Finance

FP&A: What is Financial Planning And Analysis?

Modified: September 6, 2023

Learn about the crucial role of FP&A or Financial Planning and Analysis, its key responsibilities, and how it impacts a company's overall financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

In an organization, financial planning and analysis or FP&A plays a crucial role by performing budgeting, forecasting, analytical processes. Accordingly, it supports its financial health, business strategy, and major corporate decisions of the CEO, CFO, and the Board of Directors.

FP&A helps align business processes and strategies with financial goals by evaluating progress toward those goals. Also, by combining in-depth analysis of both financial and operational data.

FP&A As A Discipline

The financial planning and analysis discipline measures and plans business operations by relying heavily on statistical analysis. Besides that, but it also forecasts their financial impact by taking internal variables, a broader demographic and economic trends, subjective, and qualitative evaluation into account.

Photo by rawpixel from Pixabay

FP&A As A Role

On the corporate side, FP&A is also an in-house finance role. FP&A directors, managers, and analysts are responsible for providing senior management and executives with the information and analysis. They need this to make major financial, operational, and strategic decisions for the organization.

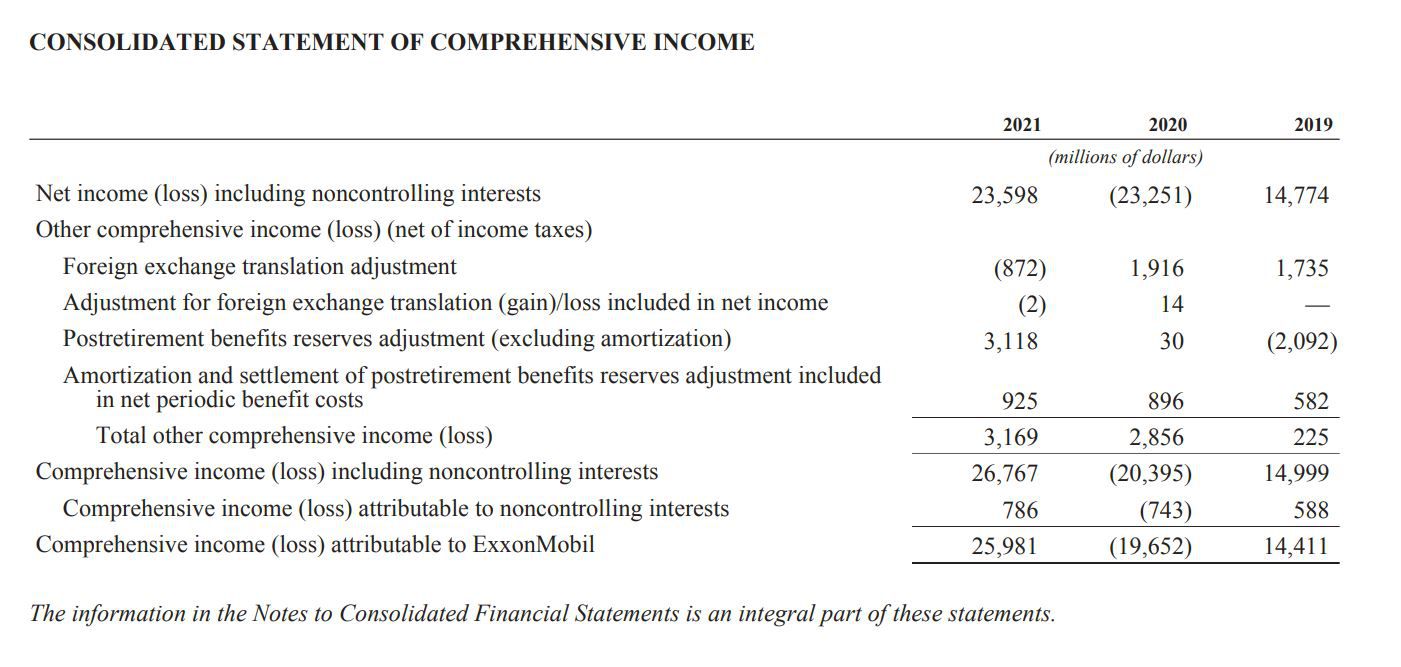

Financial planning and analysis gives a forecast of the company’s income statement (profit and loss) and operating performance for the year and upcoming quarter. These will inform the company of the progress and effectiveness of its investments and strategic plans. FP&A also enables the management to communicate with its external stakeholders.

