Finance

What Is Code 806 On An IRS Transcript

Published: October 31, 2023

Discover what Code 806 on an IRS transcript means and how it relates to your finances. Gain insights into this important financial code to navigate tax matters effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to dealing with taxes, the Internal Revenue Service (IRS) plays a crucial role in ensuring compliance and enforcing tax laws. One of the tools that the IRS uses to keep track of taxpayer information is the IRS Transcript. This document provides a detailed record of a taxpayer’s account, including their tax return history, payments, credits, and any related activity.

However, sometimes taxpayers may come across a code on their IRS Transcript that they are unfamiliar with. One such code is Code 806, which can cause confusion and concern. In this article, we will delve into the specifics of Code 806 on an IRS Transcript, explaining its meaning, potential implications, and how to navigate through any issues that may arise as a result.

Understanding the IRS Transcript and the codes associated with it is vital for any taxpayer who wants to ensure compliance, understand their tax situation, or resolve any discrepancies. By shedding light on Code 806, we aim to provide you with valuable insights into this particular code’s significance and equip you to take appropriate action, if necessary.

Overview of IRS Transcripts

An IRS Transcript is a document that provides a detailed summary of a taxpayer’s financial interactions with the IRS. It includes information on tax returns filed, payments made, credits applied, and any adjustments made to the account. IRS Transcripts are often used for various purposes, such as verifying income when applying for a loan or resolving tax-related issues.

There are different types of IRS Transcripts, each serving a specific purpose. Some of the commonly requested transcripts include:

- Tax Return Transcript: This transcript provides a summary of the taxpayer’s filed tax return, including information on adjusted gross income (AGI), filing status, and any accompanying schedules and forms.

- Account Transcript: An account transcript provides a comprehensive overview of the taxpayer’s account, including payments, penalties, and any adjustments made to the account.

- Wage and Income Transcript: This transcript includes information on reported income, such as wages, dividends, and interest, which is useful for verifying income when applying for loans or resolving income-related discrepancies.

