Finance

What Is An Endowment Life Insurance Policy?

Published: October 15, 2023

Learn about the benefits and features of an endowment life insurance policy, an important financial tool for long-term planning and security. Finance your future with peace of mind.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Life Insurance?

- Understanding Endowment Policies

- Features of an Endowment Life Insurance Policy

- Benefits of an Endowment Life Insurance Policy

- Drawbacks of an Endowment Life Insurance Policy

- How Does an Endowment Life Insurance Policy Work?

- Who Should Consider an Endowment Life Insurance Policy?

- How to Choose an Endowment Life Insurance Policy

- Conclusion

Introduction

Life insurance is an important financial tool that provides financial security and peace of mind to individuals and their families. It offers protection against the uncertainties of life and helps to ensure that loved ones are taken care of in the event of an untimely death. While traditional life insurance policies primarily focus on the protection aspect, there are other types of life insurance policies that offer a combination of protection and savings.

One such policy is the Endowment Life Insurance Policy. This type of policy is designed to provide both a death benefit and a savings component. It offers a lump sum payment to the policyholder at the end of the policy term, essentially acting as a savings plan. This makes it a unique and versatile option for individuals who want to secure their financial future while also having the flexibility to withdraw funds during their lifetime.

In this article, we will explore the intricacies of an endowment life insurance policy. We will discuss its features, benefits, drawbacks, and how it works. We will also help you determine whether an endowment life insurance policy is a suitable option for your financial needs.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company that provides a financial safety net for the insured and their beneficiaries in the event of the insured’s death. It is a way to ensure that loved ones are protected and financially supported in the face of a tragic loss.

When a person purchases a life insurance policy, they pay regular premiums to the insurance company. In return, the insurance company agrees to pay a predetermined sum of money, known as the death benefit, to the policy’s beneficiaries upon the insured’s death. This ensures that the insured’s loved ones are provided for and can cover expenses such as funeral costs, mortgage payments, and other financial obligations.

There are different types of life insurance policies available, each with its own unique features and benefits. These include term life insurance, whole life insurance, universal life insurance, and endowment life insurance. While all of these policies offer some form of financial protection, they differ in terms of coverage duration, premium structure, and additional benefits.

Life insurance is essential for individuals who have dependents or financial obligations that would be difficult to manage in the event of their passing. It provides peace of mind, knowing that loved ones will have the necessary funds to maintain their standard of living and meet their future financial needs.

