Finance

What Is Investment Analysis?

Published: October 17, 2023

Learn the essentials of investment analysis in finance. Discover how to evaluate investment opportunities and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Investment Analysis

- Importance of Investment Analysis

- Types of Investment Analysis

- Fundamental Analysis

- Technical Analysis

- Quantitative Analysis

- Qualitative Analysis

- Steps in Investment Analysis

- Gathering and Analyzing Data

- Evaluating Risk and Return

- Making Investment Decisions

- Conclusion

Introduction

Investment analysis is a fundamental concept in the world of finance. It is the process of evaluating various investment opportunities to determine their potential returns and risks, with the goal of making informed investment decisions. Whether you are an individual seeking to grow your personal wealth or a financial institution managing portfolios for clients, the ability to effectively analyze investments is crucial.

Investment analysis involves examining financial data, market trends, and other relevant information to assess the performance and potential of different investment options. By conducting a comprehensive analysis, investors can gain insight into the viability of an investment and make educated decisions that align with their goals and risk appetite.

The primary objective of investment analysis is to determine the attractiveness of an investment opportunity. This evaluation considers various factors, such as the expected return on investment, the level of risk involved, the liquidity of the investment, and the suitability for the investor’s portfolio. By understanding these aspects, investors can allocate their resources strategically and optimize their investment strategies to maximize returns.

This article will delve into the key components of investment analysis, including its importance, different types of analysis, and the steps involved in the process. By gaining a thorough understanding of investment analysis, you will be equipped with the knowledge and tools necessary to make informed investment decisions in today’s complex financial markets.

Definition of Investment Analysis

Investment analysis refers to the process of evaluating potential investments to determine their suitability, profitability, and risk. It involves examining various financial metrics, market factors, and other relevant information to assess the potential returns and risks associated with an investment.

At its core, investment analysis aims to provide investors with a clear understanding of the fundamental value and potential growth prospects of an investment option. By conducting a comprehensive analysis, investors can determine whether an investment aligns with their financial goals and risk tolerance.

Investment analysis includes a wide range of techniques and methodologies, such as fundamental analysis, technical analysis, quantitative analysis, and qualitative analysis. These approaches provide different perspectives on evaluating investments and help investors gain insights into the underlying factors that may impact an investment’s performance.

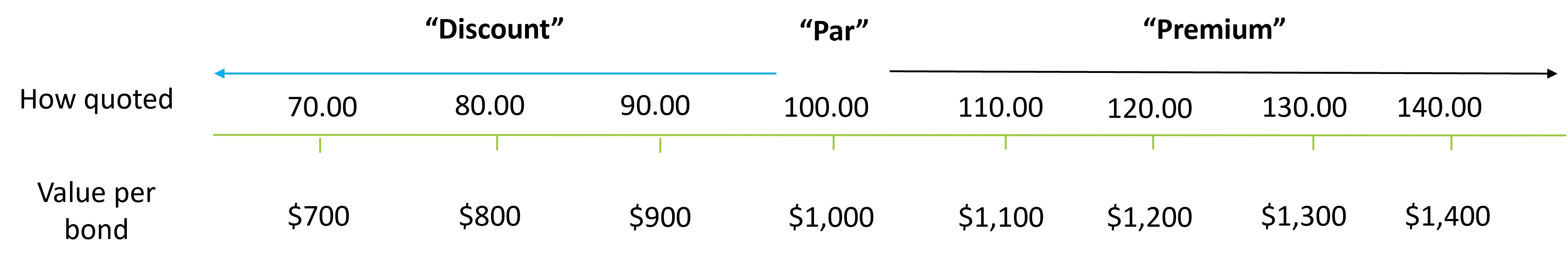

Within investment analysis, various financial metrics and indicators are analyzed to assess the attractiveness of an investment. These include earnings per share (EPS), price-to-earnings (P/E) ratio, return on investment (ROI), net present value (NPV), and many others. By examining these metrics, investors can gauge the financial health of a company or investment and its potential for generating returns.

Furthermore, investment analysis takes into account market trends, industry analysis, and macroeconomic factors that can impact the performance of an investment. These factors help investors identify potential opportunities and risks, allowing them to adjust their investment strategies accordingly.

Overall, investment analysis is a critical tool for investors to make informed decisions and manage their portfolios effectively. By thoroughly analyzing investment options and understanding their potential risks and rewards, investors can increase their chances of achieving their financial objectives while mitigating potential losses.

