Finance

What Is Liquidity Management?

Published: February 23, 2024

Learn the importance of liquidity management in finance and how it impacts businesses. Explore strategies for effective cash flow and risk management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Liquidity management is a critical aspect of financial management that encompasses the strategic balancing of a company's assets and liabilities to ensure it maintains sufficient cash and cash equivalents to meet its short-term obligations. In essence, it involves the efficient monitoring and utilization of available funds to facilitate smooth operations and capitalize on growth opportunities.

In the dynamic landscape of finance, liquidity management plays a pivotal role in safeguarding the financial stability and sustainability of an organization. By effectively managing liquidity, businesses can mitigate the risk of insolvency, enhance their ability to respond to unexpected financial needs, and capitalize on strategic investments. This article delves into the fundamental concepts of liquidity management, its significance, techniques, and the challenges associated with it.

Liquidity management is not solely confined to large corporations; it is equally vital for small and medium-sized enterprises (SMEs) and even individuals. Whether it's meeting payroll, settling short-term debts, or seizing a lucrative investment prospect, the ability to access readily available funds is indispensable. As such, understanding liquidity management is a fundamental aspect of financial literacy for businesses and individuals alike.

In the subsequent sections, we will explore the intricacies of liquidity management, the techniques employed to optimize it, and the hurdles that organizations encounter in this domain. Understanding these facets will empower businesses and individuals to navigate the financial terrain with prudence and agility, ensuring their financial well-being and resilience in the face of economic fluctuations and unforeseen challenges.

