Finance

What Is A Sort Code In Banking

Published: October 13, 2023

Learn about the importance of sort codes in the world of banking and how they play a vital role in financial transactions. Explore the significance and relevance of finance-related sort codes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Sort Code

- Purpose of Sort Codes in Banking

- How Sort Codes are used for Identifying Banks and Branches

- Process of Obtaining a Sort Code

- Importance of Sort Codes in Banking Transactions

- Benefits of Sort Codes for Banks and Customers

- Examples of Sort Codes and their Meaning

- Frequently Asked Questions about Sort Codes

- Conclusion

Introduction

When it comes to banking, there are various codes and numbers that play a crucial role in facilitating smooth financial transactions. One such important code is the sort code. If you have ever wondered what a sort code is and what it is used for, you’re in the right place.

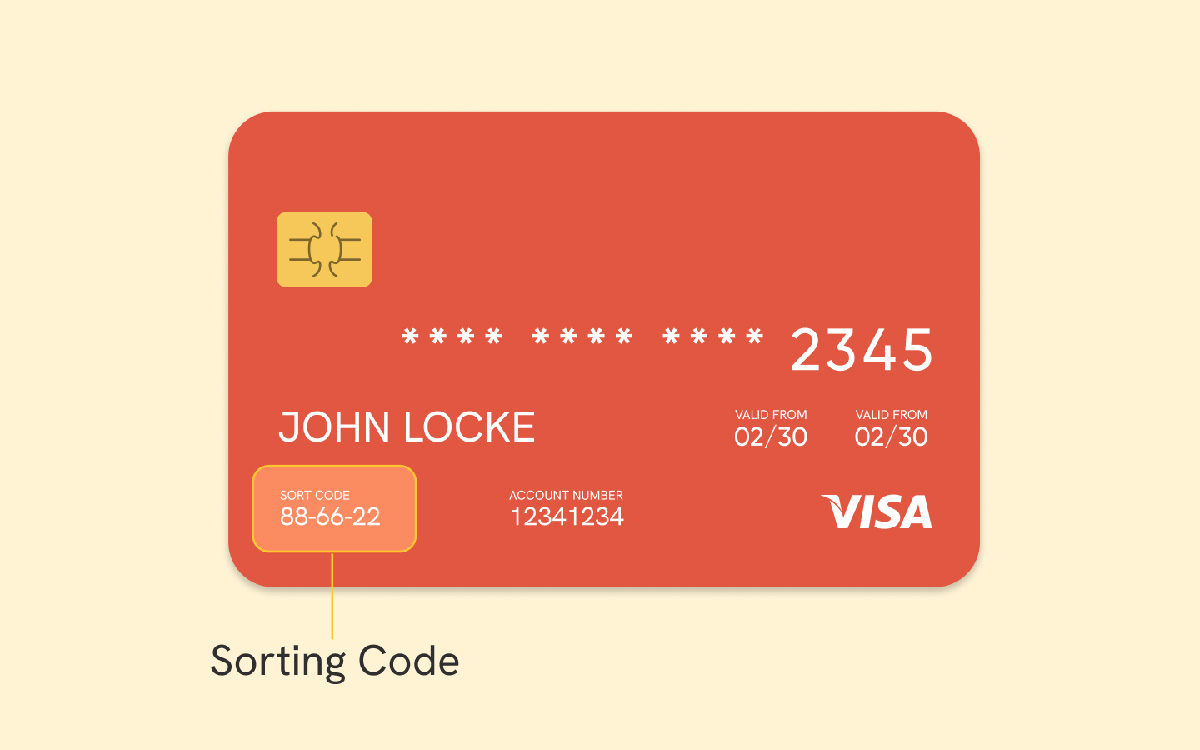

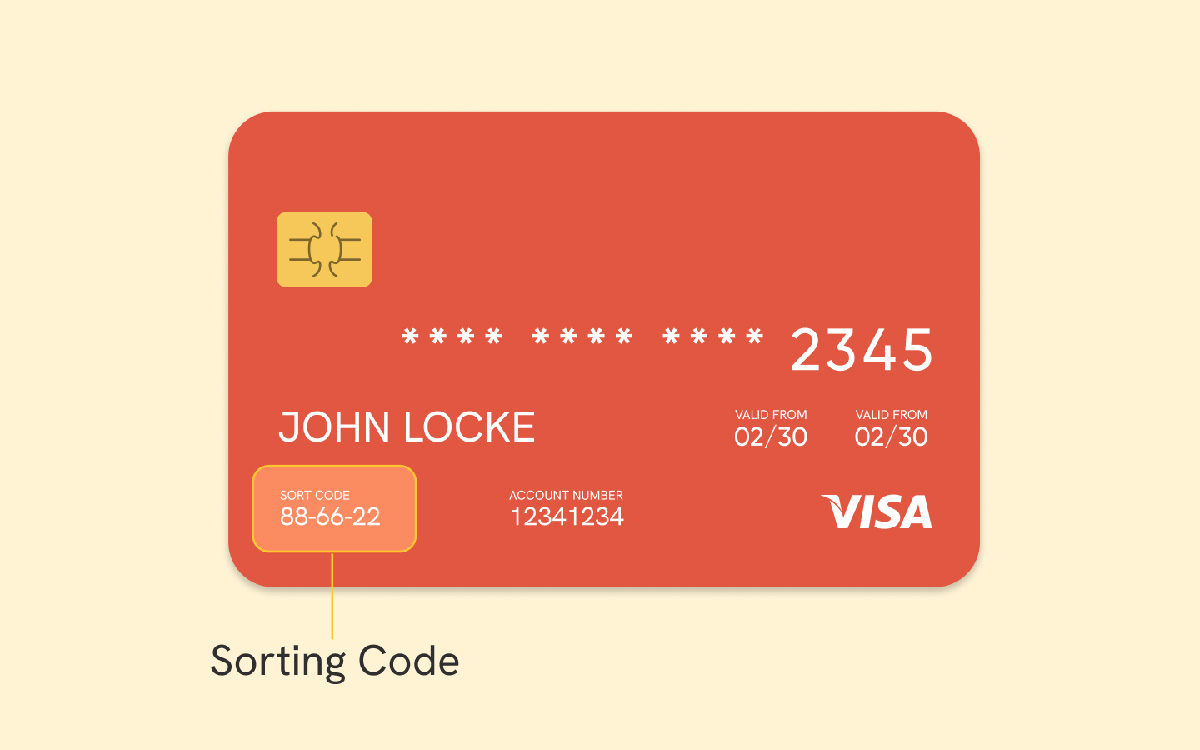

A sort code is a unique identification code used in the banking system in the United Kingdom and Ireland. It is a six-digit number that helps in identifying a specific bank and branch location. This code is vital for various financial transactions, including direct deposits, electronic payments, and interbank transfers.

The purpose of the sort code is to ensure that the funds are properly routed to the correct bank and branch in any financial transaction. It acts as a routing number, guiding the transfer of money between accounts within the same bank or across different financial institutions. Understanding the importance of sort codes can help individuals and businesses navigate the complexities of banking transactions more efficiently.

