Finance

What Is Chase Credit Journey

Published: January 13, 2024

Discover how Chase Credit Journey can help you track and manage your finances. Get insights, access your credit score, and take control of your financial journey with Chase.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Chase Credit Journey – an innovative tool designed to help you manage and monitor your credit health. In today’s fast-paced financial landscape, having a strong credit score is more important than ever. It affects everything from obtaining loans and credit cards to renting an apartment or even securing a job. Chase Credit Journey offers a comprehensive suite of features and benefits to empower individuals like you with the knowledge and tools to take control of your credit.

With Chase Credit Journey, you can gain valuable insights into your credit score and the factors influencing it. Whether you’re just starting on your credit-building journey or looking to improve your existing credit, this tool provides you with the necessary information to make informed decisions and take action.

But what sets Chase Credit Journey apart? In addition to the standard credit monitoring and reporting features, this tool goes above and beyond by offering personalized recommendations, educational resources, and helpful tips to help you reach your financial goals. Whether you’re aiming to boost your credit score, better understand credit utilization, or simply establish healthy financial habits, Chase Credit Journey is here to guide you every step of the way.

In the following sections, we’ll explore the various features and benefits of Chase Credit Journey, how to sign up for this service, and how it can help you gain a deeper understanding of your credit score. Let’s dive in and discover the power of Chase Credit Journey.

Features of Chase Credit Journey

Chase Credit Journey offers a range of features designed to assist you in managing and improving your credit score. Let’s explore some of the key features:

- Credit Score Tracking: Chase Credit Journey provides you with free access to your credit score, allowing you to monitor any changes over time. This feature helps you stay updated and informed about your creditworthiness.

- Credit Factors Analysis: Understanding the factors that influence your credit score is crucial. Chase Credit Journey offers insights into the key factors affecting your credit, such as payment history, credit utilization, length of credit history, and more. This analysis helps you identify areas for improvement.

