Finance

What Is Clear Access Banking

Published: October 13, 2023

Discover the benefits of clear access banking and how it can simplify your finance management. Open an account today and gain control over your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Clear Access Banking

- Benefits of Clear Access Banking

- Features of Clear Access Banking

- Comparison with Traditional Banking

- How to Open a Clear Access Bank Account

- Eligibility Criteria for Clear Access Banking

- Fees and Charges of Clear Access Banking

- Limitations of Clear Access Banking

- Customer Reviews and Feedback

- Conclusion

Introduction

Welcome to the world of Clear Access Banking, a revolutionary approach to banking that offers convenience, transparency, and flexibility like never before. In this article, we will explore what Clear Access Banking is, its benefits, features, and how it is different from traditional banking. So, whether you’re a tech-savvy individual, a small business owner, or someone who values hassle-free banking, read on to discover the exciting possibilities that Clear Access Banking can offer.

Clear Access Banking is a modern and innovative way of managing your finances. It leverages technology to provide a seamless banking experience that goes beyond the limitations of traditional brick-and-mortar banks. With Clear Access Banking, customers can access their accounts anytime, anywhere, using a variety of digital channels such as mobile apps and online banking platforms.

Unlike traditional banking, Clear Access Banking eliminates the need for physical branches, long queues, and inconvenient banking hours. Instead, it offers a user-friendly interface that allows customers to perform various transactions, including depositing and withdrawing funds, paying bills, transferring money, and managing their accounts – all with just a few clicks or taps.

Clear Access Banking aims to simplify the banking process by providing a streamlined and efficient experience. It enables customers to manage their finances on the go, without the hassle of visiting a physical branch or dealing with complex paperwork. With secure and encrypted platforms, customers can have peace of mind knowing that their financial information is protected.

Furthermore, Clear Access Banking provides a high level of transparency, giving customers complete visibility into their transactions and account balances in real-time. This transparency empowers individuals and businesses to make informed financial decisions and stay in control of their money.

In the next sections, we will delve deeper into the benefits and features of Clear Access Banking, making it clear why this digital banking solution is gaining popularity among people from all walks of life.

Definition of Clear Access Banking

Clear Access Banking is a modern banking concept that leverages technology and digital platforms to provide customers with easy and convenient access to their financial accounts. It eliminates the need for physical branches and offers a range of digital channels for banking transactions, such as mobile apps, online banking platforms, and ATMs.

With Clear Access Banking, customers can perform various banking activities, including checking account balances, transferring funds, making payments, applying for loans, and managing investments, all from the comfort of their own devices. This digital banking solution allows users to access their accounts at any time and from anywhere, making banking more flexible and accessible.

Clear Access Banking is designed to simplify the banking experience by providing intuitive and user-friendly interfaces. Customers can navigate through the platforms easily, perform transactions seamlessly, and stay informed about their financial activities in real-time. Whether you are an individual looking to manage your personal finances or a business owner needing to handle your company’s financial transactions, Clear Access Banking offers the tools and features to meet your needs.

One of the key aspects of Clear Access Banking is its focus on transparency. The platform provides customers with comprehensive visibility into their financial transactions, account balances, and fees. Customers can easily monitor their spending, track their income and expenses, and gain a better understanding of their overall financial health.

Furthermore, Clear Access Banking often collaborates with other financial technology (fintech) companies, which enables it to offer additional services and features. This can include partnerships with payment processors, investment platforms, or even integration with personal finance management apps. These collaborations enhance the banking experience and provide customers with a broader range of financial solutions.

In summary, Clear Access Banking is a digital banking solution that prioritizes convenience, accessibility, and transparency. By leveraging technology, it offers customers the ability to manage their finances efficiently, anytime, and anywhere, ultimately empowering individuals and businesses to take control of their financial well-being.

Benefits of Clear Access Banking

Clear Access Banking offers a multitude of benefits that make it a compelling choice for individuals and businesses alike. Let’s explore some of the key advantages of opting for Clear Access Banking:

- Convenience: Clear Access Banking allows you to manage your finances on your own terms. With 24/7 access to your accounts through digital platforms, you can conduct transactions, check balances, and pay bills at any time and from anywhere. Gone are the days of waiting in long queues or rushing to the bank before it closes. With Clear Access Banking, banking becomes a hassle-free experience.