In this article, we will delve deeper into the world of sort codes, exploring their significance and how they are used in banking operations. We will also discuss the process of obtaining a sort code and the benefits it brings to both banks and customers. So, let’s dive in and unravel the mysteries of sort codes in the world of finance.

Definition of Sort Code

A sort code is a unique identifier assigned to each bank and branch in the banking system of the United Kingdom and Ireland. It is a six-digit number that is used to facilitate the processing of financial transactions, such as direct deposits, electronic transfers, and automated payments.

The sort code is essentially a bank code that indicates the specific location of a bank branch. It helps in identifying the bank and branch to which the funds should be directed. Each bank has its own range of sort codes, and within that range, each branch is assigned a unique code.

The sort code is typically presented in a specific format. The first two digits represent the bank’s identification number, while the following four digits pinpoint the exact branch location. For example, in the sort code “10-12-34,” the number 10 indicates the bank, and the numbers 12-34 identify the branch.

It is important to note that the sort code is different from a bank account number. While a sort code identifies the bank and branch, the account number denotes an individual’s or business’s specific account within that branch.

The sort code system plays a crucial role in ensuring the accuracy and efficiency of financial transactions. By using the appropriate sort code, banks can quickly and accurately direct funds to the correct recipient. This helps to minimize errors and delays in processing transfers and payments.

Overall, the sort code serves as a vital component in the smooth functioning of the banking system by providing a standardized method for identifying banks and branches during financial transactions.