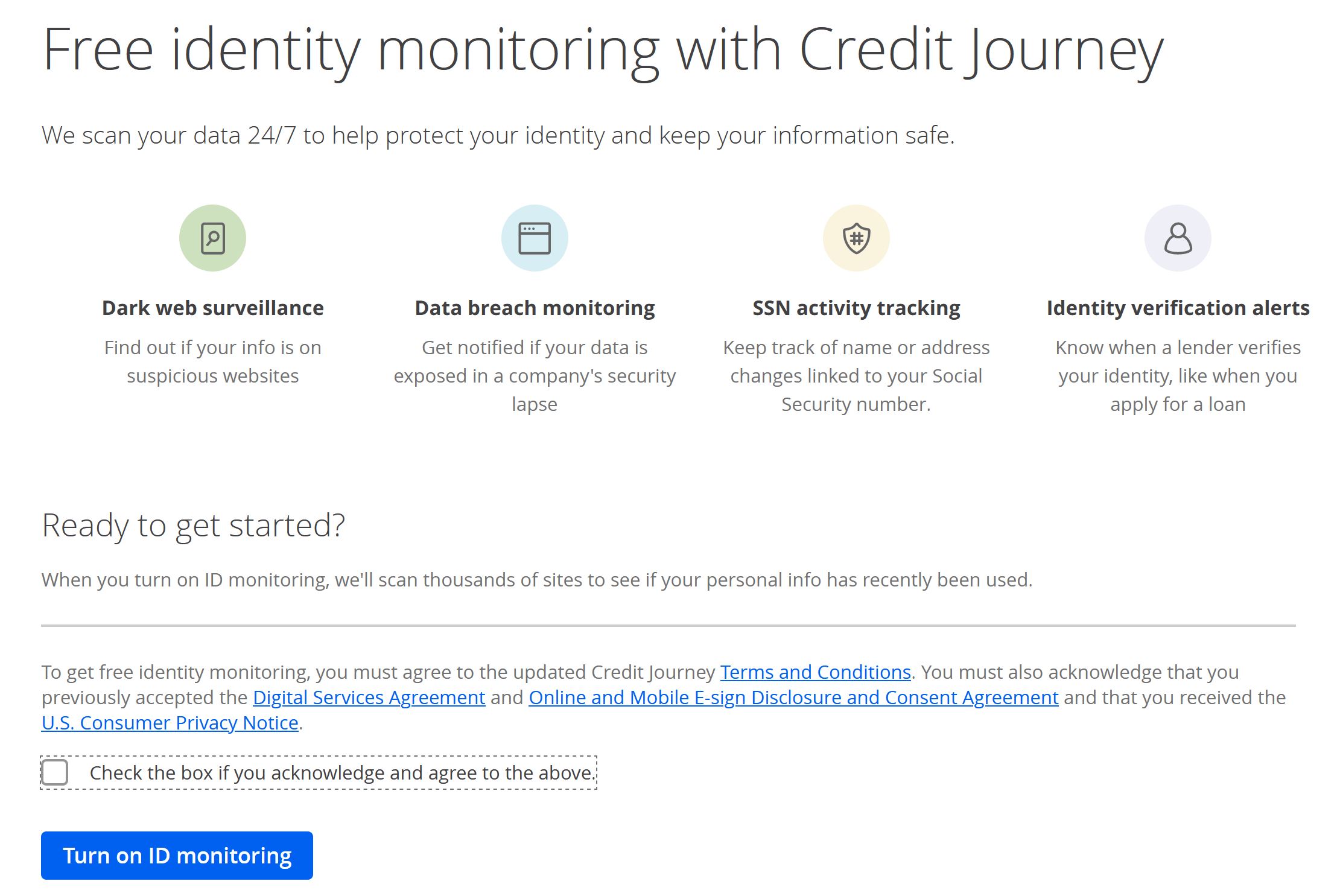

- Security Alerts: To protect you from potential identity theft or fraudulent activity, Chase Credit Journey sends you alerts when there are significant changes to your credit report. These alerts enable you to take immediate action if any suspicious activity is detected.

- Customized Action Plans: Chase Credit Journey provides personalized recommendations and action plans based on your unique credit profile. It offers practical tips and guidance on how to improve your credit score and maintain healthy financial habits.

- Credit Education Resources: Knowledge is power, especially when it comes to managing your credit. Chase Credit Journey offers a wealth of educational resources, including articles, videos, and interactive tools, to help you understand credit-related topics and make well-informed financial decisions.

- Simulated Score Tool: Wondering how certain actions might impact your credit score? Chase Credit Journey’s simulated score tool allows you to see how different scenarios, such as paying off debt or opening a new credit card account, could potentially affect your credit score.

These features combine to create a comprehensive credit management tool that empowers you to take control of your financial well-being. Whether you’re looking to monitor your credit, improve your credit score, or simply enhance your understanding of credit, Chase Credit Journey’s features have got you covered.

How to Sign Up for Chase Credit Journey

Signing up for Chase Credit Journey is quick and easy. Here’s a step-by-step guide to getting started:

- Visit the Chase Credit Journey website or download the Chase Mobile app from your device’s app store.

- If you already have an account with Chase, simply log in using your online banking credentials. If you’re a new user, click on the “Sign up” or “Get started” button to create an account.

- Fill in the required information, including your name, date of birth, Social Security number, and contact details. Make sure to provide accurate information to ensure a smooth sign-up process.

- Agree to the terms and conditions and privacy policy outlined by Chase Credit Journey.

- Verify your identity by answering a few security questions or by providing additional information if required.

- Set up your account credentials, including a username and password. Choose a strong password that combines uppercase and lowercase letters, numbers, and special characters to enhance security.

- Once you’ve completed the sign-up process, you’ll be granted access to your personalized Chase Credit Journey dashboard.

- Explore the features and tools available to you, such as credit score tracking, credit factors analysis, and education resources.

Remember, Chase Credit Journey is available to both Chase customers and non-customers alike. If you’re already a Chase customer, signing up for Chase Credit Journey allows you to easily integrate your banking and credit information for a more holistic financial overview.

Signing up for Chase Credit Journey is completely free, and there are no hidden fees or charges. So why wait? Take control of your credit health today by signing up for Chase Credit Journey and embark on a journey towards financial empowerment.