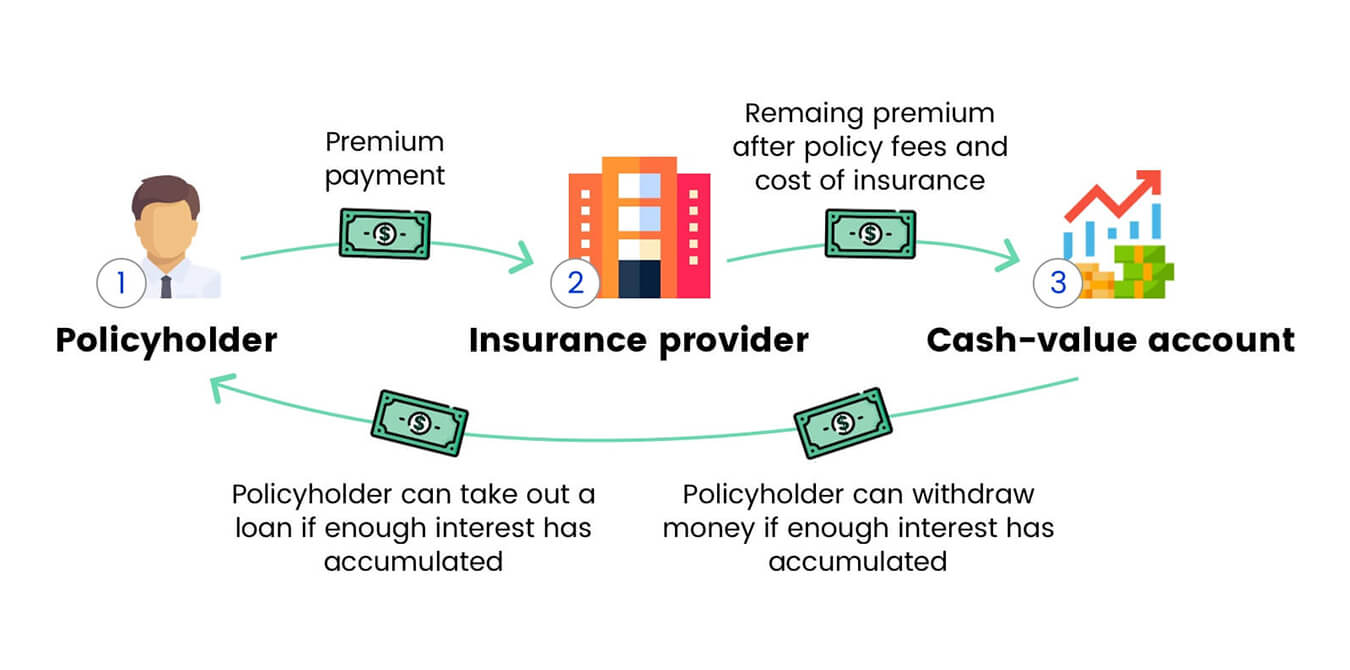

In addition to the death benefit, some life insurance policies also come with a cash value component. This allows the policyholder to accumulate savings over time, which can be used for various purposes such as supplementing retirement income, funding children’s education, or covering emergency expenses.

Now that we have a basic understanding of life insurance, let’s delve into the specifics of an endowment life insurance policy and how it differs from other types of life insurance.

Understanding Endowment Policies

An endowment policy is a type of life insurance that combines both protection and savings elements. It offers a guaranteed death benefit to the policyholder’s beneficiaries, just like traditional life insurance. However, what sets it apart is the additional feature of a maturity payout.

With an endowment policy, the policyholder pays regular premiums for a specified period, known as the policy term. At the end of this term, if the insured is still alive, they receive a lump sum payout, which is referred to as the maturity value. This maturity value can be used as a savings fund or towards fulfilling financial goals such as buying a house, funding education, or retirement planning.

One key aspect of endowment policies is that they have a fixed policy term. This term can range from 10 to 30 years or even longer, depending on the policy’s terms and conditions. This time frame provides a clear and definite period for the policyholder to plan and achieve their financial objectives.

It’s important to note that if the policyholder passes away during the policy term, the beneficiaries will receive the death benefit as specified in the policy. This ensures that the financial needs of loved ones are taken care of even in the unfortunate event of the insured’s untimely demise.

Endowment policies also come with a surrender value, which is the amount a policyholder receives if they choose to surrender the policy before the end of the term. The surrender value depends on factors such as the length of time the policy has been in force, the premiums paid, and the policy’s terms and conditions.

It’s crucial to understand that an endowment policy combines insurance and savings, making it a long-term commitment. The premiums paid towards an endowment policy are generally higher compared to a term life insurance policy. This is because a portion of the premium goes towards the cost of insurance, while the remaining amount is allocated towards savings and investment purposes.

Now that we have discussed the basic concept of endowment policies, let’s explore their features in more detail in the next section.

