Finance

What Is A Soft Credit Inquiry

Published: March 4, 2024

Learn about soft credit inquiries in the finance industry and how they impact your credit score. Understand the difference between soft and hard credit checks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Understanding the nuances of credit inquiries is crucial for anyone navigating the world of personal finance. Credit inquiries come in two primary forms: soft and hard. While both types involve a review of an individual's credit report, they serve different purposes and have varying impacts on one's credit score.

In this article, we will delve into the realm of soft credit inquiries, shedding light on their definition, implications, and significance in the realm of credit assessment. By the end of this exploration, you will have a comprehensive understanding of what constitutes a soft credit inquiry, how it differs from a hard inquiry, and the potential effects it can have on your financial standing.

Soft credit inquiries play a pivotal role in various financial transactions and assessments, and gaining insight into their nature can empower individuals to make informed decisions when it comes to managing their credit. Let's embark on this enlightening journey to unravel the intricacies of soft credit inquiries and their impact on creditworthiness.

**

Definition of a Soft Credit Inquiry

**

At its core, a soft credit inquiry, also known as a soft pull, refers to a credit check that does not impact an individual’s credit score. This type of inquiry occurs when a person or entity reviews their own credit report, or when a third party performs a credit check for non-lending purposes, such as pre-qualified offers, background checks, or account reviews by current creditors.

Soft credit inquiries provide a snapshot of an individual’s credit history without affecting their credit score. Unlike hard inquiries, which occur when a lender reviews an individual’s credit report as part of the decision-making process for a new loan or line of credit, soft inquiries are only visible to the individual and do not factor into credit scoring models used by lenders.

It’s important to note that soft credit inquiries are not initiated by the individual seeking credit, but rather by entities conducting background checks or pre-qualification assessments. These inquiries serve as a way to gather information for promotional offers, account maintenance, or employment screening, providing insights into an individual’s credit profile without the risk of negatively impacting their creditworthiness.

Understanding the distinction between soft and hard credit inquiries is essential for maintaining a clear perspective on how credit-related activities can influence one’s financial standing. By grasping the nature of soft credit inquiries, individuals can navigate credit-related processes with greater confidence and awareness of their credit report’s dynamics.

**

How Soft Credit Inquiries Affect Your Credit Score

**

Soft credit inquiries have no impact on an individual’s credit score. When a soft pull is conducted, whether initiated by the individual for personal review or by a third party for non-lending purposes, it does not affect the credit scoring models used by lenders to assess creditworthiness.

Unlike hard inquiries, which can cause a temporary dip in a credit score due to the potential risk associated with new credit accounts, soft inquiries are considered benign and do not carry any negative repercussions. This distinction is vital as it allows individuals to access their own credit reports or participate in non-lending activities without fear of damaging their credit standing.

Given that soft credit inquiries are not visible to lenders and do not impact credit scores, individuals can confidently explore pre-qualified offers, review their own credit reports, or undergo background checks without the concern of adverse effects on their creditworthiness. This distinction underscores the significance of understanding the nature of different credit inquiries and their varying implications.

By comprehending the inert nature of soft credit inquiries in relation to credit scoring, individuals can engage in credit-related activities with a clearer understanding of how these inquiries align with their overall financial well-being. This awareness empowers individuals to leverage the benefits of soft inquiries without apprehension, fostering a more informed and proactive approach to managing their credit.

**

Differences Between Soft and Hard Credit Inquiries

**

Understanding the disparities between soft and hard credit inquiries is essential for navigating the realm of credit assessment and financial decision-making. While both types involve accessing an individual’s credit report, they diverge significantly in their impact and purpose.

One of the primary distinctions lies in their effect on credit scores. Soft credit inquiries have no impact on an individual’s credit score, regardless of whether they are initiated for personal review or by a third party for non-lending purposes. In contrast, hard inquiries, which occur when a lender assesses an individual’s credit report as part of a credit application, can cause a temporary dip in the credit score due to the potential risk associated with new credit accounts.