Photo from Max Pixel

As a role, FP&A people run the annual budgeting process and manages financial performance tools such as cash flow forecast models and variance analysis. They often discuss cash flows and expenditures with treasury staff and work with corporate development on acquisition opportunities as well.

Financial Planning and Analysis vs. Accounting

Accounting mainly involves keeping records and financial reporting. FP&A, on the other hand, analyzes these financial statements and other operational and financial data produced by the accounting process. The FP&A analyst likely monitors, analyzes, and helps manage the funds needed to meet short-term obligations or the working capital.

By subtracting current liabilities from current assets which are both found in the balance sheet, the analyst calculates the working capital. If he or she finds a dangerous downward trend in it, the analyst alerts his or her colleagues and recommends ways to improve it. This may be done by reducing inventory or speeding up the collection of accounts receivable.

Photo by William Iven from Pixabay

More importantly, the financial planning and analysis department tracks and analyzes the organization’s cash flow. This measures how much money is coming in and going out within a certain period of time. The cash flow is recorded in accounts held in the general ledger which is a standard tool in accounting.

FP&A analyzes the data from cash flow and spots the positive and negative trends. These trends may affect the overall financial health of the company. FP&A analysts also recommend strategies for improvement like borrowing to meet short-term needs.

FP&A Responsibilities

Financial planning and analysis requires an understanding of the organization’s historical performance and key trends and assumptions that may impact future performance.

Forecasting the company’s financials also needs an understanding of both business and accounting operations. This makes the FP&A department “the eyes and ears” of the organization. It is the central liaison between the corporate and operations teams.

Budget and Forecast

The primary responsibility of an FP&A is to bring the long term strategic plan of senior management to reality. The strategic plan sets high-level targets such as net income, revenue, and core strategic initiatives for the company. This can be anywhere between 2-10 years in the future.

Financial planning and analysis develops the operating and financial plan needed to achieve the senior management’s strategic plan. Corporate performance management is also another name for this process. This would mean that FP&A develop a largely static annual budget updating once every year.

Since these static budgets get stale quickly, FP&A increasingly develops a rolling forecast. It is either parallel with the traditional budget or as a replacement.

Financial planning and analysis also conducts variance analysis as a key part of the forecasting process. This shows the management of how the rolling forecast and/or budget compares against actual performance.

Decision Support And Control

Aside from reporting forecasts and variances, FP&A uses that data to give management advice. It can help them make decisions on how to minimize risk, improve performance, or capture new opportunities within the organization and within the external environment.

This is why the financial planning and analysis group is typically tasked to create the monthly “Senior Management” or “CFO” book. This book usually provides the analysis of historical financial, variance explanations, updated forecast with risks and opportunities to the current plan, and KPIs (Key Performance Indicators).

These reports will provide the Chief Financial Officer (CFO) with enough information that will answer key questions from external stakeholders. It also helps identify various areas to work on to meet certain goals and optimize performance.

Photo from pxhere.com

Special Projects

From time to time, FP&A will be pulled in to work on special projects inevitably. These projects vary depending on the company and cover the following:

1. Market Research – Financial planning and analysis determines the size of a given market, its leaders and laggers. It also brings out the competitive advantage the organization may have through potential opportunities.

2. Capital Allocation – FP&A identifies where and how much should the organization spend its capital.

3. Process Optimization – Financial planning and analysis helps improve workflow inefficiency. This perennial problem for large organizations arise when various tools and technical systems do not work well with each other. Often, manual intervention can be time-consuming. That is why FP&A is also tasked to resolve it.

4. Mergers and Acquisitions (M&A) – FP&A identifies potential acquisition targets, integration, divestitures, and buy-side support.

FP&A Potential Salary and Income

As a professional, FP&A are well paid for their skills. This applies especially to those people who excel in analyzing corporate finances and accurately identifying financial moves for the optimal success of a company. The compensation in the financial planning and analysis department greatly varies between different industries and companies.

The annual salaries of entry-level junior analysts range around $50k, while senior analysts have salaries ranging $100k and above. This usually includes potential bonuses of 10-15%. Bonuses highly depends on the profit of the company and/or the FP&A analyst’s skill.

An FP&A director, manager, and the CFO (Chief Financial Officer) at a major company typically rake in a salary of between six and seven figures. This is, of course, supplemented with performance bonuses.

Photo by rawpixel from Pixabay

In conclusion, FP&A plays an important role in an organization. The budget and forecasts prepared by the FP&A group provides net income and revenue guidance to shareholders.

This helps the management achieve its strategic plan while accurately allocating resources. Ultimately, financial planning and analysis have a direct and immediate impact on the share price of the company.