Finance

What Is An Expert Advisor In Forex Trading

Published: December 22, 2023

Discover what an expert advisor is in forex trading and how it can enhance your finance strategies. Maximize your profits with expert advice and automated trading systems.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

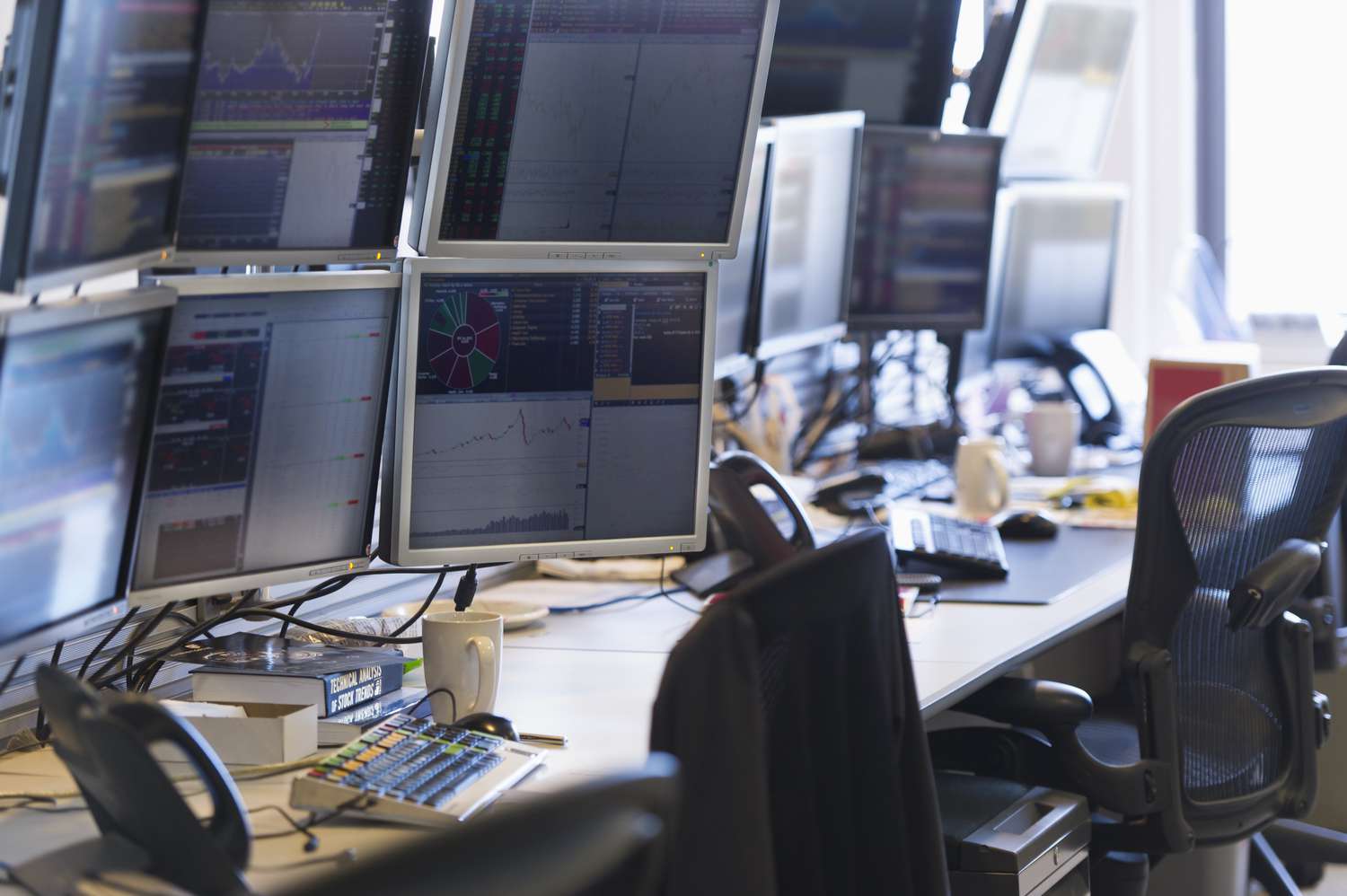

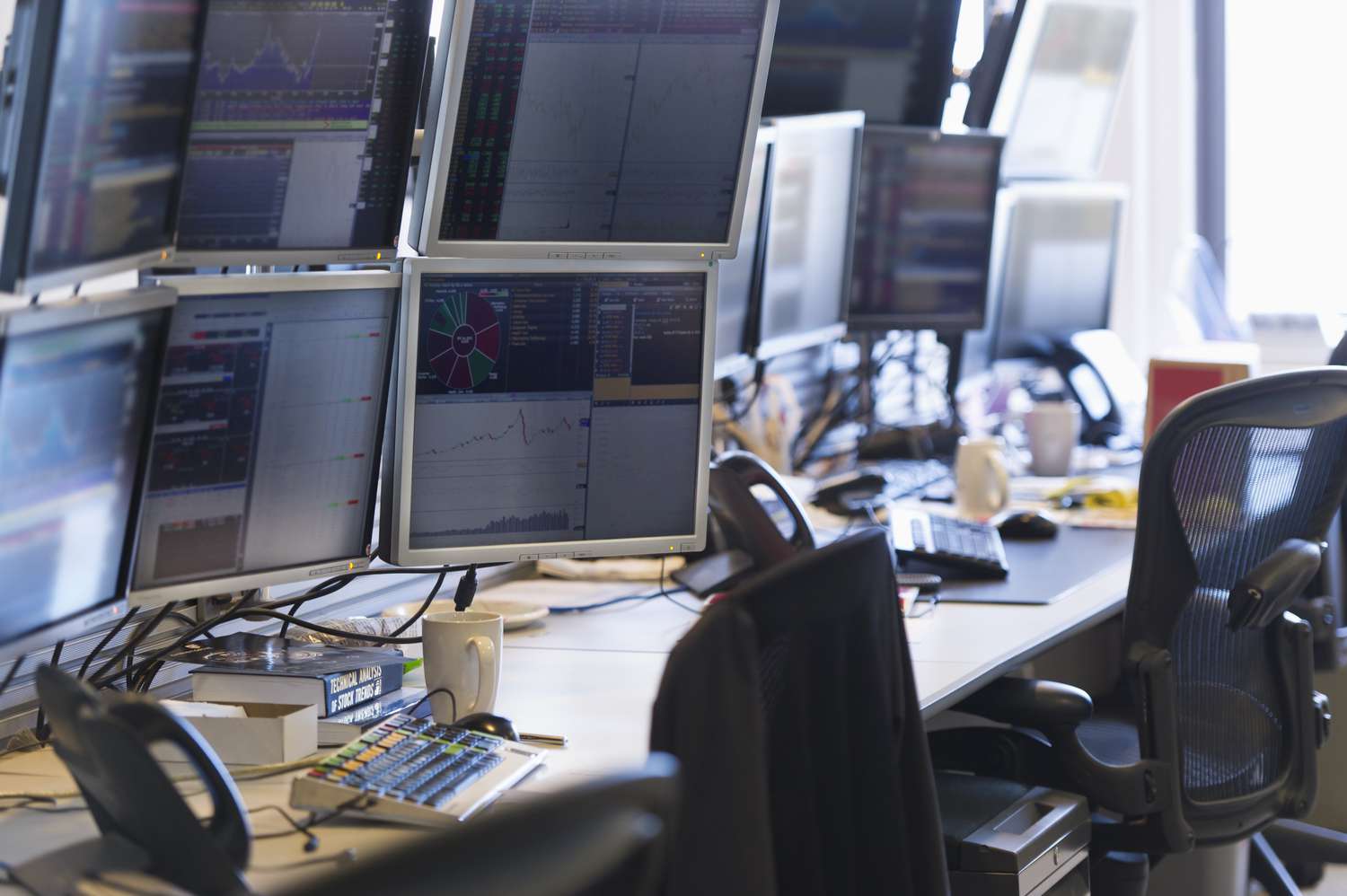

When it comes to forex trading, staying ahead of the market and making profitable trades can be a challenging task. The foreign exchange market is highly volatile, and making split-second decisions based on market conditions can be overwhelming for traders. This is where experts advisors come into play. In this article, we will explore what expert advisors are in forex trading and how they can be beneficial in navigating the complex world of currency trading.