Purpose of Sort Codes in Banking

The main purpose of sort codes in the banking system is to ensure accurate and efficient routing of funds during financial transactions. Sort codes play a crucial role in identifying the specific bank and branch to which the funds should be directed. Let’s explore the key purposes of sort codes in more detail:

- Facilitating Electronic Payments: Sort codes are essential for electronic payments, such as direct deposits, standing orders, and bill payments. When setting up these transactions, individuals and businesses need to provide the correct sort code to ensure the funds reach the intended recipient accurately.

- Enabling Interbank Transfers: Sort codes are particularly important for interbank transfers, where funds are moved between different financial institutions. By using the appropriate sort code, banks can efficiently route the funds to the recipient’s bank and branch, ensuring prompt and secure transfer of funds.

- Identifying Banks and Branches: Sort codes serve as a unique identifier for each bank and branch within the banking system. They help distinguish one bank from another and pinpoint the exact location of a specific branch. This forms the basis for accurate routing of funds during financial transactions.

- Enhancing Efficiency and Accuracy: By using sort codes, banks can streamline their processes and automate the routing of funds. This results in faster and more accurate transactions, reducing the risk of errors and delays caused by manual intervention.

- Supporting Regulatory Compliance: Sort codes are also used for regulatory purposes, such as ensuring compliance with anti-money laundering and fraud prevention measures. Banks can use the sort code information to verify the legitimacy of transactions and identify potential risks.

Overall, sort codes play a vital role in the banking system by facilitating electronic payments, enabling interbank transfers, accurately identifying banks and branches, enhancing efficiency and accuracy, and supporting regulatory compliance. They are an essential component in ensuring smooth and secure financial transactions within the banking industry.

How Sort Codes are used for Identifying Banks and Branches

Sort codes serve as a crucial tool for identifying banks and their respective branches within the banking system. They play a fundamental role in ensuring accurate routing of funds during financial transactions. Let’s explore how sort codes are utilized for this purpose:

- Uniquely Identifying Banks: Each bank is assigned a specific range of sort codes that are unique to them. These sort codes help distinguish one bank from another in the banking system. Therefore, when making a payment or transferring funds, specifying the appropriate sort code ensures that the funds are directed to the correct bank.

- Pinpointing Branch Locations: Within a bank’s range of sort codes, each branch is assigned a unique code. This helps in pinpointing the specific branch location to which the funds should be sent. By providing the correct sort code, individuals and businesses can ensure that the funds reach the intended recipient’s branch accurately.

- Routing Funds Effectively: When initiating a financial transaction, such as a direct deposit or electronic payment, the sort code is used to route the funds to the correct bank and branch. By including the sort code in the transaction details, banks are able to accurately direct the funds, minimizing errors and delays.

- Enabling Cross-Bank Transfers: Sort codes play a crucial role in interbank transfers. When funds need to be moved between different financial institutions, the appropriate sort codes are used to identify the recipient bank and branch. This ensures that the funds are routed accurately, enabling seamless cross-bank transfers.

- Verifying Account Details: Sort codes are often used in conjunction with account numbers to verify the accuracy of account details during financial transactions. By cross-referencing the sort code and account number, banks can ensure that the funds are being transferred to the correct account within the specified branch.

By utilizing sort codes, banks can identify and route funds to the correct banks and branches, ensuring the accuracy and efficiency of financial transactions. Individuals and businesses can rely on sort codes to direct their payments and transfers seamlessly, thereby minimizing errors and ensuring prompt delivery of funds.

Process of Obtaining a Sort Code

To obtain a sort code for a specific bank and branch, several steps and processes need to be followed. Let’s explore the typical process involved in obtaining a sort code:

- Establishing a Bank Account: The first step in obtaining a sort code is to establish a bank account with the desired financial institution. Whether you are an individual or a business, you will need to provide the required documentation and fulfill any criteria set by the bank to open an account.

- Providing Identification and Information: When opening a bank account, you will be required to provide certain identification documents and personal or business information. This may include proof of identity, proof of address, tax identification number, and business registration documents (if applicable).

- Bank Verification Process: Once you have provided the necessary identification and information, the bank will proceed with a verification process. This involves confirming the accuracy of the information provided and conducting any necessary background checks to ensure compliance with regulatory requirements.

- Assignment of a Sort Code: Once your account has been verified and opened, the bank will assign a sort code to your account. This sort code will be specific to the bank and branch where your account is located. The sort code will be used to identify your bank and branch in all future financial transactions.

