Consolidation and Bankruptcy

When facing overwhelming debt, deciding between debt consolidation and bankruptcy requires careful consideration of various factors. Each option has its own advantages and disadvantages, and the choice greatly depends on individual circumstances. Here are some key factors to consider when choosing between debt consolidation and bankruptcy:

Amount and Nature of Debt:

Assess the total amount of debt and the types of debts you have. Debt consolidation may be more suitable for individuals with manageable debt levels that can be feasibly paid off over time. On the other hand, bankruptcy may be considered if the debt is substantial, unmanageable, and mostly unsecured.

Financial Stability:

Evaluate your financial stability and ability to make consistent payments. If you have a steady income and can afford to make monthly payments, debt consolidation may be a viable option. However, if your income is unstable or insufficient to meet your obligations, bankruptcy may be necessary to obtain debt relief.

Credit Score and Long-Term Goals:

Consider the impact on your credit score and long-term financial goals. Debt consolidation may have a less severe impact on your credit score compared to bankruptcy, but it is important to remember that both options will affect your credit. Evaluate if rebuilding your credit score is a priority and consider how each choice aligns with your long-term financial goals.

Legal Consequences and Asset Protection:

Examine the legal consequences and asset protection offered by each option. Debt consolidation generally does not involve legal proceedings or the risk of losing assets. In bankruptcy, certain assets may be at risk, depending on the type of bankruptcy filed. Understanding the legal implications and asset protection is crucial in making an informed decision.

Timeframe and Debt Management Plan:

Consider your desired timeframe for debt repayment and your willingness to commit to a debt management plan. Debt consolidation allows for a structured repayment plan over a set period, while bankruptcy may offer a quicker resolution. Assess your ability to adhere to a repayment plan and the desired timeframe for becoming debt-free.

Ultimately, consulting with a financial advisor or a bankruptcy attorney is highly recommended when deciding between debt consolidation and bankruptcy. They can provide professional guidance, assess your unique circumstances, and help you make the best-informed decision based on your financial situation and future goals.

Conclusion

When faced with overwhelming debt, both debt consolidation and bankruptcy can provide relief and a fresh financial start. However, choosing between these options requires careful consideration of various factors and an understanding of the potential benefits and drawbacks of each approach.

Debt consolidation offers the opportunity to streamline debt repayment and potentially lower interest rates, making it more manageable for individuals. It allows for the consolidation of multiple debts into a single loan, simplifying the payment process. However, it is crucial to assess the eligibility criteria, interest rates, and potential fees associated with debt consolidation, as well as the impact on credit scores and the possibility of extended repayment periods.

On the other hand, bankruptcy is a legal process that can discharge or restructure debt, providing significant relief for those with unmanageable financial situations. It stops creditor harassment and can offer asset protection in certain cases. However, bankruptcy has long-term consequences on credit scores and may involve the sale of assets to repay creditors. It is essential to understand the specific type of bankruptcy that suits your circumstances and consult with professionals to navigate the legal process effectively.

Before making a decision, evaluate factors such as the amount and nature of your debt, financial stability, credit score, long-term goals, legal consequences, and asset protection. Consulting with a financial advisor or bankruptcy attorney is highly recommended to obtain personalized advice.

In conclusion, there is no one-size-fits-all solution when it comes to managing debt. Each individual’s situation is unique, and what works for one person may not work for another. Carefully weigh the pros and cons, assess your financial circumstances, and seek professional guidance. With proper consideration and informed decision-making, you can choose the debt relief option that is best suited to your needs, helping you regain control of your finances and pave the way towards a brighter financial future.