Home>Finance>What Is A Soft Credit Check? Definition And How It Works

Finance

What Is A Soft Credit Check? Definition And How It Works

Published: January 30, 2024

Learn what a soft credit check is in finance, its definition, and how it works. Find out how this type of credit inquiry affects your credit score and borrowing options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Soft Credit Checks: What are They and How do They Work?

When it comes to managing your finances, having a good credit score is essential. Lenders and financial institutions use your credit score to determine your creditworthiness and decide whether to grant you a loan or extend credit. But did you know that there are different types of credit checks? In this article, we’ll explore the concept of soft credit checks – what they are, how they work, and why they matter.

Key Takeaways:

- Soft credit checks do not impact your credit score

- They are commonly used by lenders for pre-qualifications or background checks

So, What Exactly is a Soft Credit Check?

A soft credit check is a type of credit inquiry that does not have a negative impact on your credit score. Unlike a hard credit check, which occurs when you apply for a loan or credit card, a soft credit check is used for informational or verification purposes. Think of it as a sneak peek into your credit history without leaving a lasting mark.

Soft credit checks are typically initiated by lenders or financial institutions when evaluating your creditworthiness for pre-qualifications, background checks, or even for promotional offers. They allow lenders to assess your financial situation without the need for your explicit consent or leaving a trace on your credit report.

How Does a Soft Credit Check Work?

When a lender or financial institution conducts a soft credit check, they usually access limited information from your credit report. This includes your personal details, current accounts, and recent credit activities. However, it does not provide insight into any missed payments or delinquencies, nor does it affect your overall credit score.

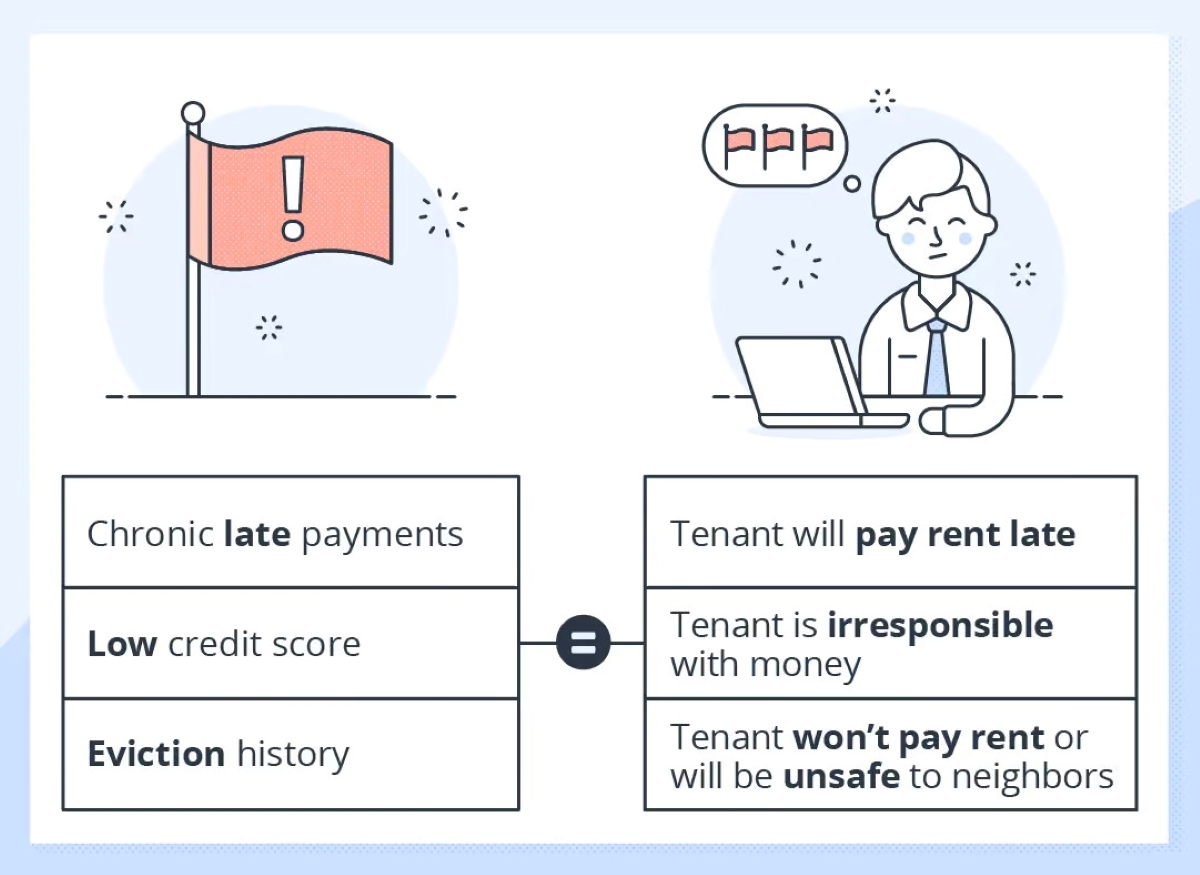

Unlike a hard credit check, which requires your authorization, soft credit checks can be performed without your knowledge. It is common for lenders to use soft credit checks to pre-qualify potential customers or to verify information on loan applications. Similarly, landlords or employers may use soft credit checks as part of background checks during rental or employment screening processes.

The Benefits of Soft Credit Checks

Soft credit checks offer several benefits compared to hard credit checks:

- No impact on your credit score: One of the most significant advantages of a soft credit inquiry is that it does not affect your credit score. This means you can have multiple soft credit checks conducted without any negative repercussions.

- Quick and convenient: Soft credit checks can be conducted instantly and without any formal application process. This makes them a useful tool for pre-qualifications, allowing you to assess your eligibility for loans or credit cards without committing to a hard credit check.

- Protection of your credit history: Soft credit checks do not leave a mark on your credit report, ensuring that your credit history remains intact. This is particularly important if you are applying for multiple loans or credit cards within a short period, as a high number of hard credit inquiries can negatively impact your credit score.

Conclusion

Soft credit checks are a valuable tool for both lenders and borrowers. They provide a quick and convenient way to assess creditworthiness without impacting your credit score. Whether you’re planning to apply for a loan or a credit card, keeping an eye on your credit history with soft credit checks can help you make informed financial decisions.

Remember, while soft credit checks may give lenders a glimpse into your financial standing, it’s crucial to maintain good credit habits and keep your credit score in check.