- Accessibility: Clear Access Banking breaks down geographical barriers. Regardless of your location, as long as you have an internet connection, you can access your accounts and perform transactions. This is especially beneficial for frequent travelers or individuals living in remote areas where access to physical bank branches may be limited.

- Cost Savings: Clear Access Banking often comes with low or no monthly fees, making it a cost-effective option compared to traditional banking. Additionally, with features like electronic statements, online bill payments, and fund transfers, you can save on paper, postage, and transportation costs.

- Enhanced Security: Clear Access Banking employs robust security measures to safeguard your financial information. Encryption protocols, multi-factor authentication, and real-time fraud detection help protect your account from unauthorized access and fraudulent activities. With Clear Access Banking, you can have peace of mind knowing that your money and personal data are safe.

- Greater Transparency: Clear Access Banking provides detailed and real-time transaction information, giving you full visibility into your financial activities. You can easily track your spending, monitor your account balances, and set up alerts to stay informed about any changes in your account. This transparency empowers you to make informed financial decisions and stay on top of your financial goals.

- Integration with Financial Tools: Clear Access Banking often integrates with various financial tools and apps, making it easier for you to manage your finances comprehensively. From budgeting apps and investment platforms to tax management software, these integrations enhance your financial management capabilities and provide a holistic view of your financial situation.

- Flexible Banking Solutions: Clear Access Banking offers a wide array of banking services tailored to your needs. Whether you require personal banking products and services or business banking solutions, Clear Access Banking provides the flexibility to customize your banking experience based on your unique requirements.

With these benefits, Clear Access Banking transforms the way individuals and businesses interact with their finances, making banking more convenient, accessible, and secure. The next section will delve into the features that make Clear Access Banking stand out from traditional banking.

Features of Clear Access Banking

Clear Access Banking offers a range of features that set it apart from traditional banking methods. These features enhance the banking experience, making it more efficient, flexible, and tailored to individual needs. Let’s explore some of the key features of Clear Access Banking:

- Online and Mobile Banking: Clear Access Banking provides user-friendly online and mobile banking platforms, allowing customers to access their accounts, perform transactions, and manage their finances on the go. With these platforms, you can check balances, transfer funds, pay bills, and even deposit checks remotely, all from the convenience of your device.

- Mobile Apps: Clear Access Banking often offers mobile apps that provide a seamless and intuitive banking experience. These apps allow you to access your accounts, make payments, and track your financial activities from your smartphone or tablet. Some apps may also offer additional features such as budgeting tools, spending insights, and personalized notifications.

- ATM Access: Despite its digital nature, Clear Access Banking typically provides access to a network of ATMs. This allows you to withdraw cash, check balances, and perform other basic banking functions. Some Clear Access Banking providers may even reimburse ATM fees incurred at out-of-network ATMs.

- Customer Support: Clear Access Banking understands the importance of customer support. Many providers offer 24/7 customer service through various channels like phone, email, or live chat. This ensures that you can get assistance whenever you need it, addressing any concerns or issues that may arise.

- Integration with External Accounts: Clear Access Banking often allows you to link your external financial accounts, such as credit cards, loans, and investments. This integration provides a centralized view of your financial information, making it easier to manage all your accounts from a single platform.

- Automated Payments and Transfers: Clear Access Banking offers the convenience of automated payments and transfers. You can set up recurring payments for bills, loan installments, and other regular expenses. Additionally, you can schedule automatic transfers between accounts, enabling you to save or move funds without manual intervention.

- Remote Check Deposits: Many Clear Access Banking providers allow you to deposit checks remotely using your mobile device. With the snap of a photo, you can securely deposit checks into your account without the need to visit a physical branch.

- Financial Planning Tools: Some Clear Access Banking platforms provide built-in financial planning tools or collaborate with third-party applications. These tools can help you budget, track your expenses, set financial goals, and monitor your progress towards achieving them.

- Real-Time Transaction Notifications: Clear Access Banking often offers real-time notifications for account activities. You can receive alerts about transactions, low balances, or any suspicious activity, allowing you to stay informed and quickly identify any potential issues.