Expert advisors, also known as EAs, are automated trading systems that can execute trades on behalf of traders. These systems are designed to analyze market data, identify trading signals, and automatically place trades based on pre-defined parameters. Essentially, they are computer programs that take the emotion out of trading, relying on a set of rules and algorithms to make trading decisions.

With the advancement in technology, expert advisors have become increasingly popular among forex traders. They offer several advantages, including the ability to trade 24/7, faster trade execution, and the removal of emotional biases that can often lead to poor decision-making. While they can be incredibly useful tools, it is important to understand how they work and the potential drawbacks associated with their use.

In this article, we will delve into the details of expert advisors, exploring their functionalities, benefits, and drawbacks. We will also discuss how to choose the right expert advisor for your trading style and provide some tips to optimize their performance. So, whether you are a seasoned trader or just starting your forex journey, read on to discover how expert advisors can revolutionize your trading experience.

Definition of Expert Advisor

An expert advisor, commonly referred to as an EA, is a software program designed to automate trading operations in the forex market. It is essentially a set of algorithms and rules that enable the program to analyze market data, identify trading opportunities, and execute trades automatically, without the need for human intervention.

Expert advisors are developed using programming languages like MQL (MetaQuotes Language) for the MetaTrader platform, which is one of the most widely used trading platforms in forex. They are typically written by experienced traders or programmers who have a deep understanding of the forex market and trading strategies.

These automated systems can be customized to suit a trader’s individual preferences and trading style. Traders can set various parameters such as entry and exit points, trade size, risk management rules, and indicators to be used for analyzing the market. Once these parameters are set, the expert advisor will monitor the market, execute trades based on the predefined rules, and manage open positions accordingly.

Expert advisors can be highly sophisticated, utilizing complex mathematical algorithms and technical indicators to identify patterns and generate trading signals. They can also incorporate fundamental analysis and news feeds to make informed trading decisions. With the advancement in technology, some expert advisors even have machine learning capabilities, allowing them to adapt and improve their trading strategies over time.

Using expert advisors offers several advantages for forex traders. They provide the ability to trade 24/7, even when the trader is not available to monitor the market. This ensures that potential trading opportunities are not missed. Additionally, expert advisors can execute trades with high speed and precision, removing the human factor that can sometimes lead to errors or delays in placing orders.

It is important to note that expert advisors are not a guaranteed path to profits. While they can be powerful tools for automating trading activities, they still rely on the accuracy of the underlying trading strategy and the quality of the market analysis. Traders should thoroughly test and optimize their expert advisor before deploying it in live trading to ensure its effectiveness.

Now that we understand what expert advisors are, let’s explore how they work in more detail in the next section.

How Expert Advisors Work

Expert advisors work by following a set of predefined rules and algorithms to analyze market data, generate trading signals, and execute trades automatically. These rules and algorithms are based on various trading strategies and technical indicators that the trader chooses to incorporate into the expert advisor.

When a trader activates an expert advisor on their trading platform, the program starts collecting real-time market data. This data includes price movements, volume, and other relevant indicators. The expert advisor then applies predefined rules to this data to identify potential trading opportunities.

These rules can be based on technical analysis indicators, such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), or any other indicator that the trader deems relevant. The expert advisor can also incorporate fundamental analysis, taking into account economic news releases, geopolitical events, and other factors that may impact the market.

Once the expert advisor identifies a trading signal based on the predefined rules, it will automatically execute the trade on behalf of the trader. The execution can be done instantly, ensuring that the trade is entered at the desired price level without delays.

In addition to trade execution, expert advisors can also manage open positions. They can set stop-loss and take-profit levels to protect profits and limit losses. Some expert advisors also have trailing stop functionality, which adjusts the stop-loss level as the trade moves in the trader’s favor, locking in profits along the way.

Expert advisors can be backtested to evaluate their past performance and profitability. Traders can use historical trading data to simulate how the expert advisor would have performed in different market conditions. This allows them to assess the effectiveness of the expert advisor and make any necessary adjustments or optimizations before using it in live trading.