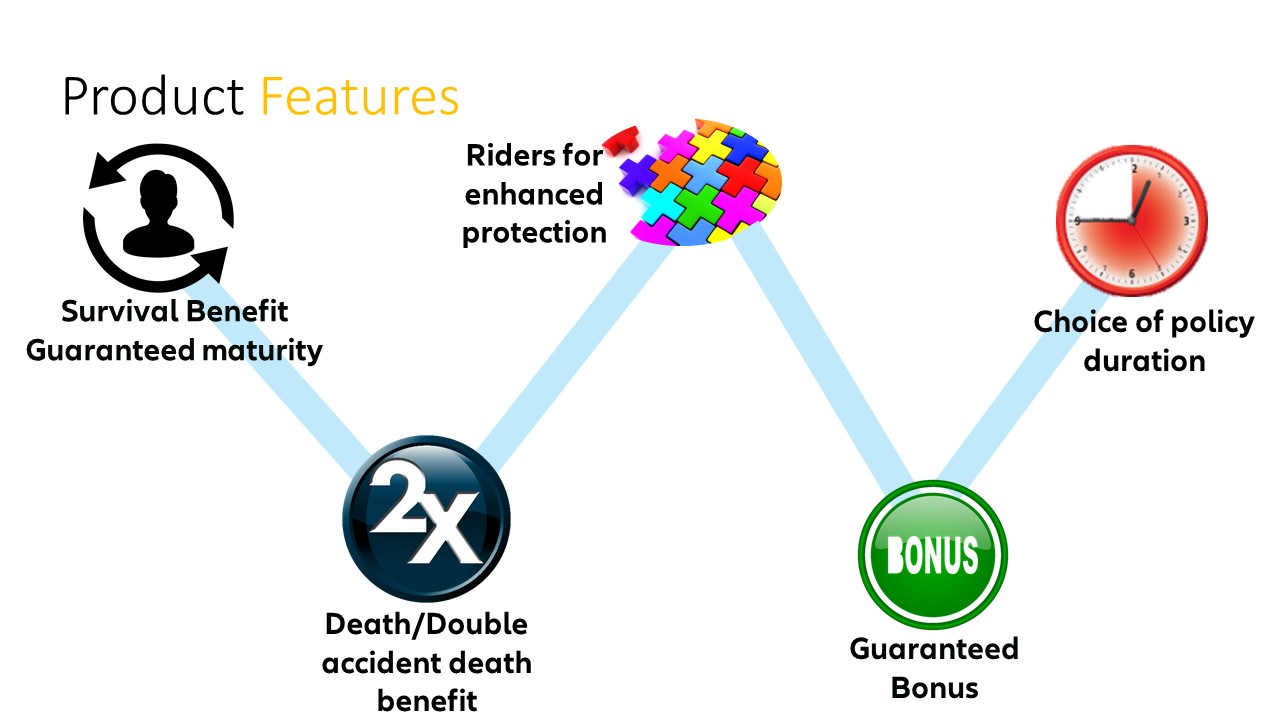

Features of an Endowment Life Insurance Policy

Endowment life insurance policies come with several distinct features that set them apart from other types of life insurance. Understanding these features will help you determine if an endowment policy aligns with your financial goals and needs. Let’s explore some key features:

- Death Benefit: Like other life insurance policies, an endowment policy offers a death benefit. This means that in the event of the policyholder’s death during the policy term, a predetermined sum of money is paid out to the beneficiaries. The death benefit helps provide financial protection to loved ones and can be used to cover expenses such as funeral costs, outstanding debts, and ongoing financial obligations.

- Maturity Payout: The distinguishing feature of an endowment policy is the maturity payout. If the policyholder survives the policy term, they receive a lump sum payout called the maturity value. This maturity value is predetermined at the time of policy inception and can be used as a savings fund or to meet specific financial goals.

- Fixed Policy Term: Endowment policies have a fixed policy term, ranging from 10 to 30 years or even longer. This allows the policyholder to plan and work towards their financial objectives within a specific timeframe. It provides a sense of clarity and certainty regarding the duration of premium payments and the payout at maturity.

- Premium Payments: Policyholders of endowment policies are required to pay regular premiums throughout the policy term. These premium payments are typically higher compared to term life insurance policies because they include both the cost of insurance coverage and the savings component. The premiums are determined based on factors such as the policyholder’s age, health condition, policy term, and desired maturity value.