Importance of Investment Analysis

Investment analysis plays a vital role in the world of finance, and its importance cannot be overstated. Here are some key reasons why investment analysis is essential:

- Identifying Profitable Opportunities: Investment analysis helps investors identify lucrative investment opportunities. By analyzing financial data, market trends, and industry dynamics, investors can uncover potential investments that are expected to generate significant returns.

- Evaluating Risk and Return: Investment analysis allows investors to assess the risk and return potential of different investment options. By considering factors such as historical performance, volatility, and market conditions, investors can make informed decisions that align with their risk tolerance and investment objectives.

- Optimizing Portfolio Allocation: Investment analysis helps investors optimize their portfolio allocation. By evaluating different investments and their potential risks and rewards, investors can strategically allocate their resources across various asset classes to achieve a well-diversified and balanced portfolio.

- Managing investment risk: Investment analysis enables investors to evaluate the risk associated with their investments. By examining factors such as company financials, industry conditions, and macroeconomic trends, investors can identify potential risks and take appropriate measures to mitigate them.

- Enhancing Returns: Through investment analysis, investors can identify opportunities to enhance their returns. By rigorously analyzing investment options, including their growth potential, valuation, and future prospects, investors can select investments that offer attractive risk-adjusted returns.

- Providing a Framework for Decision-making: Investment analysis provides a structured framework for decision-making. It helps investors assess and compare different investment options based on their financial goals, risk tolerance, and investment strategies. This ensures that investment decisions are made based on thorough analysis rather than relying on emotions or impulse.

- Meeting Regulatory and Compliance Requirements: Investment analysis is essential to ensure compliance with regulatory requirements. Various financial institutions and investment professionals are bound by regulations that mandate thorough analysis and due diligence when making investment recommendations.

In summary, investment analysis serves as a crucial tool for investors to make informed decisions, manage their risk, and maximize their returns. It provides a systematic approach to evaluate investment opportunities and helps investors align their investment strategies with their financial goals.

Types of Investment Analysis

Investment analysis encompasses various methods and techniques that investors employ to evaluate investment opportunities. Here are the main types of investment analysis:

- Fundamental Analysis: Fundamental analysis involves examining the financial health and performance of a company or investment. It focuses on factors such as earnings, revenue, cash flow, balance sheets, and industry trends. By analyzing these fundamental factors, investors can estimate the intrinsic value of an investment and assess its potential for long-term growth.

- Technical Analysis: Technical analysis relies on studying historical price and volume data to predict future price movements. It focuses on chart patterns, trends, and indicators such as moving averages, support and resistance levels, and oscillators. Technical analysis is commonly used in active trading strategies to identify short-term trading opportunities.

- Quantitative Analysis: Quantitative analysis involves using mathematical and statistical models to analyze investments. It relies on data such as historical returns, volatility, correlations, and other financial metrics. Quantitative analysis helps investors identify patterns, trends, and relationships to make data-driven investment decisions.

- Qualitative Analysis: Qualitative analysis involves evaluating non-financial factors that can impact investment performance. These factors include the quality of management, company culture, competitive advantages, and market outlook. Qualitative analysis complements fundamental analysis by providing a holistic perspective on an investment.

- Macro-Economic Analysis: Macro-economic analysis examines broader economic indicators such as GDP growth, interest rates, inflation rates, and government policies. It helps investors assess the overall economic environment and identify potential macroeconomic risks and opportunities that can impact their investments.

While these are the main types of investment analysis, it’s important to note that investors often combine multiple approaches to gain a comprehensive understanding of an investment opportunity. By utilizing a combination of these analysis methods, investors can make more well-informed decisions and have a more comprehensive view of their investments.

Fundamental Analysis

Fundamental analysis is a method used to evaluate investments by examining the financial and non-financial aspects of a company. It focuses on understanding the intrinsic value of an investment based on its fundamental factors, such as earnings, revenue, cash flow, and industry trends.

Key elements of fundamental analysis include:

- Financial Statements: Fundamental analysis involves analyzing a company’s financial statements, including the balance sheet, income statement, and cash flow statement. These statements provide insights into a company’s profitability, liquidity, and financial health.

- Earnings and Revenue: Investors examine a company’s earnings and revenue growth trends to assess its profit-making potential. Factors such as sales growth, profit margins, and return on equity are analyzed to gauge a company’s financial performance.