These features make Clear Access Banking a flexible and efficient banking solution. Whether you’re an individual looking for convenient ways to manage your personal finances, or a business owner seeking streamlined banking services, Clear Access Banking offers the tools and features to meet your needs. In the next section, we will compare Clear Access Banking with traditional banking to highlight the advantages of this digital banking approach.

Comparison with Traditional Banking

Clear Access Banking offers several advantages over traditional banking methods. Let’s compare Clear Access Banking with traditional banking to understand the key differences:

Convenience:

Clear Access Banking provides unparalleled convenience compared to traditional banking. With Clear Access Banking, you can access your accounts, conduct transactions, and manage your finances anytime and anywhere using digital platforms. In contrast, traditional banking requires physical visits to bank branches during limited operating hours, leading to potential time constraints and inconvenience.

Accessibility:

Clear Access Banking breaks geographical barriers and offers accessibility beyond physical branches. As long as you have an internet connection and a compatible device, you can perform banking activities with Clear Access Banking. Traditional banking, on the other hand, limits accessibility to specific branches, which can be inconvenient for individuals in remote areas or frequent travelers.

Cost Savings:

Clear Access Banking often comes with lower fees and fewer transaction costs compared to traditional banking. Many Clear Access Banking providers offer no monthly fees and provide free or reimbursed ATM withdrawals. Additionally, with paperless statements and online transactions, Clear Access Banking reduces the need for physical paperwork and associated costs.

Speed of Transactions:

Clear Access Banking allows for faster transaction processing compared to traditional banking. With instant fund transfers, immediate updates on balances, and real-time transaction notifications, Clear Access Banking provides quicker and more efficient banking experiences. Traditional banking, on the other hand, may involve delays in transaction processing and updating of account information.

Transparency:

Clear Access Banking offers a higher level of transparency. Customers can access real-time updates on transactions, account balances, and fees, providing full visibility into their financial activities. Traditional banking may lack this level of transparency, with customers having to rely on periodic statements to review their transactions and account details.

Personalization and Integration:

Clear Access Banking often provides personalized banking experiences tailored to individual needs. With features like financial planning tools, budgeting apps, and seamless integration with third-party services, customers can customize their banking experience. Traditional banking may offer limited personalization options and may require separate third-party applications for specialized financial services.

Customer Service:

Clear Access Banking typically provides 24/7 customer support through various channels, allowing customers to get assistance whenever they need it. Traditional banking may have limited customer service hours, making it challenging to resolve issues or get immediate support outside of regular business hours.

Although Clear Access Banking offers numerous advantages, it’s important to note that there are still some instances where traditional banking may be preferred. For customers who value face-to-face interactions, personalized advice, or the assurance of physical branch presence, traditional banking may be more suitable. Ultimately, the choice between Clear Access Banking and traditional banking depends on individual preferences, needs, and comfort levels with digital platforms.

Next, let’s explore how you can open a Clear Access Bank account and the eligibility criteria involved.

How to Open a Clear Access Bank Account

Opening a Clear Access Bank account is a simple and straightforward process. Here are the general steps to follow:

- Research and Choose a Clear Access Bank: Start by researching and comparing different Clear Access Banking providers. Consider factors such as fees, features, customer reviews, and the level of convenience offered. Once you have identified a suitable Clear Access Bank, proceed to the next step.

- Visit the Clear Access Bank’s Website: Go to the official website of the Clear Access Bank you have selected. Look for information on account opening procedures and requirements. Most Clear Access Banks provide detailed guidelines on their websites, making it easy for customers to understand the process.

- Select the Type of Account: Determine the type of account you want to open. Clear Access Banks typically offer a range of options, including personal checking accounts, savings accounts, business accounts, and specialized accounts tailored to specific needs. Choose the account that aligns with your financial goals and requirements.

- Gather Required Documents and Information: Prepare the necessary documents and information to complete the account opening process. This may include your identification documents, proof of address, Social Security Number (SSN) or Tax Identification Number (TIN), and employment or income details. Check the Clear Access Bank’s website for the specific requirements.