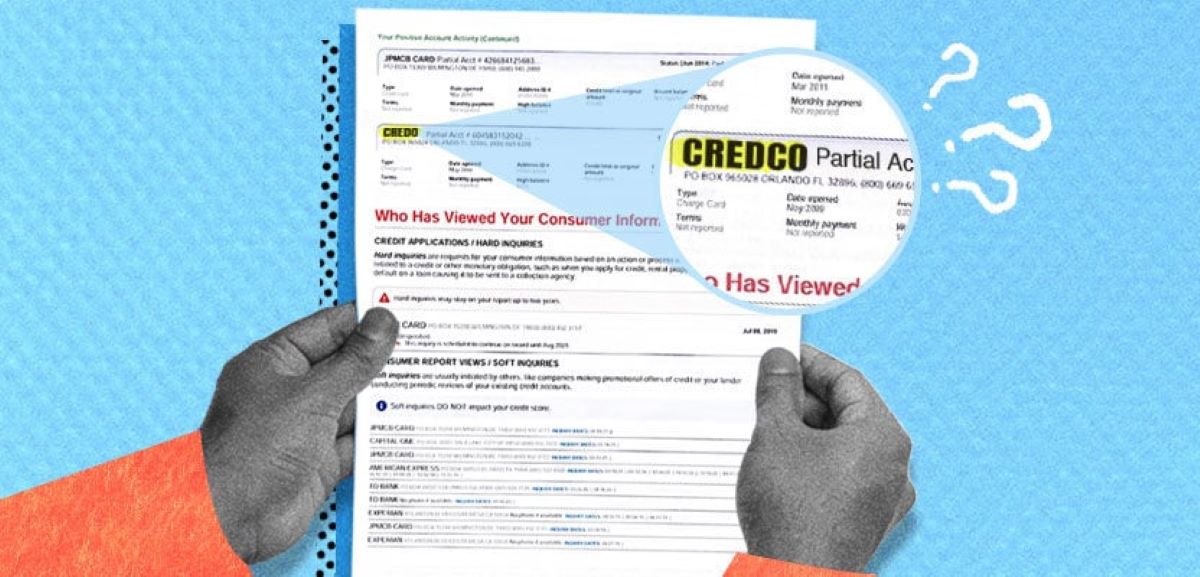

Another differentiating factor is the visibility of these inquiries to potential lenders. Soft inquiries are visible only to the individual and do not appear on the credit reports seen by lenders, whereas hard inquiries are visible to both the individual and potential creditors. This discrepancy underscores the confidential nature of soft inquiries and their exclusion from the credit assessment process employed by lenders.

Furthermore, the purposes of these inquiries vary significantly. Soft credit inquiries are often conducted for non-lending reasons, such as pre-qualified offers, background checks, or account reviews by current creditors. On the other hand, hard inquiries are integral to the credit application process, as they provide lenders with insights into an individual’s credit behavior and help assess the associated risk of extending credit.

By grasping these disparities, individuals can make informed decisions when engaging in credit-related activities. Whether exploring pre-qualified offers, reviewing their own credit reports, or applying for new credit, understanding the differences between soft and hard credit inquiries empowers individuals to navigate the financial landscape with confidence and clarity.

**

Common Reasons for Soft Credit Inquiries

**

Soft credit inquiries serve various non-lending purposes, offering insights into an individual’s credit history without impacting their credit score or visibility to potential lenders. Understanding the common reasons for these inquiries sheds light on their prevalence in everyday financial activities and credit-related assessments.

One prevalent reason for soft credit inquiries is pre-qualified offers extended by credit card companies, lenders, or other financial institutions. These offers are based on a preliminary assessment of an individual’s credit profile to determine their eligibility for specific financial products. By conducting a soft pull, these entities can gauge an individual’s creditworthiness without the individual’s credit score being affected.

Background checks conducted by employers or landlords also constitute common reasons for soft credit inquiries. Employers may review an individual’s credit report as part of the hiring process to assess their financial responsibility and trustworthiness, while landlords may use soft inquiries to evaluate a prospective tenant’s ability to meet rental obligations.