- Notifying Account Holders: After receiving a sort code, the bank will inform you of the assigned sort code for your account. This information will usually be shared through account statements, online banking platforms, or official correspondence from the bank. It is essential to note down and retain this sort code for future reference.

The process of obtaining a sort code may vary slightly between banks and jurisdictions. It is advisable to check with your specific bank to understand their requirements and procedures for obtaining a sort code. By following the necessary steps and providing the required information, you can obtain a sort code and begin conducting financial transactions smoothly.

Importance of Sort Codes in Banking Transactions

Sort codes play a crucial role in facilitating seamless and accurate banking transactions. Their importance lies in ensuring that funds are properly routed to the correct bank and branch. Let’s explore why sort codes are important in banking transactions:

- Accurate Routing of Funds: Sort codes are essential for accurately routing funds during financial transactions. By providing the correct sort code, individuals and businesses can ensure that the funds reach the intended recipient at the correct bank and branch. This helps prevent misdirected payments and ensures prompt delivery of funds.

- Avoiding Delays and Errors: The use of sort codes minimizes the risk of errors and delays in banking transactions. By including the appropriate sort code, banks can efficiently process payments and transfers, reducing the likelihood of manual intervention or data entry mistakes that can lead to transactional discrepancies.

- Enabling Interbank Transfers: Sort codes enable the smooth execution of interbank transfers. When transferring funds between different financial institutions, the sort code helps identify the recipient’s bank and branch, ensuring that the funds are routed accurately. This facilitates efficient movement of money between accounts held at different banks.

- Ensuring Compliance with Regulations: Sort codes are an integral part of regulatory compliance in the banking industry. Financial institutions must adhere to various regulations, including anti-money laundering and fraud prevention measures. By utilizing sort codes, banks can verify the legitimacy of transactions and mitigate potential risks.

- Facilitating Electronic Payments: Sort codes are crucial for electronic payments, such as direct deposits, standing orders, and bill payments. When initiating these transactions, the correct sort code must be provided to ensure that the funds are directed to the correct recipient’s bank and branch. This enhances the efficiency and convenience of electronic payment methods.

- Supporting Seamless Account Management: By using sort codes, individuals and businesses can easily manage their accounts across different banks and branches. Sort codes streamline the process of transferring funds between accounts held at different locations, allowing for smooth account management and enhanced financial flexibility.

Overall, sort codes are of utmost importance in banking transactions, as they ensure accurate and efficient routing of funds, help avoid delays and errors, enable interbank transfers, support regulatory compliance, facilitate electronic payments, and enhance seamless account management. Understanding the significance of sort codes can help individuals and businesses make the most of their banking experience.

Benefits of Sort Codes for Banks and Customers

Sort codes provide numerous benefits to both banks and customers in the realm of banking transactions. Let’s explore the advantages that sort codes offer to these key stakeholders:

- Efficient Processing of Transactions: Sort codes streamline the processing of financial transactions for both banks and customers. By including the appropriate sort code, banks can quickly route funds to the correct recipient, minimizing delays and ensuring prompt delivery. Customers benefit from faster transaction processing, allowing for timely payments and transfers.

- Accurate Identification of Banks and Branches: Sort codes serve as a unique identifier for each bank and branch. This enables precise identification and verification during financial transactions. For banks, sort codes help efficiently direct funds to the correct bank and branch. Customers benefit from the assurance that their funds will reach the intended recipient’s account accurately.

- Seamless Interbank Transfers: Sort codes play a critical role in enabling smooth interbank transfers. Banks can use sort codes to identify the recipient’s bank and branch, facilitating seamless transfers between different financial institutions. This convenience benefits both banks and customers, as it allows for efficient movement of funds across banking networks.

- Enhanced Security and Compliance: By utilizing sort codes, banks can ensure compliance with regulatory requirements, such as anti-money laundering and fraud prevention measures. Sort codes provide a level of security by enabling banks to verify the legitimacy of transactions and detect any potential risks. Customers benefit from enhanced security measures that protect their financial transactions.

- Convenience in Account Management: Sort codes offer convenience to customers in managing their accounts. Customers can easily transfer funds between their accounts held at different banks and branches by using the appropriate sort codes. This flexibility allows for seamless account management and financial flexibility, ensuring a smooth banking experience.