Benefits of Using Chase Credit Journey

Using Chase Credit Journey offers a multitude of benefits for individuals looking to manage and improve their credit health. Let’s explore some of the key advantages:

- Free Access to Your Credit Score: With Chase Credit Journey, you can obtain your credit score for free. This information is essential for understanding your creditworthiness and tracking your progress over time.

- Insights into Credit Factors: Chase Credit Journey provides you with valuable insights into the factors influencing your credit score. This knowledge enables you to identify areas that need improvement and take appropriate action.

- Personalized Recommendations: Based on your unique credit profile, Chase Credit Journey offers customized recommendations and action plans. These suggestions empower you to make informed decisions and develop effective strategies for improving your credit.

- Identity Theft Protection: The security alerts feature of Chase Credit Journey helps safeguard your identity. By monitoring your credit report for unusual activity, you’ll receive immediate notifications that can help prevent potential identity theft and fraudulent transactions.

- Educational Resources: Chase Credit Journey provides a wealth of educational resources to enhance your financial understanding. You can access articles, videos, and interactive tools that cover various credit-related topics, empowering you to make smart financial decisions.

- Simulated Score Tool: With the simulated score tool, you can explore “what-if” scenarios to see how different actions might impact your credit score. This feature empowers you to make informed decisions and plan ahead for future financial endeavors.

- Seamless Integration with Chase: If you’re an existing Chase customer, using Chase Credit Journey allows for easy integration of your banking and credit information. This seamless integration provides you with a holistic view of your financial health.

By utilizing these benefits, you can take proactive steps towards improving your credit score and achieving your financial goals. Whether you’re looking to secure a mortgage, obtain a loan, or simply build a solid credit history, Chase Credit Journey provides the tools and resources necessary for success.

Remember, it’s never too late to start managing your credit health. Sign up for Chase Credit Journey today and embark on a journey towards financial stability and empowerment.

Understanding Your Credit Score with Chase Credit Journey

One of the key benefits of using Chase Credit Journey is gaining a better understanding of your credit score. Your credit score plays a vital role in determining your creditworthiness and can impact your financial opportunities. Here’s how Chase Credit Journey helps you comprehend your credit score:

Access to Your Credit Score: Chase Credit Journey grants you access to your credit score for free. Your credit score provides a snapshot of your creditworthiness and helps lenders assess the level of risk involved in lending to you.

Understanding Credit Factors: Chase Credit Journey breaks down the factors that influence your credit score. These factors include payment history, credit utilization, length of credit history, new credit applications, and credit mix. By understanding how these factors impact your score, you can identify areas for improvement.

Interactive Credit Score Analysis: Chase Credit Journey offers an interactive credit score analysis feature. This tool allows you to explore how different actions, such as paying off debt or opening a new credit card, can potentially affect your credit score. Through this analysis, you can make informed decisions to improve your credit.

Trends and Historical Data: Chase Credit Journey provides you with access to historical data and trends related to your credit score. You can track changes and fluctuations over time, helping you evaluate the effectiveness of your credit-building strategies.

Credit Score Simulator: Chase Credit Journey’s credit score simulator allows you to experiment with different scenarios. You can simulate the impact of actions such as making on-time payments, reducing your credit utilization, or paying off debts. This feature gives you a glimpse into how these actions can influence your credit score.

By utilizing these features, you can gain valuable insights into your credit score and the factors affecting it. This knowledge empowers you to make informed decisions, take actions to improve your credit, and achieve your financial goals.

Understanding your credit score is the foundation for building a strong financial future. Sign up for Chase Credit Journey today and take control of your credit health.

Monitoring and Managing Your Credit with Chase Credit Journey

Chase Credit Journey offers powerful tools and features to help you effectively monitor and manage your credit. Here’s how this service assists you in staying on top of your credit health:

Credit Monitoring: Chase Credit Journey actively monitors your credit report for any changes or updates. You’ll receive alerts regarding significant changes, such as new accounts, inquiries, or delinquencies. This feature allows you to promptly respond to any potential fraudulent activity and take action to protect your credit.

Credit Report Access: Chase Credit Journey provides you with free access to your credit report from TransUnion. You can review your report to ensure its accuracy and identify any discrepancies that may require resolution.