- Cash Value Accumulation: Over time, an endowment policy accumulates a cash value that grows tax-deferred. This cash value is separate from the death benefit and can be accessed by the policyholder through partial withdrawals or policy loans. The cash value accumulates based on the performance of investments made by the insurance company, usually in a mix of bonds, stocks, and other financial instruments.

- Surrender Value: If the policyholder decides to surrender the policy before the end of the term, they are entitled to receive a surrender value. This is the amount of money paid by the insurance company, taking into account the premiums paid and the cash value accumulated. The surrender value is typically lower than the maturity value but provides a financial option if the policyholder needs to discontinue the policy.

Understanding the features of an endowment life insurance policy is crucial when considering this type of policy. It’s important to evaluate your financial goals, risk tolerance, and long-term commitment before making a decision. Now, let’s examine the benefits of an endowment life insurance policy in the following section.

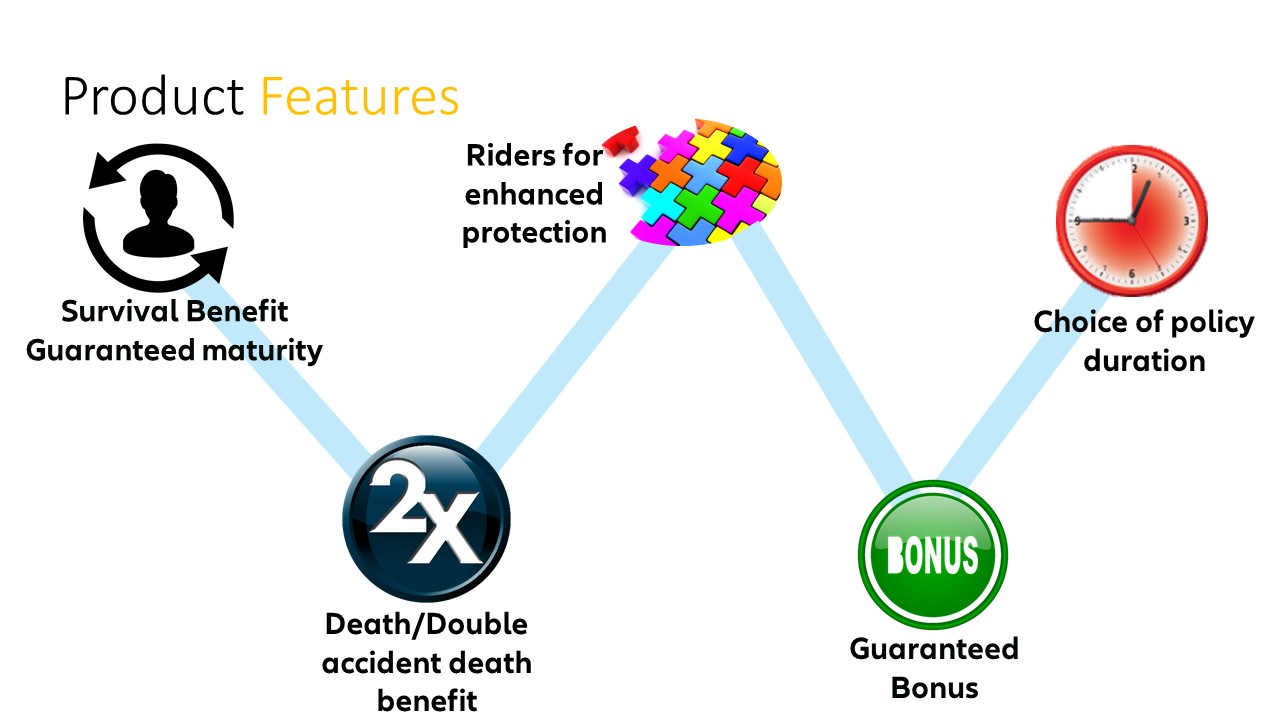

Benefits of an Endowment Life Insurance Policy

Endowment life insurance policies offer several benefits that make them an attractive option for individuals looking to combine both protection and savings. Let’s explore some of the key benefits:

- Death Benefit: Like other life insurance policies, endowment policies provide a death benefit to the beneficiaries in the event of the policyholder’s death during the policy term. This ensures that loved ones are financially protected and can cover immediate expenses and ongoing financial obligations.