- Support for Electronic Payments: Sort codes are essential for electronic payments, such as direct deposits and bill payments. By providing the correct sort code, customers can ensure accurate routing of funds, making electronic payments faster and more efficient. Banks benefit from the efficiency of electronic payment systems, reducing the need for manual intervention.

Overall, sort codes provide numerous benefits to both banks and customers. They enable efficient transaction processing, accurate identification of banks and branches, seamless interbank transfers, enhanced security and compliance, convenience in account management, and support for electronic payments. The utilization of sort codes contributes to a smoother and more effective banking experience for all involved.

Examples of Sort Codes and their Meaning

Sort codes consist of six digits that are used to identify specific banks and branches within the banking system. Let’s look at some examples of sort codes and understand their meanings:

- Sort Code: 12-34-56

Meaning: The first two digits “12” represent the bank identification number, while the following four digits “34-56” signify the specific branch identification. This sort code belongs to a particular bank and branch within the banking system. - Sort Code: 98-76-54

Meaning: In this case, the first two digits “98” represent a different bank than the previous example. The following four digits “76-54” identify the specific branch location. This sort code belongs to a different bank and branch within the banking system. - Sort Code: 11-22-33

Meaning: Here, the first two digits “11” indicate a different bank than the previous examples. The subsequent four digits “22-33” pinpoint the specific branch location associated with this sort code.

It’s important to note that these examples are for illustrative purposes only. Each bank has its own range of sort codes, and within that range, each branch is assigned a unique code. Therefore, the actual digits of sort codes can vary widely across different banks and branches.

When initiating a financial transaction or providing payment details, it is crucial to accurately input the sort code to ensure that the funds are directed to the correct bank and branch. Verifying the sort code with the recipient or referring to official bank documentation can help ensure the accuracy of the information provided.

Understanding the meaning and significance of sort codes allows individuals and businesses to navigate banking transactions more efficiently and with greater confidence.

Frequently Asked Questions about Sort Codes

Here are some commonly asked questions about sort codes in the banking system:

- What is the purpose of a sort code?

The purpose of a sort code is to identify a specific bank and branch within the banking system. It is used to ensure accurate routing of funds during financial transactions. - Where can I find my bank’s sort code?

You can typically find your bank’s sort code on your bank statements, online banking platforms, or by contacting your bank’s customer service. It is important to note down and retain your sort code for future reference. - Can a sort code be used to identify an individual account?

No, a sort code alone cannot identify an individual account. It is used to identify the bank and branch, while the account number is used to identify the specific individual or business account within that branch. - Can a sort code change?

Yes, sort codes can change, typically when there are mergers or acquisitions involving banks or reorganization within banks. It is important to stay updated with any changes that may occur and ensure you have the correct sort code for your bank and branch. - Are sort codes unique to each bank and branch?

Yes, each bank and branch within the banking system has a unique sort code. This ensures that funds are accurately routed to the intended bank and branch during financial transactions. - Can I use a sort code to transfer funds internationally?

No, sort codes are specific to the banking system in the United Kingdom and Ireland. To transfer funds internationally, you will need to use other codes, such as SWIFT codes or IBAN numbers, depending on the destination country.

If you have any specific questions or concerns about sort codes, it is recommended to reach out to your bank for further clarification and guidance.

Conclusion

Sort codes play a vital role in the banking system, ensuring accurate and efficient routing of funds during financial transactions. These six-digit codes uniquely identify banks and branches, enabling seamless electronic payments, interbank transfers, and streamlined account management. The importance of sort codes lies in their ability to accurately direct funds to the correct recipient, minimizing errors and delays.

For banks, sort codes enhance transaction processing, enable interbank transfers, and support regulatory compliance. The use of these codes promotes efficiency, security, and seamless integration within the banking network. Customers also benefit greatly from sort codes by experiencing faster transactions, increased convenience in account management, and enhanced security measures.

It is important for individuals and businesses to understand the significance of sort codes when conducting banking transactions. Verifying and using the correct sort code ensures that funds are routed accurately, avoiding misdirected payments and providing peace of mind. Staying informed about changes in sort codes, obtaining the correct information from banks, and reaching out for assistance when needed is key to navigating the banking system effectively.

In conclusion, sort codes serve as a fundamental component of the banking infrastructure, simplifying financial transactions and promoting efficient communication between banks and their customers. By utilizing sort codes effectively, individuals and businesses can enjoy the benefits of secure, accurate, and timely banking services.