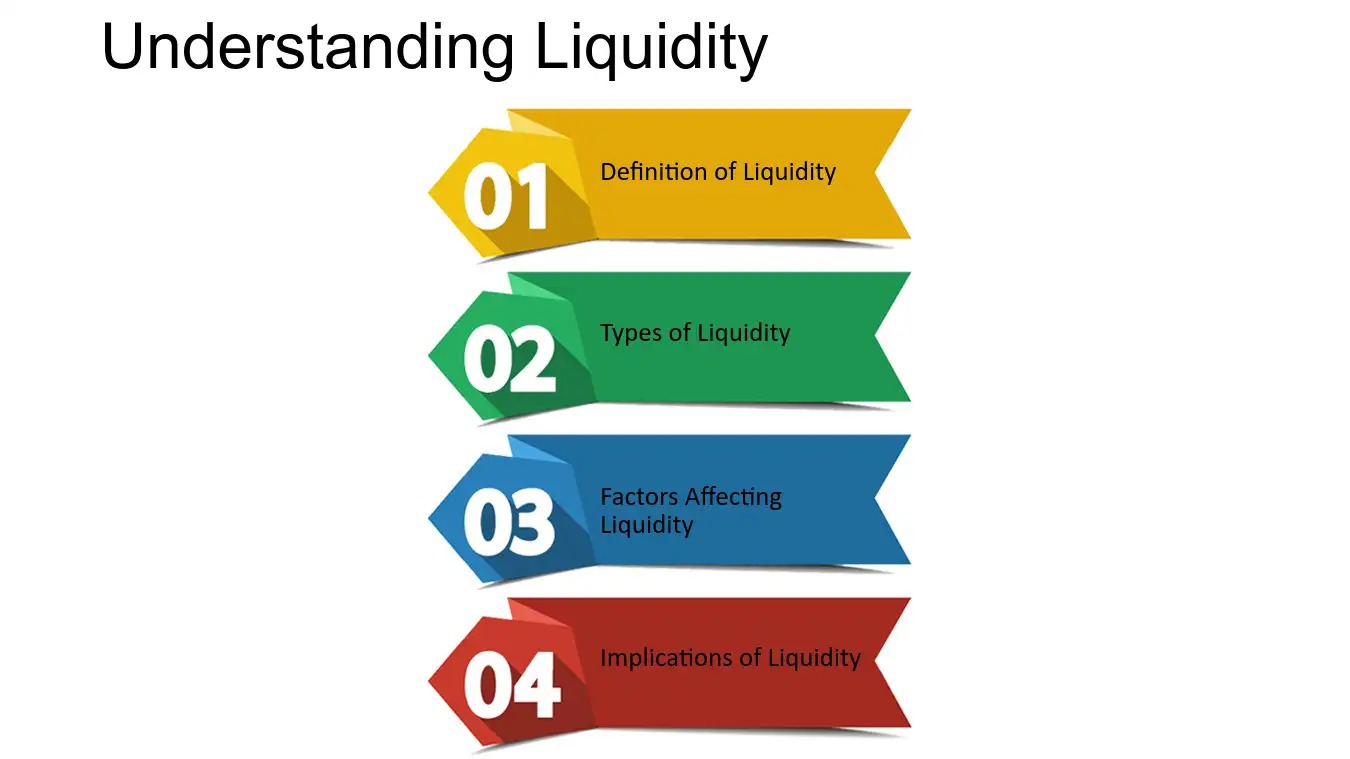

Understanding Liquidity

Liquidity refers to the ease with which an asset can be converted into cash or cash equivalents without causing a significant impact on its value. In financial terms, it represents the degree to which an entity can meet its short-term financial obligations promptly. Assets such as cash, marketable securities, and accounts receivable are considered highly liquid, as they can be readily converted into cash, whereas long-term investments and physical assets may have lower liquidity due to the time and effort required to convert them into cash.

Understanding liquidity is crucial for assessing the financial health of an organization. It provides insights into the company’s ability to manage its short-term cash flow requirements and navigate unforeseen financial challenges. By maintaining an optimal level of liquidity, businesses can bolster their resilience and capitalize on opportunities that arise in the market.

One of the key metrics used to gauge liquidity is the current ratio, which compares a company’s current assets to its current liabilities. A higher current ratio indicates a stronger liquidity position, as it signifies that the company possesses more current assets that can be utilized to settle short-term obligations. However, a very high current ratio may also indicate underutilized resources, prompting a need for strategic deployment of funds to optimize returns.

Furthermore, the concept of liquidity extends beyond the realm of corporate finance and permeates personal financial management. Individuals also need to maintain adequate liquidity to cover their day-to-day expenses, emergency funds, and other short-term financial needs. By comprehending the principles of liquidity, individuals can make informed decisions regarding their savings, investments, and financial planning, thereby ensuring their financial well-being and security.

Ultimately, liquidity serves as the lifeblood of financial stability, enabling businesses and individuals to weather economic uncertainties and capitalize on growth opportunities. By grasping the nuances of liquidity and its management, stakeholders can navigate the financial landscape with prudence, confidence, and resilience.

Importance of Liquidity Management

Liquidity management holds profound significance for businesses of all sizes, as well as for individuals, owing to its multifaceted impact on financial stability and operational efficiency. The following are key reasons why liquidity management is of paramount importance:

- Meeting Short-Term Obligations: Effective liquidity management ensures that entities can promptly settle their short-term financial commitments, such as vendor payments, utility bills, and employee salaries. By maintaining adequate cash reserves and managing short-term assets prudently, organizations can avoid liquidity crises and uphold their credibility in the market.

- Capitalizing on Opportunities: Optimal liquidity empowers businesses to capitalize on favorable market conditions and strategic investment opportunities. Whether it involves expanding operations, acquiring assets at opportune moments, or venturing into new markets, having sufficient liquidity enables organizations to act swiftly and decisively, thereby enhancing their competitive edge.

- Resilience in Adverse Conditions: Sound liquidity management serves as a buffer against economic downturns, unforeseen expenses, and market volatilities. It provides organizations with the necessary financial cushion to navigate challenging times, sustain operations, and emerge stronger from adversities.

- Enhancing Creditworthiness: Maintaining optimal liquidity levels augments an entity’s creditworthiness in the eyes of lenders, investors, and other stakeholders. It instills confidence in the organization’s ability to honor its financial commitments, thereby facilitating access to favorable credit terms and investment opportunities.

- Strategic Decision-Making: By actively managing liquidity, businesses can make informed and strategic decisions regarding cash flow, working capital, and resource allocation. This enables them to optimize their financial resources, minimize borrowing costs, and maximize returns on investments.

These facets collectively underscore the pivotal role of liquidity management in fostering financial stability, operational agility, and long-term sustainability. Whether in the corporate or personal finance sphere, adept liquidity management is indispensable for navigating the complexities of the financial landscape and harnessing opportunities for growth and prosperity.

Liquidity Management Techniques

Effective liquidity management entails the implementation of strategic techniques aimed at optimizing cash flow, managing short-term assets, and mitigating liquidity risks. The following are key techniques employed in liquidity management:

- Cash Flow Forecasting: By conducting robust cash flow forecasting, organizations can anticipate their short-term cash needs and surpluses, enabling proactive liquidity management. This involves analyzing historical cash flows, factoring in future revenue and expenses, and identifying potential liquidity gaps.