- Maturity Payout: One significant benefit of an endowment policy is the maturity payout. If the policyholder survives the policy term, they receive a lump sum payout known as the maturity value. This can be used for various purposes such as paying off a mortgage, funding higher education, or supplementing retirement income.

- Forced Savings: Endowment policies encourage disciplined savings. By paying regular premiums over the policy term, policyholders are essentially setting aside money towards a financial goal. This forced savings provides a structured approach to saving, ensuring financial stability and a lump sum payout at maturity.

- Tax Benefits: Depending on the country’s tax laws, endowment policies may offer tax advantages. In some cases, the premiums paid towards the policy may be eligible for tax deductions, and the maturity value may be tax-free. It’s important to consult with a tax advisor to understand the specific tax implications of an endowment policy in your jurisdiction.

- Flexibility: Endowment policies offer a level of flexibility that appeals to many policyholders. The lump sum payout at maturity can be used for any purpose, allowing individuals to meet their unique financial goals. Additionally, some endowment policies allow for partial withdrawals or policy loans, providing access to the cash value accumulated within the policy.

- Peace of Mind: An endowment policy provides a sense of financial security and peace of mind. Knowing that there is a guaranteed payout at maturity or a death benefit in case of an unfortunate event can help individuals and their families feel protected and confident about their financial future.

It’s important to consider these benefits when evaluating whether an endowment life insurance policy is the right choice for you. However, it’s also essential to understand the drawbacks and limitations of such policies, which we will explore in the next section.

Drawbacks of an Endowment Life Insurance Policy

While endowment life insurance policies offer several advantages, it’s important to consider the drawbacks and limitations that come with them. Here are some key drawbacks to keep in mind:

- Higher Premiums: Compared to term life insurance policies, endowment policies typically have higher premium payments. This is because a portion of the premium goes towards the cost of insurance coverage, while the remaining amount is allocated towards savings and investment purposes. The higher premiums can be a deterrent for individuals with limited financial resources.

- Lower Returns: The returns on endowment policies are generally lower compared to other investment options such as mutual funds or stocks. While the cash value within the policy accumulates over time, the growth rate may not match the potential returns of other investment vehicles. It’s important to evaluate the potential returns and compare them to alternative investment options before committing to an endowment policy.

- Rigid Policy Terms: Endowment policies have fixed policy terms, which means that the policyholder must adhere to the specified duration of premium payments. This lack of flexibility can be a drawback if the policyholder’s financial circumstances change or if they require access to funds before the policy term ends. Surrendering the policy before maturity may result in lower payout than expected.

- Opportunity Cost: By allocating funds towards an endowment policy, there is an opportunity cost involved. This means that the funds used for the policy premiums could have potentially been invested in other higher-return investment options. It’s important to evaluate whether the benefits of an endowment policy outweigh the potential returns of alternative investment avenues.

- Tax Implications: While endowment policies may offer tax benefits, it’s essential to consider the tax implications. The tax treatment of premiums and payouts can vary depending on the country’s tax laws. Policyholders should consult with a tax advisor to understand the specific tax implications associated with an endowment policy in their jurisdiction.

- Limited Policy Options: Endowment life insurance policies offer limited customization options compared to universal life insurance policies. The investment choices and flexibility within the policy may be more restricted, making it less suitable for individuals who prefer more control and options in managing their investments.

Considering these drawbacks will help you make an informed decision about whether an endowment life insurance policy aligns with your financial goals and circumstances. It’s important to weigh the benefits against the drawbacks before committing to a policy.

In the next section, we will dive deeper into how an endowment life insurance policy works, shedding light on the mechanisms behind it.

How Does an Endowment Life Insurance Policy Work?