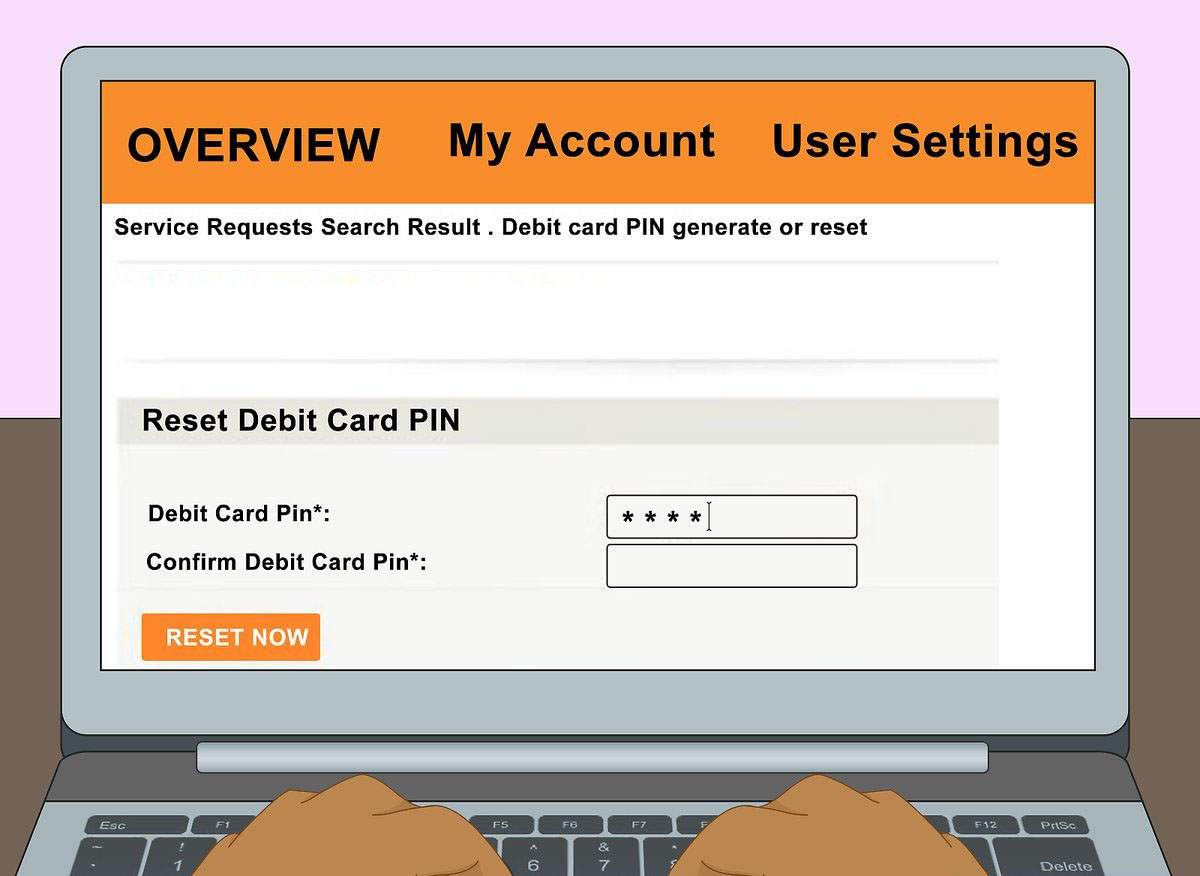

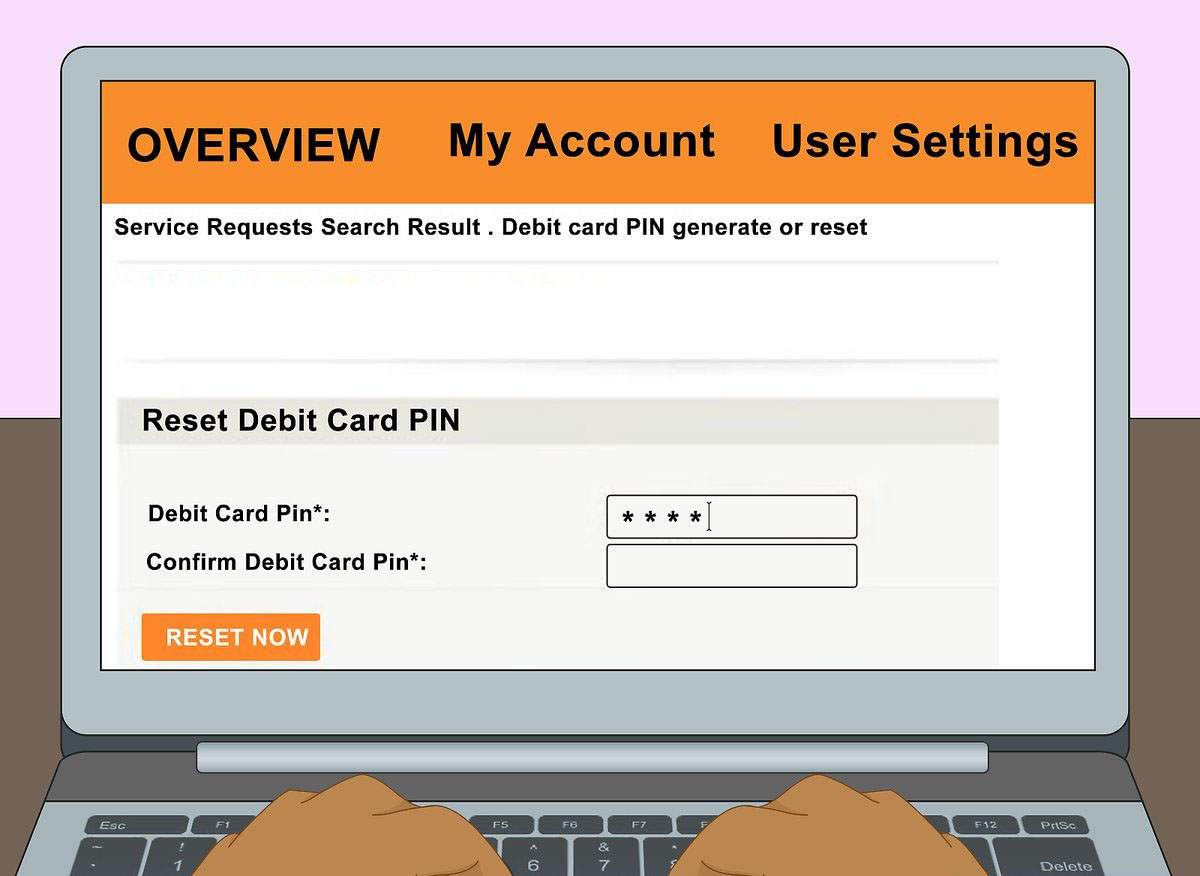

- Start the Online Application: Begin the online application process by clicking on the “Open an Account” or similar button on the Clear Access Bank’s website. Fill in the required personal information and upload the necessary documents as instructed.

- Identity Verification: Clear Access Banks often employ identity verification procedures to ensure security and compliance. You may be asked to provide additional verification, such as answering security questions, providing a digital signature, or submitting a photo or scan of your identification documents.

- Agree to Terms and Conditions: Review the terms and conditions of the Clear Access Bank and agree to them. It is important to read and understand any fees, account policies, and privacy policies associated with the account.

- Submit the Application: Once you have completed all the necessary steps, review your application for accuracy and submit it. You may receive an acknowledgment or confirmation email from the Clear Access Bank, indicating that your application has been received.

- Fund Your Account: Once your account is approved, you will typically need to fund it. Clear Access Banks offer a range of funding options, such as electronic transfers, direct deposits, wire transfers, or even the option to deposit a physical check by mail or at an affiliated ATM.

- Start Using Your Clear Access Bank Account: Once your account is opened and funded, you can start utilizing the various features and services provided by the Clear Access Bank. Download any mobile apps offered and explore the online banking platform to conveniently access and manage your account.

It is worth noting that the specific steps and requirements may vary slightly from one Clear Access Bank to another. It is recommended to carefully read the instructions and guidelines provided on the Clear Access Bank’s website to ensure a smooth account opening process.

Next, let’s explore the eligibility criteria for opening a Clear Access Bank account.

Eligibility Criteria for Clear Access Banking

Clear Access Banking is designed to be accessible to a wide range of individuals and businesses. While the specific eligibility criteria may vary slightly from one Clear Access Bank to another, here are some common requirements:

- Age: To open a Clear Access Bank account, you typically need to be at least 18 years old. Some Clear Access Banks may also offer specialized accounts for minors, requiring parental consent or joint ownership.

- Residency: Clear Access Banks generally require applicants to be residents of the country or region where the bank operates. You may need to provide proof of address, such as a utility bill or bank statement, to verify your residency.