- Working Capital Management: Optimizing working capital through efficient management of accounts receivable, accounts payable, and inventory levels is instrumental in maintaining liquidity. Streamlining working capital cycles and minimizing inefficiencies enhances the availability of cash for operational requirements.

- Short-Term Investments: Prudent allocation of excess cash into short-term, highly liquid investments such as money market instruments and Treasury bills can generate returns while ensuring quick access to funds when needed. This approach balances liquidity with the opportunity to earn a modest yield on idle cash.

- Revolving Credit Facilities: Establishing access to revolving credit lines provides a safety net for managing short-term liquidity needs. These facilities offer flexibility in borrowing funds as and when required, thereby supplementing existing cash reserves during periods of cash flow constraints.

- Liquidity Stress Testing: Conducting liquidity stress tests enables organizations to assess their resilience against adverse scenarios, such as sudden market downturns or unexpected cash outflows. By simulating such scenarios, entities can identify potential vulnerabilities and devise preemptive measures to bolster their liquidity positions.

- Optimizing Cash Management: Leveraging advanced cash management techniques, including concentration and disbursement systems, notional pooling, and zero balancing, facilitates efficient cash utilization and minimizes idle balances across multiple accounts and entities.

These techniques are instrumental in proactively managing liquidity, optimizing cash resources, and fortifying an organization’s financial resilience. By integrating these strategies into their financial management practices, businesses can navigate the dynamic financial landscape with agility and foresight, ensuring that they are well-equipped to meet their short-term obligations and capitalize on strategic opportunities.

Challenges in Liquidity Management

Despite its critical importance, liquidity management presents various challenges that organizations and individuals must navigate effectively. Understanding and addressing these challenges is essential for maintaining financial stability and operational continuity. The following are key challenges encountered in liquidity management:

- Volatility in Cash Flows: Fluctuations in revenue streams, unexpected expenses, and seasonality can lead to erratic cash flows, making it challenging to predict and manage short-term liquidity needs effectively.

- Optimizing Working Capital: Balancing the need to maintain adequate working capital with the imperative to minimize excess liquidity requires astute working capital management. Inefficient inventory management and extended receivables collection periods can strain liquidity.

- Market Uncertainties: External factors such as interest rate fluctuations, shifts in market dynamics, and geopolitical events can impact liquidity positions, necessitating proactive risk management and contingency planning.

- Regulatory Compliance: Adhering to stringent regulatory requirements, particularly in the financial services sector, demands meticulous attention to liquidity ratios, stress testing, and reporting obligations, adding complexity to liquidity management practices.

- Access to Credit: Limited access to credit facilities or unfavorable credit terms can constrain an entity’s ability to bolster its liquidity through external financing, especially during economic downturns or credit market tightening.

- Technology and Infrastructure: Outdated or inadequate financial systems and technology infrastructure can impede efficient cash flow monitoring, liquidity forecasting, and real-time access to critical financial data.

Overcoming these challenges necessitates a holistic approach to liquidity management, encompassing robust financial planning, risk mitigation strategies, and the adoption of advanced financial technologies. By proactively addressing these challenges, businesses and individuals can fortify their liquidity positions, enhance their financial resilience, and capitalize on growth opportunities with confidence.

Conclusion

Liquidity management stands as a cornerstone of financial prudence, playing a pivotal role in sustaining the operational vitality and resilience of businesses and individuals. By comprehensively understanding liquidity and embracing effective management techniques, stakeholders can navigate the intricate terrain of short-term finance with agility and foresight.

From meeting short-term obligations and capitalizing on opportunities to fortifying resilience in adverse conditions, the significance of liquidity management reverberates across diverse facets of financial well-being. It empowers organizations to make informed decisions, optimize cash resources, and enhance their creditworthiness, thereby fostering long-term sustainability and growth.

Despite the challenges inherent in liquidity management, proactive risk mitigation, robust financial planning, and leveraging advanced financial technologies can empower entities to surmount these obstacles and fortify their liquidity positions. By embracing a holistic approach to liquidity management, businesses and individuals can bolster their financial stability, navigate market uncertainties, and capitalize on growth opportunities with confidence.

Ultimately, liquidity management transcends mere financial prudence; it embodies the art of balancing short-term needs with long-term aspirations, ensuring that entities are well-prepared to seize opportunities, weather challenges, and thrive in the ever-evolving landscape of finance.

Embracing the principles of liquidity management equips stakeholders with the acumen to navigate the dynamic financial terrain with prudence, agility, and resilience, thereby fostering enduring financial well-being and prosperity.