- Industry Analysis: Fundamental analysis considers the industry in which a company operates. Understanding the industry dynamics, competitive landscape, and market trends is essential to evaluate a company’s potential for growth and sustainability.

- Management: The quality and competence of a company’s management team are crucial aspects of fundamental analysis. Evaluating the track record and expertise of the management team provides insights into their ability to steer the company towards success.

- Valuation: Fundamental analysis includes the assessment of a company’s valuation. This involves comparing its stock price to its intrinsic value to determine if it is undervalued or overvalued. Common valuation metrics used include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and discounted cash flow (DCF) analysis.

Fundamental analysis helps investors make informed investment decisions based on the long-term potential and fundamentals of a company. It seeks to identify stocks or assets that are believed to be undervalued or overvalued in the market.

By conducting thorough fundamental analysis, investors can gain insights into a company’s financial stability, growth prospects, competitive position, and overall risk levels. This information is vital in determining the suitability and potential return of an investment, enabling investors to make well-informed decisions that align with their investment objectives and risk tolerance.

Technical Analysis

Technical analysis is a method used to evaluate investments by analyzing historical price and volume data. It focuses on identifying patterns, trends, and indicators to predict future price movements and make informed investment decisions.

Here are the key elements of technical analysis:

- Charts and Patterns: Technical analysis relies on analyzing price charts to identify patterns and trends. Common chart patterns include support and resistance levels, trendlines, and chart formations such as head and shoulders or double tops. These patterns can provide insights into potential future price movements.

- Indicators: Technical analysts use a variety of indicators to assess market trends and momentum. These indicators include moving averages, relative strength index (RSI), stochastic oscillators, and MACD (moving average convergence divergence). These indicators help identify overbought or oversold conditions and potential trend reversals.

- Volume Analysis: Technical analysis considers trading volume as an important factor. It helps analyze the strength of price movements and identify potential buying or selling pressure. An increase in volume during a price rally or a decrease during a price decline can provide valuable insights into the potential direction of an investment.

- Support and Resistance: Technical analysts identify key support and resistance levels on price charts. Support levels are price levels where buying demand is expected to be strong, preventing prices from falling further. Resistance levels, on the other hand, are price levels where selling pressure is expected to be strong, limiting further price increases.

- Trend Analysis: Technical analysis aims to identify and follow market trends. It involves analyzing price charts and indicators to determine the prevailing trend, whether it’s an uptrend, downtrend, or a sideways consolidation phase.

Technical analysis is widely used by traders and short-term investors to identify potential entry and exit points. It helps them capitalize on short-term price fluctuations and take advantage of market inefficiencies.

However, it’s important to note that technical analysis is not without limitations. It is based on historical price data and patterns, which may not always accurately predict future price movements. Additionally, technical analysis does not consider fundamental factors and may not be suitable for long-term investment decisions.

Nevertheless, technical analysis can be a valuable tool for investors to supplement their analysis and make well-informed decisions. By combining technical analysis with other investment analysis methods, investors can gain a more comprehensive view of an investment opportunity and potentially improve the timing and success of their trades.

Quantitative Analysis

Quantitative analysis is a method used to evaluate investments by applying mathematical and statistical models to analyze financial data and identify patterns, trends, and relationships. It involves using quantitative techniques to make data-driven investment decisions.

Here are the key elements of quantitative analysis:

- Financial Metrics: Quantitative analysis relies on analyzing various financial metrics, such as earnings per share (EPS), price-to-earnings (P/E) ratio, return on investment (ROI), and others. These metrics provide insights into a company’s financial performance and help assess its valuation and potential for future growth.

- Statistical Models: Quantitative analysts use statistical models to analyze investment data and identify patterns. These models can include regression analysis, time series analysis, and correlation analysis. By applying these models to historical data, analysts can identify relationships and trends that can be used to make investment decisions.

- Backtesting: Quantitative analysis often involves backtesting, which is the evaluation of investment strategies using historical data. By testing investment strategies against historical market data, analysts can assess their effectiveness and potential for future performance.

- Risk Management: Quantitative analysis helps investors manage risk by quantifying and analyzing various risk factors. This includes assessing the volatility of an investment, measuring the correlation between different assets, and using risk metrics such as value at risk (VaR) to estimate potential losses.