- Identification: Clear Access Banks often require valid identification documents to establish your identity. This typically includes a government-issued photo identification, such as a passport or driver’s license. Some Clear Access Banks may accept more than one form of identification.

- Social Security Number (SSN) or Tax Identification Number (TIN): Clear Access Banks operating in countries that require tax identification numbers may ask for your SSN or TIN, as these are important for regulatory and compliance purposes.

- Employment or Income Details: Some Clear Access Banks may require you to provide information about your employment or income. This can help determine your financial stability and eligibility for certain account types or services. Self-employed individuals may be required to provide evidence of their business or professional activities.

- Compliance with Regulatory Requirements: Clear Access Banks are subject to various financial regulations and may require applicants to comply with these regulations. This can include anti-money laundering (AML) and know your customer (KYC) procedures, which are essential for preventing illicit activities and ensuring the security of the banking system.

- Other Specific Requirements: Depending on the Clear Access Bank and the type of account you wish to open, there may be additional eligibility criteria. For example, business accounts may require proof of business registration, articles of incorporation, or other relevant documents.

It is important to note that meeting the eligibility criteria does not guarantee approval of your Clear Access Banking application. Clear Access Banks may conduct internal reviews and assessments to evaluate the risk associated with approving an account and may exercise discretion in accepting or rejecting applications.

If you meet the eligibility criteria, you can proceed with the account opening process as outlined in the previous section. It is recommended to review the specific eligibility requirements of a particular Clear Access Bank by visiting their official website or contacting their customer support for more detailed information.

Next, let’s discuss the fees and charges associated with Clear Access Banking.

Fees and Charges of Clear Access Banking

Clear Access Banking typically offers competitive fee structures and aims to provide cost-effective banking solutions for customers. While the specific fees and charges may vary from one Clear Access Bank to another, here are some common fees and charges associated with Clear Access Banking:

- Monthly Maintenance Fee: Some Clear Access Banks may charge a monthly maintenance fee for certain types of accounts. This fee covers the cost of providing banking services and maintaining the account. However, many Clear Access Banks offer fee-free or low-fee accounts to attract and retain customers, so it’s important to compare the fees across different options.

- Transaction Fees: Certain transactions may be subject to fees, such as ATM withdrawals, wire transfers, or international transactions. These fees can vary depending on the Clear Access Bank and the type of transaction. Clear Access Banks may provide fee-free transactions within their ATM network or offer a certain number of fee-free transactions per month.

- Overdraft Fees: If you spend more money than is available in your Clear Access Bank account, you may incur overdraft fees. Clear Access Banks may charge a fee for covering the overdraft or decline the transaction. It’s important to review the overdraft policies and associated fees of the Clear Access Bank to understand the charges and avoid unexpected overdraft fees.

- Additional Services Fees: Clear Access Banks may offer additional services, such as printed checks, account statements, or stop payment requests, which may incur additional fees. These fees vary depending on the specific service and the Clear Access Bank. Most Clear Access Banks provide electronic statements and offer alternatives to printed checks to reduce the dependency on these services.

- Foreign Exchange Fees: If you make transactions in foreign currencies, Clear Access Banks may charge foreign exchange fees. These fees typically involve a percentage or flat rate for converting the currency. Clear Access Banks may also charge currency conversion fees for international wire transfers and purchases made using foreign currencies.

- Inactive Account Fees: Some Clear Access Banks may charge a fee if your account remains inactive for a certain period of time. The criteria and duration for considering an account as inactive vary between Clear Access Banks. To avoid this fee, ensure you review and comply with the Clear Access Bank’s account activity requirements.

- ATM Fees: Clear Access Banks may charge ATM fees when you use an out-of-network ATM. These fees can vary depending on the Clear Access Bank and the ATM operator. Some Clear Access Banks provide fee reimbursements for a certain number of out-of-network ATM transactions per month or may have a network of fee-free ATMs.

- Third-Party Service Fees: Clear Access Banks may integrate with third-party service providers, such as payment processors or investment platforms. These services may have their own fees and charges, which are separate from the Clear Access Banking fees. It’s important to review the fee structures of these third-party services before utilizing them through Clear Access Banking.