Payment History Tracking: Timely payments are crucial for maintaining a strong credit profile. Chase Credit Journey tracks your payment history and notifies you of any missed or late payments. This helps you stay accountable and take action to improve your payment habits.

Credit Utilization Monitoring: Your credit utilization ratio, which is the percentage of your available credit that you’re using, has a significant impact on your credit score. Chase Credit Journey helps you monitor your utilization and provides guidance on how to keep it within a healthy range.

Identity Theft Protection: Chase Credit Journey’s robust security features help protect against identity theft. You’ll receive alerts if there are any suspicious activities on your credit report, allowing you to take immediate steps to protect your identity and credit.

Financial Goal Setting: Chase Credit Journey enables you to set financial goals and track your progress. Whether you’re aiming to pay off debt, increase your credit score, or save for a major purchase, this tool helps you stay focused and motivated.

Education and Resources: Chase Credit Journey provides educational resources and articles to help you improve your financial literacy. You can access tips, advice, and strategies to enhance your credit management skills and make informed financial decisions.

By leveraging these monitoring and management features, you can stay informed about your credit health and take proactive steps to improve it. Chase Credit Journey equips you with the knowledge and tools necessary to navigate the complex world of credit.

Don’t wait to take control of your credit. Sign up for Chase Credit Journey today and empower yourself with the tools to monitor and manage your credit effectively.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions about Chase Credit Journey:

- Is Chase Credit Journey free to use?

- Do I need to be a Chase customer to use Chase Credit Journey?

- Does signing up for Chase Credit Journey impact my credit score?

- How often is my credit score updated in Chase Credit Journey?

- Can I access Chase Credit Journey on my mobile device?

- Will I receive alerts if there are any changes to my credit report?

- Can I use Chase Credit Journey to improve my credit score?

- Is my personal information secure with Chase Credit Journey?

Yes, Chase Credit Journey is completely free to use. There are no hidden fees or charges associated with this service.

No, Chase Credit Journey is available to both Chase customers and non-customers. You can sign up and access the tool regardless of whether you have a Chase banking or credit card account.

No, signing up for Chase Credit Journey does not impact your credit score. Checking your credit score and using the monitoring features offered by Chase Credit Journey are considered “soft inquiries” and do not have any negative impact on your credit.

Your credit score is updated once a week in Chase Credit Journey. This frequency allows you to stay informed about any changes or fluctuations in your score.

Yes, Chase Credit Journey is available as a mobile app for both iOS and Android devices. You can conveniently access and manage your credit health on the go.

Yes, Chase Credit Journey provides you with alerts when there are significant changes to your credit report. These alerts help you stay informed about any potential fraudulent activity or important updates.

Absolutely! Chase Credit Journey offers personalized recommendations, credit analysis, and educational resources to help you improve your credit score. By following the guidance provided and implementing sound financial practices, you can work towards boosting your creditworthiness over time.

Yes, Chase Credit Journey prioritizes the security and confidentiality of your personal information. The tool employs robust encryption and security measures to safeguard your data.

If you have more specific questions or concerns about Chase Credit Journey, it’s recommended to reach out to Chase’s customer service or refer to their official documentation for further assistance.

Conclusion

Chase Credit Journey is a powerful tool that empowers individuals to take control of their credit health. With its comprehensive features, personalized recommendations, and educational resources, Chase Credit Journey is more than just a credit monitoring tool. It provides you with the knowledge, insights, and tools necessary to understand, monitor, and manage your credit effectively.

By utilizing Chase Credit Journey, you can access your credit score for free, gain valuable insights into the factors influencing your credit score, and receive alerts for any significant changes to your credit report. The customizable action plans, credit education resources, and simulated score tool enable you to make informed decisions, improve your credit score, and achieve your financial goals.

Whether you’re a current Chase customer or not, you can sign up for Chase Credit Journey and start your journey towards financial empowerment. The ability to monitor your credit, track your payment history, manage your credit utilization, and protect yourself against identity theft are just a few of the many benefits this tool offers.

Take advantage of this free and comprehensive resource to gain a better understanding of your credit score, set financial goals, and navigate the complex landscape of credit. Start using Chase Credit Journey today and embark on a path towards a healthier and more secure financial future.