- Algorithmic Trading: Quantitative analysis is commonly used in algorithmic trading, where investment decisions are made by computer algorithms. These algorithms use quantitative models and historical data to assess market conditions and execute trades automatically.

Quantitative analysis is particularly prevalent in hedge funds, financial institutions, and quantitative investment firms. By leveraging advanced mathematical and statistical techniques, investors can gain a deeper understanding of investment opportunities and develop systematic trading strategies.

However, it’s important to note that quantitative analysis has its limitations. It relies heavily on historical data and statistical models, which may not always accurately predict future market movements. Human judgment and qualitative analysis are still important factors in investment decision-making.

Nonetheless, by combining quantitative analysis with other methods, such as fundamental and technical analysis, investors can enhance their investment decision-making process and potentially gain a competitive edge in the market.

Qualitative Analysis

Qualitative analysis is a method used to evaluate investments by assessing non-financial factors that can impact the performance and value of an investment. Unlike quantitative analysis, which focuses on numerical data, qualitative analysis considers subjective factors such as the quality of management, market outlook, and competitive advantages of a company.

Here are the key elements of qualitative analysis:

- Management: Qualitative analysis includes evaluating the quality and competence of a company’s management team. This involves assessing their track record, experience, leadership skills, and ability to execute strategic initiatives. A strong management team is often seen as a positive indicator of a company’s future success.

- Industry Analysis: Qualitative analysis considers the industry in which a company operates. Evaluating industry dynamics, market trends, and competitive landscape helps assess the potential for growth and profitability. An industry with favorable growth prospects and a sustainable competitive advantage is often seen as an attractive investment opportunity.

- Business Model: Understanding a company’s business model is crucial in qualitative analysis. Assessing the uniqueness, durability, and scalability of a company’s business model provides insights into its ability to generate sustainable revenue and profitability over the long term.

- Competitive Advantage: Qualitative analysis considers a company’s competitive advantage or unique selling proposition. This includes analyzing factors such as brand equity, intellectual property, customer loyalty, and market positioning. Investments in companies with sustainable competitive advantages may have higher potential for long-term success.

- Market Outlook: Qualitative analysis takes into account the overall market outlook, including economic conditions, consumer behavior, and regulatory factors. Understanding these external influences helps assess the potential risks and opportunities for an investment.

Qualitative analysis complements quantitative analysis by providing a more holistic view of an investment opportunity. While quantitative analysis focuses on numerical data, qualitative analysis provides insights into the qualitative characteristics and intangible factors that can impact investment performance.

It’s important to note that qualitative analysis relies on subjective judgment and is more difficult to quantify compared to quantitative analysis. Different investors may have varying interpretations of qualitative factors. Therefore, investors need to research and evaluate qualitative information carefully and consider multiple perspectives.

By conducting thorough qualitative analysis alongside quantitative analysis, investors can gain a more comprehensive understanding of investment opportunities and make well-informed decisions based on a broader range of factors.

Steps in Investment Analysis

Investment analysis involves a systematic approach to evaluating investment opportunities. While the specific steps may vary depending on the nature of the investment and the investor’s preferences, here are the general steps in the investment analysis process:

- Gathering and Analyzing Data: The first step is to gather relevant data about the investment opportunity. This includes financial statements, market data, industry reports, and any other information that can provide insights into the investment’s performance and potential.

- Evaluating Risk and Return: Once the data is gathered, the investor needs to assess the risk and return potential of the investment. This involves analyzing financial metrics, market trends, and other factors to determine the expected return on investment and the level of risk associated with the investment.

- Making Investment Decisions: Based on the analysis of the data and evaluation of risk and return, investors need to make informed investment decisions. This includes deciding whether to invest in the opportunity, the amount to invest, and the appropriate time to enter or exit the investment.

- Monitoring and Reviewing: After making the investment, it is important to continuously monitor the investment’s performance and review the analysis periodically. This allows investors to stay informed about any changes in the investment’s performance, risk factors, or market conditions.

Throughout the investment analysis process, it is crucial to maintain objectivity and be mindful of any biases or emotions that may influence decision-making. Relying on data-driven analysis and considering multiple perspectives can help mitigate these biases and enhance the accuracy of the investment analysis.