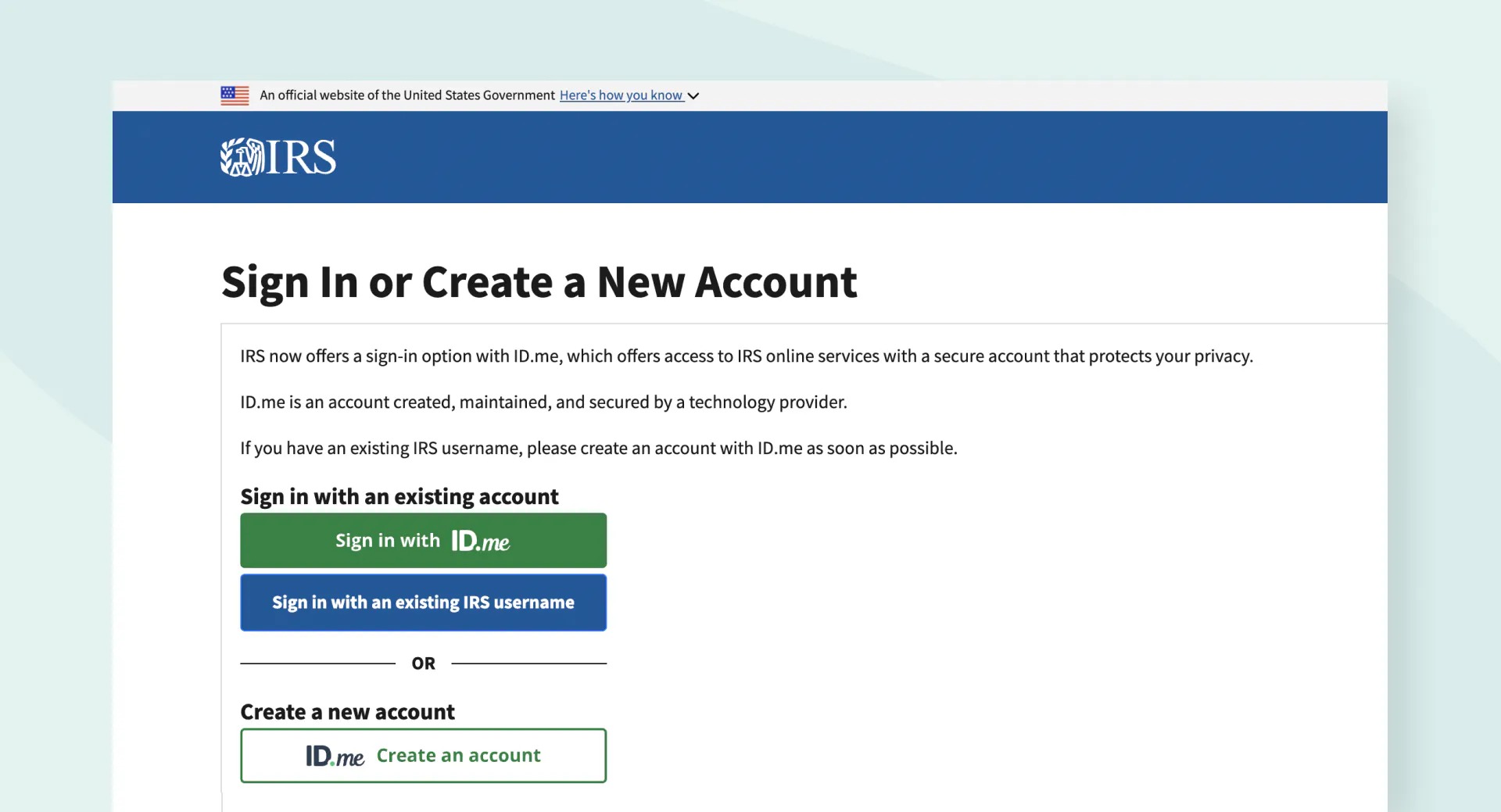

IRS Transcripts can be obtained online through the IRS website, by phone, or by mail. It is important to note that IRS Transcripts do not provide a future projection of tax liabilities or tax refunds. They solely provide historical information about a taxpayer’s account and transactions with the IRS.

Reviewing an IRS Transcript can help taxpayers identify any discrepancies, errors, or potential issues that need to be addressed. It is essential to closely review the details provided in the transcript and take appropriate action if any irregularities are discovered.

Understanding IRS Code 806

When you receive your IRS Transcript, you may come across various codes that provide additional information about your tax account. One such code is Code 806. Understanding the meaning behind this code is essential for deciphering its implications and taking appropriate action.

Code 806 on an IRS Transcript signifies an adjustment made by the IRS to the taxpayer’s account. It indicates that the IRS has made changes to the taxpayer’s reported income, deductions, credits, or other tax-related information. The specific details of the adjustment will be outlined in the accompanying transcript.

While Code 806 does indicate that there has been an adjustment, it does not provide specific information regarding the reason behind the adjustment. To obtain more detailed information about the nature of the adjustment, it is advisable to review the corresponding IRS Transcript, specifically the sections that provide details about the changes made.

It is important to note that not all adjustments indicated by Code 806 should be a cause for concern or alarm. In some cases, the adjustment may be a routine correction made by the IRS to ensure accurate reporting and compliance with tax laws. For example, the adjustment could be related to the correction of a mathematical error, a clarification of a deduction, or the inclusion of missing information.

On the other hand, an adjustment indicated by Code 806 could also be a result of an IRS audit or examination. If this is the case, the adjustment may be more significant and could potentially result in additional tax liability, penalties, or interest owed by the taxpayer.

Understanding the specific nature of the adjustment and its potential implications is crucial. It is recommended to review the IRS Transcript carefully, paying close attention to the details provided, and seeking assistance or guidance if needed.

Common Explanations for Code 806 on an IRS Transcript

While Code 806 on an IRS Transcript indicates an adjustment made by the IRS, the specific reason for the adjustment may vary. Here are some common explanations for Code 806:

- Mathematical Error: In some cases, Code 806 may be used to rectify a mathematical error on the taxpayer’s tax return. This usually involves correcting calculations or computations that were incorrectly reported.

- Missing Information: Code 806 may also be used to address missing or incomplete information on the taxpayer’s tax return. This could include omitted income, deductions, or credits that were not originally reported.

- Deduction Adjustment: Another explanation for Code 806 could be an adjustment related to deductions claimed on the tax return. This could involve disallowing certain deductions or modifying the amounts claimed based on IRS guidelines or audit findings.

- Income Adjustment: Code 806 might be used to indicate an adjustment made to the taxpayer’s reported income. This could stem from the IRS determining that additional income should have been reported or that certain income was incorrectly classified or excluded.

- Tax Credit Modification: If the taxpayer claimed certain tax credits on their return, an adjustment indicated by Code 806 could be related to modifications made to those credits. This could include disallowing certain credits or adjusting the amounts claimed based on IRS regulations.

- Audit Result: In some cases, Code 806 may be used to denote an adjustment resulting from an IRS audit or examination. This could involve changes made by the IRS based on their findings during the audit process, potentially leading to additional tax liability.

It is important to note that these explanations are not exhaustive, and the specific reason for Code 806 on your IRS Transcript may be unique to your tax situation. Reviewing your IRS Transcript in detail and seeking guidance from a tax professional can help you understand the specific nature and implications of the adjustment.

