Home>Finance>What Is An LLC? Limited Liability Company Structure And Benefits Defined

Finance

What Is An LLC? Limited Liability Company Structure And Benefits Defined

Published: December 19, 2023

Discover the benefits and structure of an LLC, or Limited Liability Company. Learn how this finance entity can provide liability protection and tax advantages.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is an LLC? Limited Liability Company Structure and Benefits Defined

Are you considering starting a small business or structuring your existing business entity? One popular option worth exploring is the Limited Liability Company (LLC). In this blog post, we will dive into what an LLC is, its structure, and the benefits it can offer to entrepreneurs and business owners.

Key Takeaways:

- An LLC is a flexible business entity that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability protection of a corporation.

- LLCs provide personal asset protection, simplified management, and flexibility in tax planning.

What is an LLC?

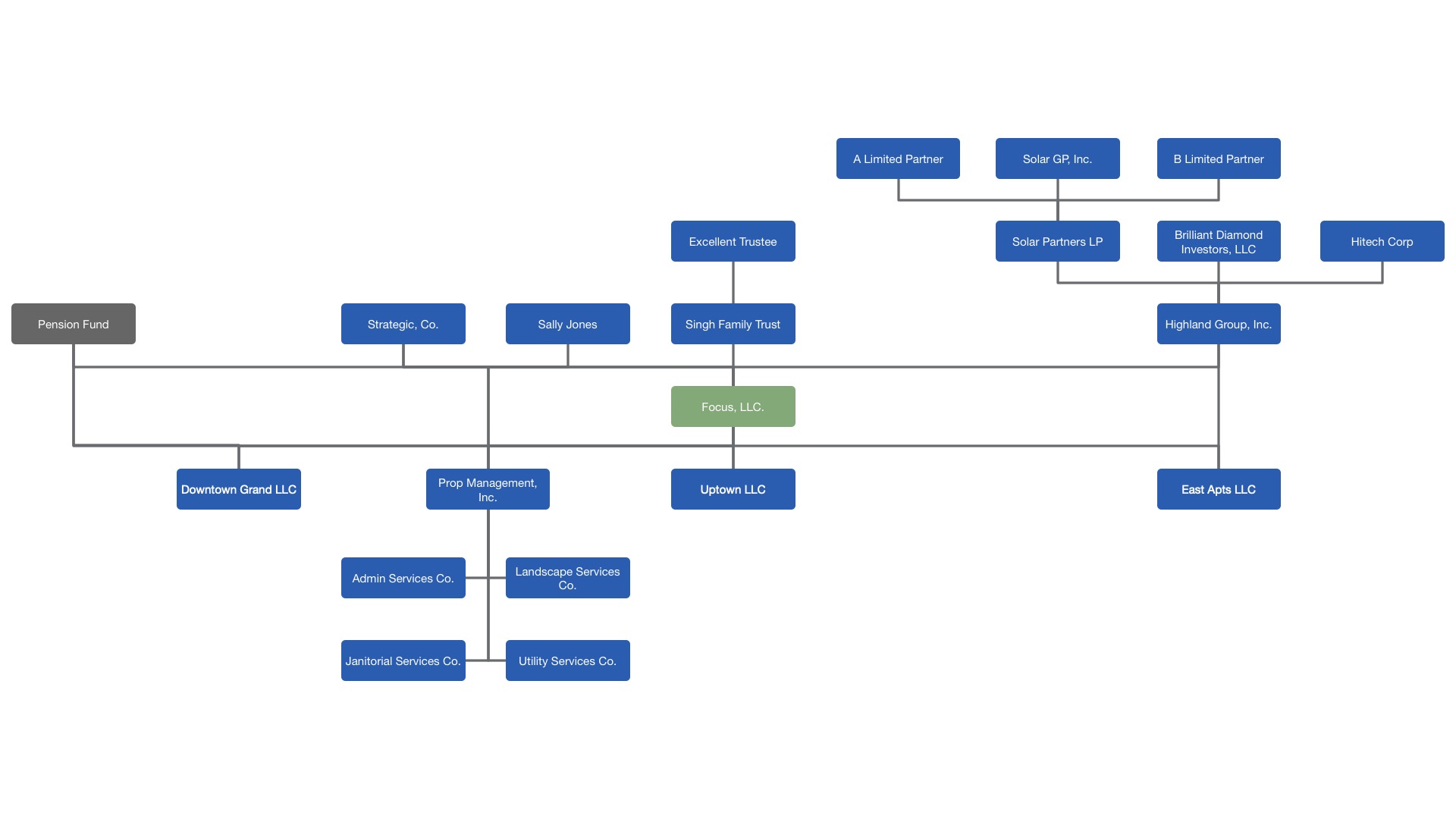

An LLC, or Limited Liability Company, is a business structure that offers personal liability protection and flexibility in terms of taxation and management. It is a hybrid entity that combines features of both a partnership or sole proprietorship and a corporation.

One of the main advantages of forming an LLC is that it provides personal liability protection to its owners, also known as members. This means that the members’ personal assets are generally protected from any liabilities or debts incurred by the business. In the event the business faces legal issues or financial obligations, the members’ personal assets, such as their homes or savings accounts, will not typically be at risk.

Additionally, the LLC structure offers flexibility in terms of taxation. By default, an LLC is treated as a pass-through entity for tax purposes. This means that the profits and losses of the business are “passed through” to the members’ individual tax returns. This can provide significant tax advantages, as it allows for the avoidance of double taxation that occurs with corporations.

Another notable feature of an LLC is its simplified management structure. Unlike corporations, which have a more formalized governance structure with a board of directors, officers, and shareholders, an LLC can be managed by its members or by appointed managers. This flexibility allows for a more informal and less bureaucratic approach to business management.

Benefits of an LLC

Now that you have a better understanding of what an LLC is, let’s explore some of the benefits it can offer:

- Personal Asset Protection: As mentioned earlier, one of the main advantages of an LLC is that it provides personal liability protection. This means that if the business faces legal or financial challenges, the members’ personal assets are generally safeguarded.

- Tax Flexibility: The pass-through taxation of an LLC allows for simplicity in tax planning. It eliminates the need for the entity to file a separate tax return, and instead, the profits and losses are reported on the members’ individual tax returns, potentially reducing tax liabilities.

- Flexibility in Management: Unlike corporations, where governance can be more complex, an LLC offers the flexibility to be managed by its members or by appointed managers. This allows for a less formalized management structure and more agility in decision-making.

These are just a few of the benefits an LLC can provide. Keep in mind that the advantages may vary depending on your specific business needs and the regulations and laws of your jurisdiction. Consulting with a legal or tax professional is recommended to ensure compliance and fully understand the implications of forming an LLC.

In conclusion, an LLC is a business structure that offers personal liability protection and flexibility in taxation and management. It is a popular choice for entrepreneurs and small business owners who want to protect their personal assets while enjoying the advantages of a pass-through tax structure and simplified management. Consider exploring the benefits of an LLC if you’re looking to start or restructure a business entity.