It’s important to note that investment analysis is an ongoing process. The market and investment environment are dynamic, and factors influencing the investment may change over time. Regularly re-evaluating and adjusting the investment analysis as needed is critical to ensure that the investment remains aligned with the investor’s goals and preferences.

By following these steps and conducting thorough analysis, investors can make informed decisions, minimize risks, and maximize the potential returns of their investments.

Gathering and Analyzing Data

Gathering and analyzing data is a crucial step in the investment analysis process. It involves collecting relevant information about the investment opportunity and conducting a thorough analysis to gain insights into its performance and potential. Here are the key aspects of gathering and analyzing data:

- Financial Statements: Start by obtaining the financial statements of the company or investment under consideration. This includes the balance sheet, income statement, and cash flow statement. These statements provide a snapshot of the company’s financial health, profitability, and cash flow position.

- Market Data: Gather market data to understand the broader economic conditions and industry trends that may impact the investment. This includes data on interest rates, inflation, GDP growth, and other relevant macroeconomic indicators. Additionally, gather information about the specific industry in which the investment operates to evaluate its growth potential and competitive landscape.

- Company Information: Collect information about the company itself, such as its history, management team, corporate structure, and any recent news or developments. This information helps assess the company’s reputation, strategy, and potential risks or opportunities.

- Industry Research: Conduct in-depth research into the industry in which the investment operates. Identify the industry’s main competitors, market size, growth potential, and key trends. Understanding the industry dynamics and competitive landscape is vital in assessing the investment’s long-term prospects.

- Comparative Analysis: Conduct a comparative analysis by comparing the investment to its peers within the same industry. This includes analyzing financial ratios, such as the price-to-earnings (P/E) ratio, return on investment (ROI), and debt-to-equity ratio, to evaluate the investment’s relative performance and valuation.

- Qualitative Factors: Consider qualitative factors that may impact the investment. This includes evaluating the quality of management, the company’s competitive advantages or unique selling propositions, any regulatory or legal factors, and market conditions that could influence the investment’s performance.

Once the data is gathered, the next step is to analyze it thoroughly. This involves interpreting the financial statements, identifying trends or patterns, and assessing the investment’s strengths, weaknesses, opportunities, and threats. Use various analytical tools and techniques, such as ratios, spreadsheets, visualization tools, and statistical models, to gain insights from the data.

It is important to note that the quality and accuracy of the data play a significant role in the analysis. Ensure that the data sources are reliable and up-to-date to make informed investment decisions. Additionally, consider any biases or limitations in the data that may impact the analysis. Statistics and financial ratios should be interpreted in the context of the investment and its specific industry.

By gathering and analyzing comprehensive and reliable data, investors can make well-informed decisions and gain a deeper understanding of the investment’s potential risks and rewards. Proper data analysis serves as the foundation for the subsequent steps in investment analysis, including evaluating risk and return and making investment decisions.

Evaluating Risk and Return

Evaluating the risk and return of an investment is a critical step in the investment analysis process. It involves assessing the potential rewards and the level of risk associated with a particular investment option. Here’s what you need to consider when evaluating the risk and return:

- Expected Return: Start by estimating the potential return of the investment. This may involve analyzing historical data, financial projections, and industry trends to determine the expected future performance of the investment. Consider factors such as revenue growth, profitability, and dividend payments to assess the potential for generating positive returns.

- Risk Assessment: Evaluate the level of risk associated with the investment. This includes considering both market risk and investment-specific risk factors. Market risk refers to the overall volatility and uncertainty in the market, while investment-specific risk factors can include factors such as business risks, industry risks, regulatory risks, and financial risks.

- Diversification: Assess the potential benefits of diversification. Diversifying your investment portfolio across different asset classes, industries, and geographical regions can help mitigate risk by reducing exposure to any single investment or sector. Consider how the investment aligns with your existing portfolio and whether it adds diversification benefits.

- Risk-Return Tradeoff: Evaluate the risk-return tradeoff of the investment. Generally, investments with higher potential returns tend to carry higher levels of risk. Consider your risk tolerance and investment objectives to determine if the potential return is worth the associated risk. Different investors may have different risk preferences based on their financial goals and personal circumstances.

- Time Horizon: Consider your investment time horizon when evaluating risk and return. Some investments may have the potential for higher returns over the long term but may also be subject to higher short-term volatility. Evaluate whether the investment aligns with your investment time horizon and financial goals.