Impact and Consequences of Code 806

Code 806 on an IRS Transcript indicating an adjustment can have various impacts and consequences depending on the nature and extent of the adjustment. Here are some potential effects:

Additional Tax Liability: If the adjustment results in an increase in reported income or disallowance of certain deductions or credits, it may lead to additional tax liability. The taxpayer could owe more taxes, including penalties and interest, based on the revised calculations.

Refund Reduction: In cases where the adjustment decreases the amount of reported credits or deductions, it can lead to a reduction in the taxpayer’s refund. The revised calculations may result in a lower refund amount than initially anticipated.

Penalties and Interest: If the adjustment is a result of underreported income, negligence, or intentional disregard of tax laws, the IRS may impose penalties and interest on the owed amount. The penalties can vary depending on the type and severity of the violation.

Extended Audit or Examination: If the adjustment is a consequence of an IRS audit or examination, it could lead to a more extensive review of the taxpayer’s tax return and financial records. The audit process may involve additional inquiries, requests for supporting documentation, and possibly further adjustments.

Impact on Filing and Reporting: An adjustment indicated by Code 806 could have implications for future tax filings and reporting. It is crucial for taxpayers to understand the reasons behind the adjustment and take appropriate steps to ensure accurate reporting in future returns.

It’s important for taxpayers to promptly address and resolve any issues related to Code 806. Ignoring or neglecting the adjustment may result in accumulating penalties, interest, and potential legal consequences. Seeking professional assistance from a tax advisor or enrolled agent is recommended to understand the impact of Code 806 and to navigate the necessary steps to address the adjustment.

Resolving Issues Related to Code 806 on an IRS Transcript

If you come across Code 806 on your IRS Transcript, it is important to take proactive steps to resolve any issues related to the adjustment. Here are some steps you can take to address the situation:

1. Review the IRS Transcript: Carefully review the IRS Transcript, paying close attention to the sections that provide details about the adjustment. Understand the nature of the adjustment, including the specific changes made by the IRS.

2. Seek Professional Guidance: Consider seeking guidance from a tax professional, such as a tax advisor or enrolled agent. They can help you understand the implications of Code 806, assess the accuracy of the adjustment, and guide you on the appropriate steps to resolve the issue.

3. Gather Relevant Documentation: Collect any relevant documentation, such as supporting records, receipts, or documentation related to the adjustments made by the IRS. These documents can help strengthen your case during the resolution process.

4. Respond to IRS Notices or Correspondence: If you receive any notices or correspondence from the IRS regarding the adjustment, respond promptly. Failure to respond or provide the requested information could escalate the situation and potentially lead to further penalties or consequences.

5. Request an Audit Reconsideration: If the adjustment is a result of an audit or examination, you may have the option to request an Audit Reconsideration. This allows you to provide additional information or evidence to challenge the adjustment and potentially lead to a more favorable outcome.

6. Explore Payment Options: If the adjustment results in additional tax liability, it is important to explore available payment options. The IRS may offer installment agreements or other arrangements to help you manage the owed amount in a more feasible manner.

7. Maintain Documentation: Keep copies of all correspondence, notices, and relevant documentation related to the adjustment. This will serve as evidence and support for your case in case of any future inquiries or disputes.

Resolving issues related to Code 806 requires active participation and timely action. By being proactive and seeking professional guidance, you can navigate through the process more effectively and work towards a resolution that is favorable to your circumstances.

Conclusion

Dealing with Code 806 on an IRS Transcript can be a daunting and confusing experience for taxpayers. However, understanding the meaning and implications of this code is crucial for effectively resolving any issues that may arise.

In this article, we have provided an overview of IRS Transcripts and explained the significance of Code 806. We explored common explanations for this code and discussed the potential impact and consequences it can have on taxpayers.

When faced with Code 806, it is essential to review your IRS Transcript carefully, seeking professional guidance if needed. By understanding the nature of the adjustment and taking appropriate action, you can work towards resolving any issues and minimizing potential penalties or additional tax liabilities.

Be proactive in addressing the adjustment, gather relevant documentation, and respond to any IRS notices promptly. Seeking the assistance of a tax professional can provide valuable insights and guidance during the resolution process.

Remember, resolving issues related to Code 806 may require persistence and patience. By staying informed, maintaining clear communication with the IRS, and adhering to tax laws and regulations, you can navigate the process effectively and safeguard your financial well-being.

As always, it is recommended to consult with a qualified tax professional for personalized advice and guidance tailored to your specific situation. With their expertise and support, you can navigate through any challenges that may arise and ensure compliance with tax laws.