Endowment life insurance policies work by combining both protection and savings elements. Let’s explore the mechanics of how an endowment policy works:

1. Premium Payments: The policyholder pays regular premiums to the insurance company, typically on a monthly, quarterly, or annual basis. These premiums include the cost of insurance coverage and the savings component.

2. Insurance Coverage: A portion of the premium goes towards providing the death benefit, which is a payout to the beneficiaries in the event of the policyholder’s death during the policy term.

3. Savings Component: The remaining portion of the premium is allocated towards the savings component of the policy. This money accumulates over the policy term, growing tax-deferred, and forms the cash value.

4. Investments: The insurance company invests the cash value accumulated from policyholder premiums. These investments are typically made in a mix of bonds, stocks, and other financial instruments. The returns generated from these investments contribute to the growth of the policy’s cash value.

5. Maturity Payout: If the policyholder survives the policy term, they receive a lump sum payout called the maturity value. This amount is predetermined at the time of policy inception and is based on factors such as the premium amount, policy term, and projected investment returns.

6. Death Benefit: In the unfortunate event of the policyholder’s death during the policy term, the beneficiaries receive the death benefit. This provides financial protection to loved ones and helps cover immediate expenses and ongoing financial obligations.

7. Surrender Value: If the policyholder wishes to surrender the policy before the end of the term, they can receive a surrender value. This amount is calculated based on the premiums paid and the cash value accumulated within the policy. The surrender value may be lower than the maturity value.

It’s important to note that endowment policies have a fixed policy term, and the premiums must be paid for the entire duration. The policyholder has no control over the investment decisions made by the insurance company. The growth of the cash value and the performance of the policy are dependent on the insurer’s investment strategy.

Individuals considering an endowment life insurance policy should carefully evaluate their financial goals, risk tolerance, and long-term commitment. Comparing different policy options and understanding the terms and conditions will help make an informed decision.

In the next section, we will discuss who should consider an endowment life insurance policy and its suitability for different individuals.

Who Should Consider an Endowment Life Insurance Policy?

An endowment life insurance policy can be a suitable option for individuals who have specific financial goals and are looking for a combination of protection and savings. Let’s explore who should consider an endowment life insurance policy:

1. Individuals with specific financial goals: If you have specific financial goals that require a lump sum payout at a predetermined time in the future, such as buying a house, funding your child’s education, or supplementing retirement income, an endowment policy can help you achieve those goals. The maturity value of the policy provides a guaranteed payout that can be used for these purposes.

2. Risk-averse individuals: Endowment policies provide a level of security and stability for risk-averse individuals. The guaranteed death benefit ensures that loved ones are financially protected in the event of the policyholder’s death. Additionally, the maturity value provides a guaranteed payout at the end of the policy term, which can alleviate concerns about market fluctuations or investment risks.

3. Those seeking forced savings: If you struggle with disciplined saving and want a structured approach to savings, an endowment policy can be beneficial. The regular premium payments act as a forced savings mechanism, helping you accumulate funds over the policy term. This can be particularly advantageous for individuals who find it challenging to save consistently on their own.

4. Individuals with a long-term outlook: Endowment policies are long-term commitments, typically lasting 10 to 30 years or even longer. If you have a long-term financial plan and are willing to commit to regular premium payments, an endowment policy can provide a reliable and predictable savings avenue. The fixed policy term allows you to plan and work towards your financial objectives within a defined timeframe.

5. Those seeking tax benefits: Depending on the country’s tax laws, endowment policies may offer tax advantages. In some cases, the premiums paid towards the policy may be eligible for tax deductions, and the maturity value may be tax-free. If you want to take advantage of potential tax benefits, an endowment policy can be a suitable option. However, it’s important to consult with a tax advisor to understand the specific tax implications in your jurisdiction.

It’s important to note that an endowment life insurance policy may not be suitable for everyone. If you have short-term financial goals, have a higher risk appetite, or prefer more control over your investments, other types of life insurance policies or investment options may be more suitable for your needs.