Keep in mind that no investment is entirely risk-free, and there is always a degree of uncertainty involved. It’s crucial to thoroughly assess the risks and potential returns of an investment and determine whether they align with your risk tolerance and investment objectives.

Additionally, it’s advisable to seek professional advice and consider using risk management tools such as stop-loss orders or diversification strategies to help manage investment risks. Regularly review and update your risk assessment as market conditions, industry trends, and investment-specific factors may change over time.

By thoroughly evaluating the risk and return of an investment, you can make informed decisions that align with your financial goals, risk tolerance, and investment strategy. Understanding and managing risk is essential for building a well-balanced and successful investment portfolio.

Making Investment Decisions

After gathering and analyzing data, evaluating the risk and return, and considering various factors, it’s time to make investment decisions. This step involves determining whether to invest in a particular opportunity, how much to invest, and when to enter or exit the investment. Here’s what you should consider when making investment decisions:

- Investment Objectives: Clarify your investment objectives and align them with the specific opportunity. Consider whether the investment fits within your long-term financial goals, such as capital preservation, income generation, or capital appreciation.

- Risk Tolerance: Evaluate your risk tolerance level. This is influenced by your financial situation, time horizon, and comfort with market fluctuations. Be aware of your capacity to absorb potential losses and ensure the investment aligns with your risk tolerance.

- Diversification: Assess the diversification benefits of the investment. Determine if the opportunity adds value to your existing portfolio by mitigating the risk of concentration in a single asset. Consider how the investment complements and balances your overall portfolio allocation.

- Exit Strategy: Establish an exit strategy and criteria for when to sell or exit the investment. Define specific triggers, such as reaching a certain price target, changes in market conditions, or a significant shift in the investment’s fundamentals, to guide your decision-making process in the future.

- Consider Professional Advice: Seek advice from financial professionals, such as investment advisors or portfolio managers. They can provide valuable insights and assist you in making well-informed investment decisions based on their expertise and market knowledge.

- Review and Monitor: Regularly review and monitor your investments. Keep track of the performance, economic conditions, and any changes in relevant factors. Continuously assess whether the investment is aligning with your objectives and adjust your approach if needed.

Remember that investment decisions should be based on a comprehensive analysis and not driven by emotions or short-term market fluctuations. While investments involve risks, a well-thought-out investment strategy and disciplined decision-making process can help mitigate risks and increase the likelihood of achieving your financial goals.

It’s important to note that individual investment decisions should be based on personal circumstances and that there is no one-size-fits-all approach. Factors such as age, financial goals, risk appetite, and time horizon may vary among investors, leading to unique investment decisions.

Ultimately, making investment decisions requires careful consideration of various factors, a clear understanding of your financial goals, and the ability to adapt to changing market conditions. By following a systematic and disciplined approach, you can position yourself for long-term investment success.

Conclusion

Investment analysis is a crucial process for investors to evaluate opportunities, assess risks and returns, and make informed investment decisions. By following a systematic approach, investors can increase their chances of achieving their financial goals and optimizing their investment returns.

The steps involved in investment analysis, such as gathering and analyzing data, evaluating risk and return, and making investment decisions, provide a structured framework to guide investors through the decision-making process. Thorough analysis of financial statements, market data, and qualitative factors helps gain insights into the investment’s potential and its compatibility with the investor’s goals and risk appetite.

Furthermore, understanding different types of investment analysis, such as fundamental analysis, technical analysis, quantitative analysis, and qualitative analysis, allows investors to consider a variety of perspectives and gain a more comprehensive view of investment opportunities.

Investors should remember that investment analysis is an ongoing process. Regular monitoring and review of investments is essential to stay informed about changes in performance, risk factors, and market conditions. It’s also important to adapt to changing market dynamics and rebalance portfolios based on evolving financial goals and risk tolerance.

While investment analysis provides valuable insights, it’s crucial to note that investing involves risks, and no analysis can guarantee success or eliminate the possibility of losses. Investors must carefully evaluate their risk tolerance and make investment decisions accordingly. Seeking advice from financial professionals can also help navigate the complexities of investment analysis and enhance the decision-making process.

In conclusion, investment analysis is a fundamental tool for investors to analyze investment opportunities, evaluate risks and returns, and make well-informed decisions. By following a structured approach, continuously monitoring investments, and adapting to changing market conditions, investors can optimize their investment strategy and work towards their financial objectives.