It’s important to carefully review the fee schedules and terms and conditions provided by the Clear Access Bank you are considering. Clear Access Banks strive to be transparent about their fees and charges, allowing customers to make informed decisions about their banking choices.

Remember, fees and charges can vary, so it’s essential to compare the fee structures of different Clear Access Banks to find the one that aligns with your financial needs and objectives.

Next, let’s discuss the limitations of Clear Access Banking to provide a comprehensive overview of this digital banking solution.

Limitations of Clear Access Banking

While Clear Access Banking offers numerous benefits and convenience, it is important to be aware of its limitations. Understanding these limitations can help you make an informed decision when considering Clear Access Banking as your preferred banking solution. Here are some common limitations of Clear Access Banking:

- Lack of Physical Branches: Clear Access Banking operates primarily through online platforms and may not have physical branch locations. This can be a limitation for customers who prefer face-to-face interactions or need personalized assistance from bank staff. However, many Clear Access Banks provide robust customer support through various channels to address customer queries and concerns.

- Cash Handling Limitations: Clear Access Banking may have limitations when it comes to cash handling. While you can use ATMs within the Clear Access Bank’s network to withdraw cash, depositing cash may be more challenging. Clear Access Banks often provide alternative methods, such as third-party cash deposit services or reliance on affiliated ATM networks. It’s important to consider your cash handling needs and ensure they align with the offerings of the Clear Access Bank you choose.

- Dependence on Technology: Clear Access Banking heavily relies on technology and digital infrastructure. In cases of system outages, network disruptions, or technical glitches, customers may experience temporary limitations in accessing their accounts or conducting transactions. However, Clear Access Banks invest in robust systems and redundancies to minimize such disruptions and often provide alternative channels to mitigate any inconveniences.

- Limited Cashier Services: Clear Access Banking may not offer cashier services for certain transactions, such as obtaining cashier’s checks or making large cash deposits. These types of services often require physical presence at bank branches. Consider whether you require these types of services frequently and if they can be accommodated through alternative methods offered by the Clear Access Bank.

- Internet and Technology Requirements: Clear Access Banking necessitates a reliable internet connection and compatible devices, such as smartphones, tablets, or computers, to access and manage your accounts. It is crucial to have access to the internet and keep your devices secure to avoid potential risks associated with online banking.

- Compliance with Regulations: Clear Access Banks must comply with financial regulations and may have more stringent identity verification requirements compared to traditional banks. This is to ensure the security of customer accounts and prevent fraudulent activities. As a customer, you should be prepared to provide the necessary identification documents and comply with the regulatory procedures during the account opening and management processes.

- Limited Personalized Services: While Clear Access Banks offer a range of features and tools to manage your finances, personalized services may be limited compared to traditional banking. The level of personalization and tailored advice from bank staff may not be as extensive in Clear Access Banking. However, Clear Access Banks often provide comprehensive self-help resources and online support to assist customers in managing their financial needs effectively.

- Dependencies on Third-Party Services: Clear Access Banks may integrate with third-party service providers, such as payment processors or investment platforms. While these partnerships enhance the banking experience, it also means that customers may be subject to the terms, conditions, and fees of these third-party services. It is important to review and understand the terms and conditions associated with any integrated services offered by the Clear Access Bank.

By understanding these limitations, you can assess whether Clear Access Banking aligns with your banking preferences and needs. Clear Access Banking provides a convenient and flexible banking experience, but it’s important to evaluate these limitations, along with its benefits, to make an informed banking decision.

Next, let’s explore customer reviews and feedback to gain insights into the real-world experiences of Clear Access Banking users.

Customer Reviews and Feedback

Customer reviews and feedback play a vital role in evaluating the quality and performance of Clear Access Banking. While experiences can vary, it is valuable to consider the opinions of existing customers to gain insights into the strengths and weaknesses of different Clear Access Banks. Here are some common factors highlighted in customer reviews:

- Convenience and Ease of Use: Many customers appreciate the convenience and user-friendly interfaces offered by Clear Access Banks. They highlight the ease of performing transactions, accessing account information, and managing their finances from anywhere at any time. Positive reviews often mention the convenience of digital platforms and mobile apps in conducting banking activities quickly and efficiently.