Furthermore, expert advisors can be optimized using parameters such as trade entry rules, risk management strategies, and indicators. Traders can run optimization tests to find the best combination of parameters that yield the highest profitability.

While expert advisors offer the convenience and potential for enhanced trading efficiency, it is important for traders to monitor their performance regularly. The forex market is dynamic and can experience rapid changes, so ongoing evaluation and adjustment of the expert advisor’s settings may be necessary to adapt to evolving market conditions.

In the next section, we will explore the benefits of using expert advisors in forex trading.

Benefits of Using Expert Advisors in Forex Trading

Using expert advisors in forex trading offers several benefits that can potentially enhance a trader’s trading experience and improve their overall profitability. Let’s explore some of the key advantages:

- 24/7 Trading: One of the significant advantages of using expert advisors is the ability to trade around the clock. Since the forex market operates 24 hours a day, 5 days a week, traders can miss trading opportunities when they are not available. Expert advisors eliminate this problem by automatically scanning the market and executing trades even when the trader is offline or occupied with other responsibilities.

- Emotion-Free Trading: Emotions can often lead to irrational trading decisions, such as holding onto losing trades for too long or exiting winning trades too early. Expert advisors remove the emotional aspect from trading as they rely on predefined algorithms and rules. This eliminates impulsive and irrational decisions, resulting in a more disciplined and consistent trading approach.

- Increased Speed and Accuracy: Expert advisors can execute trades much faster than manual trading. They are capable of analyzing market data and instantly placing trades according to the predefined rules. This eliminates the potential for delays or missed opportunities due to human limitations. Additionally, expert advisors are programmed to execute trades with precision, ensuring that the trade is entered at the desired price level and with the correct trade size.

- Backtesting and Optimization: Expert advisors can be backtested using historical data to assess their performance and profitability. Traders can simulate how the expert advisor would have performed in different market conditions, allowing them to make informed decisions about its suitability. Furthermore, expert advisors can be optimized by adjusting various parameters, such as trade entry rules and risk management strategies, to find the optimal settings that generate maximum profitability.

- Diversification: Expert advisors enable traders to diversify their trading strategies and portfolios. Since expert advisors can be programmed with different trading strategies and incorporate various indicators, traders can run multiple expert advisors simultaneously, each with a different approach. This diversification helps spread the risk and reduces the reliance on a single trading strategy.

It is important to note that while expert advisors offer several benefits, they are not a guaranteed route to success in the forex market. Proper testing, optimization, and ongoing monitoring are essential to ensure the effectiveness of the expert advisor and adapt to changing market conditions.

In the next section, we will discuss some of the drawbacks to consider when using expert advisors in forex trading.

Drawbacks of Using Expert Advisors in Forex Trading

While expert advisors offer numerous benefits, it is important to understand and consider the potential drawbacks associated with their use. Let’s explore some of the limitations of using expert advisors in forex trading:

- Lack of Adaptability: Expert advisors operate based on predefined rules and algorithms. They are programmed to follow specific trading strategies and indicators. However, the forex market is dynamic and can experience sudden changes in volatility, trend patterns, or economic factors. Expert advisors may not be able to adapt quickly to these changes, resulting in suboptimal trading decisions.

- Dependency on Historical Data: Expert advisors are often backtested using historical data to evaluate their performance. However, past performance does not guarantee future results. Market conditions can change, making historical data less relevant. Traders should be cautious when solely relying on backtest results to make decisions about an expert advisor’s potential profitability.

- Technical Issues: Expert advisors are software programs, and like any technology, they can encounter technical issues or glitches. Connectivity problems, power outages, or even updates to the trading platform can disrupt the proper functioning of the expert advisor. Traders should be prepared to address any technical issues that may arise and have a contingency plan in place to protect their trading activities.

- Over-Optimization: While optimizing expert advisors can be beneficial, there is a risk of over-optimization. Over-optimization occurs when the expert advisor is fine-tuned too much to fit historical data, resulting in a strategy that may not perform well in live trading. Traders should be cautious about overfitting the expert advisor to past data and consider the impact of different market conditions on its performance.