Additionally, current creditors often perform soft credit inquiries as part of account reviews to assess existing customers’ credit behavior and determine eligibility for credit limit increases or promotional offers. These inquiries allow creditors to gain insights into their customers’ credit profiles without triggering any negative impact on their credit scores.

Moreover, individuals themselves may initiate soft credit inquiries to review their own credit reports for monitoring purposes or to assess their eligibility for financial products. This proactive approach enables individuals to stay informed about their credit standing and make well-informed decisions when considering new credit opportunities.

By recognizing these common reasons for soft credit inquiries, individuals can appreciate the diverse contexts in which these inquiries occur and the non-invasive nature of their impact on credit scores. This awareness fosters a clearer understanding of the role of soft inquiries in credit-related activities and empowers individuals to navigate various financial assessments with confidence and insight.

**

How to Monitor Soft Credit Inquiries

**

Monitoring soft credit inquiries is an essential aspect of maintaining awareness and control over one’s credit profile. While soft inquiries do not impact credit scores or visibility to potential lenders, staying informed about the frequency and nature of these inquiries can provide valuable insights into one’s credit-related activities.

One effective method for monitoring soft credit inquiries is to regularly review one’s credit reports from the major credit bureaus, including Equifax, Experian, and TransUnion. These reports provide a comprehensive overview of an individual’s credit history, including details of both soft and hard inquiries. By examining these reports, individuals can identify instances of soft inquiries and gain clarity on the entities conducting these checks.

Utilizing credit monitoring services can also facilitate the tracking of soft credit inquiries. These services offer real-time alerts and notifications regarding any changes or activities on an individual’s credit report, including the occurrence of soft inquiries. By leveraging these proactive monitoring tools, individuals can stay informed about soft inquiries and promptly address any unauthorized or unexpected credit checks.

Regularly reviewing account statements and credit notifications from existing creditors can also aid in monitoring soft credit inquiries. Many creditors provide updates on account activity, including instances of soft inquiries conducted for account reviews or promotional offers. Staying attentive to these communications can help individuals stay informed about the soft inquiries initiated by their current creditors.

Furthermore, maintaining open communication with entities that may conduct soft inquiries, such as potential employers, landlords, or financial institutions offering pre-qualified offers, can provide clarity on the nature and purpose of these inquiries. By seeking transparency and understanding from these entities, individuals can gain insights into the reasons behind soft inquiries and ensure that they align with their financial intentions.

By implementing these monitoring practices, individuals can proactively track and manage soft credit inquiries, fostering a deeper understanding of their credit-related activities and maintaining control over their credit profiles. This vigilance contributes to a comprehensive approach to credit management, empowering individuals to make informed decisions and address any unexpected or unauthorized credit checks effectively.

**

Conclusion

**

Soft credit inquiries play a significant role in various credit-related activities, offering insights into an individual’s credit history without impacting their credit score or visibility to potential lenders. Understanding the nature of soft inquiries, their implications, and methods for monitoring them is essential for navigating the complex landscape of personal finance and credit management.

By comprehending the distinction between soft and hard credit inquiries, individuals can approach credit-related activities with greater confidence and awareness. The inert nature of soft inquiries, coupled with their prevalence in pre-qualified offers, background checks, and account reviews, underscores their significance in everyday financial assessments.

Moreover, the ability to monitor soft credit inquiries through regular credit report reviews, credit monitoring services, and proactive communication with relevant entities empowers individuals to stay informed about their credit-related activities and maintain control over their credit profiles.

Ultimately, the knowledge and vigilance surrounding soft credit inquiries contribute to a more informed and proactive approach to credit management. By leveraging this understanding, individuals can confidently engage in credit-related activities, assess pre-qualified offers, and stay attuned to their credit standing without fear of adverse impacts on their creditworthiness.

Embracing this comprehensive perspective on soft credit inquiries equips individuals with the awareness and agency to make informed decisions, safeguard their credit profiles, and navigate the multifaceted realm of personal finance with clarity and confidence.