In the next section, we will discuss how to choose the right endowment life insurance policy that aligns with your financial goals and circumstances.

How to Choose an Endowment Life Insurance Policy

Choosing the right endowment life insurance policy requires careful consideration of your financial goals, risk tolerance, and personal circumstances. Here are some factors to consider when selecting an endowment policy:

1. Set your financial goals: Determine your specific financial goals and the timeframe within which you aim to achieve them. Whether it’s buying a house, funding your child’s education, or saving for retirement, having a clear understanding of your objectives will help you select an endowment policy that aligns with your goals.

2. Evaluate the policy term: Consider the length of the policy term. The policy term should align with your financial goals and the time required to achieve them. Longer policy terms may offer higher maturity values but require a longer commitment, while shorter terms may offer quicker access to funds but result in lower maturity values.

3. Assess the premium amount: Determine the affordability of the premiums. The premium amount should fit comfortably within your budget, ensuring that you can consistently make the payments throughout the policy term. Take into account your income, expenses, and other financial obligations before committing to a specific premium amount.

4. Compare maturity values: Review the maturity values offered by different endowment policies. The maturity value should provide the desired lump sum payout to meet your financial goals. Compare the projected maturity values of various policies to determine which one offers the most favorable outcome for your needs.

5. Understand the death benefit: Consider the death benefit offered by the endowment policies. The death benefit should provide adequate financial protection to your loved ones in the event of your untimely demise during the policy term. Ensure that the death benefit is sufficient to cover immediate expenses, outstanding debts, and ongoing financial obligations.

6. Examine the surrender value: Evaluate the surrender value of the policy. The surrender value is the amount you receive if you decide to surrender the policy before the end of the term. Compare the surrender values of different policies and consider the flexibility it offers if you need to discontinue the policy or access funds before maturity.

7. Seek professional advice: Consult with a financial advisor or insurance agent who specializes in life insurance. They can help you navigate through the various policy options, explain the terms and conditions, and assist you in selecting the most suitable endowment policy based on your unique financial situation and objectives.

8. Research the insurance company: Before finalizing any policy, research the insurance company offering it. Look for a reputable and financially stable insurance company with a strong track record. Assess the company’s ratings and reviews to ensure they have a history of reliable customer service and claims settlement.

By considering these factors and seeking professional advice, you can choose an endowment life insurance policy that aligns with your financial goals, provides the necessary protection, and suits your individual circumstances.

In the next section, we will wrap up our discussion on endowment life insurance policies.

Conclusion

An endowment life insurance policy offers a unique combination of protection and savings, making it a compelling option for individuals seeking financial security and a means to achieve specific financial goals. With a guaranteed death benefit and a maturity payout at the end of the policy term, an endowment policy provides peace of mind and a tangible financial benefit.

Throughout this article, we have explored the various aspects of an endowment life insurance policy, including its features, benefits, drawbacks, and how it works. We have highlighted the importance of setting financial goals, evaluating policy terms, assessing premium affordability, and considering the death benefit and surrender value.

Endowment policies are particularly suitable for individuals with specific financial goals and a long-term outlook. They provide a structured savings mechanism, tax benefits in certain cases, and the security of guaranteed payouts. However, it’s important to carefully weigh the advantages against the potential drawbacks, such as higher premiums and lower returns compared to other investment options.

In order to choose the right endowment policy, it is recommended to seek the guidance of a financial advisor or insurance professional who can provide personalized advice based on your unique circumstances and objectives. They can help evaluate different policy options, explain the terms and conditions, and ensure that the selected policy aligns with your financial goals.

Remember, selecting an insurance policy is a significant decision that should not be taken lightly. Take the time to thoroughly understand the policy terms, compare different offerings, and consider your long-term financial needs.

In conclusion, an endowment life insurance policy can provide a reliable and structured approach to financial protection and savings. By carefully considering your goals and circumstances, and seeking professional advice, you can choose an endowment policy that offers both peace of mind and the means to achieve your financial aspirations.