- Limited Human Judgment: Expert advisors are purely based on predefined rules and algorithms. They lack the ability to exercise human judgment, intuition, and discretion. Market conditions may sometimes require a trader’s subjective judgment to make appropriate trading decisions. Expert advisors cannot adapt to unexpected events or easily incorporate fundamental analysis that may influence the market.

Despite these drawbacks, expert advisors can still be valuable tools when used properly. Traders should carefully consider these limitations and evaluate whether the benefits outweigh the drawbacks based on their individual trading style and goals.

In the next section, we will discuss how to choose the right expert advisor for your forex trading needs.

Choosing the Right Expert Advisor

Choosing the right expert advisor is crucial for successful forex trading. With so many options available in the market, it can be overwhelming to determine which expert advisor is the most suitable for your trading needs. Here are some key factors to consider when selecting an expert advisor:

- Strategy and Trading Style: Consider your preferred trading strategy and style. Are you a day trader looking for intraday scalping opportunities, or do you prefer swing trading with longer time frames? Different expert advisors may be designed to cater to specific trading styles, so it is essential to choose one that aligns with your strategy and objectives.

- Performance and Reliability: Evaluate the performance and reliability of the expert advisor. Look for evidence of consistent profitability, such as verified track records or real-time performance reports. It is also essential to consider factors like drawdown, win rate, and risk-to-reward ratio to assess the risk associated with using the expert advisor.

- Customization and Flexibility: Consider the level of customization and flexibility offered by the expert advisor. It should allow you to adjust parameters, indicators, and risk management settings according to your preferences. A customizable expert advisor helps you adapt to various market conditions and optimize its performance based on your trading approach.

- Support and Updates: Check if the expert advisor provider offers reliable and responsive customer support. They should be available to address any technical issues or inquiries promptly. Additionally, regular updates and improvements to the expert advisor are crucial to ensure it remains effective in the evolving market conditions.

- Reviews and Recommendations: Research and read reviews from trusted sources or fellow traders who have used the expert advisor. Their experiences and insights can provide valuable information about the pros and cons of the expert advisor. However, be cautious of biased or misleading reviews and always consider multiple sources of information.

- Demo Testing: Before using an expert advisor in live trading, always perform thorough demo testing. Most reputable expert advisor providers offer demo accounts where you can test the performance and functionality of the expert advisor in simulated market conditions. This allows you to assess if it meets your expectations and aligns with your trading goals.

Remember, while choosing an expert advisor is important, it is equally vital to continuously monitor its performance, regularly assess its effectiveness, and make necessary adjustments if needed. The forex market is dynamic, and what works today may not work tomorrow.

By thoroughly researching, testing, and selecting the right expert advisor, you can leverage its capabilities to enhance your forex trading experience and potentially improve your trading results.

In the concluding section, we will summarize the key points discussed and wrap up the article.

Conclusion

In conclusion, expert advisors offer automation and convenience in forex trading, allowing traders to execute trades based on pre-defined rules and algorithms. They can provide several benefits, including 24/7 trading, emotion-free decision-making, increased speed and accuracy, backtesting capabilities, and the ability to diversify trading strategies.

However, it is important to be aware of the drawbacks associated with expert advisor usage. They may lack adaptability to changing market conditions, rely heavily on historical data, encounter technical issues, be prone to over-optimization, and lack human judgment and discretion.

When selecting an expert advisor, consider factors such as the strategy and trading style it caters to, its performance and reliability, customization options, customer support and updates, and user reviews and recommendations. Additionally, thorough demo testing is essential to ensure the expert advisor aligns with your trading goals.

Remember that an expert advisor is a tool, and its effectiveness depends on the underlying trading strategy, market analysis, and proper optimization. It is not a guaranteed path to success, and continuous monitoring and adjustments are necessary to adapt to changing market dynamics.

Incorporating expert advisors into your forex trading can streamline your trading process and potentially improve your trading efficiency. However, it is crucial to use them judiciously and combine them with your own judgment and analysis to achieve optimal results.

By understanding the strengths and limitations of expert advisors and selecting the right one for your needs, you can enhance your trading experience and increase your chances of success in the Forex market.