- Transparency and Real-time Updates: Clear Access Banks are praised for their transparent approach to banking. Customers appreciate the real-time updates on transactions, account balances, and fee structures. Being able to easily track and monitor their financial activities provides a sense of control and empowerment over their finances.

- Customer Service: The quality of customer service provided by Clear Access Banks is an important aspect for customers. Positive reviews often highlight helpful and responsive customer support teams that address queries, provide guidance, and resolve issues promptly. Clear Access Banks that offer 24/7 customer service channels are particularly appreciated by customers who value accessibility and timely assistance.

- Cost-effectiveness: Customers appreciate the cost savings and reduced fees associated with Clear Access Banking. Positive reviews often mention the absence of monthly maintenance fees, low transaction fees, and reimbursements for out-of-network ATM fees. The competitive fee structures offered by Clear Access Banks are considered a significant advantage by many customers.

- Security Measures: Maintaining the security and privacy of customer information is crucial in Clear Access Banking. Positive reviews emphasize the strong security measures implemented by Clear Access Banks, such as encryption, multi-factor authentication, and fraud detection systems. Customers value the peace of mind in knowing that their financial data is protected from unauthorized access and potential fraud.

- Integration and Additional Services: Many customers appreciate the integration of Clear Access Banks with other financial tools and services. Positive reviews often mention partnerships with payment processors, investment platforms, and budgeting apps. The availability of these additional services enhances the overall banking experience and provides customers with a broader range of financial solutions.

- Technology Reliability: Reliable technology infrastructure is crucial for the smooth functioning of Clear Access Banking. Positive reviews acknowledge Clear Access Banks that invest in robust systems and minimize system outages or technical glitches. Customers value seamless access to their accounts and reliable performance across digital platforms.

While most customer reviews are positive, it is also important to consider negative feedback or concerns expressed by some customers. This can include issues related to platform usability, transaction limitations, or specific account-related challenges. Reading a variety of customer reviews can provide a balanced perspective and help you make an informed decision regarding the choice of a Clear Access Bank.

It is recommended to explore customer reviews and feedback on reputable review platforms, social media channels, or the Clear Access Banks’ official websites to gather comprehensive insights into the experiences of existing customers.

Next, let’s conclude the article with a recap of the advantages of Clear Access Banking and its potential impact on the future of banking services.

Conclusion

Clear Access Banking has transformed the way individuals and businesses manage their finances by offering convenience, transparency, and flexibility. With the ability to access accounts anytime, anywhere, through digital platforms, Clear Access Banking has gained popularity among those seeking a hassle-free banking experience.

The benefits of Clear Access Banking are significant. It provides convenience by allowing users to conduct transactions, check balances, and pay bills at their convenience, without the constraints of visiting physical branches during limited operating hours. The accessibility of Clear Access Banking goes beyond geographical limitations, catering to customers in remote areas or frequent travelers who may find it challenging to access traditional bank branches. Furthermore, Clear Access Banking often comes with low or no monthly fees, reducing costs and providing a cost-effective banking solution.

The features of Clear Access Banking, such as online and mobile banking, integration with financial tools, and real-time transaction updates, enhance the banking experience further. Customers appreciate the user-friendly interfaces and the ability to manage their accounts with ease. Clear Access Banking also prioritizes security with encryption protocols, multi-factor authentication, and real-time fraud detection, ensuring customers’ financial information is protected.

While Clear Access Banking offers numerous advantages, it is not without limitations. Customers need to consider factors such as the lack of physical branches, limitations in cash handling, dependence on technology, and potential dependencies on third-party services. It is crucial to review these limitations and assess whether they align with individual preferences and requirements.

The future of banking services is undoubtedly influenced by Clear Access Banking. This innovative banking approach leverages technology to provide efficient, transparent, and customer-centric solutions. As technology continues to advance, Clear Access Banking is likely to enhance its features and services, providing even more convenience and tailored experiences to customers.

By understanding the benefits, features, limitations, and customer feedback associated with Clear Access Banking, individuals and businesses can make informed choices regarding their banking preferences. Whether you are tech-savvy, value convenience, or seek cost-effective solutions, Clear Access Banking offers an exciting banking alternative to traditional methods.

As the banking landscape continues to evolve, Clear Access Banking is poised to play a significant role in shaping the future of financial services, providing individuals and businesses with the flexibility, accessibility, and convenience they desire.